ACC 570 CH 19 HOMEWORK SOLUTIONS PART A – CORPORATE

advertisement

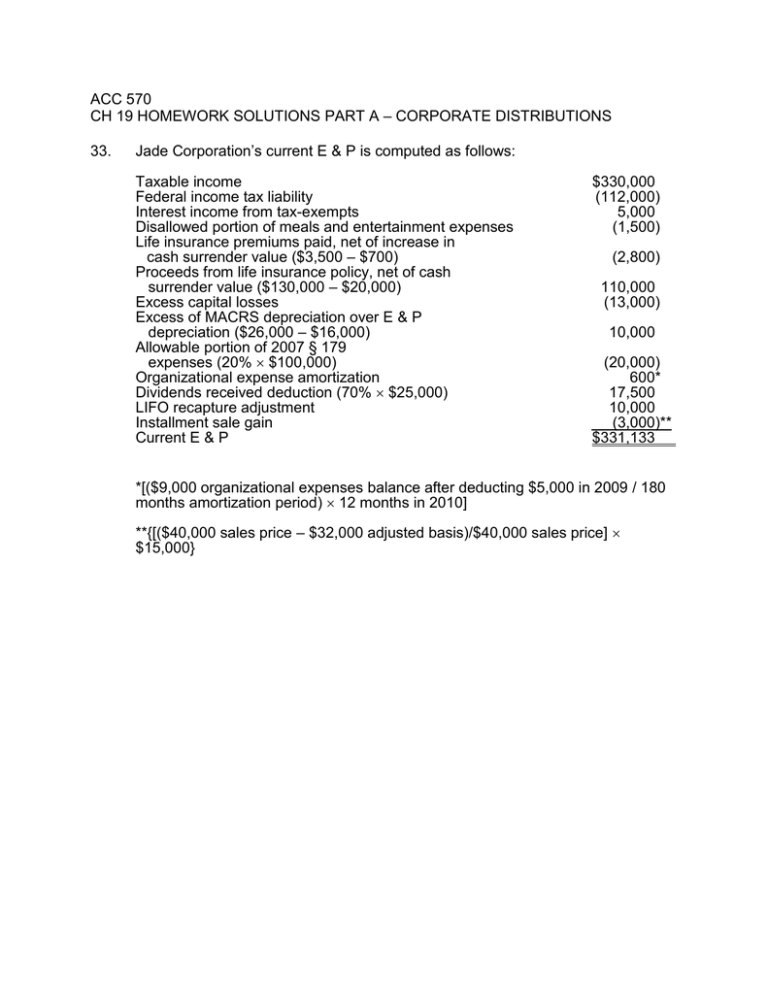

ACC 570

CH 19 HOMEWORK SOLUTIONS PART A – CORPORATE DISTRIBUTIONS

33.

Jade Corporation’s current E & P is computed as follows:

Taxable income

Federal income tax liability

Interest income from tax-exempts

Disallowed portion of meals and entertainment expenses

Life insurance premiums paid, net of increase in

cash surrender value ($3,500 – $700)

Proceeds from life insurance policy, net of cash

surrender value ($130,000 – $20,000)

Excess capital losses

Excess of MACRS depreciation over E & P

depreciation ($26,000 – $16,000)

Allowable portion of 2007 § 179

expenses (20% $100,000)

Organizational expense amortization

Dividends received deduction (70% $25,000)

LIFO recapture adjustment

Installment sale gain

Current E & P

$330,000

(112,000)

5,000

(1,500)

(2,800)

110,000

(13,000)

10,000

(20,000)

600*

17,500

10,000

(3,000)**

$331,133

*[($9,000 organizational expenses balance after deducting $5,000 in 2009 / 180

months amortization period) 12 months in 2010]

**{[($40,000 sales price – $32,000 adjusted basis)/$40,000 sales price]

$15,000}

34.

a.

b.

c.

d.

e.

f.

g.

h.

i.

Taxable Income

Increase (Decrease)

$20,000

($36,000)

No effect

$9,000

($60,000)

($60,000)

No effect

($90,000)

No effect

E & P Increase

(Decrease)

No effect

$33,900*

$140,000

$21,000**

$60,000

$48,000***

($12,000)†

($10,000)††

($50,000)

*Although mining exploration costs are deductible in full under the income tax,

they are amortized over 120 months when computing E & P. Since $300 per

month is amortizable ($36,000/120 months), $2,100 is currently deductible for

E & P purposes ($300 × 7 months). Thus, of the $36,000 income tax deduction,

$33,900 is added back to E & P ($36,000 – $2,100 deduction allowed).

**The receipt of a $30,000 dividend generates a dividends received deduction of

$21,000 with a net effect on taxable income of a $9,000 increase. For E & P

purposes, the dividends received deduction is added back.

***Only 20% of current-year § 179 expense is allowed for E & P purposes. Thus,

80% of the amount deducted for income tax purposes is added back.

†In each of the four succeeding years, 20% of the § 179 expense is allowed as a

deduction for E & P purposes.

††ADS

straight-line depreciation is allowed for E & P purposes; thus, E & P is

decreased by $10,000 (the excess of ADS depreciation over the amount

allowed under MACRS).

36.

a.

b.

Amount

Taxable

Return of

Capital

$ 70,000

$60,000

Taxed to the extent of current E & P.

$70,000

Accumulated E & P and current E & P netted

on the date of distribution.

$140,000

c.

$150,000

$ -0-

Taxed to the extent

accumulated E & P.

of

current

and

d.

$ 80,000

$50,000

Accumulated E & P and current E & P are

netted on the date of distribution. There is

a dividend to the extent of any positive

balance.

e.

$100,000

$30,000

When the result in current E & P is a deficit for

the year, the deficit is allocated on a pro rata

basis to distributions made during the year. On

June 30, E & P is $100,000 [current E & P is a

deficit of $20,000 (i.e., 1/2 of $40,000) netted

with accumulated E & P of $120,000].

43.

Sandpiper owns 25% of Owl. Owl distributes land (FMV=50; basis=80), subject

to 40k debt.

a.

Sandpiper Corporation has dividend income of $10,000 [$50,000 (fair market

value of the land) – $40,000 (liability on the land)]. The $10,000 dividend creates

an $8,000 dividends received deduction under § 243. Consequently, only $2,000

of the dividend is subject to tax. Sandpiper Corporation has a basis of $50,000 in

the land.

b.

Owl Corporation may not deduct the loss on the land. Its E & P is reduced by

$40,000 [the $80,000 basis of the land (which is greater than the fair market

value) – the $40,000 liability on the land]. Balance is now $120,000.