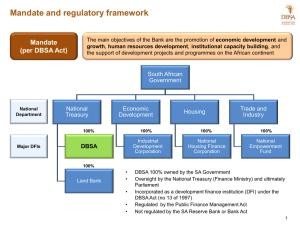

DBSA`s Mandate

advertisement

SOLAR PARK TP Nchocho Group Executive: Investment Banking Division 28 October 2010 Development Bank of Southern Africa Table of Contents DBSA’s MANDATE PROBLEM STATEMENT ROLE OF DBSA IN SOLAR PARK FINANCING FRAMEWORK COORDINATING ROLE ENGAGEMENTS WITH FINANCIAL INSTITUTIONS NEXT STEPS DBSA’s Mandate DBSAs Mandate Problem Statement Role of DBSA Financing Framework Coordinating Role Engagements with banks • DBSA is a regional development finance institution that operates throughout the SADC region. • DBSA’s Mandate: To promote economic development & growth, human resources development and institutional capacity building in the region. To support sustainable development projects & programmes in the region. Focus on economic, social and institutional infrastructure and cooperation with the private sector. • DBSA roles: Financier, Partner, Advisor, Implementer & Integrator. Next Steps Problem Statement DBSAs Mandate Problem Statement Role of DBSA Financing Framework Coordinating Role Engagements with banks Next Steps • Solar Park to house large scale solar projects. • Different technologies > at different stages of development. • Aggregate funding requirements not fully quantified yet > FS • However, significant level of debt & equity anticipated: Park Infrastructure, Transmission infrastructure, and Individual solar projects/ IPPs. • Need for a Coordinated Approach. • International players > the Ease to Do Business! The Role of DBSA in the Solar Park DBSAs Mandate Problem Statement Role of DBSA Financing Framework Coordinating Role Engagements with banks Next Steps • Financing framework ....convening a Working Group. • Facilitating the Coordinated Approach to mobilize the funding required from various sources. • Coordinate project bankability assessments/ due diligences to the extent required, based on financing framework agreed upon. • Assistance to the Northern Cape Provincial government and the Municipality – Institutional ; Technical ; Funding • Assistance to other SOE’s that may have a role to play. Financing Framework DBSAs Mandate Problem Statement Role of DBSA Financing Framework Coordinating Role Engagements with banks Next Steps • Set up a finance working group made up of local and international DFIs and commercial banks. • Articulation of a coherent Financing Framework for IPP Plants including possible funding models, options, and sources that are available in the RSA market. • Undertake an iterative financial analysis to quantify costs and benefits of various financial instruments. • Development of Project Finance models for each of the solar technologies proposed. • Develop an Info Memorandum (“IM”) for the Solar Park programme. • Determine commitment levels from financial institutions and identify funding gap, if any. • Streamline the financing process and optimize financing terms. Coordinating Role: ALL PARTIES DBSAs Mandate Problem Statement Role of DBSA Financing Framework Coordinating Role Engagements with banks Next Steps • An Interface Platform between local and international development finance institutions, commercial banks and solar project developers. • Coordinate Due Diligence (DD) activities and project appraisal processes between Commercial Banks and DFI’s to minimize duplication. • Coordinate financial structuring and advise on appropriate capital structures and instruments . • Coordinate the processes to eventually club and optimize commercial banks and DFI funding. Engagements with Financial Institutions DBSAs Mandate Problem Statement Role of DBSA Financing Framework Coordinating Role Engagements with banks • Generally interested in funding the Solar Park. • Indicative funding criteria: Bankable PPA. Regulatory certainty. Confirmation of all required approvals including EIA. Proven solar technology. EPC contractor and Technology partner experience. Full EPC wrap. Equity availability. • To potentially provide funding at project level or on a consolidated basis. • General willingness to work on a coordinated funding approach. Next Steps Next Steps DBSAs Mandate Problem Statement Role of DBSA Financing Framework Coordinating Role Engagements with banks • Assist with the bankable feasibility study (“BFS”) process. • Establish a finance working group. • Continue engagements with local and international commercial banks, DFIs, and non-Bank funders. • Engage all relevant parties on the risk allocation framework for the project. • Finalise the financing framework for the project. Next Steps Thank you very much!