Intermediate Accounting, 11th ed.

Kieso, Weygandt, and Warfield

Chapter 23: Statement of Cash

Flows

Chapter 23: Statement of Cash

Flows

After studying this chapter, you should

be able to:

1. Describe the purpose of the statement of

cash flows.

2. Identify the major classifications of cash

flows.

3. Differentiate between net income and

net cash flows from operating activities.

4. Contrast the direct and the indirect

methods of calculating net cash flow

from operating activities.

Chapter 23: Statement of Cash

Flows

5. Determine net cash flows from investing

and financing activities.

6. Prepare a statement of cash flows.

7. Identify sources of information for a

statement of cash flows.

8. Identify special problems in preparing a

statement of cash flows.

9. Explain the use of a work sheet in

preparing a statement of cash flows.

Usefulness of the Statement of

Cash Flows

The information may help users assess

the following aspects:

• The entity’s ability to generate future cash

flows

• The entity’s ability to pay dividends and

meet obligations

• The reasons as to why net income and net

cash flow from operating activities differ

• Cash and non-cash investing and financing

activities during the year

The Cash Flow Statement

The cash flow statement provides

information about:

the cash receipts (cash inflows), and

• uses of cash (cash outflows) during the

period

•

Inflows and outflows are reported for:

• operating activities,

• investing activities, and

• financing activities during the period

Statement of Cash Flows: Concept

Operating

activities

Investing

activities

Financing

activities

inflows

Cash

Pool

Operating

activities

Investing

activities

outflows

Financing

activities

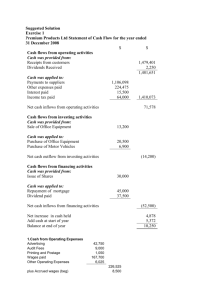

Preparing a Statement of Cash

Flows

There are two methods of preparing

the statement of cash flows:

1. the indirect method and

2. the direct method

The indirect method derives cash

flows from accrual basis statements.

The direct method determines cash

flows directly for each source or use

of cash.

Statement of Cash Flows: Indirect

Method: Concept

Earned

Revenues

+

Eliminate

Non-cash revenues

Net Income

Expenses

Incurred

-

Operating

cash flow

Eliminate

Non-cash charges

The Statement of Cash Flows:

Indirect Method

Accrual Basis Statements

Cash Flow Statement

Income Statement

items & Changes in

Current Assets and

Current Liabilities

Operating activities:

Adjust net income for accruals

and non-cash charges to get

cash flows

Balance Sheet: Changes

In Non-Current Assets

Investing activities:

Inflows from sale of assets and

Outflows from purchases of

assets

Balance Sheet: Changes in

Non-Current Liabilities

and Equity

Financing activities:

Inflows and outflows

from loan and equity

transactions

Direct Method: Operating

Activities

Inflows

• From sales of goods

or services

• From returns on loans

(interest) and returns

on equity securities

(dividends)

Outflows

• To suppliers for

inventory

• To employees for

services

• To government for

taxes

• To lenders for interest

• To others for expenses

Investing and Financing Activities

• For the direct and indirect methods

the sections reporting investing and

financing activities are the same.

• The net inflows or outflows for each

section (under the two methods) are

identical.

• The operating activities are reported

differently.

Format of the Statement of Cash

Flows: Indirect Method

Cash flows from operating activities:

Net Income

Adjustments (to arrive at cash flow from operations)

(List of individual inflows and outflows)

Net cash flow from operating activities

$ XXX

$ XX

$ XXX

Cash flows from investing activities:

(List of individual inflows and outflows)

Net cash flow from investing activities

$ XX

$ XXX

Cash flows from financing activities:

(List of individual inflows and outflows)

Net cash flow from financing activities

$ XX

$ XXX

Major Classes of Cash Receipts

and Payments

Formula to Compute Cash

Receipts from Customers

Formula to Compute Cash

Payments for Operating Expenses

Indirect Method: Special Items

Note the following adjustments to net

income in deriving operating cash flow:

• Loss on sale of assets is added to net income

• Gain on sale of assets is deducted from net

income

• Discount on bonds payable (as amortized) is

added to net income

• Premium on bonds payable (as amortized) is

deducted from net income

Format of the Statement of Cash

Flows: Direct Method

Cash flows from operating activities:

Cash receipts (individually): Inflows

Cash payments to suppliers (separately): outflows

Net cash flow from operating activities

$ XXX

($ XXX)

$ XXX

Cash flows from investing activities:

(List of individual inflows and outflows)

Net cash flow from investing activities

$ XX

$ XXX

Cash flows from financing activities:

(List of individual inflows and outflows)

Net cash flow from financing activities

$ XX

$ XXX

Direct Method: Concept

Cash Receipts

Cash Payments

From sale of

goods and

services to

customers

To suppliers

From receipts

of interest and

dividends

To employees

less

For operating exp equals

For interest

For taxes

Cash

flow

from

operations

Cash Flow Statement: Direct

Method

Cash receipts from customers:

= Revenue from credit sales + Decrease in A/Rec balances

- Increase in A/Rec balances

Cash Flow Statement: Direct

Method

Cash payments to suppliers:

= Cost of goods sold + Increase in inventory

- Decrease in inventory

+ Decrease in accounts payable

- Increase in accounts payable

Cash Flow Statement: Direct

Method

Cash payments for operating and other expenses:

= Operating expenses + Increase in prepaid expenses

- Decrease in prepaid expenses

+ Decrease in accrued expenses payable

- Increase in accrued expenses payable

Reporting Significant Non-Cash

Transactions

• Transactions not involving cash inflows or

cash outflows are non-cash transactions.

• They are not reported in the body of the

cash flow statement.

• If material, they are reported as notes to the

statement or in a supplementary schedule to

the financial statements.

• Example: Issue of bonds (payable) for

purchase of land.

Worksheet

• A work sheet may be useful when a

number of adjustments are needed.

• Involves three steps:

1. Enter beginning and ending balance sheet

data.

2. Enter the data that explains the changes in

balance sheet accounts (other than cash).

3. Enter the increase or decrease in cash on cash

line and at the bottom of the work sheet. This

entry results in the totals of the reconciling

items to agree.

COPYRIGHT

Copyright © 2004 John Wiley & Sons, Inc. All rights reserved.

Reproduction or translation of this work beyond that permitted

in Section 117 of the 1976 United States Copyright Act without

the express written permission of the copyright owner is

unlawful. Request for further information should be addressed

to the Permissions Department, John Wiley & Sons, Inc. The

purchaser may make back-up copies for his/her own use only

and not for distribution or resale. The Publisher assumes no

responsibility for errors, omissions, or damages, caused by the

use of these programs or from the use of the information

contained herein.