Document

Responsibility

Accounting

Prepared by

Douglas Cloud

Pepperdine University

9-1

Objectives

Define goal congruence and explain its relationship to control and performance chapter, you should evaluation.

Identify the types of responsibility centers and explain the differences among them.

Determine the positive and negative aspects of specific criteria used for evaluating the performance of responsibility centers.

Continued

9-2

Objectives

Calculate contribution margin variances and explain their significance.

Describe the pros and cons of including cost allocation in performance reports.

Describe some approaches to allocating costs to responsibility centers.

Explain how cost allocations can create ethical problems.

9-3

A major objective of management control is to encourage goal congruence , which means that as people work to achieve their own goals, they also work to accomplish the company’s goals.

9-4

Responsibility Centers

A responsibility center is an activity, such as a department, that a manager controls.

Types of Responsibility Centers

Cost centers

Revenue centers

Profit centers

Investment centers

9-5

Responsibility Centers

A cost center is a segment whose manager is responsible for costs, but not revenues. A cost center can be relatively small.

Examples:

A manufacturing cell

The office of the chief executive

The legal department

9-6

Responsibility Centers

A revenue center is a segment whose manager is responsible for earning revenues, but not for the costs of generating revenues.

Examples:

Hospitals

Marketing departments

9-7

Responsibility Centers

• A profit center is a segment whose manager is responsible for revenues as well as costs.

• An investment center is a segment whose manager is responsible not only for revenues and costs, but also for the investment required to generate profits.

9-8

Transfer Price

A transfer price is the price that one center charges another center within the company.

9-9

Performance Evaluation Criteria

Selecting criteria to measure and evaluate performance is important because the criteria influence managers’ actions. The most common deficiencies in performance measures are:

– using a single measure that emphasizes only one objective of the organization; and

– using measures that either misrepresent or fail to reflect the organization’s objectives or the employee’s responsibilities.

9-10

The Balanced Scorecard

An approach known as the balanced scorecard has become popular recently. This approach extends performance evaluation from merely looking at financial results to formally incorporating measures that look at customer satisfaction, internal business processes, and the learning and growth potential of the organization.

9-11

The Balanced Scorecard

The balanced scorecard asks four basic questions:

1. How do customers see us? (the customer perspective)

2. What must we excel at? (the internal business process perspective)

3. Can we continue to improve and create value?

(the learning and growth perspective)

4. How do we look to stockholders? (the financial perspective)

9-12

9-13

Responsibility Reports for Cost Centers

Current Month Year to Date

Over Over

Budget (Under) Budget (Under)

Report to Supervisor of Work

Station 106—Drill Press

Materials

Direct labor

Supervision

Power, supplies, miscellaneous

Totals

$ 3,200

14,200

1,100

910

$(80 ) $ 12,760 $ 110

170

(50 )

24

87,300

4,140

3,420

880

(78 )

92

$19,410 $ 64 $107,620 $1,004

Report to Supervisor of

Fabrication Department

9-14

Responsibility Reports for Cost Centers

Current Month Year to Date

Over Over

Budget (Under) Budget (Under)

Report to Supervisor of

Fabrication Department

Station 106—Drill Press

Station 107—Grinding

Station 108—Cutting

Total work stations

$19,410 $ 64 $107,620 $1,004

17,832 122 98,430 (213 )

23,456 876 112,456 1,227

$60,698 $1,062 $318,506 $2,018

Continued

9-15

Responsibility Reports for Cost Centers

Current Month Year to Date

Over Over

Budget (Under) Budget (Under)

Report to Supervisor of

Fabrication Department

Departmental costs (common to work stations):

General supervision

Cleaning

Other

Total

$12,634 $ 0 $ 71,234 $ 0

6,125 324 32,415 762

1,890 (67 ) 10,029 (108 )

$81,347 $1,319 $432,184 $2,672

Report to Manager of

Factory

9-16

Responsibility Reports for Cost Centers

Current Month Year to Date

Over Over

Budget (Under) Budget (Under)

Report to Manager of Factory

Fabrication department

Milling department

Assembly department

Casting department

Total departments

$ 81,347 $1,319 $ 432,184 $2,672

91,234 (2,034 ) 405,190 (4,231 )

107,478 854 441,240 1,346

78,245 (433 ) 367,110 689

$358,304 $ (294 )$1,645,724 $ 476

Continued

9-17

Responsibility Reports for Cost Centers

Current Month Year to Date

Over Over

Budget (Under) Budget (Under)

General factory costs

(common to departments):

Engineering

Heat and light

Building depreciation

General administration

Total factory costs

$ 14,235 $261 $ 81,340 $842

8,435 178 46,221 890

3,400 0

23,110 340

20,400

126,289

0

776

$407,484 $ 485 $1,919,974 $2,984

9-18

Responsibility Reports for Profit Centers (000s)

Current Month Year to Date

Over Over

Budget (Under) Budget (Under)

Report to Product Manager—

Appliances, European Region

Sales

Variable costs:

Production

Selling and administrative

Total variable costs

Contribution margin

Direct fixed costs

Product margin

$122.0

$ 1.5

$387.0

$ 3.2

$ 47.5

$ 2.8

$150.7

$ 5.9

12.2

1.8

38.7

1.9

$ 59.7

$ 4.6

$189.4

$ 7.8

$ 62.3

$ (3.1 ) $197.6

$(4.6 )

36.0

$ (1.2 ) 98.5

(3.1 )

$ 26.3

$ (1.9 ) $ 99.1 $ (1.5 )

To report to manage—European Region

9-19

Responsibility Reports for Profit Centers (000s)

Current Month Year to Date

Over Over

Budget (Under) Budget (Under)

Report to Manager—

European Region

Profit margins:

Appliances

Industrial equipment

Tools

Total product margins

Regional expenses (common to all product lines)

Regional margin

$26.3

$(1.9 ) $ 99.1

$(1.5 )

37.4

3.2

134.5

7.3

18.3

1.1

59.1

(2.0 )

$82.0

$ 2.4

$292.7

$ 3.8

18.5

0.8

61.2

(1.3 )

$63.5

$ 1.6

$231.5

$ 5.1

Report to Executive Vice President

9-20

Responsibility Reports for Profit Centers (000s)

Current Month Year to Date

Over Over

Budget (Under) Budget (Under)

Report to Executive Vice

President

Regional margins:

European

Asian

North American

Total regional margins

Corporate expenses (common to all regions)

Corporate profit

$ 63.5

$ 1.6

$ 231.5 $ 5.1

78.1

(4.3 ) 289.4

(8.2 )

211.8

(3.2 ) 612.4

(9.6 )

$353.4

$ (5.9 ) $1,133.3 $(12.7 )

87.1

1.4

268.5

3.1

$266.3

$ (7.3 ) $ 864.8 $(15.8 )

Analyzing Contribution

Margin Variance

Profit depends on several factors, including selling prices, sales volumes, and costs.

Budgeted and actual profits rarely coincide because prices, volume, and costs can (and do) vary from expectations. To plan and to evaluate previous decisions, managers need to know the sources of variances.

9-21

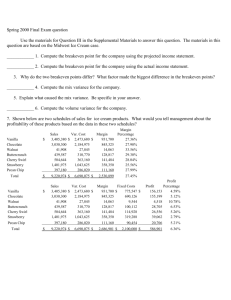

Contribution Margin Variance

Example

Horton Company expected to sell 20,000 units at $20 with unit variable costs of $12. Horton actually sold

21,000 units at $19.

Sales

Budgeted Actual Difference

$400,000 $399,000 $(1,000)

Variable costs 240,000 252,000 (12,000)

Contribution margin $160,000 $147,000 $(13,000)

9-22

Sales Volume Variance

The sales volume variance is the difference between

(1) the contribution margin the company would have earned selling the budgeted number of units at the budgeted unit contribution margin and (2) the contribution margin it would have earned selling the actual number of units at the budgeted unit contribution margin.

Sales = budgeted contribution x (actual unit – budgeted unit) volume variance margin per unit sales sales

$8,000 = $8 x (21,000 – 20,000)

9-23

Sales Price Variance

The sales price variance is the difference between (1) actual total contribution margin and (2) total contribution margin that would have been earned at the actual volume and budgeted unit contribution margin.

Sale price variance = units sold x (actual price – budgeted price)

$21,000 F = 21,000 x ($19 - $20)

9-24

Cost Allocations on

Responsibility Reports

Operating departments in manufacturers work directly on products. Operating departments in a retail company serve customers directly.

Service departments (service centers) provide services to operating departments and to one another. Examples: human resources, accounting, and building security.

9-25

Arguments Against Allocating

Indirect Fixed Costs

1.

Because indirect fixed costs are not controllable by the users, allocating them violates the principle of controllability.

2.

Including allocated costs on performance reports could lead to poor decisions because managers will treat the costs as differential.

9-26

Allocation Methods and Effects:

Allocating Actual Costs Based on Actual Use

This method is flawed in two respects.

–

It allocates actual costs rather than budgeted costs. Allocating actual costs passes the inefficiencies (or efficiencies) of one department to the next.

–

It allocates fixed costs based on use.

9-27

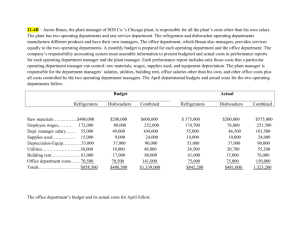

Allocation Example

Raleigh Company has one service department, Maintenance, and two operating departments, Fabrication and Assembly. Data for the departments follow:

Operating Hours of Maintenance Service Used

Department: Budgeted Actual

Fabrication 20,000 20,000

Assembly

Total

Maintenance Department Costs for Year:

Budgeted

Variable (budgeted, $5.00; actual, $5.10) $200,000

Fixed

Totals

20,000

40,000

75,000

$275,000

10,000

30,000

Actual

$153,000

79,500

$232,500

9-28

Allocation Example

Actual per-hour cost

$232,500 of providing the service = = $7.75/hr.

9-29

Allocations would be:

Fabrication (20,000 x $7.75)

Assembly (10,000 x $7.75)

$155,000

77,500

Total maintenance costs allocated $232,500

Methods to Allocate Service

Department Costs (Appendix)

Direct method

Step method

Reciprocal method

9-30

Direct Method

• Illustrated in the chapter material

• Direct method ignores services that service depts. Provide to other service depts.

9-31

Step-Down Method

• Also called: step-down allocation or step method

• Recognizes that service depts. Provide services for other service depts. As well as operating depts.

• Result: costs of all service depts., except first to be allocated, will reflect their shares of the costs of some other service depts.

9-32

Reciprocal Method

• Also called simultaneous method

• Recognizes the services that each service dept. renders to other service depts.

• 1 st – the percentages that each service dept. receives from the other are decided upon.

• 2 nd – adjusted costs are calculated – to recognize that depts. Provide service to each other.

• Finally – these adjusted costs are allocated to the operating depts. Using the percentages computed.

9-33

Chapter 9

The End

9-34

9-35