Chapter 8

Consumer

Purchasing

Strategies and

Legal Protection

McGraw-Hill/Irwin

Copyright © 2007 by The McGraw-Hill Companies, Inc. All rights reserved.

Financial Implications of

Purchasing Decisions

• Commonly overlooked trade-offs

when buying include…

Paying a higher price over time by using credit

to buy items you need now.

Buying unknown, possibly poor-quality brands,

that are less expensive.

Selecting brands that may be difficult to service

or repair.

Ordering by mail or online to save time and

money, but return or repair may be difficult.

Taking time and effort to comparison shop.

8-2

Social Factors

Economic Factors

Consumer prices

Interest rates

Lifestyle

Culture

Supply/demand

Brand name

Warranty

Product Quality

Attitudes

Ads

Media/Internet

Hobbies

Consumer

Buying

Influences

Peer

Tax rates

Govt. regs.

group

Personal Factors

Sex and age

Marital status

Occupation

Income

Education

Family size

Housing type

Ethnic group

Religion

8-3

Personal Consumer Protection

• To protect yourself as a consumer…

Deal with reputable companies.

Avoid signing contracts, documents you do not

understand.

Be cautious about offerings that seem too

good to be true - they probably are.

Compare the cost of buying on credit with the

cost of paying cash. Compare interest rates

the seller offers with other sources.

Avoid rushing to get a good deal.

8-4

Practical Purchasing Strategies

Timing purchases.

Be aware if the price varies with the time of the

year.

Store selection.

Choice of retailer depends on location, price,

product.

Cooperatives -non-profit organization; members

save money.

Comparison shopping of store and national

brands; avoid impulse buying (unplanned

purchasing).

Look for information on label and open dating.

8-5

Practical Purchasing Strategies

(continued)

Price comparison.

Unit pricing provides a standard of measurement.

Coupons (online: coolsavings.com; centsoff.com;

couponsurfer.com) and rebates (partial refund).

Convenience & ready-to-use products may mean higher

prices. Large is not always the best buy, and “Sale”

prices vary among stores.

• Evaluate warranties.

Full or limited express warranties, usually written.

Implied warranty of merchantability-fit for normal use.

• Service contracts -also called extended

“warranties.”

8-6

Purchasing a Car: A Research-Based

Approach - Phase 1: Preshopping Activities

Problem identification.

Information gathering.

Personal contacts.

Media information-television, websites

Independent testing organizations- Consumer

Reports

Government agencies.

Online Sources – www.edmunds.com,

www.caranddriver.com, www.autoweb.com

8-7

Phase 2: Evaluation of Alternatives

• Comparison shopping.

• Selecting vehicle options-convenience, appeal,

etc.

• Comparing used vehicles- www.carmax.com,

www.carfax.com

• Leasing an automobile

1) lower payments, small initial cash outlay

2) no ownership in vehicle

3) maximum # of miles/year; charged for extra miles.

4) know the capitalized cost of the lease, the money

factor, the monthly payment, number of payments,

and the residual value.

8-8

Phase 3: Determining Purchase Price

• Negotiation

Know necessary information about the product.

Deal with a person of authority to give you a lower

price or additional features.

Used-cars: Check newspaper ads, Kelly Blue Book

(www.kbb.com), www.edmunds.com

New cars: Set-price dealers, car-buying services

Compare financing alternatives.

Variety of lenders-some lenders may pre-approve

you.

Avoid being upside-down in your car.

Look for rebates or low-interest financing.

Consider the APR, total finance charge. Check out

www.bankrate.com

8-9

Phase 4: Postpurchase Activities

Lemon Laws.

Maintenance and ownership costs

Use the item correctly to have improved

performance and fewer repairs.

Investigate, evaluate and negotiate a

variety of servicing options.

Operation costs; fixed and variable

expenses.

Automobile servicing sources; dealers,

service stations, garages, Wal-Mart, etc.

8-10

The Used Car Inspection Process

• Outside the car.

• Inside the car.

• The engine.

Have a mechanic or technician of your choice

estimate the costs of potential repairs.

Odometer fraud.

• The road test.

8-11

Buying a Used Vehicle

• Sources of used vehicles.

New-car dealers.

Used-car dealers.

Private parties.

Auctions, used car superstores such as

CarMax, or online at sites such as

www.dealernet.com

Consumer protection for used car buyers.

FTC buyer’s guide in window.

Buy from a source that gives some

assurance of the vehicle’s reliability.

8-12

Used-Car Price Negotiation

• Price information sources

Edmund’s Used Car Prices or edmunds.com

NADA Official Used Car Guide.

Kelly Blue Book kbb.com

• The more new cars sold the

more used cars there are for

sale, keeping the prices down.

8-13

Gathering Information

• Sticker price - suggested retail price. It

includes the base price of the

vehicle plus accessories.

• Invoice price - dealers cost.

• Know the dealer’s cost by consulting...

Consumer Reports www.consumerreports.org

Edmund’s New Car Prices

www.Edmunds.com

• Buy in winter, early spring or end-ofmonth.

8-14

Selecting Options

• Mechanical devices.

Engine size, transmission, power steering,cruise

control, and antilock brakes.

• Comfort and convenience options.

Power seats, air conditioning.

Stereo systems, power locks.

• Aesthetic features.

Special paint.

Mag wheels.

• Service contract - look for costs and

exclusions.

8-15

Determining a Purchase Price

• Price bargaining - compare dealers.

• Set-price dealers.

• Car buying services.

Also called an auto broker.

$50-$200 over dealer’s cost.

• Online car buying

www.autobytel.com or autoadvisor.com .

• The sales agreement - specific details.

• Consumer protection for new-car buyers.

Warranties and lemon laws.

8-16

Financing an Automobile Purchase

• Financing sources.

Banks, credit unions, other financial

institutions, finance companies, or

dealer financing.

Get preapproved for a certain amount.

• Consider the length of the loan.

Upside down equity means that your

car is worth less that what you still owe

on your car loan.

• Check the APR and any rebates.

8-17

Leasing a Motor Vehicle

• Advantages.

Small cash outflow.

Lower monthly payments than buying.

Lease provides detailed records - helps if you

use your car for business purposes.

• Disadvantages.

No ownership interest.

Must meet requirements.

May have additional costs for extra mileage,

turning the car in early, or for certain repairs.

8-18

Types of Leases

• Closed-end.

You return the car at the end of the lease and pay

for any extra mileage or damage, but you are

committed for the full lease term.

• Open-end.

Easier to terminate the lease, but you have higher

lease payments and they may require you to pay

for the difference between the expected value of

the leased vehicle and the amount for which they

sell it.

• Single-payment - prepaid, discounted

lease.

8-19

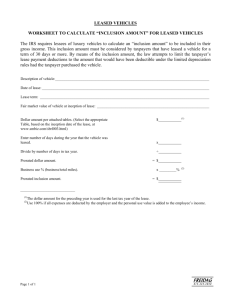

Financial Aspects of Leasing

• Capitalized cost - the price of the vehicle.

Average buyer pays 92% of list, average

person who leases pays 96% of list.

• Money factor - interest rate.

• Monthly payment amount and number of

payments.

• Residual value - expected value of the vehicle

at the end of the lease. You may decide to

return, keep, or sell the vehicle. If the residual

value is less than market value, return it.

8-20

Financial Aspects of Leasing

(continued)

• Avoiding lease traps.

Not knowing the total cost of the agreement,

including the cost of the vehicle. Don’t just look

at the monthly payment.

Making a larger up-front payment than is

required, or paying unnecessary add-on costs.

Negotiating the monthly payment rather than

the cost of the vehicle.

Not having the value of any trade-in vehicle

reflected in the lease.

Signing a contract you don’t understand.

8-21

Costs of Operating a Car

• Fixed Costs.

Depreciation is the largest fixed cost.

Interest on loan.

Insurance.

License, registration and taxes.

• Variable Costs.

Gas and oil.

Tires.

Maintenance and repairs.

Parking and tolls.

8-22

Costs of Operating a Car

(continued)

• Keep good expense records.

• Follow the maintenance schedule in the

manual.

• Vehicle servicing options.

Car dealers.

Automobile repair shops.

Service stations.

Department and discount stores.

Specialty shops such as oil/lube, muffler,

transmission, and tire shops

Be alert for signs of fraud.

8-23

Steps in Resolving

Consumer Complaints

(continued)

Take legal action - options for

consumers...

Small claims court.

Class action suits.

Using a lawyer.

Other legal alternatives.

• Legal aid society.

• Prepaid legal services.

• Legal questions can be

researched at www.nolo.com.

8-25