INTERMEDIATE

ACCOUNTING

Seventh Canadian Edition

KIESO, WEYGANDT, WARFIELD, YOUNG, WIECEK

Prepared by:

Gabriela H. Schneider, CMA

Northern Alberta Institute of Technology

CHAPTER

23

Statement of Cash Flows

Learning Objectives

1. Describe the purpose and uses of the statement

of cash flows.

2. Define cash and cash equivalents.

3. Identify the major classifications of cash flows

and explain the significance of each.

4. Contrast the direct and indirect methods of

calculating net cash flow from operating

activities.

Learning Objectives

5. Differentiate between net income and cash flows

from operating activities.

6. Prepare a statement of cash flows.

7. Read and interpret a statement of cash flows.

8. Identify the financial reporting and disclosure

requirements for the statement of cash flows.

9. Use a work sheet to prepare a statement of cash

flows. (Appendix 23A)

Statement of Cash Flows

Introduction to

the Statement

Usefulness

What is cash?

Classification of

cash flows

Format of the

statement

Preparing a

Statement of Cash

Flows

Sources of

information and

steps

First illustration

Second illustration

Third illustration

Interpreting the

statement

Reporting and

Appendix A Disclosure Issues

Use of a

Worksheet

Cash flow

statement

Cash flow per

Preparing the

share

worksheet

Free cash flow

Analysis of

transactions

Financial reporting

examples

Completing

the work

Perspectives

sheet

Usefulness of the

Statement of Cash Flows

•

The information may help users assess the

following:

– The entity’s ability to generate future cash

flows

– The entity’s ability to pay dividends and

meet obligations, and increase capacity

– The reasons why net income and net cash

flow from operating activities differ

Cash and Cash Equivalents

Cash

• Cash on hand

• Demand deposits

All references to Cash

include Cash Equivalents

when discussing the

Statement of Cash Flows

Cash Equivalents

• Investments that are

– Short term,

– Highly liquid, and

– Easily converted to a

known amount of cash

– Subject to an

insignificant risk of

change in value

The Cash Flow Statement

•

The cash flow statement provides

information about:

• the cash receipts (cash inflows), and

• uses of cash (cash outflows) during the

year

•

Inflows and outflows are reported for:

• operating activities

• investing activities, and

• financing activities during the year

Cash Flow Classifications

1. Operating Activities

•

The cash flows resulting from the primary

revenue generating activities of the business,

such as

•

•

•

•

•

Collections from customers

Payments to suppliers

Payments to employees

Payments to CRA for tax

Cash flow provided by operating activities

necessary for long term sustainability of the

business

Cash Flow Classifications

2. Investing Activities

•

•

The acquisition and disposal of long term

assets and long-term investments

Examples include:

•

•

•

Purchase/disposal of capital assets

Acquiring an interest in another corporation

Cash flow generated by investing activities

shows if the business is investing in its future

Cash Flow Classifications

3. Financing Activities

•

•

Changes in long-term debt or equity capital

Examples include:

•

•

•

Issuing debt, or repayment of debt

Issuing new shares, or repurchase of

currently outstanding shares

Provides information to assess potential for

future claims to entity’s cash, extent of debt

and increased interest charges

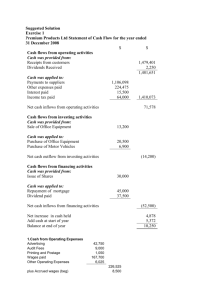

Exercise E23-1: Identify

Transactions

• Identify each of the transactions as either

–

–

–

–

Operating activity

Investing activity

Financing activity

Significant noncash investing or financing

activity

– None of the above

Exercise E23-1: Identify

Transactions

a) Acquisition of raw materials

Operating Activity (noncash)

b) Declaration of dividends

Financing Activity (noncash)

c) Acquisition of a 4% interest in a company

Investing Activity

d) Contribution to employees’ pension plan

Operating Activity

e) Equipment leased through capital lease

Significant noncash investing and financing activity

f) Office space leased with an operating lease

Operating Activity (noncash)

Exercise E23-1: Identify

Transactions

g)

h)

i)

j)

k)

l)

Paid interest on outstanding debt and amortized the

discount

Financing Activity

Paid the supplier from transaction a)

Operating Activity

Paid for new fleet of vehicles

Investing Activity

Received dividend payment from c)

Operating Activity

Sold vehicles for an amount greater than book value

Investing Activity

Stock options granted to executives

Noncash Operating and Financing Activity

Statement of Cash Flows:

Concept

Operating

activities

Inflows

Investing

activities

Financing

activities

Cash

Pool

Operating

activities

Investing

activities

Outflows

Financing

activities

Significant Noncash

Transactions

• Transactions that do not involve the direct

receipt or disbursement of cash in the period

• Examples:

– Asset purchased, paid for by assuming debt,

or issuance of shares

– Conversion of debt to equity

• Noncash transactions are not reported on the

Statement of Cash Flows

Preparing a

Statement of Cash Flows

• Two methods of preparing the operating cash

flow section of the Statement of Cash Flows:

– Indirect method

– Direct method

• Indirect method derives operating cash flows

from accrual basis income statement

• Direct method determines operating cash flows

directly for each operating source or use of

cash

Cash Flow from Operations:

Indirect Method – Concept

Earned

Revenues

+

Net Income

Expenses

Incurred

-

Eliminate

non-cash revenues

Operating

cash flow

Eliminate

non-cash charges

The Statement of Cash Flows:

Indirect Method

Accrual Basis Statements

Cash Flow Statement

Income Statement items

and changes in Current

Assets and Current Liabilities

Operating activities:

Adjust net income for accruals,

non-cash charges and nonoperating gains/losses

Balance Sheet:

Changes in

Non-Current Assets

Investing activities:

Inflows from sale of assets and

outflows for purchases of assets

Balance Sheet:

Changes in Non-Current

Liabilities and Equity

Financing activities:

Inflows and outflows from loan

and equity transactions

Cash Flows from Operations:

Direct Method

Inflows

• Received from

customers for cash

sales and on account

• Cash dividends and

interest received

Outflows

• To suppliers for cash

purchases and

payments on account

• To employees for

salaries and wages paid

• To government for taxes

paid

• To lenders for interest

paid

• To others for expenses

paid

Format of the Statement of

Cash Flows (Indirect Method)

Cash flows from operating activities:

Net Income (Loss)

Adjustments (List individual adjustments)

Net cash flow from operating activities

$ XXX

$ XX

$ XXX

Cash flows from investing activities:

(List individual inflows and outflows)

Net cash flow from investing activities

$ XX

$ XXX

Cash flows from financing activities:

(List individual inflows and outflows)

Net cash flow from financing activities

$ XX

$ XXX

Change in cash

$ XXX

Format of the Statement of Cash

Flows (Direct Method)

Cash flows from operating activities:

Cash receipts (individually): Inflows

Cash payments (separately): outflows

Net cash flow from operating activities

$ XXX

($ XXX)

$ XXX

Cash flows from investing activities:

(List individual inflows and outflows)

Net cash flow from investing activities

$ XX

$ XXX

Cash flows from financing activities:

(List individual inflows and outflows)

Net cash flow from financing activities

$ XX

$ XXX

Change in cash

$ XXX

Indirect Method: Example

Tax Consultants Inc. began operations on January 1, 2005.

The income statement and balance sheet for year 2005 follow.

Income Statement

Revenues

Less: Operating expenses

Income before Tax

Less: Income Tax

Net Income

$ 125,000

85,000

40,000

6,000

$ 34,000

A dividend of $14,000 was declared during year.

Indirect Method: Example

Balance Sheet

Dec 31, 2005 Jan 1, 2005

Assets:

Cash

Accounts Receivable

Total

$ 49,000

36,000

$ 85,000

$-0-0$-0-

Liabilities and Shareholders’ Equity:

Accounts Payable

$ 5,000

Common Shares

60,000

Retained Earnings

20,000

Total

$85,000

$-0-0-0$-0-

Operating Activities

Accrual Basis

Net Income

$34,000

Accounts Receivable +$ 36,000

Accounts Payable

+$ 5,000

Changes between beginning

and ending balances

Cash Flow

Net Income

$34,000

Less: Increase in A/R

Add: Increase in A/P

$ 36,000

$ 5,000

Operations: Net Inflow $3,000

See explanations next slide

Operating Activities

Accounts Receivable

Increased by $36,000

Cash collections are

less than revenue

recognized

Reduce net income

by $36,000 to derive

cash flows from

operations

Operating Activities

Accounts Payable

Increased by $5,000

Cash paid for purchases

is less than expenses

reported

Increase net income

by $5,000 to derive

cash flows from

Operations; net

income for the year

increases by $5,000

Investing and

Financing Activities

Accrual Basis

Cash Flow

Financing Activities:

Common Stock + $60,000

Retained Earnings +

$20,000

Beg Bal:

$

0

Net Income:

34,000

less: Dividends (14,000)

End Balance: $20,000

Issue of Shares: $60,000

Dividends paid: ( 14,000)

Inflow

46,000

Cash Flow Statement:

(Indirect Method) - Summary

• Cash provided by operating activities: $ 3,000

• Cash used by investing activities:

-0-

• Cash provided by financing activities:

46,000

• Net inflow for the year

$ 49,000

• Beginning cash balance:

$

• Cash, end of year

$ 49,000

-0-

Other Items

• Income statement gains and losses on disposal of

long-term assets must be adjusted in determining

cash from operations. Why?

• These result from investing activities, not

operating activities and

• The amount of the cash flow is the proceeds on

disposal, not the gain or loss

Other Items

• Income statement gains and losses on

redemption of long-term debts must be adjusted

in determining cash from operations. Why?

• These result from financing activities, not

operating activities and

• The amount of the cash flow is the amount paid to

redeem the debt, not the gain or loss

Exercise E23-6: Cash Flows from

Operating Activities - Indirect

Method

• Using the Income Statement and Additional

Information provided

• Prepare the Operating Activities section of the

Statement of Cash Flows

• Year ended December 31, 2005

• Solution follows

Exercise E23-6: Cash Flows

from Operating Activities Indirect Method

Net Income

$1,050,000

Non-Cash Items and

Changes in Working Capital:

Increase in A/R

Decrease in Inventory

$(360,000)

300,000

Increase in Prepaids

(170,000)

Decrease in A/P

(275,000)

Increase in Accrued

10,000

Amortization Expense

60,000

Cash Flow from Operating Activities

(435,000)

$615,000

Direct Method: Concept

Cash Payments

Cash Receipts

To suppliers

Collections from

customers

To employees

less

From receipts

of interest and

dividends

For operating exp

For interest

For taxes

equals

Cash

flow

from

operations

Cash From Operations: Direct

Method

Refer to Tax Consultant Inc. the data for the indirect method.

Cash receipts from customers:

= Revenue from credit sales – Increase in A/R balances

= $125,000 – $36,000 = $89,000

Cash payments to suppliers:

= cost of goods sold

= $85,000 – $5,000 = $80,000

Direct Method:

Operating Activities

Operating Activities:

Cash receipts from customers

Cash paid to suppliers

Cash paid for income taxes

Net cash inflow

$ 89000

(80,000)

(6,000)

$ 3,000

Exercise E23-5: Cash Flows from

Operating Activities - Direct Method

• Using the Income Statement and Additional

Information provided

• Prepare the Operating Activities section of the

Statement of Cash Flows

• Year ended December 31, 2005

• Solution follows

Exercise E23-6: Cash Flows from

Operating Activities - Direct Method

Cash Flow from Operating Activities:

Cash receipts from customers (1)

Cash payments to suppliers

for goods and services (2)

Cash payments to and on behalf

of employees (3)

Cash provided by Operating Activities

$6,540,000

(5,130,000)

(795,000)

$ 615,000

Calculations

(1) 6,900,000 – 360,000 = 6,540,000

(2) 4,700,000 + 450,000 + 700,000

- 300,000 (inv.) + 170,000 (ppd.)

+ 275,000 (A/P) – 60,000 (amort.)

- (280,000 + 525,000) (salaries) = 5,130,000

(3) 280,000 + 525,000 – 10,000 = 795,000

Special Items: Amortization

Given:

Property, plant, and equipment

Accumulated amortization

2005

2004

$277,000 $247,000

(178,000) ( 167,000)

Other information:

Amortization expense

$ 33,000

Gain on sale of equipment

$ 14,500

During 2005, equipment costing $45,000 was sold for cash

Present relevant T- accounts and cash flow information.

Special Items:

Amortization - Steps

• Prepare the T-Account for accumulated

amortization and determine the accumulated

amortization on asset sold

• Determine cash from sale of equipment

• Determine any purchases of plant and

equipment (at cost)

• Identify the inflows and outflows affecting the

operating and investing sections

Special Items: Amortization

1 Accumulated Amortization

2

Equipment Sold

Accum. amort. (beg): $167,000

Plus: amortization

expense

$ 33,000

less: amortization on

equipment sold (?)

$ 22,000

Accum. amort. (ending): $178,000

Equipment sold (cost):

$45,000

Less: Accum. amort. on

equipment

22,000

Book value of equipment sold 23,000

Add: Gain on sale

14,500

Cash from sale of equipment $37,500

3 Prop., Plant, & Equipment

Beginning balance:

$247,000

Add: Purchases (?)

$ 75,000

Less: Equipment Sold $ 45,000

Ending balance:

$277,000

4

Cash Flow Statement

Operating Activities:

Amortization – Adjust. $ 33,000

Gain on sale

($14,500)

Investing Activities:

Sale of equipment - inflow $37,500

Asset purchases - outflow ($75,000)

Reporting Significant

Non-Cash Transactions

•

•

•

•

Transactions not involving cash inflows or

cash outflows are non-cash transactions

They are not reported in the body of the

cash flow statement

If material, they are reported as notes to the

statement or in a supplementary schedule to

the financial statements

Example: issue of bonds (payable) for the

purchase of land

Reporting and Disclosure Issues

CICA Handbook, Section 1540 requires the

following disclosure:

1.

2.

3.

4.

Pre-tax cash flows from extraordinary items

Cash flow for interest and dividend payments

Income tax cash flows

Business combination and business unit/segment

disposal cash flows

5. Policy for determining cash and cash equivalents,

and its components

COPYRIGHT

Copyright © 2005 John Wiley & Sons Canada, Ltd.

All rights reserved. Reproduction or translation of

this work beyond that permitted by Access Copyright

(The Canadian Copyright Licensing Agency) is

unlawful. Requests for further information should be

addressed to the Permissions Department, John

Wiley & Sons Canada, Ltd. The purchaser may make

back-up copies for his or her own use only and not

for distribution or resale. The author and the

publisher assume no responsibility for errors,

omissions, or damages caused by the use of these

programs or from the use of the information

contained herein.