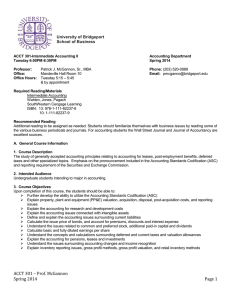

Long Island University - University of Bridgeport

advertisement

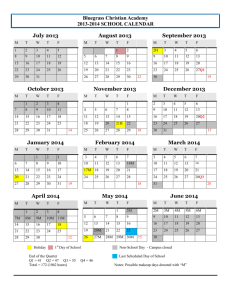

University of Bridgeport School of Business ACCT 300 Intermediate Accounting I – Fall 2013 Day and Time of Course Name of Professor Telephone Number: Email: Office: Office Hours: Tuesday, 6:00PM – 8:30PM Patrick J. McGannon, Sr. (203) 520-0989 pmcganno@bridgeport.edu Mandeville Hall Room 10 Monday 5:15 – 6:00 Tuesday 5:15 – 5:45 By Appointment Course Materials Required Reading/Materials Intermediate Accounting Wahlen, Jones, Pagach SouthWestern Cengage Learning ISBN: 13: 978-1-111-82237-8 10: 1-111-82237-9 Recommended Reading Additional reading to be assigned as needed. A. General Course Information 1. Course Description This course applies generally accepted accounting principles to the preparation of financial statements, including balance sheet, income statement, statement of cash flows and retained earnings statements. 2. Intended Audience Undergraduate students intending to major in accounting. 1 3. Course Objectives Upon completion of this course, the students should be able to: Explain GAAP and sources of GAAP Understand the relationship between the various accounting rule-making entities and oversight bodies Utilize the Accounting Standards Codification (ASC) Explain ethical issues involved in accounting and financial reporting Explain the objectives of financial reporting and the relationships among the objectives Explain the qualities of useful information Explain and prepare the basic financial statements and their components Explain the reporting techniques in an annual report Explain income and revenue recognition Compute, classify and report income from various sources Explain cash discounting methods, bad debt estimation, and accounting for short-term accounts receivable Differentiate between periodic and perpetual inventory systems Explain inventory reporting issues, gross profit methods, gross profit valuation, and retail inventory methods Explain property, plant and equipment (PP&E) valuation, acquisition, disposal, post acquisition costs, and reporting issues Explain the accounting for research and development costs Explain the accounting issues connected with intangible assets B. Prerequisites ACCT 101 and ACCT 102 C. Mode of Instruction Classes will consist of discussion of previously assigned reading, topical lectures and problem solving both inside and outside of class. D. Student Responsibilities 1. Academic Honesty Standards Students should familiarize themselves with, and adhere to, the standards as set forth in the policies on cheating and plagiarism as defined in Chapters 2 and 5 of 2 the “Key to UB” or the approved graduate handbook. These standards may be found at http://www.bridgeport.edu/pages/2623.asp. 2. Class Participation Class participation will be comprised of the following items: Assigned problems, attendance and contribution to the class discussion. In addition to the problems we will work in class, there will be problems assigned that the student will work on during discussion of a topic. Once the related topic or chapter is concluded, the student will turn in the assigned problem by the following class session. These problems will not be graded, but not turning in problems will result in a reduction to the overall class participation grade. Problems must be submitted in a neat, orderly, and well thought out manner. Problems MUST be done in EXCEL or some other spreadsheet software. (See Communication below). Do not use WORD or other word processing software, unless assignments call for a written report. I will review submitted problems, and I will look for a reasonable attempt to complete the problem. Do not try to submit problems that were done 15 minutes before they are due. I will know, and I will penalize you accordingly. There is no requirement to get the answer correct. The only requirement is to turn in the problems according to the guidelines stated above. Problems not turned in timely will receive no credit. NO EXCUSES. Students are expected to be fully prepared for all classes, and are encouraged to contribute to the class discussion. Discussion among students usually facilitates the understanding of a topic. Moreover, some students may bring a different view on the subject matter that had not been previously considered. Regular and active class participation enhances the learning process. Attendance will be taken regularly. There are very few reasons for missing class. These are enumerated in the student handbook. Should you believe you have a valid reason, please contact me before class, not at 9:00PM the night of class. You may use your cell phone’s text message service for this purpose. My number is at the beginning of this syllabus. Please note that just coming to class does not guarantee you the full class participation grade. 3 Lateness is also unacceptable, as is leaving during class, coming back late from breaks, or leaving before class is over. All of these will have a detrimental effect on your class participation grade. As with most accounting courses, the student should not expect a positive outcome by simply coming to class each week. You cannot learn this material in 2 1/2 hours each week. Students should allocate time outside of class in order to master this material. It is suggested the student devote at least 15-20 hours each week outside class to study this material. 3. Communication The University e-mail system will be used to communicate with students. You should check your UB email frequently, but no less than daily. E-mail has developed into the single most used form of communication in business today. As such it is to your advantage to develop the habit of looking at yours frequently. You must use your UB account to communicate with me, and I will use your account to communicate with you. I don’t need to know any other account you may use, nor do I accept the fact you may never check your UB account. You may uses your devices to take notes, etc., but for no other purpose. There will be time during the class breaks to get your updates. As such your devices should be on “Vibrate”. I expect you to respect the learning environment by not sneaking a peek at your phones during class. I maintain neither a Facebook nor Twitter account. Requests to me via these media will go unanswered. E. Grading The course grade will be determined by the following components: Case studies Tests Class Participation Final Examination 20% 40% 10% 30% 100% 4 Tests will be administered every 2-3 topics or chapters. Tentative test dates: September 17 October 15 November 12 There will be 2 components of each test. The first will be a take-home and will consist of problems and essays. This portion will be due the following week. Failure to turn this portion in when due will result in a grade of zero for that part. You will take the second part in class. This part will be a series of multiple choice questions. Please note this part will not take the entire class. The final examination is December 10, and may be cumulative. Therefore it is important to constantly review material already covered. If you cram the night before the final you are only getting superficial knowledge of the material. As such this will translate into a superficial grade. Students will be evaluated based upon the categories set forth above. What a student needs, or requires is completely irrelevant. If you need to keep a scholarship, be reimbursed by an employer, get hired by an employer, etc. you must deal with that. It will not ever be a factor in computing your grade. If you keep track of your grades, prepare appropriately for classes and tests, you should know where you stand. It is incumbent upon the student to ask questions, to ask for clarification, or to contact me if he/she is struggling. Final grades will be calculated based upon the following scale: A AB+ B BC+ 94+ 90-93 87-89 84-86 80-83 77-79 4.00 3.67 3.33 3.00 2.67 2.33 C CD+ D DF 74-76 70-73 67-69 64-66 60-63 < 60 2.00 1.67 1.33 1.00 0.67 0.00 Make-Up Policy: If you miss any of the in-class tests you must take a make-up. The make-up will be the week following the regularly scheduled test. Please note that this is the only time you can make-up a test. In addition, there will be a penalty assessed on the make-up. The penalty will be determined by the point value of the test. 5 There is no make-up for the final examination TENTATIVE COURSE SCHEDULE To be provided 6