2013/14 dbsa scoring scenario

advertisement

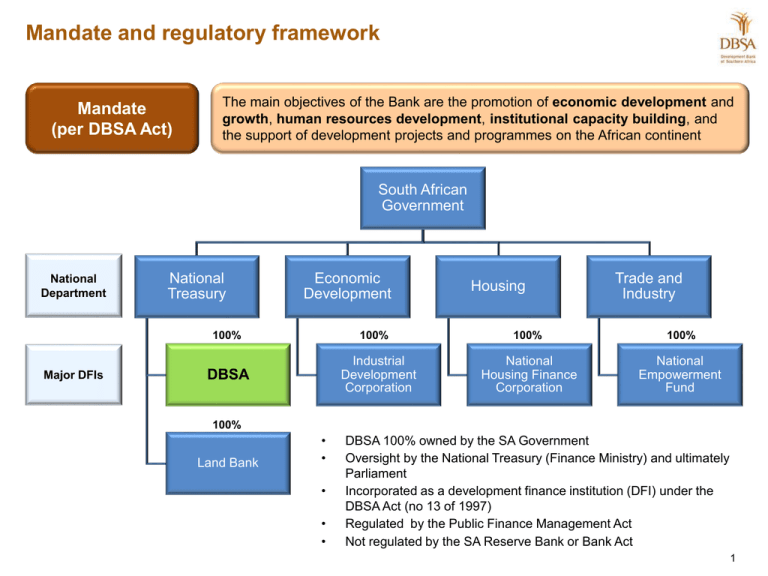

Mandate and regulatory framework Mandate (per DBSA Act) The main objectives of the Bank are the promotion of economic development and growth, human resources development, institutional capacity building, and the support of development projects and programmes on the African continent South African Government National Department National Treasury Economic Development 100% Major DFIs 100% Industrial Development Corporation DBSA Housing Trade and Industry 100% 100% National Housing Finance Corporation National Empowerment Fund 100% Land Bank • • • • • DBSA 100% owned by the SA Government Oversight by the National Treasury (Finance Ministry) and ultimately Parliament Incorporated as a development finance institution (DFI) under the DBSA Act (no 13 of 1997) Regulated by the Public Finance Management Act Not regulated by the SA Reserve Bank or Bank Act | 1 DBSA plays a critical role around implementation of the National Development Plan (NDP) DBSA’s role Outcome Example Create an economy that will create more jobs • IDD: ASIDI and Eastern Cape Rural Housing Investing in economic infrastructure • Funding of various energy, transport and ICT projects Environmentally sustainable and resilient: Transition to a low carbon-economy • Preparation and funding of IPPs An inclusive and integrated rural economy • Funding of bulk water supply • Eastern Cape Rural Housing Programme South Africa in the region and the world • Funding of projects in SADC • North-South corridor Transforming Human Settlements • Eastern Cape Rural Housing Programme • Housing Impact Fund Improving the quality of education, training and innovation • IDD: ASIDI programme • Funding of student accommodation Quality health care for all • IDD: refurbishment of health clinics and construction of doctors’ rooms Social protection Building safer communities Building a capable and developmental state Provision of technical support in the planning and implementation of projects Fighting corruption IDD: management of procurement processes in appointing service providers Transforming society and uniting the country Direct Indirect Supporting development impact through investment in social and economic infrastructure | 2 Not applicable DBSA strategic framework is aligned to the government’s economic policy and programs National imperatives National Development Plan Presidential Infrastructure Coordinating Commission Vision A prosperous and integrated region, progressively free of poverty and dependence Mission To advance the development impact in the region by expanding access to development finance and effectively integrating and implementing sustainable development solution Improve the quality of life of people through the development of social infrastructure Support Economic Growth through investment in economic infrastructure Support Regional Integration Strategy Objectives Sustained growth in development impact Integrated infrastructure solutions provider Financial Sustainability Strategic Enablers Balance Sheet Capacity High Performance Culture Partnerships Business Intelligence Operational Excellence Innovation Values Shared Vision High Performance Service Orientation Performance Measures Growth in disbursements: 20%+ CAGR Cost to income ratio: 35% long term Return on equity: 5-6% in long term Equity Growth: Inflation linked IDD Growth: Full cost recovery and R500M revenue Innovation Integrity Competitive Advantages Integrated infrastructure solutions provider (“cross-sell”) Early stage risk (project prep) Trusted partner Access to infra. decision-makers (esp. public sector) Basel III – ability to provide longer tenor debt | 3 DBSA primarily plays a key role in the prepare, fund and build phases of the infrastructure development value chain DBSA’s primary focus 1 2 Client / markets Services Plan • Under-resourced municipalities Plan 3 Prepare 4 Finance Prepare 5 Build • • • • • • Project identification Feasibility assessments Technical assistance Financial structuring Project Preparation funds Lead arranger Provide vanilla and boutique financing opportunities • Debt • Mezzanine Finance • Limited non–recourse lending • MLA • Managing the design and construction of key projects in the education, health and housing sectors • Project Management support, including to the Jobs and Green funds • • • • Municipalities Public-private partnerships Public-public partnerships Regional integration South Africa • National and provincial • Municipalities government departments • State–Owned Enterprises • Municipalities • Public-Private Partnerships • Public-Public Partnerships • Private sector Maintain / improve • Supporting the maintenance and/or improvement of social infrastructure projects • National and provincial government departments • Municipalities The rest of Africa • State-Owned Enterprises • Public–Private Partnerships • Private sector Integration across the value chain and innovative solutions to drive infrastructure delivery and development impact | 4 Record infrastructure disbursements of R12.7Bn – 39% growth Total disbursements Highlights 18,000 DBSA Restructuring 16,000 14,000 15.4 R million Total approvals amounted to R14.0 billion and commitments to R12.2 billion • Total disbursements of R12.7 billion (2012/13: R9.2 billion & 2013/14 target: R11.0 billion) supporting 116 projects: 12.7 12,000 10,000 • 8.3 8.3 9.2 8.0 8,000 6,000 4,000 • Energy sector – 53% of financing • South Africa – 72% (R9.1 billion) of total disbursements • Rest of SADC: R3.6 billion (2012/13: R1.6 billion) 2,000 2009/10 2010/11 2011/12 2012/13 2013/14 Actual 2014/15 Target Disbursements per sector Disbursements: SA vs Rest of SADC Other 14% Rest of SADC 28% Housing & education 3% ICT 5% Water & sanitation 7% Energy 53% South Africa 72% Roads & transportation 18% | 5 Development impact Municipal Funding: Households benefited 140,000 117 Number of households benefited 120,000 100,000 264 000 households benefiting from municipal financing, 35% of funding from the DBSA 84 80,000 Energy Generation • Renewable: 2,588 MW (16% of funding from DBSA) • Coal IPP: project preparation financing for 3,600 MW Housing • Funded 120,000 units of housing (30% of project funding from DBSA) Roads • Enabled 1,880km of roads (55% of project funding from DBSA) Education • Student accommodation of 1,630 beds (46% of project funding from DBSA) 60,000 40,000 Non-municipal Funding (RSA and SADC): Projects supported via third party financing: 34 29 20,000 Electrification Water Sanitation • ICT broadband cable system • Two new airports in Africa and the expansion of one in South-Africa • Cellular operations in the rest of Africa • Various renewable energy projects Roads DBSA is playing a pivotal role in development Note: Estimate as of time of commitment; DBSA contribution relates to the portion of project financing provided by the DBSA |6 Infrastructure financing Targeting 20% annual growth rate for next three years: • ~ 70% in South Africa, remaining 30% in the rest of Africa • More than doubling our disbursements to under-resourced municipalities Total disbursements 25 R22.0 bn CAGR: 20 R17.8 bn R15.4 bn R billion • Rest of Africa: 18% 15 R12.7 bn 10 R8.1 bn South Africa: 25% R9.2 bn 5 0 Actual 2012 Actual 2013 Actual 2014 South Africa 2015 2016 2017 Rest of Africa We aim to be at the heart of infrastructure development on the continent Our growth ambitions will enable DBSA to become a leading infrastructure financier in Africa, meaningfully contributing to economic growth and regional integration | 7 CONTENTS ITE M PRESENTATION CONTENTS PAG E 1. CONTEXT – Financing Role of DFIs 3 2. DBSA Mandate as an Infrastructure DFI 4 3. DBSA Investment appraisal module 5 4. DBSA Investment Appraisal and responsible investment 6 5. DBSA social appraisal module 7 | 2 Development finance institutions (DFIs) support the promotion of human rights through the provision of sustainable financing essential for social and economic development. Risk Public Sector Fiscal transfers and grants Cost Recovery Private Sector Capital DFI Role Cost recovery potential Cost Recovery Risk Access to long term financing to support sustainable development is essential to enable the growth required to facilitate Africa’s social and economic transformation and address the continents infrastructure and social services backlogs. DFIs play a catalytic role in financing sustainable investment, providing technical services essential to package sustainable development solutions, and promoting responsible investment practices. Over 140 DFIs operate in Africa, with the mandate to finance infrastructure, agriculture, manufacturing, housing and small and medium enterprises (SMEs). Source: Calice (2014); Graphic Adapted from Musasike, L et | 3 The DBSA is an infrastructure Development Finance Institution (DFI) that operates in South Africa and Africa. The DBSA’s strategy is based on supporting national infrastructure imperatives including the National Development Plan and work of the Presidential Infrastructure Co-ordinating Committee while achieving financial sustainability as a foundation for future growth. Achieve financial sustainability as foundation for future growth DBSA to achieve financial sustainability over the medium term (grow equity greater than inflation) within acceptable risk framework: • Revenue maximisation • Non-interest income growth (e.g. syndication) • Operational cost and impairments management • Direct delivery: activities agreed with the shareholder and only undertaken on a SOURCE: full cost recovery basis Provision of development finance and delivery capacity to build and maintain sustainable infrastructure Infrastructure funding Direct delivery Deliver infrastructure Drive investments focusing on: • SA (energy, health, transport & logistics, water, ICT, housing, municipal infrastructure, education, LNG) • International (energy, transport & logistics, bulk water, ICT) • Grow development assets • Leverage third party funds through syndication • Diversify product offering in support of infrastructure development (e.g. trade finance) Support key government priorities: local government, health, education and regional integration; Support the catalytic implementation of particular development interventions for maximum development impact | DBSA 4 As an infrastructure DFI, the DBSA provides financing for development solutions that are economically, socially and environmentally sustainable. Social Appraisal: To consider potential investment projects, the DBSA conducts an integrated appraisal module incorporating: • Mapaka and Juana Income Generation Model Income: Pn x Qn Less direct expenses: P n x Qn Financial Appraisal: Assess financial & investment model Verify financial & equity assumptions Stress test model Propose funding options Institutional Appraisal: Role of Board Strategic plan Organizational structure Institutional capacity Policy compliance Legislative compliance Management capacity Socio Economic Market Assessment including: Market Resources People Existing developments Demand / absorption capacity for project Technology Options Conceptual design Environmental impact & sustainability Operations & maintenance considerations Appropriateness of use pay options & take off agreements Capital Expenditure Finance Cash flow Income statement Balance sheet Stakeholder identification Community mobilization Representative structures Impact on affected parties Impact on beneficiaries Readiness to receive project Economic Appraisal Local economy/ socio economic analysis Cost benefit analysis Estimated development impact Sector Appraisal Project fit to sector development objectives Project demand Project feasibility project viability Institutional arrangements Key technical risks Environmental Appraisal Technical solutions impact on environment GHG Screening Risk Categorization Identify impact indicators Impact mitigation measures Environmental impact matrix Project impact rating | 5 As an infrastructure DFI, the DBSA promotes responsible investment through application of best practice principles in its investment decision making. The DBSA integrated appraisal module takes into consideration: The International Financial Corporation (IFC) Sustainability Framework Socially Responsible Investing The United Nations Development Programme’s (UNDP) Principles of Good Governance The International Organization for Standardization (ISO) 26000, and The Integrated Reporting Committees Framework for Integrated Reporting Mainstreaming of gender and marginalised groups The King III Report on Corporate Governance and Compliance with national legislation / regulations including the South African Companies Act (2011), the Public Finance Management Act (PFMA) (2012 ), the Municipal Finance Management Act (MFMA) (2003). DBSA commitment to sustainability principles is evidenced by DBSA accreditation to various international sustainability initiatives. The DBSA is accredited as a national project agent of the Global Environment Facility (GEF). | 6 DBSA Social and Institutional analysts provide social and institutional assessment services for all proposed investment projects / programmes. Depending on the nature and type of project being assessed, the social assessment would address: • Level of community mobilisaton • Level of community organisation • Stakeholders groups legitimacy • Level of representation • Forms of representation • Legitimacy of spokespersons • Forms of communication/ feedback • Project impact on affected parties • Project impact on beneficiaries • Readiness of community to receive a project • Positive impacts • Negative impacts • Mitigation • Positive impacts • Negative impacts • Mitigants • Social stability – violence, crime, employment • Willingness to pay | 7 The DBSA utilises a Development Results Template (DRT) to capture the development results of the Banks activities and enable reporting on DBSA development activities. The DRT serves to: Evaluate the development effectiveness of the DBSA’s operations; Facilitate reporting on the results of DBSA operations; Enable the DBSA to balance financial and developmental imperatives; Ensure that the DBSA is able to maximize the development effectiveness and impact of its funding operations and interventions and Measure ability to achieve its targets and deliver on the DBSA mandate. To enable effective development reporting, the DRT indicators are to form part of the Reporting Conditions of all loan agreements with potential DBSA clients | 8 Presentation presented by: Mohan Vivekanandan, Group Executive: Strategy, DBSA | 8 Appendix APPENDIX – DBSA Projects | 16 Metropolitan Municipality: City of Tshwane Heartherly/Mamelodi Electrification Project Description The project involved the construction of a substation designed to provide a firm capacity of 105 MYA at 11 000 volts. Heatherly substation will receive its electricity supply from the City of Tshwane Metropolitan Municipality's 132 kV distribution network until a new 132 kV power line is constructed from the Njala 132 kV infeed. Development Impact • • Project Status • The project provided access to electricity to over 1,000 households 49 job opportunities were created during construction, 33 of which were unskilled and 41 were female labourers The project is complete and has been commissioned | 17 Metropolitan Municipality: City of Tshwane Babelegi Bulk Water Supply Project Description The scope of the project consisted of the construction of a 15 ML reservoir, water tower and pump-stations on the existing Babelegi reservoir site. The scope of works also included the replacement of the corroded sections of the supply pipeline from the Temba Water Purification Plant. Development Impact • • Project Status • The project has improved the quality of water and provided access to 15k households in the Hammanskraal area. It created 145 jobs to skilled, semi- and unskilled individuals. The project is complete and has been commissioned | 18 Market 3 Municipality: Thulamela INEP Programme Pictures ELECTRIFICATION OF TSHIDZINI VILLAGE (110 HOUSEHOLDS) | 19 Education: University of KwaZulu UNIVERSITY OF KWAZULU 4 YEAR CAPITAL DEVELOPMENT PROGRAMME A 4 Year Capital Development Programme (R450 million) for the University of KwaZulu Natal was approved in July 2010. An element of the overall Infrastructure Programme was for Health Sciences facilities. R40 million of the DBSA Loan was used to supplement the grant funding of R261 million from the Howard Hughes Foundation and the Universities own funds to complete the construction of the KwaZulu Natal Research Institute for Tuberculosis and HIV (K-RITH) Building on the grounds of the Nelson Mandela School of Medicine at the University of KwaZulu Natal in Durban. The K-RITH building was completed in 2012 at a total cost of R346 million. The building is a seven story 4000 square meter medical research building. The facility includes Biosafety level 3 laboratories, which are able to cope with pathogens that cause TB and Aids. Approximately 10 K-RITH research groups conduct research in the building. | 20 Energy: Jeffrey’s Wind Farm Project Project Description • • • • Jeffreys Bay Wind Farm is a 138 MW wind project. One of the largest wind farms in South Africa (with 60 wind turbines erected on 3 700 hectares) It is located between the towns of Jeffreys Bay and Humansdorp, in the Kouga Municipality in the Eastern Cape Project Size: R2.9 billion • Debt: R2.2 billion (72%) • Equity: R0.8 billion (28%) Project Investors • • • • • • • Globeleq Mainstream Renewable Power Old Mutual Thebe Investment Corporation Amandla Omoya Trust Enzani Technologies Usizo Engineering Local/South African ownership : 41% Project Lenders (Debt providers) • Development Bank of Southern Africa (“DBSA”) Barclays Africa/Absa Liberty Group Ltd Sanlam Life Ltd Sanlam Credit Conduit (Pty) Ltd • • • • | 21 Energy: Jeffrey’s Wind Farm Project DBSA Role in the Project • • Senior Lender: R825 million Empowerment/Equity Funder (to facilitate the acquisition of equity shareholding by BEE Investors) Thebe Investment Corporation: R68.2 million Amandla Omoya: 45.7 million Usizo Engineering: R15.2 million Enzani Technologies: R15.2 million Project Status • The Project reached commercial operation date (i.e. completed construction) on 15 May 2014. Benefits (electricity, carbon emissions, water savings) • • • • • Expected Electricity Production: 460 000MWh/annum Provides power to 100 000 Households per annum Annual carbon emissions avoided: 420 000 tonnes Project lifetime carbon emission avoided: 8 400 000 tonnes Water savings: 590 000 000 litres per annum Development Impact • 6% ownership by the Amandla Omoya Local Community Trust (i.e. this exceeds the minimum ownership threshold of 2.5%) A % of project revenues has been allocated to be spent on socio economic and enterprise development programmes (“SED” and “ED”), over and above the Local Community Trust ownership. 80% of the allocated budget from SED and ED will be focused on education support programmes. • • | 22 Energy: Khi! Solar One Concentrated Solar Power Project Project Description • • • Khi! Solar One Concentrated Solar Power Plant is a 50 MW solar project. The tower plant will be located on a 600 ha site close to Upington, in the Northern Cape Province. Project Size: R4.1 billion • Debt: R2.7 billion (65%) • Equity: R1.4 billion (35%) Project Investors • Abengoa (Spanish Company), • Industrial Development Corporation, • !Khi Local Community Trust Local/South African ownership : 49% Project Lenders (Debt providers) • • • • • • Development Bank of Southern Africa (“DBSA”) Sanlam Credit Conduit (Pty) Ltd International Finance Corporation, Industrial Development Corporation, European Investment Bank (“EIB”), Praparco & FMO | 23 Energy: Khi! Solar One Concentrated Solar Power Project DBSA Role in the Project • Senior Lender: R500 million Project Status • The Project is currently under construction Benefits (electricity, carbon emissions) • Expected Electricity Production: 172 000 MWh/annum Provides power to 37 400 Households per annum Annual carbon emissions avoided: 183 000 tonnes Project lifetime carbon emission avoided: 3 660 000 tonnes • • • Development Impact • • 20% ownership by the !Khi Local Community Trust Local Community Trust (i.e. this exceeds the minimum ownership threshold of 2.5%) A % of project revenues has been allocated to be spent on socio economic and enterprise development programmes (“SED” and “ED”), over and above the Local Community Trust ownership. | 24 Transport: A Re Yeng Tshwane Rapid Transit Project | 25 Transport: A Re Yeng Tshwane Rapid Transit Project • • • • • A Re Yeng is one of 12 cities’ Bus Rapid Transit (“BRT”) projects approved via government’s Public Transport Strategy & Action Plan to improve access and quality of public transport; Tshwane Rapid Transit (Pty) Ltd (“TRT”) is a bus operating company set up in terms of National Land Transport Act (“NLTA”) to operate the BRT in the City of Tshwane (“CoT”); TRT to be owned by the incumbent taxi and bus operators in CoT; Key positives included: • Established bus operating company; • Effectively utilised existing taxi association structures to facilitate negotiations. DBSA approved R488 million for TRT to fund the acquisition of 171 buses in a R786 million transaction co-funded with HSBC Bank Plc • • • • • • Support of Integrated Rapid Public Transport Networks, part of national Gvt’s Public Transport Strategy, a key social initiative; Correct socio-economic impact of poor historic spatial planning; Improved quality of life through a safe, affordable, reliable, efficient and integrated transport system; Economic growth of R271m through investment in marginalized areas and R822m in provincial capital formation; 1,002 new direct jobs to be created from bus project as well as 11,000 from construction of required supporting infrastructure; R161m household income and R85m fiscal impact. | 26 ASIDI 49 Schools – Eastern Cape Mahahane SPS (before) Mahahane SPS (after) | 27 ASIDI 22 Schools - Mpumalanga Goba PS (before and after photos) Loding PS (before and after photos) | 28 ASIDI 50 Schools – Eastern Cape Langeni SPS(before and in construction photos) | 29 Doctors Consulting Rooms Programme 4 ROOMED UNIT | 30 Clinic Facilities Refurbishment Programme BEFORE AFTER BEFORE AFTER | 31