Document

advertisement

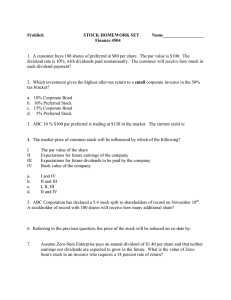

1.

Which of the following statements about common stock ownership is False?

Your Answer: Par value is a relatively useful means to estimate share value.

2.

When a company wishes to raise capital through the sale of common stock but does not want to

give up control it issues:

Correct Answer: nonvoting stock.

3.

If firms have issued __________ they must pay all passed dividends in arrears before dividends

can be paid to common stockholders.

Correct Answer: cumulative preferred stock

4.

__________ are wealthy individuals who provide venture capital in return for a portion of a new

firm's equity, but do not maintain strong oversight.

Correct Answer: Angel capitalists

5.

When investment bankers buy shares directly from a new company at an agreed upon price and

bear the risk of reselling it to the public at a profit, they are providing a(n):

Correct Answer: underwriting service.

6.

All of the following are found in an efficient market, EXCEPT:

Correct Answer: stocks tend to be underpriced.

7.

Preferred stock can be valued using the:

Correct Answer: zero-growth value model.

8.

Newport Printing paid a $2.50 dividend over the past year. During the coming year, the dividend

is expected to rise by five percent, while the required return on stocks in this risk class is eleven

percent. What is the value of Newport Printing?

Correct Answer: $43.75

{$2.50(1.05)} / (0.11 – 0.05

9.

City Foods, a rapidly growing convenience store, paid a dividend of $2.00 during 2003. They

expect to see their dividend grow at a twenty percent rate for the next two years and then level

out at a continuous six percent growth rate. City Food's required rate of return is twelve percent.

What is the value of City Foods' common stock?

Correct Answer: $44.96

Dividends2004 = $2.40, Dividends2005 = $2.88, Dividends2006 = $3.05; PV1994 Dividend = $2.14,

PV1995 Dividend = $2.30; PEnd of 1995 = $3.05 / (.12-.06) = $50.83; PVPrice at end of 1995 = $40.52

10.

Country Utilities' preferred stock pays a $4.75 annual dividend and is priced at $46.34. The riskfree rate is expected to decline from 8 percent to 5 percent and with it so will the required return

on Country Utilities' preferred. Given that an eleven percent expected return on the market

portfolio and a beta of 0.75 for the preferred issue, what will be the new price of Country

Utilities' preferred?

Correct Answer: $50.00

$4.75 / {.05 + 0.75(0.11 - 0.05)} = $4.75 / 0.095

11.

Duke Furs' balance sheet shows total assets of $3 million, total liabilities (including preferred

stock) of $1.7 million, and 200,000 shares of stock. If the assets could be sold for $4 .25 million,

what is liquidation value per share?

Correct Answer: $12.75 per share

$4,250,000 - $1,700,000 / 200,000 shares

12.

__________ focuses on investor actions and the impact of investor psychology on stock prices.

Correct Answer: Behavior finance

13.

La Crescent Graphics has anticipates a free cash flow of $4 million next year, which is expected

to grow by four percent per year. La Crescent Graphics balance sheet indicates that it has $19

million in debt, which is selling at par. It also has $2 million in preferred stock outstanding. If La

Crescent Graphics has a required rate of return equal to nine percent, what is its value based on

free cash flow?

Correct Answer: $59.0 million

4 / (0.09 – 0.04) - $19 - $2 = $80 - $19 - $2 = $59 million