Presentation January Learning Bonds

advertisement

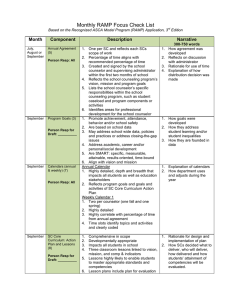

www.leedsgrenville.com Improved future earnings potential Higher labour force participation rates Less susceptible to unemployment Business, government, society... Children with as little as $3,000 in savings have greater odds of graduating from high school than children with no savings. The existence of any education savings can increase the likelihood that a child will graduate high school by 50%! Canada Education Savings Grant (CESG) • Grant equal to 20% of contributions Additional CESG • Additional 20% depending on income • Up to $2,000 to child’s RESP with no contribution requirement • The “bucket” which holds the savings for school. • Not the same tax exemptions for the contributor as RRSP contributions • RESP contents also qualify for government grants to supplement and enhance the savings A federal education grant Up to $2,000 in education funds for eligible children No parent/family contributions required Currently only 1 in 3 children who are eligible are accessing this grant National average uptake was 27% in 2012 Child born in 2004 or later Eligible for National Child Benefit Supplement (NCBS) for the child; eligible for CLB $500 on enrolment $25 to cover cost of opening an RESP $100 every year after to age of 15 to or maximum of $2,000 CLB per eligible child; continued NCBS eligibility required. Retroactivity Two easy steps… 1) Social Insurance number (SIN) for parent and child Need birth certificate to apply for SIN 2) Open a RESP with a provider who offers the Canada Learning Bond Contact Bank to discuss or let smooth the way. Use Smartsaver.org to find a financial provider who offers the Canada Learning Bond 1. Online tool to apply for CLB and to initiate process to open an RESP 2. Just need SIN numbers on hand (parent and child) 3. 10 minutes to complete online application 4. SmartSAVER sends to financial institute of client choice 5. Financial Institute calls client to arrange an appointment 6. Attend with identification, and sign the paperwork 1. Lack of awareness of CLB and how to access it Awareness /Education campaign Ongoing referral and support to clients 2. Fear it will affect benefits It is fully exempt; no impact 3. Lack of proper identification or the funds to secure Birth Certificate cost $25 SIN is free! 4. Multiple steps Coordinate sign up events with banks and Service Canada Apply through SmartSAVER.org 1 Educate and equip Case Managers to refer 2 Fund Birth Certificates through Discretionary Benefits for OW and ODSP recipient families 3 Workshops for Clients 4 Referral for 1:1 support and assistance applying • Started promotion to staff and in turn clients in November 2015. • Approximately 25 of 50 parents referred have attended the workshops that ran into midDecember. • To quantify follow through in January 2016. • Tweak and Repeat Up-take rates by first 3 digits of postal code Tools and Resources are available Outreach toolkit Videos Wallet Cards Organize a Sign Up Event RESP Event checklist and steps Cobranded Financial Institution Fact Sheets Generic Fact Sheet