R20 500 + 7% of the amount over R750 000

advertisement

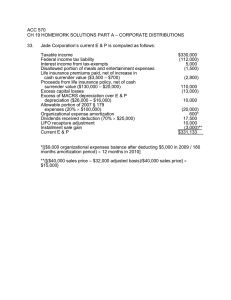

Budget & Tax Update 2009 1 The morning ahead • 2009 Budget • 2008 Tax update 2 PART 1 BUDGET 2009 3 Main tax proposals • Personal income tax relief of R13.6 billion • Fuel taxes to increase by 23c (petrol) and 24c (diesel) per litre • RAF levy to increase by 17,5c per litre • Increased sin taxes • Green taxes • New luxury motor vehicle excise taxes to tax carbon emissions • Tax on energy-intensive light bulbs • Increase in the plastic bag levy from 3c to 4c per bag • Incentives for investments in energy efficient technologies 4 Tax collections 2003 - 2010 R billion Collections 700 2003 600 2004 500 2005 400 300 200 100 0 2006 2007 2008 2009 2009 revised 2010 5 Tax collections 2003 - 2010 Other taxes 100% Excise duties 80% Customs duty (R Bn) SDL 60% Retirement funds Transfer duties 40% Fuel levy VAT 20% Individuals (R Bn) 0% 2003 2005 2007 2009 2010 Companies (R Bn) 6 Personal income tax relief 7 Tax tables 8 Rebates 2003 2004 2005 2006 2007 2008 2009 2010 Primary rebate - under 65 4860 Increase - over 65 Increase 3000 5400 5800 6300 7200 7740 8280 9756 11% 7% 8.6% 14% 7.5% 7.0% 17.8% 3100 3200 4500 4500 4680 5040 5400 3.3% 3.2% 41% 0.0% 4.0% 7.7% 7.1% 9 Tax threshold 2010 2009 Under 65 R54 200 R46 000 Over 65 R84 200 R74 000 10 Interest and taxable dividend exemption 2010 2009 Under 65 R21 000 R19 000 Over 65 Foreign dividends & R30 000 R27 500 interest R3 500 R3 200 11 Basic interest exemption 2003 - 2010 35000 30000 27500 25000 30000 20000 19000 15000 10000 10000 5000 6000 0 1000 2003 3200 2004 2005 - under 65 2006 2007 - over 65 2008 2009 21000 3500 2010 Foreign interest 12 Capital exemptions 2010 Donations tax Estate duty CGT annual exclusion Primary residence exclusion 2009 R100 000 R100 000 R3,5m R3,5m R17 500 R16 000 R1,5m R1,5m 13 Company tax rates Years of assessment ending between 1/4/09 and 31/3/10 2010 2009 Non-mining companies 28% 28% Close corporations 28% 28% Employment companies 33% 33% Taxable income of a non-resident 33% 33% company Other companies 28% 28% 14 Small business corporations Years of assessment ending between 1 April 2009 - 31 March 2010 Taxable income Rate of tax R 0 - 54 200 54 201 - 300 000 300 000 - 0% 10% of the amount over R54 200 R24 580 + 28% of the amount over R300 000 15 Turnover tax for micro businesses Years of assessment ending on 28 February 2010 Turnover Rate of tax R 0 - 100 000 0% 100 001 - 300 000 1% of the amount over R100 000 300 001 - 500 000 R2 000 + 3% of the amount over R300 000 500 001 - 750 000 R8 000 + 5% of the amount over R500 000 750 001 - R20 500 + 7% of the amount over R750 000 16 STC Rate of STC on dividends declared 14 March 1996 – 30 September 2007 On or after 01 October 2007 12.50% 10% 17 Other tax rates 2010 2009 Trusts (other than special trusts) 40% 40% Estate duty 20% 20% Donations tax 20% 20% PBOs & recreational clubs 28% 28% 18 Individuals • Medical scheme contributions • No tax-free fringe benefit on medical scheme contributions • monthly monetary caps increased from R570 to R625 for each of the first two beneficiaries and from R345 to R380 for each additional beneficiary Tax deduction to be claimed (based on monthly cap) Deduction to be replaced with a tax credit in 2 years’ time 19 CGT on sale of primary residence • Proceeds up to R2 million to be disregarded • Primary residence exclusion remains at R1,5m 20 Increase in “sin” taxes • Malt beer - increased by 7c to 79c per 340ml can • Unfortified wine - increased by 14c to R1.98 per litre • Fortified wine - increased by 32c to R3.72 per litre • Spirits - increased by R3.21 to R25.05 per 750ml • Cigarettes - increased by 88c to R7.70 per packet of 20. 21 Other proposals • SITE system may be discontinued by 2010/2011 • Travel allowances to be deductible only if supported by a log book; “deemed” business expenses to be scrapped from 2011 22 New subsistence allowance rates • Travel in the Republic meals and incidental costs: R260 per day incidental costs only: R80 per day • Travel outside the Republic daily amount is available on the SARS website 23 Estate duty • R3,5m abatement Benefit for both spouses • 1-year usufruct schemes to be closed down • 5-year additional assessment rule to be reconsidered 24 Relief for winding up dormant property-holding companies • Various pressures exist to liquidate entities with inactive real estate (e.g. vacant land and residential property). To alleviate these pressures, it is proposed that rollover relief be provided to facilitate these liquidations for a transitional period 25 Small business corporations • Permitted investments for shareholders to include shelf companies 26 ‘Green taxes’ • Incentives for cleaner production • Plastic bag levy increases from 3c to 4c per bag • Taxation of incandescent light bulbs - R3 • Emission reduction credits • Motor vehicle ad valorem duties and emission taxes • International air passenger departure tax • Fuel levies 27 VALUE-ADDED TAX • Voluntary registration threshold • False statement on VAT forms • VAT registration verifications • VAT implications of reorganisations 28 PART 2 TAX UPDATE 29 Medical expenses (section 18) • Taxpayers with a handicap or a handicapped spouse/ child receive deductions for all medically-related expenses (without 7.5% hurdle) • Uncertainty as to the type of expenses that will qualify for deduction Definition of ‘handicapped person’ replaced with ‘disabled person’ The terms ‘handicapped person’, etc are outdated condition must last longer than 1 year and diagnosed by a registered medical practitioner Types of deductible expenses List to be reviewed annually 30 RETIREMENT BENEFITS • Pre-retirement withdrawals from retirement funds • Allocations to spouses upon divorce • Default preservation of withdrawal benefits • Annuitisation of death benefits • Preservation funds • Unclaimed benefit funds • Transfers from pension to provident funds 31 Withdrawal benefits (s 1, s 6 & para 7 of Second Schedule) • Tax-free amount increased from R1 800 to R22 500 less amounts utilised on/after 1 March 2009 • Applies to aggregate of withdrawal benefits received over the tax-payer’s life-time • Tax calculated in terms of the special tax table • Effective 1 March 2009 32 Tax table for withdrawal lump sum benefits for 2009/2010 33 Divorce settlements from retirement funds (paras 2, 2B, 4 & 6 of Second Schedule) • Divorce order payments to ex-spouse from retirement fund from were taxed in the hands of the member right of recovery of tax from non-member spouse • Amendment The non-member will pay the tax on amounts awarded to him/her from the member’s retirement fund Effective 1 March 2009 34 Default withdrawal benefits (para 4(1) of Second Schedule) • Background All withdrawal benefits taxed; no incentive for reinvestment of default withdrawals • Amendment: Only taxed once the member withdraws the cash 35 Transfers from pension to provident funds (para 2 of Second Schedule) • A transfer from a pension to a provident fund is a taxable event as employee contributions to pension funds are tax-deductible but there is no deduction for provident fund contributions 36 EMPLOYERS AND EMPLOYEES • Expatriate accommodation • Deduction for repayable remuneration • Deemed employees • Additional learnership deduction for apprenticeships • Payroll giving • Personal use of business cell-phones and computers • Broad-based employee share schemes • SITE re-determination 37 Expatriate accommodation (paragraph 9(7A) of the Seventh Schedule) • No rental value (up to R25 000 pm) on accommodation provided to an employee away from his/her usual place of residence outside the Republic For up to 2 years from date of arrival (extended from 1 year); or If the employee spends less than 90 days in the Republic in that year • No exemption if the employee spent more than 90 days in the Republic in the previous year of assessment • General effective date 38 Repayable remuneration (sections 11(nA), (nB), 23(k) & 23(m)(iiA)) • Background Employee receives remuneration (e.g. maternity pay) but later fails to meet conditions and amount received is repaid to employer no tax relief for employee • Amendment Repaid benefit allowed as a tax deduction for employee PAYE refunded by employer or Deducted on tax return 39 Deemed employees (ss 11(cA), 12E(4)(a) & 23(k) and paragraphs 1, 2(1A) & 11 of Fourth schedule) • Personal service companies & personal service trusts combined under one category: personal service provider • “Labour broker” retained for individuals only 40 Learnership allowance (apprenticeships) (section 12H) • 2 deductions per year for each year of the apprenticeship • At least 1 deduction in the year the agreement is entered into • Where no formal examination is completed before the completion of the apprenticeship, the additional deductions will only be claimed upon completion • This amount will be equal to the number of years required to complete the learnership as per the initial agreement X 2 Less the allowance claimed when the agreement was entered into 41 Example • Employee X entered into a 4-year apprenticeship agreement with employer Y. • Employer Y agrees to pay X R25 000 p.a. (fixed for 4 years) • Result • Year 1: employer Y can claim s 12H allowance of R25000 • No additional allowance may be claimed in years 2 and 3 • Year 4: assuming that X has successfully completed the apprenticeship, employer Y can claim an additional allowance of R25 000 x 2 x 4 = R200000 less R25 000 (the amount claimed in year 1) = R175 000 • In essence, the ending additional deduction equals the starting and ending additional deductions for all years of the learnership less the starting deduction for the first year (which has already been taken into account 42 Payroll giving (s 18A & paragraph 2(4) of Fourth Schedule) • Background: Section 18A deduction for donations to PBOs on assessment No reduction of PAYE through the year Scope to encourage PBO donations • Amendment: Employers can deduct donations when calculating monthly PAYE Deduction limited to 5% of remuneration Section 18A deduction limited to 10% of taxable income Re-determination required on assessment 43 Personal use of employer-provided phones and computers (paras 6 & 10 of Seventh Schedule) • Background: Employees often receive cell-phones and laptops from employers for business use, but invariably some private use exists which is taxable • Amendment: To simplify administration, all telephone, and computer equipment (modems, disks, printers, software, etc) is exempt from fringe benefit tax if provided mainly for business use 44 Broad-based employee share schemes (sections 8B & 11(lA)) • Background: Employer grants qualifying shares to employees Tax-deduction for employer No taxable fringe benefit in hands of employee Qualifying requirements too stringent • Amendment: Tax-free ceiling raised to R50 000 over 5 years (previously R9 000 over 3 years) Employee participation lowered from 90% to 80% Permissible restrictions relaxed Deduction: R10 000 p.a. over 5 years 45 SITE redetermination • Refunds following broken periods (para 11B(4) of the Fourth Schedule) Effective 1 January 2008 Example • Mr P worked for 4 months and earned a salary of R5000 p.m. • SITE of R210 was deducted (calculated on an annual salary of R60 000). Mr P's salary for the year amounts to R20 000 and he should therefore not pay any tax. Mr P will now be able to claim the R840 of SITE that was withheld from his salary as a refund when he files a tax return. 46 CORPORATE TAX • STC Reforms • Dividend withholding tax Transitional arrangements Revised dividend definition Refund of withholding tax Passive Holding Companies 47 Dividend withholding tax (ss 64E and 64F) • 10% tax on the shareholder (beneficial shareholder) • Applies only to dividends declared by SA resident companies • Beneficial owner is exempt from the dividend tax if: A South African resident company; A sphere of the SA government (i.e. national, provincial and local) An exempt parastatal; A pension, provident or similar benefit fund; An approved PBO; or An environmental rehabilitation trust A shareholder in a “micro business” (refer Sixth Schedule) 48 Examples 1. Individual owns all the shares of Co.1, which owns all the shares of Co. 2; and Co. 2 owns all the shares of Co. 3. Co. 3 pays a R20 000 dividend to Co. 2, Co. 2 pays a R20 000 dividend to Co. 1; and Co. 1 pays a R20 000 dividend to the individual shareholder Result. The dividends tax only applies once the R20 000 dividend is paid to the Individual. The previous dividends are exempt. 2. Co. X is listed on the JSE and has 1 million ordinary shares, of which 600000 shares are held by resident natural persons, 300000 shares are held by pension funds and 100000 shares are held by resident companies. Co. X pays a dividend of R5 per share. Result. Dividends paid to resident natural persons are subject to the dividends tax. Dividends paid to pension funds and resident companies are exempt. 49 STC transitional arrangements (ss 64I and 64J) STC credits • Exemption for dividends previously subject to STC • STC credit dividends will be exhausted first • Dividends eligible for STC credits will be allocated pro rata amongst all shareholders within the same class, irrespective of whether they are exempt from the dividend tax • STC credits will be dependent on reporting by initial company payer to payee, failing which there will be no STC credit • STC credits will disappear 5 years after the effective date of the new Dividend Tax 50 Other transitional arrangements • Dividends declared before and paid after change-over date will be subject to STC (not dividends tax) 51 “Dividend” definition (section 1) • New dividend definition in s 1: any amount transferred by a company to a shareholder in respect of a share excluding amounts resulting in a reduction of “contributed tax capital” (CTC); and distribution of a company’s own shares • Contributed tax capital: notional amount derived from the value of any contribution made to a company as consideration for the issue of shares by the company • Starting point: share capital and share premium on cross-over date Excluding SC and SP that would have been a dividend if distributed immediately before cross-over date 52 Dividend withholding tax (ss 64G and 64H) • SA companies that pay dividends will be required to withhold 10% dividend tax from the payment Listed share pass-through system to regulated intermediaries Unlisted share pass-through system by “declared” nominee arrangements • Tax withheld must be paid to SARS by the end of the month following the month of the dividend (same as STC) 53 Refund of tax (ss 64L & 64K(2)) • Beneficial owners can obtain a refund if amounts are over-withheld 1. Company refund process: If a declaration by the beneficial owner is submitted within 1 year after payment of the dividend otherwise eligible for exemption or relief 2. SARS refund process: If a refund is not made within 1 year 3. Three-year time limit: No amount may be refunded after three years from the date on when the Dividends Tax is withheld 54 Example Company X, listed, has 1 million uncertificated shares, of which Company Y holds 100 shares through a regulated intermediary Company X pays a dividend of R5 per share; (R500 accrues to Company Y) Assume all parties are residents: Company Y is exempt from Dividends Tax Result: • Company X is exempt from withholding as the shares involved are uncertificated shares • Regulated Intermediary is not obliged to withhold if Company Y submits its declaration to Regulated Intermediary • If not, Regulated Intermediary must withhold and pay over to SARS R50 (10% of R500). • If the declaration is late but within 1 year from payment, Regulated Intermediary must pay the R50 back out of tax withholding funds otherwise to be held for SARS in relation to the next dividend payment to be made by Regulated Intermediary (as long as the Regulated Intermediary makes a dividend payment within the required 1 year period). • If no refund occurs beyond the 1 year date, Company Y can make a claim for refund directly from SARS 55 Passive Holding Companies (s 9E) • Introduced to eliminate arbitrage • 40% tax on passive ordinary revenue from financial instruments • 10% tax on dividends • Dividends paid are not subject to dividends tax if previously taxed in a PHC 56 ‘Passive holding company’ Any company, other than an excluded company, where • passive income > 80% of gross income of that company and the gross income (other than passive income) of all other companies that form part of the same group of companies, as defined in s 41 • 5 or less resident individuals (with any connected persons) at any time during the year in/directly hold more than 50% of participation rights in the company 57 Definitions within “passive holding company” • ‘passive income’= gross income derived from financial instruments • ‘gross income’ = as defined in s 1, excluding royalties and dividends if the company holds at least 20% of the total equity share capital and voting rights in the company declaring the dividend 58 ‘Excluded company’ • A listed company • A member of the same group of companies as per s 41 as a listed co. • A bank or a money-lender • An authorised user as per the Securities Services Act • Insurance company • Collective investment scheme • PBO • Approved recreational club • A foreign company as defined in section 9D • A venture capital company as defined in section 12J 59 Example • Company X is owned equally by 3 unconnected individuals. • Company X earns R500 of dividends from a 10% subsidiary, R200 of interest and R300 from payment for goods sold and delivered. • Company X also earns R1 000 of capital gains from the sale of land. • Dividends and interest constitute passive income. • Due to Company X’s less than 20% holding in Company X, the dividend received by Company is included in the calculation. • The capital gains are excluded • The sum of all passive income, (dividends and interest) is 70% of Company X’s ordinary revenue. • Company X does not satisfy the gross income requirement • Therefore, not a passive holding company 60 Example • Co. X is wholly owned by an individual. • Co. X has income of R200 of which R190 is passive income. • Company owns all the shares of a subsidiary which has R1 000 of income, of which R300 is passive income. • The total gross income of the group (i.e. Company X and Subsidiary) amounts to R1 200. • The passive income of Company X amounts to only R190 of the R900 group total (R1 200 less the R300 passive subsidiary income). • Therefore Company X is not a passive holding company. 61 SMALL BUSINESS • S 12E: asset write-off election • Micro business turnover tax • Venture capital company allowance 62 Small business corporations (section 12E) Taxpayer has the option of • 50:30:20 write-off OR • Section 11(e) wear tear From commencement of years of assessment ending on or after 1 January 2009 63 Turnover Tax for micro businesses (Section 48 & Sixth Schedule) • Turnover-based tax system • To alleviate tax compliance costs for very small businesses (not necessarily to reduce the tax liability) • Elective • Incorporated and unincorporated enterprises (sole proprietors) Certain limitations • Annual turnover up to R1million p.a. • Implementation: Years of assessment commencing on or after 1 March 2009 64 “Turnover” • • ‘Qualifying turnover’ = total receipts from carrying on business activities, excluding any Amount of a capital nature; and Government subsidies ‘Taxable turnover’ means total receipts from carrying on business 50% of proceeds on sale of a capital asset (see next slide) Investment income of a company / cc Add-back of previous year’s tax allowances in 1st year Doubtful debts, s 24C, etc (first applied against assessed loss) Excludes government subsidies Amounts accrued before registration as a micro business 65 Capital receipts • CGT exemption if proceeds do not exceed R1.5m over 3-year period • Otherwise: 50% of proceeds included in “taxable turnover” Immovable property to the extent used for business Other assets used mainly for business 66 Turnover tax for micro businesses Years of assessment ending on 28 February 2010 Turnover Rate of tax R 0 - 100 000 100 001 - 300 000 1% of the amount over R100 000 300 001 - 500 000 R2 000 + 3% of the amount over R300 000 500 001 - 750 000 R8 000 + 5% of the amount over R500 000 750 001 - 0% R20 500 + 7% of the amount over R750 000 67 Turnover tax illustration Turnover Tax R R Average 100 000 Nil 0% 200 000 1 000 0.50% 300 000 2 000 0.67% 500 000 8 000 1.60% 750 000 20 500 2.73% 1 000 000 38 000 3.80% 68 Turnover tax for micro businesses • Increase in compulsory VAT registration threshold from R300 000 to R1million • Businesses electing the TT will not be allowed to register for VAT • STC/withholding tax exemption on dividends up to R200000 • Businesses that elect the TT system must remain in the system for at least 3 years • Businesses that opt out of the regime can’t migrate back in for 3 years 69 Persons that do not qualify as a micro business • Anyone holds any shares or has any interest in the equity of another company other than permitted investments • Investment income exceeds 10% of total receipts • ‘Personal service provider’ or ‘labour broker’ without IRP30 • ‘Professional service providers’ • Total amounts received from the disposal of (i) immovable property, to the extent that it was used for business purposes; and (ii) any other asset of a capital nature used mainly for business purposes exceed R1,5m over a period of 3 years or such shorter period during which that person was a registered micro business 70 • a company With a year end other than the last day of February at any time during its year of assessment, any of its shareholders is a person other than a natural person (or the deceased or insolvent estate of a natural person) at any time during its year of assessment, any of its shareholders holds any shares or has any interest in the equity of any other company other permitted investments PBO approved recreational club • a partner in a partnership if – any of the partners is not a natural person a partner in more than one partnership partnership turnover exceeds R1m 71 VAT deregistration relief • The normal rule is that when any vendor deregisters from the VAT system, it is required to pay VAT (exit VAT) on the value of the assets held before deregistering. • All vendors that deregister from the VAT system in light of the increase in the VAT registration threshold to R1 million will be allowed to pay the exit VAT over a period of six months. • Where a vendor deregisters from the VAT system in order to register for the turnover tax, further relief will be granted to that vendor by way of a deduction up to R100 000 of the value of the assets held by that vendor prior to such deregistration. Equates to an approximate reduction of up to R12 281 in the exit VAT that will be payable. 72 VCC allowance (section 12J) • 100% deduction for investments in VCC ordinary shares Capped at R750 000 p.a. for individuals (R2.25 m lifetime limit) No limit for listed companies Unlisted corporations are excluded • Sunset clause: after 12 years 73 VCC requirements • • • Minimum gross assets to qualify as a VCC R30m for investments in non-mining qualifying enterprises R150m for investments into qualifying junior mining exploration enterprises VCC qualifying investments: At least 10% in enterprises with up to R5m gross assets, after the investment At least 80% in enterprises with up to R10m gross assets, after the investment In the case of junior mining exploration companies R100m gross assets after the investment SARS to approve applications for VCC status New VCCs have 36 months to qualify for full VCC approval. Over the medium term, special financial regulations for VCCs considered 74 100% deduction VCC (FAIS Compliant) Investor: Indiv / Listed Qualifying SME Individual – R750 000 pa deduction limit Listed – No limit; subject to 10% shareholding limit in the VCC 10% - R5m gross assets 80% - R10m gross assets 10% - any asset class 75 VCCs: excluded activities (section 12J) • Dealing in or renting land (excluding hotel keepers • Financial services e.g. banking, insurance, money lending, HP financing • Provision of professional services e.g. legal, tax advisory, broking, management consulting, auditing, accounting and other related activities • Casinos, other gambling-related activities and other games of chance • Manufacturing, buying or selling liquor, tobacco products or arms • Franchisees • Businesses conducted mainly outside SA • Investment income exceeds 20% of gross income 76 INCENTIVES AND ALLOWANCES • Residential buildings • Urban Development Zones • Loans for low-cost housing sales • Government business licenses • Strategic Industrial Policy Projects 77 Allowance for residential buildings (s 13sex) • New residential housing 5% p.a. • Low cost housing 10% p.a. • • Replaces former 10% initial/2% p.a. (from 21 October 2008) “Low cost residential unit” • • cost up to R200 000 for free standing houses and R250 000 for apartments Monthly rental does not exceed 1% of cost (with 10% p.a. escalation) • Applies to all rental housing and employer-provided housing • At least 5 units must be owned 78 Urban Development Zone allowance (s 13quat) • The incentive is extended by 5 years • Enhanced allowances: New buildings: 20%(first year) & 8% p.a. (next 10 yrs) Low cost housing in UDZ New buildings: 25% in first year; 13% over next 5 yrs; 10% in year 7 Improvements to existing buildings: 25% p.a. 79 Loans for low-cost housing sales (s 13sept) • Special write-off when selling low cost housing to employees at no more than employer cost • 10% year write-off for employer-loan portion of the sale • Recoupment when principal is repaid 80 Example • In Year 1, Employer sells a low cost residential unit to Employee X for R200000, all of which is paid via an interest-free loan account from Employer. Employee X repays R30 000 in Year 2, R25 000 in Year 3 and no repayment in Year 4. • Year 1: R20 000 (10% of R200 000). • Year 2: Deduction = R17 000 (10% of (R200000 less the R30 000 repaid)). Recoupment = R 30 000 • Year 3: Deduction = R14 500 (10% of (R200 000 less R55 000 repaid)). Recoupment = R 21 500 • The excess R3500 (i.e. R25 000 less R21 500) is rolled over to the next year Year 4: Deduction = R14 500 (10% of (R200000 less R55 000 repaid)). Recoupment = R3 500 (the remaining recoupment from last year). 81 Allowance for government business licenses (s 37D) • Initial outlay to acquire a Government license will be deducted over the life of the license • Full deduction of annual fees to maintain a license, even if funds not paid directly to Government (i.e. used for required social expenditure) 82 Strategic Industrial Policy Projects (s 12I) • Incentive to support government’s Industrial Policy Action plan (promoted by DTI) • Focus is the manufacturing sector • Targets greenfield investments and brownfield expansions and upgrades • R20billion allowable deductions over 5 years • Applications must be in by 21 December 2014 • Replaces the Strategic Industrial Project allowance • Focuses on capital investment and training • S8(4)(n) recoupment if disposed of before end of the writeoff period 83 Industrial policy projects: minimum requirements (section 12I) • Greenfield projects: Investment of R200 million in new industrial assets • Upgrades and expansions / brownfields: Investments of least 25% of value of existing industrial assets subject to a minimum of R30m • Energy efficiency: 10% reduction in usage • Spend more than 2% of wage bill on training • Training: Detailed skills development programme 84 Industrial policy projects: scoring criteria (section 12I) Greenfield investments Brownfield expansions Energy efficiency Energy efficiency Use of cleaner production technology Use of cleaner production technology Innovation, linkages to small business Innovation Location in an industrial development zone Small business linkages Employment creation (x per R1m) Employment creation (x per R1m) Training of employees Training of employees Minimum of 5 points for qualifying status Minimum of 8 points for preferred status A sub-minimum of 2 points must be attained in the labour component (employment creation + training) 85 Industrial policy projects: additional allowances (section 12I) Projects with qualifying status (5 - 7 points) • 35% investment tax allowance • Deduction of actual training expenses up to a maximum R36 000 per employee and an overall maximum of R20million per entity over 4 years. Projects with preferred status (8 - 10 points) • 55% investment tax allowance • Deduction of actual training expenses up to a maximum R36 000 per employee and an overall maximum of R30million per entity over 4 years. 86 Example • A Greenfield project qualifies for preferred status • Taxpayer purchases machinery for R300m: qualifies for s12C Result: • In the year that the machinery is brought into use, a s12C deduction of R120 million (R300 million x 40%) will be allowed • In addition, a s12I deduction of R165m (R300m x 55%) will be allowed • In each of the following 3 years, further s12C deductions of R60m (R300m x 20%) per year will be allowed 87 Body corporates (s 10(1)(e)) • Levies are tax-free but other income is taxable • Non-levy income exempt up to R50 000 Effective for years of assessment commencing on/after 1 March 2008 88 Recreational clubs (sections 10(1)(cO) & 30A) • Increase in basic exemption from R50 000 to R100 000 For years of assessment commencing on/after 1 March 2009 • Fiduciary responsibility for the club must vest in at least 3 unconnected persons General effective date 89 VALUE-ADDED TAX Industrial Development Zones Supply of right to receive money under a rental agreement Land reform transactions 90 Industrial Development Zones (s 8(24)) • Goods temporarily removed from a Customs Controlled Area are subject to VAT if not returned within 30 days • Goods returned after 30 days do not receive any VAT relief • Amendment: Goods returned after 30 days are eligible for VAT input credits (as an offset against the late charge) limited to the lesser of the initial charge or an amount based on the returned value (i.e. this test taxes the devaluation as consumption) 91 Supply of the right to receive money under a rental agreement (s 2(4)(b)) 3. Financier pays present value of the rental stream Lessor Financier 2. Cession of right to rental income 1. Rental Agreement Lessee 4. Lessee pays rental amount (R11 400 for month 1) 92 Amendment • Section 2(4)(b) (that makes the supply to the financier taxable) deleted • The supply of the right to receive the rentals is therefore a financial service and hence exempt 93 93 Land reform transactions (sections 11(1)(s) & (t)) • VAT zero-rating of land purchases in terms of Land Reform and Land Restitution programmes previously zero-rated under a specific ruling In line with pre-existing zero ratings for Government subsidised housing 94 ESTATE DUTY • Pension benefits • Time limits for assessment (subject to review) 95 Pension Benefits (section 3(2)(i)) • Background: Deemed part of deceased’s estate At death of income provider, surviving spouse and dependant children rely on these savings to alleviate financial difficulties Tax not in line with Government’s social objectives to reduce the value of benefit in these circumstances • Amendment: Lump sum benefits from retirement fund exempt from Estate Duty 96 Estate Duty – Time Limits for Assessment • The liquidation and distribution account will set a 5- year (automatic) assessment period • Assets found within the 5 years trigger a re-opening of that tax estate • Assets found afterwards are deemed to be their own Estate without going back to the date of death Estate Duty Act section 9 Budget 2009: subject to review 97 Other • Stamp Duty • Securities Transfer Tax 98 Repeal of Stamp Duties Act • Stamp duty currently only applies to leases of immovable property • To be repealed from 1 April 2009 The Stamp Duties Act will continue to apply to any instrument described in Schedule 1 of the Act executed before the date of the repeal as if the Act had not been so repealed. 99 Securities Transfer Tax • De minimus exemption for amounts less than R100 (transfers within a month) 100 Administration • Provisional tax • Estimated employees’ tax liability • Employers’ obligations • Administrative penalties • Advance tax rulings • Interest payable • Date of payment of tax to SARS 101 Provisional tax (Paragraph 20 of Fourth Schedule) • Second provisional tax payment must be based on the taxpayer’s estimate (no basic amount) Estimate must be at least 80% of the actual tax liability for the year 20% penalty on underpayment • Originally effective from 1 January 2009 SARS extended implementation to 1 March 2009 102 Estimated employees’ tax liability (paragraph 12 of Fourth Schedule) • SARS may estimate employees’ tax if an employer fails to furnish an annual PAYE return, fails to deduct employees’ tax or fails to pay over employees’ tax deducted from employees 103 Employers’ obligations (Fourth Schedule) • No IRP5 certificates may be issued until EMP501 reconciliations submitted (para 14(5)) • Penalty for non-submission of EMP501 = 10% of total employees’ tax for the year (para 14(6)) Effective 29 August 2008 (GG 31381) 104 Administrative penalties (section 75B) • Penalties prescribed by regulation • Effective from 1 January 2009 105 Advance tax rulings (s 76O) • Previously: Currently SARS has to publish all binding private rulings and binding class rulings • Amendment: A ruling that is similar to a ruling that has already been published need not be published 106 Interest on late payment of tax (s 89quat) • Interest payable at the prescribed rate on Normal tax payable in excess of the credit amount; or Credit amount in excess of normal tax payable • Effective from a date to be advised in the Gazette 107 Date of payment of tax to SARS • The Minister of Finance may move the date for payments (and returns) falling on 31 March forward by a maximum of two business days 108 Thank you! 109