Consumer Purchasing and Legal Protection Chpt8

advertisement

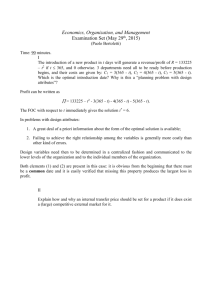

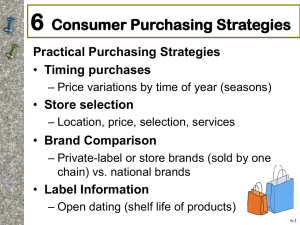

Objectives 1. 2. 3. 4. Identify strategies for effective consumer buying Implement a process for making consumer purchases Describe steps to take to resolve consumer problems Evaluate legal alternatives available to consumers Daily buying decisions involve trade-offs Wide variety of economic, social and personal factors affect daily buying habits Long term stability is achieved by not spending the entire current income Overspending leads to misuse of credit Timing purchases. Store selection. Be aware if the price varies with the time of the year. The retailer you use depends on a variety of factors. Once choice is a cooperative, which is a nonprofit organization, and members save money. Comparison shopping of store and national brands, or impulse buying (unplanned purchasing). Look for information on the label and open dating (continued) Price comparison. Unit pricing provides a standard of measurement. Coupons (online: coolsavings.com; centsoff.com; couponsurfer.com) and rebates (partial refund). More convenience, and ready-to-use products, may mean higher prices. Large is not always the best buy, and “Sale” prices vary among stores. Evaluate warranties. Full or limited express warranties, usually written. Implied warranties of merchantability. Service contracts -also called extended “warranties.” Phase 1-Preshopping Activities Problem identification. Information gathering. Personal Contacts Business Organizations Media Information Independent Testing Organizations Government Agencies Online Sources Phase 2: Evaluation of Alternatives Price analysis. (continued) Prices can vary for all types of products. Assess differences in quality in relation to price. Price and quality are not always closely related. Comparison shopping can be beneficial when... Buying expensive or complex items. Buying items that you purchase often. It can be done easily with advertisements, catalogs, or online. Different sellers offer different prices and services. Product quality or prices vary greatly. Mechanical devices. Engine size, transmission, power steering, cruise control, and antilock brakes. Comfort and convenience options. Power seats, air conditioning. Stereo systems, power locks. Aesthetic features. Metallic paint. Special Trim. Common sources of used cars include New-car dealers Used-car dealers Private sales Auctions and dealers sell previously owned cars Used-car superstores Online used-car businesses Advantages. Small cash outflow. Lower monthly payments than buying. Lease provides detailed records - helps if you use your car for business purposes. Disadvantages. No ownership interest. Must meet requirements. May have additional costs for extra mileage, turning the car in early, or for certain repairs. Capitalized cost - the price of the vehicle. Average buyer pays 92% of list, average person who leases pays 96% of list. Money factor - interest rate. Monthly payment amount and number of payments. The residual value - expected value of the vehicle at the end of the lease. You may decide to return, keep, or sell the vehicle. If the residual value is less than market value, return it. Negotiation may be used in some buying situations. Used-Car Price Negotiation Price information sources Have all the necessary information. Deal with a person who has the authority to give you a lower price or additional features. Edmund’s Used Car Prices or edmunds.com NADA Official Used Car Guide. Kelly Blue Book kbb.com The more new cars sold the more used cars there are for sale, keeping the prices down. Sticker price - suggested retail price. It includes the base price of the vehicle plus accessories. Invoice price - dealers cost. Know the dealer’s cost by consulting... Consumer Reports www.consumerreports.or g Edmund’s New Car Prices www.Edmund's.com Buy in winter, early spring or end-of-month. Price bargaining - compare dealers. Set-price dealers. Car buying services. Also called an auto broker. $50-$200 over dealer’s cost. Online car buying (continued) www.autobytel.com or autoadvisor.com. The sales agreement - specific details. Consumer protection for new-car buyers. Warranties and lemon laws. Financing sources. Consider the length of the loan. Banks, credit unions, other financial institutions, finance companies, or dealer financing. Get preapproved for a certain amount. Upside down equity means that your car is worth less that what you still owe on your car loan. Check the APR and any rebates. Three days to cancel some contracts of =>$25. Maintenance and ownership costs may be associated with some purchases. Use the item correctly to have improved performance and fewer repairs. Investigate, evaluate and negotiate a variety of servicing options. Complain if you are not satisfied with a purchase. Consider what you have learned from the purchase. Fixed Costs. Depreciation is the largest fixed cost. Insurance. License, registration and taxes. Variable Costs. Gas and oil changes. Tires, other wear and tear items. Maintenance and repairs. (continued) Keep good expense records. Follow the maintenance schedule in the manual. Vehicle servicing options. Car dealers. Automobile repair shops. Service stations. Department and discount stores. Specialty shops such as oil/lube, muffler, transmission, and tire shops Be alert for signs of fraud.