Old exam questions

advertisement

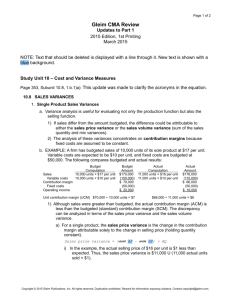

Spring 2000 Final Exam question Use the materials for Question III in the Supplemental Materials to answer this question. The materials in this question are based on the Midwest Ice Cream case. ____________ 1. Compute the breakeven point for the company using the projected income statement. ____________ 2. Compute the breakeven point for the company using the actual income statement. 3. Why do the two breakeven points differ? What factor made the biggest difference in the breakeven points? ____________ 4. Compute the mix variance for the company. 5. Explain what caused the mix variance. Be specific in your answer. ____________ 6. Compute the volume variance for the company. 7. Shown below are two schedules of sales for ice cream products. What would you tell management about the profitability of these products based on the data in these two schedules? Vanilla Chocolate Walnut Buttercrunch Cherry Swirl Strawberry Pecan Chip Total Vanilla Chocolate Walnut Buttercrunch Cherry Swirl Strawberry $ $ $ Pecan Chip Total $ Margin Sales Var. Cost Margin Percentage 3,405,380 $ 2,473,680 $ 931,700 27.36% 3,030,300 2,184,975 845,325 27.90% 41,908 27,845 14,063 33.56% 439,587 310,770 128,817 29.30% 504,644 363,160 141,484 28.04% 1,401,975 1,043,625 358,350 25.56% 397,180 286,020 111,160 27.99% 9,220,974 $ 6,690,075 $ Sales Var. Cost 3,405,380 $ 2,473,680 $ 3,030,300 2,184,975 41,908 27,845 439,587 310,770 504,644 363,160 1,401,975 1,043,625 2,530,899 27.45% Margin Fixed Costs 931,700 $ 775,547 $ 845,325 690,126 14,063 9,544 128,817 100,112 141,484 114,928 358,350 319,288 Profit Profit Percentage 156,153 4.59% 155,199 5.12% 4,518 10.78% 28,705 6.53% 26,556 5.26% 39,062 2.79% 397,180 286,020 111,160 90,454 20,706 5.21% 9,220,974 $ 6,690,075 $ 2,686,901 $ 2,100,000 $ 586,901 6.36% Question III supplemental materials An accountant working for you compiled the following data on an ice cream manufacturer and distributor. Budgeted Contribution Margin at Forecasted Volume Standard Contribution Margin/Gallon Vanilla Chocolate Walnut Buttercrunch Cherry Swirl Strawberry Pecan Chip Total Forecasted Forecasted Gallon Sales Contribution Margin 0.4235 0.4335 0.5625 0.4771 0.5053 0.4778 0.5558 2,400,100 2,000,000 40,000 261,500 201,000 630,000 160,000 $1,016,442 867,000 22,500 124,762 101,565 301,014 88,928 0.4431 5,692,600 $2,522,211 Budgeted Contribution Margin at Actual Volume Standard Contribution Margin/Gallon Vanilla Chocolate Walnut Buttercrunch Cherry Swirl Strawberry Pecan Chip Total Actual Flexible Budget Gallon Sales Contribution Margin 0.4235 0.4335 0.5625 0.4771 0.5053 0.4778 0.5558 2,200,000 1,950,000 25,000 270,000 280,000 750,000 200,000 $931,700 845,325 14,063 128,817 141,484 358,350 111,160 0.4460 5,675,000 $2,530,899 Difference in Gallons Sold Vanilla Chocolate Walnut Buttercrunch Cherry Swirl Strawberry Pecan Chip (200,100) (50,000) (15,000) 8,500 79,000 120,000 40,000 Projected Income Statement Sales $ 8,461,000 Variable Costs Contribution Margin 5,938,789 2,522,211 Fixed Costs 2,000,000 Projected Profit $ 522,211 Income Statement for Actual Results Sales Variable Costs Contribution Margin $ 8,665,625 5,756,625 2,909,000 Fixed Costs Actual Profit 2,100,000 $ 809,000 Actual units sold x target selling price $ 8,465,625 Mgt413a Fall 97 Question IV Use the material in the supplemental materials for this exam to answer this question. _______________ 1. If the salesperson who sells these units estimated monthly fixed costs at $4,000, what is her monthly budgeted break-even point? 2. Why do you think actual sales of the TP28953A product were so much lower than budgeted? Give calculations (if you think they are appropriate) to support your answer. ______________ 3. Compute the volume variance for the salesperson for the period covered by these data. 4. In total for the period covered, did the salesperson get a better or worse price than that originally budgeted? Give numbers to support your answer. ______________ 5. Compute the mix variance for this salesperson for the period. See the material on the next page for the data you use to answer this question. Question IV Material One of your salesman presented you with the following information about her sales for the past month. Use this information to answer the questions on pages of the test. Item Number TP28900A TP28902A TP28913A TP28954A TP28953A TP28970A TP28972ZA Description PA77600 TRANS. MOTOR KIT PA77601 TRANS. MOTOR KIT PA77629 BUMPER KIT PA77648 FLATBED BOX PA77649 FLATBED KIT PA77650 FLATBED KIT PA77651B STEERING HANDLE CLAMP Totals Std Cost $90.8733 93.1095 4.0524 18.9491 30.1982 26.4883 4.5801 Budgeted Budgeted Unit Price Quantity $130.00 5 124.95 100 8.50 90 47.50 8 60.00 50 53.50 8 12.50 25 286 Actual Quantity 3 65 111 1 5 4 1 190 Actual Units Budgeted Budgeted x Budget x Budget Actual Cost Revenue Price Cost Revenue $454.37 $650.00 $390.00 $272.62 $520.00 9,310.95 12,495.00 8,121.75 6,052.12 6,552.75 364.72 765.00 943.50 449.82 944.00 151.59 380.00 47.50 18.95 72.50 1,509.91 3,000.00 300.00 150.99 600.00 211.91 428.00 214.00 105.95 232.50 114.50 312.50 12.50 4.58 19.50 $12,117.94 $18,030.50 $10,029.25 $7,055.03 $8,941.25 Mgt413a Fall 98 Question IV (25 Points) Use the information in the supplemental materials to answer this question. 1. Which customer generated the most sales? Customer ____________________ Amount of sales _______________________ 2. Which customer generated the most contribution margin? Customer ____________________ Amount of margin _______________________ 3. Which customer generated the biggest selling price variances? Customer ____________________ Amount of price variance _______________________ 4. Assume the total budgeted contribution margin for this period was $1,800 and total budgeted units was 360. How much was the volume variance for the period? Show calculations. ___________________ Volume variance 5. Compute the mix variance for this case. Use the data from question 4 to answer this question. ___________________ Mix variance 6. Describe one way you would use the data in this question to create value for a company. You do not need all of this page to create an answer to this question. Question IV Materials Product Box Hammer Shovel Box Hammer Hammer Shovel Box Shovel Customer Albert Albert Albert Fred Fred Fred Fred Jack Jack Target Selling Price Box Hammer Shovel 10 20 30 Quantity 10 70 80 40 50 30 20 60 20 Total Sales $80 1,190 1,600 480 1,000 600 700 600 600 Total Variable Cost $50 1,050 1,200 200 750 450 300 300 300 380 $6,850 $4,600 Unit Variable Cost 5 15 15 Margin $30 140 400 280 250 150 400 300 300 $2,250 Actual Unit Price $8 17 20 12 20 20 35 10 30 Actual Units x Target Price $100 1,400 2,400 400 1,000 600 600 600 600 $7,700