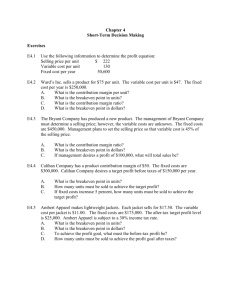

Chapter title

advertisement

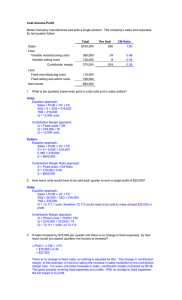

Decision Making and CVP EMBA 5412 Fall 2007 Decision-Making Process Set goals and objectives Gather information Evaluate alternatives Plan and implement Get feedback and revise Mugan 2007 2 Strategic Decision Making Strategic Planning Company policies and plans to reflect how to reach the company goals. Answers the following two major questions: What are the ways of achieving? What to we want to accomplish? Mugan 2007 3 Managerial Accounting • Process of – – – – – Identifying Measuring Analyzing Interpreting Communicating information in pursuit of a company’s goals – Managerial accountants – business partners/consultants in companies – Provides information to managers Mugan 2007 4 Cost Management Perspective • Provide highest quality service/goods with lowest possible cost • Objectives: – Determine cost of resources consumed in company’s activities – Eliminate non-value added activities as much as possible – Determine efficiency and effectiveness of all major activities – Identify and evaluate new activities that can improve the performance of the company Mugan 2007 5 Strategic Cost Management • Value chain – Get raw materials and other resources – Research and development – including quality assessment – Product design – Production – Marketing – Distribution – Customer service • Should understand the value chain • Cost drivers in activities • Managing the cost relationships to a company’s advantage – strategic cost management Mugan 2007 6 Exh. 1.2 The Value Chain R& D Desig n Supply Production Marketing Distribution Customer service Value of products and services Support services •Accounting •Human resources •Legal services •Information systems •Telecommunications Mugan 2007 Primary processes 7 Exh. 1.1 Strategic Position of a Company and its missions • New market potential • Be early entrant • Achieve growth • Capture market share High Return Hold Medium Harvest Low Divest Build • Continuing market • Maintain growth • Be a major player • Protect market share • Continuing market • Maintain cash flow • Maintain volume • Cut costs • Declining market • Exit at lowest cost • Minimize losses • Find a buyer quickly Risk Low Medium Mugan 2007 High 8 Types of Costs The opportunity cost is the monetary amount associated with the next best use of the resource. • differential costs- (benefits) – costs or benefits that change between/among alternatives • Irrelevant costs -Costs that don’t change are irrelevant to the decision • Choose the alternatives where differential benefits exceed differential costs • Opportunity costs • Sunk costs • Controllable /avoidable costs/discretionary costs Costs that have already been incurred and cannot be Mugan changed no matter what action is 2007 taken in the future. 9 Cost Definitions Fixed Costs: Costs incurred when there is no production. Marginal cost: cost of producing (and selling) one more unit = variable costs after the initial production stage Average cost: Total costs divided by number of units produced Mugan 2007 10 Cost Definitions TC = FC + (VC Q) for Q in relevant range Total costs (TC) are a linear function of quantity (Q) produced over a relevant range. Variable Cost (VC): Cost to produce one more unit. Variable cost is a linear approximation of marginal opportunity costs. Fixed Cost (FC): Predicted total costs with no production (Q=0). Relevant Range: Range of production quantity (Q) where a constant variable cost is a reasonable approximation of opportunity cost. Mugan 2007 11 Cost Curve Total Cost –Mixed Cost Y Total Cost Variable Cost per unit or marginal cost Average Cost Fixed Cost X Mugan 2007 12 Cost Drivers • Cost driver: units of physical activity most highly associated with total costs in an activity center Examples of cost drivers: – – – – Quantity produced Direct labor hours Number of set-ups Number of orders processed • Different activity drivers might be used for different decisions • Costs could be fixed, variable, or mixed in different situations Mugan 2007 13 Cost Estimation Example • • • In each month, Exclusive Billiards produces between 4 to 10 pool tables. The plant operates on 40-hr shift to produce up to seven tables. Producing more than seven tables requires the craftsmen to work overtime. Overtime work is paid at a higher hourly wage. The plant can add overtime hours and produce up to 10 tables per month. The following table contains the total cost of producing between 4 and 10 pool tables. Required: a. compute average cost per pool table for 4 to 10 tables Estimate fixed costs per month. Pool Tables Total Cost 4 5 6 7 8 9 10 62800 66000 69200 72400 75800 79200 82600 Pool Tables Total Cost Variable Cost Average Cost 4 62.800 15.700 5 66.000 3.200 13.200 6 69.200 3.200 11.533 7 72.400 3.200 10.343 8 75.800 3.400 9.475 9 79.200 3.400 8.800 10 82.600 3.400 8.260 FC= FC= Mugan 2007 TC VC 66.000 4 x 3200= 12800 50.000 14 Format of Income Statement Financial Accounting (traditional – required for financial statements and tax ) Sales Revenue - Cost of goods sold (product costs) = Gross profit - General, selling, administrative, and taxes (period costs) = Net income Decision Making( useful for managers – internal oriented) Revenue - Variable costs (product and selling and administration) = Contribution margin - Fixed costs and taxes( product and selling and administration) = Net income Mugan 2007 15 Income Statement Example FM Manufacturing Company has sales of TL 1.800.000 for the first quarter of 2008. In selling 6.000 units of gadgets the company incurred the following costs: Variable Fixed Cost of Goods Sold 750.000 540.000 Selling Expenses 95.000 60.000 Administrative Expenses 80.000 65.000 Prepare a traditional and a CVP income statement for the first quarter of 2008. Mugan 2007 16 Income Statement Example Traditional Income Statement FM Manufacturing Income Statement For the first Quarter 2008 Sales 1.800.000 TL Cost of Goods Sold (1.290.000) Gross Margin 510.000 Selling Expenses (155.000) Administrative Expenses (145.000) Net Income Before Tax 210.000 TL CVP Income Statement FM Manufacturing Income Statement For the first Quarter 2008 Sales (5000 units) 1.800.000 TL Variable Costs: Production Costs 750.000 Selling Expenses 95.000 Administrative Expenses 80.000 Total Variable Costs 925.000 Contribution Margin 875.000 Fixed Costs: Production Costs 540.000 Selling Expenses 60.000 Administrative Expenses 65.000 Total Fixed Costs 665.000 Net Income Before Tax 210.000 TL Mugan 2007 17 CVP definitions Cost-Volume-Profit (C-V-P) analysis is very useful for production and marketing decisions. Contribution margin equals price per unit minus variable cost per unit: CM = (P – VC). Total contribution margin equals total revenue minus total variable costs: (CM Q) = (P - VC) Q. Mugan 2007 18 COST VOLUME PROFIT ANALYSIS • HELPFUL TO UNDERSTAND THE RELATIONSHIP AMONG VARIABLE COSTS, FIXED COSTS AND PROFIT • BASIC ASSUMPTIONS: – SELLING PRICE IS CONSTANT – COSTS ARE LINEAR AND CAN BE DIVIDED INTO FIXED AND VARIABLE – FIXED ELEMENT CONSTANT OVER THE RELEVANT RANGE – UNIT VARIABLE COST CONSTANT OVER THE RELEVANT RANGE – SALES MIX IS CONSTANT – INVENTORIES STAY AT THE SAME LEVEL Mugan 2007 19 Basics of Cost-Volume-Profit Analysis CVP Income Statement FM Manufacturing Income Statement For the first Quarter 2008 Sales (5000 units) 1.800.000 TL Variable Costs: Production Costs 750.000 Selling Expenses 95.000 Administrative Expenses 80.000 Total Variable Costs 925.000 Contribution Margin 875.000 Fixed Costs: Production Costs 540.000 Selling Expenses 60.000 Administrative Expenses 65.000 Total Fixed Costs 665.000 Net Income Before Tax 210.000 TL Mugan 2007 CM is used first to cover fixed expenses. Any remaining CM contributes to net operating income. 20 The Contribution Approach Sales, variable expenses, and contribution margin can also be expressed on a per unit basis. If FM sells an additional gadget, TL 175 additional CM will be generated to cover fixed expenses and profit. FM Manufacturing Income Statement For the first Quarter 2008 Sales (5000 units) 1.800.000 TL Variable Costs: Production Costs 750.000 Selling Expenses 95.000 Administrative Expenses 80.000 Total Variable Costs 925.000 Contribution Margin 875.000 Fixed Costs: Production Costs 540.000 Selling Expenses 60.000 Administrative Expenses 65.000 Total Fixed Costs 665.000 Net Income Before Tax 210.000 TL Per Unit selling price 360 TL Unit Cost Unit Sell. Exp Unit Adm. Exp variable cost per unit (vcu) contribution margin per unit (cmu) 150 TL 19 TL 16 TL 185 TL 175 TL Mugan 2007 21 The Contribution Approach CVP Income Statement FM Manufacturing Income Statement For the first Quarter 2008 Sales (5000 units) 1.800.000 TL Variable Costs: Production Costs 750.000 Selling Expenses 95.000 Administrative Expenses 80.000 Total Variable Costs 925.000 Contribution Margin 875.000 Fixed Costs: Production Costs 540.000 Selling Expenses 60.000 Administrative Expenses 65.000 Total Fixed Costs 665.000 Net Income Before Tax 210.000 TL Mugan 2007 Each month FM must generate at least TL 665.000 in total CM to break even. 22 The Contribution Approach If FM sells 3800 units in a quarter, it will be operating at the break-even point. CVP Income Statement FM Manufacturing Income Statement For the first Quarter 2008 Sales (5000 units) 1.368.000 TL Variable Costs: Production Costs 570.000 Selling Expenses 72.200 Administrative Expenses 60.800 Total Variable Costs 703.000 Contribution Margin 665.000 Fixed Costs: Production Costs 540.000 Selling Expenses 60.000 Administrative Expenses 65.000 Total Fixed Costs 665.000 Net Income Before Tax 0 TL Mugan 2007 23 The Contribution Approach If FM sells one more gadget (3801 gadgets), net operating income will increase by TL 175. CVP Income Statement FM Manufacturing Income Statement For the first Quarter 2008 Sales (5000 units) 1.368.360 TL Variable Costs: Production Costs 570.150 Selling Expenses 72.219 Administrative Expenses 60.816 Total Variable Costs 703.185 Contribution Margin 665.175 Fixed Costs: Production Costs 540.000 Selling Expenses 60.000 Administrative Expenses 65.000 Total Fixed Costs 665.000 Net Income Before Tax 175 TL Mugan 2007 24 The Contribution Approach We do not need to prepare an income statement to estimate profits at a particular sales volume. Simply multiply the number of units sold above break-even by the contribution margin per unit. If FM sells 4000 gadgets, its net income will be 35.000 TL. Mugan 2007 25 Break-Even Analysis Break-even analysis can be approached in two ways: 1. Equation method 2. Contribution margin method Mugan 2007 26 EQUATION METHOD-1 SALES= VARIABLE COSTS+FIXED COSTS + PROFIT p*q= vcu *q + FC + ¶ p= price; q=quantity sold (in terms of units) vcu=variable cost per unit = VC/ q;(includes both manufacturing and selling and administrative) FC= total fixed costs; ¶= profit AT BREAKEVEN PROFIT = 0 p*q=vcu *q +FC q * (p-vcu) = FC BREAKEVEN in units sold: (q) q= FC ÷ (p - vcu) OR q=FC ÷ cmu Breakeven Sales amount = selling price x breakeven quantity Mugan 2007 27 EQUATION METHOD-2 Sales = (Variable Cost Ratio x Sales) + Fixed Costs + Profit VCR = Variable Cost Ratio FC = total fixed costs (both manufacturing, and selling and administrative) AT BREAKEVEN PROFIT = 0 Sales = (Sales x VCR) + FC + 0 Therefore Sales amount (monetary terms) at breakeven point is Sales (breakeven)= FC ÷ (1-VCR) BREAKEVEN in units sold= Sales (breakeven) ÷ selling price Mugan 2007 28 Sensitivity Analysis EFFECT OF CHANGE IN FIXED COSTS? EFFECT OF CHANGE IN VARIABLE COSTS? EFFECT OF CHANGE IN SELLING PRICE? Mugan 2007 29 Break-Even Analysis Here is the information from FM Company: Cost and price information Selling Price (p) Per Unit TL 360 100,00% Variable Manufacturing Cost 150 Variable Selling Expense 19 Variable Administrative Expense 16 Variable Cost per Unit (vcu) 185 Contribution Margin per Unit (cmu) 175 Total Fixed Costs TL 665.000 Mugan 2007 51,39% 48,61% 30 Equation Method-1 We can calculate the break-even point as follows: Sales = Variable expenses + Fixed expenses + Profits 360q = 185q + 665.000 + 0 Where: q = Number of gadgets sold TL 360 = Unit selling price TL 185 = Unit variable expense TL 665.000 = Total fixed expense Breakeven units = q= 3800 gadgets Mugan 2007 31 Equation Method-2 The equation can be modified to calculate the break-even point in sales dollars. Sales = Variable expenses + Fixed expenses + Profits X = 0,5139X + 665.000 + 0 Where: X = Total sales amount 0,5139 = Variable expenses as a % of sales TL 665.000 = Total fixed expenses Breakeven Sales amount = Sales (BE) = TL 1.368.000* *rounding error might occur Mugan 2007 32 Reconciliation of the Equation Method 1 and 2 From equation method 1: Breakeven units: 3800 gadgets x price 360= TL 1.368.000 = sales amount at breakeven From equation 2: Breakeven sales amount: 1.368.000 ÷ TL 360 per unit= 3800 gadgets = breakeven units Mugan 2007 33 CONTRIBUTION MARGIN RATIO CMR= CONTRIBUTION MARGIN RATIO = CM / SALES OR cmu/p VCR = VARIABLE COST RATIO = VC/SALES OR vcu/p CM= SALES - TOTAL VC VC= SALES – CM (variable costs include both manufacturing and selling and administrative variable costs) cmu =CONTRIBUTION MARGIN PER UNIT= p - vcu=CM/q CM = total contribution margin vcu= variable cost (manufacturing and selling and administrative per unit) p= selling price cmu = contribution margin per unit CMR +VCR= 1 Mugan 2007 34 Contribution Margin Method The contribution margin method has two key equations. Break-even point = in units sold Break-even point in total sales dollars = Fixed expenses Unit contribution margin Fixed expenses CM ratio Mugan 2007 35 Contribution Margin Method Let’s use the contribution margin method to calculate the breakeven sales amount at FM Company. Break-even point in total sales dollars = Fixed expenses CM ratio TL 665.000 = TL 1.368.000 break-even sales 48,61% Mugan 2007 36 PROFIT ANALYSIS • AT BREAKEVEN PROFIT = 0 • BEFORE BREAKEVEN LOSS; AFTER BREAKEVEN PROFIT • CM COVERS FIXED COST UPTO BREAKEVEN POINT • AFTER BREAKEVEN POINT INCREASE IN CM WILL INCREASE NET INCOME • CM = FC + INCOME BEFORE TAX Mugan 2007 37 Basic Analysis using CVP • EFFECT OF CHANGE IN FIXED COSTS? • EFFECT OF CHANGE IN VARIABLE COSTS? • EFFECT OF CHANGE IN SELLING PRICE? Mugan 2007 38 Target Profit Analysis The equation and contribution margin methods can be used to determine the sales volume needed to achieve a target profit. Suppose FM Company wants to know how many gadgets must be sold to earn a before tax profit of TL100,000. Mugan 2007 39 The CVP Equation Method Sales = Variable expenses + Fixed expenses + Profits 360q = 185q + 665.000 + 100.000 Where: q = Number of gadgets sold TL 360 = Unit selling price TL 185 = Unit variable expense TL 665.000 = Total fixed expense TL 100.000 = profit BEFORE tax Target income units = q= 4372*gadgets *rounded up Mugan 2007 40 The Contribution Margin Approach Unit sales to attain = the target profit Fixed expenses + Target profit Unit contribution margin TL 665.000 + TL100,000 = 4372 TL175 per gadget gadgets Or TL 100.000 ÷ TL 175 = 572 more units after the breakeven point need to be sold 3800+572= 4372 gadgets Mugan 2007 41 Target Income –after tax profit Assume that FM Company’s tax rate is 20%; and the company wants an after-tax income of TL 100.000. How many units must it sell? After tax TL 100.000 ÷0.8 (after tax percent of net income) = Before Tax income of TL 125.000 Then the company needs to sell after breakeven TL 125.000 ÷ TL 175 = 715*(rounded up) more units 3800(breakeven )+715(units after breakeven) = 4515 gadgets Mugan 2007 42 The Margin of Safety • The margin of safety is the excess of budgeted (or actual) sales over the breakeven amount of sales. • The margin of safety can also be expressed as – % of sales – Units Margin of safety = Total sales - Break-even sales MoS TL = ACTUAL OR BUDGETED SALES - BREAKEVEN SALES $ MoS % = MoS TL / ACTUAL OR BUDGETED SALES MoS units = MoS TL / selling price Mugan 2007 43 The Margin of Safety FM Company FM Manufacturing Income Statement For the first Quarter 2008 Sales units Sales Variable Costs: Production Costs Selling Expenses Administrative Expenses Total Variable Costs Contribution Margin Fixed Costs: Production Costs Selling Expenses Administrative Expenses Total Fixed Costs Net Income Before Tax CURRENT SALE 5.000 1.800.000 TL BREAKEVEN 750.000 95.000 80.000 925.000 875.000 570.000 72.200 60.800 703.000 665.000 540.000 60.000 65.000 665.000 210.000 TL 540.000 60.000 65.000 665.000 0 3.800 1.368.000 Margin of safety = 1.800.000 - 1.368.000= TL 432.000 MoS % = MoS units = 432.000 ÷ 1.800.000= 24% 432.000 ÷ 360 = 1200 gadgets Mugan 2007 44 Cost Structure and Profit Stability Cost structure refers to the relative proportion of fixed and variable costs in an organization. Managers often have some latitude in determining their organization’s cost structure. Mugan 2007 45 Operating Leverage • The effect of cost structure on operating income • Higher operating leverage – very sensitive to changes in sales volume Degree of Contribution margin = operating leverage Operating income Mugan 2007 46 Operating Leverage At FM, the degree of operating leverage is. FM Manufacturing Income Statement For the first Quarter 2008 Sales units Sales Variable Costs: Production Costs Selling Expenses Administrative Expenses Total Variable Costs Contribution Margin Fixed Costs: Production Costs Selling Expenses Administrative Expenses Total Fixed Costs Net Income Before Tax CURRENT SALE 5.000 1800000 750.000 95.000 80.000 925.000 875.000 540.000 60.000 65.000 665.000 210.000 Mugan 2007 TL 875.000 =4,17 TL 210.000 If sales increase by 10% income is going increase by 41,67% 47 Cost Structure and Profitability • High variable costs lead to lower CM and less vulnerable in crisis time • High fixed costs cause higher breakeven point; after the breakeven point profits increase faster than the high variable cost company • Degree of operating leverage effects: – For a given % change in sales, income will increase by (% increase in sales *degree of operating leverage) – Degree of operating leverage decreases as the sales move away from the breakeven point – If variable costs are high degree of operating leverage low; and vice versa Mugan 2007 48 Structuring Sales Commissions Companies generally compensate salespeople by paying them either a commission based on sales or a salary plus a sales commission. Commissions based on sales dollars can lead to lower profits in a company. Let’s look at an example. Mugan 2007 49 Structuring Sales Commissions Pipeline Unlimited produces two types of surfboards, the XR7 and the Turbo. The XR7 sells for $100 and generates a contribution margin per unit of $25. The Turbo sells for $150 and earns a contribution margin per unit of $18. The sales force at Pipeline Unlimited is compensated based on sales commissions. Mugan 2007 50 Structuring Sales Commissions If you were on the sales force at Pipeline, you would push hard to sell the Turbo even though the XR7 earns a higher contribution margin per unit. To eliminate this type of conflict, commissions can be based on contribution margin rather than on selling price alone. Mugan 2007 51 The Concept of Sales Mix • Sales mix is the relative proportion in which a company’s products are sold. • Different products have different selling prices, cost structures, and contribution margins. Mugan 2007 52 Multiple Products Example • Let’s assume Han sells synthetic fiber filled and dawn feather sleeping bags. Then we’ll calculate a break-even point that encompasses both products and their cost-price parameters. Description Synthetic Dawn Feather Total sold Total Sales 250.000 300.000 550.000 % of Total 45,5% (250000 ÷ 550000) 54,5% (300000 ÷ 550000) 100,0% Mugan 2007 53 Multiple Products Example Cost other related information Description Synthetic Dawn Feather Total sold Fixed Costs Number Selling Unit Unit of price variable contribution sleeping cost margin bags 500 TL 300 TL 200 TL 500 1.000 450 550 300 800 TL 170.000 Mugan 2007 54 Multiple Products Example Description Synthetic Daw n Feather Selling Unit Unit Sales Mix price variable contribution Contribution % cost margin Margin Ratio (amount) 500 TL 300 TL 1.000 450 200 TL 550 Weighted CMR 40,00% 45,50% 55,00% 54,50% 48,18% Breakeven Sales Amount = TL 170.000 ÷ 48.18% = TL 352.880 Mugan 2007 55 Multiple Products Example At Breakeven Han needs to sell of each product Synthetic Dawn Feather * rounded up to the next whole unit Sale Amount Number of Breakeven Sale of Each Selling bags to be Sales mix Amount TL Product TL Price TL sold* 45,50% 352.880 160.560 500 322,00 54,50% 192.320 1.000 193,00 Or we can use the following method Mugan 2007 56 Multiple Products Example Weighted-average unit contribution margin Contribution Weighted Description % of total margin contribution Synthetic 200 62,5% 125 Dawn Feather 550 37,5% 206,25 Weighted-average contribution margin 331 TL 200 × 62.5% Mugan 2007 57 Multiple Products Example The break-even point is 514 combined units. We can use the sales mix to find the number of units of each product that must be sold to break even. Break-even Fixed expenses = point Weighted-average unit contribution margin Break-even = point 170,000 331.25 Break-even = 514 combined units point Mugan 2007 58 Multiple Products Example Combined break-even sales 514 Product Synthe tic Daw n Fe athe r Total units % of total 62,5% 37,5% Individual sales 321 193 514 The break-even point of 514 units is valid only for the sales mix of 62.5% and 37.5%. Sales amount to break even: There is a slight difference between the results of the approaches due to rounding. Number of Selling bags to be Total Price TL sold Sales 500 321,00 160.500 1.000 193,00 193.000 353.500 Mugan 2007 59 In Class – Multiple Customers Cali sells PROD 1.0 which is a top electronic spreadsheet product. Now, the company is coming up with the new version –PROD 2.0. The company offers the new version at substantially lower prices to customers who has PROD 1.0 (upgrade customers). Cali plans to sell 200.000 units of PROD 2.0 and wants to have a net income of TL 7.000.000 after tax. Current tax rate is 20%. The expected sales mix in units is 60% new customers; and 40% upgrade customers. Cali management wants to know: • What the expected breakeven in units and TLs for PROD 2.0 at 60/40 sales mix. • Whether they will be able to attain its target income with the expected sales level and sales mix. • What the optimal sales mix is. Relevant information appear in the following slide. Mugan 2007 60 In Class – Multiple Customers Cali Cost and Revenue Information New Customer Selling Price Variable Costs: Production Costs Selling Expenses Total Variable Costs Contribution Margin Fixed Costs: Production Costs Selling Expenses Administrative Expenses Total Fixed Costs Mugan 2007 Upgrade Customers 210 120 25 65 90 120 25 15 40 80 9.000.000 3.000.000 2.000.000 14.000.000 9.000.000 3.000.000 2.000.000 14.000.000 61 Solution to CALI Modeling Multiple Cost Drivers An insight from activity-based costing: costs may be a function of multiple activities, not merely sales volume. Some costs treated as fixed (when sales volume is the only activity) may now be considered variable. Total Cost = (Unit variable cost × Sales units) + (Batch cost × Batch activity) + (Product cost × Product activity) + (Customer cost × Customer activity) + (Facility cost × Facility activity) Mugan 2007 63 Multiple Cost Drivers • Variable costs may arise from multiple cost drivers or activities. A separate variable cost needs to be calculated for each driver. Examples include: – Customer or patient count – Passenger miles – Patient days – Student credit-hours – Set-up Costs – number of setups Mugan 2007 64 Multiple Cost Drivers EMBA Company produces a single product with the following costs: Selling price: TL 200 Variable production costs per product TL 120 Variable gift wrapping costs TL 10 per customer Fixed costs TL 4500 Determine the breakeven sales. Mugan 2007 65 Multiple Cost Drivers Operating Income = Sales – (Variable production cost x number of units sold) - ( Variable gift wrapping cost x number of customers) - Fixed Costs Rev/Cost per unit/customer (TL) Sales Variable Production costs Variable Packaging costs Total Variable Costs Contribution margin Fixed Costs Operating Income Number of products sold 150 200 120 10 Number of Total Rev/ Customers Cost (TL) 150 30.000 18.000 1500 30.000 18.000 1.500 19.500 10.500 4.500 6.000 If EMBA sells 150 products to 100 customers? Mugan 2007 66 Multiple Cost Drivers Rev/Cost per unit/customer (TL) Sales Variable Production costs Variable Packaging costs Total Variable Costs Contribution margin Fixed Costs Operating Income Number of products sold 150 200 120 10 Number of Total Rev/ Customers Cost (TL) 100 30.000 18.000 1000 30.000 18.000 1.000 19.000 11.000 4.500 6.500 Number of units sold is NOT the only determinant of operating income; there are two cost drivers – the number of units sold; and – the number of customers Mugan 2007 67 Multiple Cost Drivers • There is no unique breakeven point Rev/Cost per unit/customer (TL) Sales Variable Production costs Variable Packaging costs Total Variable Costs Contribution margin Fixed Costs Operating Income Number of products sold 60 200 120 10 Rev/Cost per unit/customer (TL) Sales Variable Production costs Variable Packaging costs Total Variable Costs Contribution margin Fixed Costs Operating Income Number of Total Rev/ Customers Cost (TL) 30 12.000 7.200 12.000 7.200 300 7.500 4.500 4.500 0 300 Number of products sold 57 200 120 10 Mugan 2007 Number of Customers Total Rev/ Cost (TL) 6 11.400 6.840 60 11.400 6.840 60 6.900 4.500 4.500 0 68 In Class – CVP multiple cost drivers Sade Comp is a distributor of special dolls. For 2008, Seyda, the manager, plans to purchase the dolls for TL 30 each and sell them for TL 45 each. Sade’s fixed costs are expected to be TL 240.000. Seyda’s only other costs will be variable costs of TL 60 per shipment for each customer regardless of the number of dolls in the order. Seyda wants to know: How much operating income will be if she sell 40,000 dolls in 1.000 shipments? 800 shipments? She estimates that she can make 500 shipments in 2008. She wants to know how many dolls she needs to sell to breakeven. Is this the only breakeven point? Can she have other breakeven points if she can make more or less shipments? Mugan 2007 69 Solution to Sade Company USING CVP with Absorption Costing • Poli Company produces and sells coffee mugs. Cost and revenue related information is provided below. Selling price per unit variable manufacturing, cost per unit Fixed Manufacturing Costs Variable selling and administrative costs Fixed Selling and Administrative costs Contribution Margin per unit Mugan 2007 13 6 100.000 2 0 5 71 USING CVP with Absorption Costing Determine the break-even point under contribution approach. Breakeven for Variable Costing: Fixed Costs: manuf and selling Contribution Margin per unit Breakeven units Mugan 2007 100.000 5 20000 72 USING CVP with Absorption Costing • If the company uses absorption costing and wants to determine the breakeven point, three cases arise. Case 1 sales = production inventory beginning - units inventory ending - units production units sales units contribution margin per unit fixed manufacturing costs fixed manufacturing costs per unit-current fixed manufacturing costs per unit-previous period unit sold from inventory fixed cost absorbed in units sold fixed cost absorbed in inventories-beginning fixed cost absorbed in inventories-ending total fixed manufacturing costs breakeven units Mugan 2007 10.000 10.000 25.000 25.000 5 100.000 4 4 0 100.000 40.000 40.000 100.000 20.000 73 USING CVP with Absorption Costing • Let’s prove: at 20,000 units – sales=production Absorption Income Statement Case 1 sales = production Sales Cost of Goods Sold: Variable Manuf Costs Fixed Manuf Costs Gross Margin Selling and Administrative Costs Variable Fixed Net Income Before Tax Variable Costing Income Statement Case 1 sales = production 260.000 Sales Variable Costs: 120.000 Manufacturing 100.000 Selling, administrative 220.000 40.000 Contribution Margin Fixed Costs: 40.000 Manufacturing 0 Selling, administrative 40.000 260.000 120.000 40.000 160.000 100.000 100.000 0 100.000 0 Net Income Before Tax Mugan 2007 0 74 USING CVP with Absorption Costing Case 2 sales < production inventory beginning - units inventory ending - units production units sales units contribution margin per unit fixed manufacturing costs fixed manufacturing costs per unit-current fixed manufacturing costs per unit-previous period unit sold from inventory fixed cost absorbed in units sold fixed cost absorbed in inventories-beginning fixed cost absorbed in inventories-ending total fixed manufacturing costs breakeven units Mugan 2007 10.000 15.000 25.000 20.000 5 100.000 4 4 (5.000) 80.000 40.000 60.000 80.000 16.000 75 USING CVP with Absorption Costing Absorption Income Statement at breakeven per absorption Case 2 sales < production Sales Cost of Goods Sold: Variable Manuf Costs Fixed Manuf Costs Gross Margin Selling and Administrative Costs Variable Fixed Variable Costing Income Statement at breakeven per absorption Case 2 sales < production 208.000 Sales Variable Costs: 96.000 Manufacturing 80.000 Selling, administrative 176.000 32.000 Contribution Margin Fixed Costs: 32.000 Manufacturing 0 Selling, administrative 32.000 Net Income Before Tax 0 Net Income Before Tax 208.000 96.000 32.000 128.000 80.000 100.000 0 100.000 (20.000) Amount of fixed manufacturing costs absorbed in the units sold Amount of fixed manufacturing costs absorbed in the increase in ending Muganinventory 2007 76 USING CVP with Absorption Costing Case 3 sales > production inventory beginning - units inventory ending - units production units sales units contribution margin per unit fixed manufacturing costs fixed manufacturing costs per unit-current fixed manufacturing costs per unit-previous period unit sold from inventory fixed cost absorbed in units sold fixed cost absorbed in inventories-beginning fixed cost absorbed in inventories-ending total fixed manufacturing costs breakeven units Mugan 2007 10.000 5.000 25.000 30.000 5 100.000 4 4 5.000 120.000 40.000 20.000 120.000 24.000 77 USING CVP with Absorption Costing Absorption Income Statement at breakeven per absorption Case 3 sales > production Sales Cost of Goods Sold: Variable Manuf Costs Fixed Manuf Costs Gross Margin Selling and Administrative Costs Variable Fixed Variable Costing Income Statement at breakeven per absorption Case 3 sales > production 312.000 Sales Variable Costs: 144.000 Manufacturing 120.000 Selling, administrative 264.000 48.000 Contribution Margin Fixed Costs: 48.000 Manufacturing 0 Selling, administrative 48.000 Net Income Before Tax Amount of fixed manufacturing costs absorbed in the units sold 312.000 144.000 48.000 192.000 120.000 100.000 0 100.000 0 Net Income Before Tax Amount of fixed manufacturing costs Mugan 2007 absorbed in the increase in ending inventory 20.000 78 With fixed selling and admin costs Case 1 sales = production inventory beginning - units inventory ending - units production units sales units contribution margin per unit fixed manufacturing costs fixed manufacturing costs per unit-current fixed manufacturing costs per unit-previous period unit sold from inventory fixed cost absorbed in units sold fixed cost absorbed in inventories-beginning fixed cost absorbed in inventories-ending total fixed manufacturing costs fixed selling and administrative TOTAL FIXED COSTS breakeven units Case 1 sales = production Case 1 sales = production Absorption Income Statement Variable Income Statement Sales 286.000 Sales Cost of Goods Sold: Variable Costs: Variable Manuf Costs 132.000 Manufacturing Fixed Manuf Costs 100.000 Selling, administrative 232.000 Gross Margin 54.000 Contribution Margin 10.000 10.000 25.000 25.000 5 100.000 4 4 Selling and Administrative Costs Fixed Costs: 0 Variable 44.000 Manufacturing 100.000 Fixed 10.000 Selling, administrative 40.000 54.000 40.000 100.000 Net Income Before Tax 0 Net Income Before Tax 10.000 110.000 22.000 Mugan 2007 286.000 132.000 44.000 176.000 110.000 100.000 10.000 110.000 0 79 With fixed selling and admin costs Case 2 sales < production Case 2 sales < production Absorption Income Statement Sales Cost of Goods Sold: Variable Manuf Costs Fixed Manuf Costs Case 2 sales < production Variable Income Statement 234.000 Sales 234.000 Variable Costs: 108.000 Manufacturing 108.000 80.000 Selling, administrative 36.000 188.000 144.000 46.000 Contribution Margin 90.000 inventory beginning - units 10.000 inventory ending - units 15.000 production units 25.000 sales units 20.000 contribution margin per unit 5 fixed manufacturing costs 100.000 Gross Margin fixed manufacturing costs per unit-current 4 fixed manufacturing costs per unit-previous period 4 Selling and Administrative Costs Fixed Costs: unit sold from inventory (5.000) Variable 36.000 Manufacturing fixed cost absorbed in units sold 80.000 Fixed 10.000 Selling, administrative fixed cost absorbed in inventories-beginning 40.000 46.000 fixed cost absorbed in inventories-ending 60.000 total fixed manufacturing costs 80.000 Net Income Before Tax 0 Net Income Before Tax fixed selling and administrative 10.000 TOTAL FIXED COSTS 90.000 breakeven units 18.000 Mugan 2007 100.000 10.000 110.000 (20.000) 80 With fixed selling and admin costs Case 3 sales > production inventory beginning - units inventory ending - units production units sales units contribution margin per unit fixed manufacturing costs fixed manufacturing costs per unit-current fixed manufacturing costs per unit-previous period unit sold from inventory fixed cost absorbed in units sold fixed cost absorbed in inventories-beginning fixed cost absorbed in inventories-ending total fixed manufacturing costs fixed selling and administrative TOTAL FIXED COSTS breakeven units Case 3 sales > production Absorption Income Statement Sales Cost of Goods Sold: Variable Manuf Costs Fixed Manuf Costs Case 3 sales > production Variable Income Statement 338.000 Sales 338.000 Variable Costs: 156.000 Manufacturing 156.000 120.000 Selling, administrative 52.000 276.000 208.000 62.000 Contribution Margin 130.000 10.000 5.000 25.000 30.000 5 100.000 Gross Margin 4 4 Selling and Administrative Costs Fixed Costs: 5.000 Variable 52.000 Manufacturing 120.000 Fixed 10.000 Selling, administrative 40.000 62.000 20.000 120.000 Net Income Before Tax 0 Net Income Before Tax 10.000 130.000 26.000 Mugan 2007 100.000 10.000 110.000 20.000 81