Page 1 of 2

Gleim CMA Review

Updates to Part 1

2015 Edition, 1st Printing

March 2015

NOTE: Text that should be deleted is displayed with a line through it. New text is shown with a

blue background.

Study Unit 10 – Cost and Variance Measures

Page 353, Subunit 10.8, 1.b.1)a): This update was made to clarify the acronyms in the equation.

10.8 SALES VARIANCES

1. Single Product Sales Variances

a. Variance analysis is useful for evaluating not only the production function but also the

selling function.

1) If sales differ from the amount budgeted, the difference could be attributable to

either the sales price variance or the sales volume variance (sum of the sales

quantity and mix variances).

2) The analysis of these variances concentrates on contribution margins because

fixed costs are assumed to be constant.

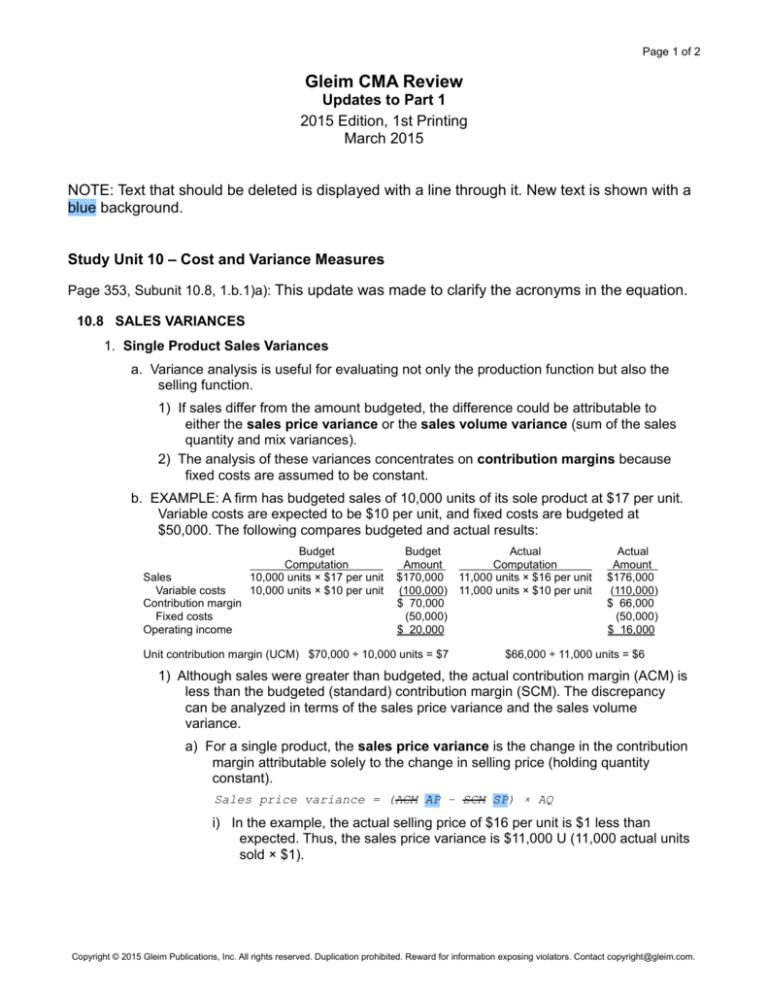

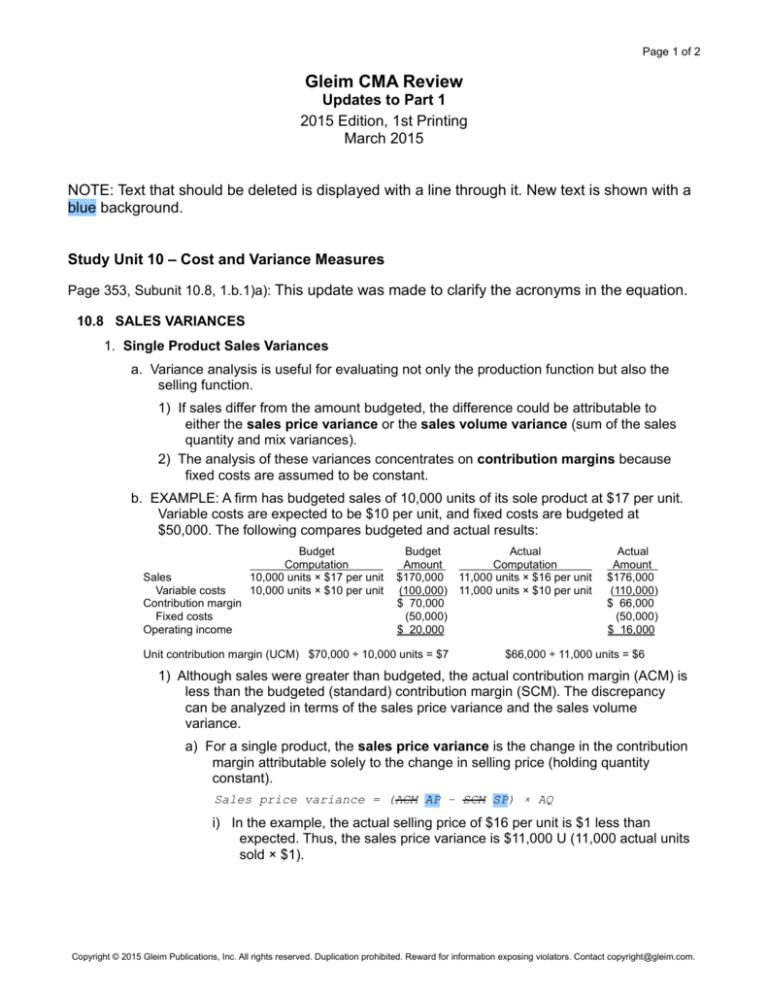

b. EXAMPLE: A firm has budgeted sales of 10,000 units of its sole product at $17 per unit.

Variable costs are expected to be $10 per unit, and fixed costs are budgeted at

$50,000. The following compares budgeted and actual results:

Sales

Variable costs

Contribution margin

Fixed costs

Operating income

Budget

Computation

10,000 units × $17 per unit

10,000 units × $10 per unit

Budget

Amount

$170,000

(100,000)

$ 70,000

(50,000)

$ 20,000

Unit contribution margin (UCM) $70,000 ÷ 10,000 units = $7

Actual

Computation

11,000 units × $16 per unit

11,000 units × $10 per unit

Actual

Amount

$176,000

(110,000)

$ 66,000

(50,000)

$ 16,000

$66,000 ÷ 11,000 units = $6

1) Although sales were greater than budgeted, the actual contribution margin (ACM) is

less than the budgeted (standard) contribution margin (SCM). The discrepancy

can be analyzed in terms of the sales price variance and the sales volume

variance.

a) For a single product, the sales price variance is the change in the contribution

margin attributable solely to the change in selling price (holding quantity

constant).

Sales price variance = (ACM AP – SCM SP) × AQ

i) In the example, the actual selling price of $16 per unit is $1 less than

expected. Thus, the sales price variance is $11,000 U (11,000 actual units

sold × $1).

Copyright © 2015 Gleim Publications, Inc. All rights reserved. Duplication prohibited. Reward for information exposing violators. Contact copyright@gleim.com.

Page 2 of 2

Study Unit 12 – Internal Controls -- Risk and Procedures for Control

Page 420, Subunit 12.2, Question 11: This update clarifies the answer explanation for

incorrect answer choice (B).

11. Which one of the following situations represents a

strength of internal control for purchasing and

accounts payable?

A.

Prenumbered receiving reports are issued

randomly.

B.

Invoices are approved for payment by the

purchasing department.

C.

Unmatched receiving reports are reviewed on

an annual basis.

D.

Vendors’ invoices are matched against

purchase orders and receiving reports before a

liability is recorded.

Answer (D) is correct.

REQUIRED: The strength in internal control relevant to

purchasing and accounts payable.

DISCUSSION: A voucher should not be prepared for

payment until the vendor’s invoice has been matched against

the corresponding purchase order and receiving report. This

procedure provides assurance that a valid transaction has

occurred and that the parties have agreed on the terms, such

as price and quantity.

Answer (A) is incorrect. Prenumbered receiving reports

should be issued sequentially. A gap in the sequence may

indicate an erroneous or fraudulent transaction. Answer (B) is

incorrect. Invoices should not be approved by purchasing. That

is the job of the accounts payable department. The approval of

an invoice for payment is a basic duty of the purchasing

department and would therefore not represent a strength of

internal control for purchasing and accounts payable.

Answer (C) is incorrect. Annual review of unmatched receiving

reports is too infrequent. More frequent attention is necessary

to remedy deficiencies in internal control.

Copyright © 2015 Gleim Publications, Inc. All rights reserved. Duplication prohibited. Reward for information exposing violators. Contact copyright@gleim.com.