Regional integration through infrastructure

advertisement

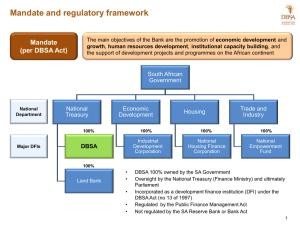

Development Bank of Southern Africa Regional Integration Through Infrastructure Development Piet Viljoen Principal Programme Manager 1 Content The DBSA as DFI DBSA Portfolio Trends in infrastructure financing through PPPS Challenges of enhancing investment in infrastructure Towards a solution: DBSA’s approach Examples of successful investments in PPPs 2 DBSA Classification and Challenges The UN DESA commissioned report classifies the DBSA as one of the DFIs where: “..the challenge for these institutions is to combine its development-orientated activities with its need to be a selffinancing and profitable institution” “This dilemma of profit versus development impact touches nearly every aspect of DBSA’s ventures, including identification of new markets, projects, priorities and geographical distribution of projects” 3 The DBSA’s view is that the above mentioned tension can be managed effectively: Its approach is to use income streams from investments in commercially viable projects to provide concessionary loans to specified categories of clients The DBSA 4 Development Finance Institution wholly owned by the South African Government Mandate to pursue economic development through the financing of commercially viable public and private projects/programmes (investments, capacity building and human development) Geographical mandate extends to the SADC region under a ⅔-⅓ rule Borrowers are both public and private sector – critical capability of DBSA Mandate to take risk and can provide funding up to 15 years Investment grade credit ratings equivalent to those of the Republic of South Africa Financially-sustainable since establishment Baa1 & AAA rating DBSA’s Mandate 5 Originally mandated to extend SA infrastructure Networks into SADC to facilitate regional integration Advent of NEPAD and its focus on AEU and RECs Recent SADC Summit: increased focus on integration – Ministerial Task Team DBSA current mandate in SADC supports all the elements of Regional Integration DBSA’s support to Regional Integration Regional 6 Integration is promoted through: Increased and more diversified economic production Infrastructure that both leads to increased production and supports the distribution of goods and services within and between countries Integration of markets The DBSA’s mandate in SADC requires it to play a role in all three the above areas. This presentation will focus on infrastructure I will now focus on the DBSA’s SADC portfolio, experiences, approaches and examples of support to infrastructure PPP projects 7 Key Strategic Objectives 8 Promote greater regional integration through financing infrastructure and productive sectors Maximise private sector involvement in infrastructure development Facilitate and promote private sector and commercialisation of public sector initiatives Promote broad-based participation of BEE and indigenous groups in economic activities Facilitate Capital Markets Development in SADC to support long term financing and capacitate local institutions. Strengthen the capacity of investee entities and Regional Economic Communities (RECs) with an appropriate combination of finance and Knowledge Products (TA, Capacity Building, Project Preparation assistance to prepare for bankability, etc.) Earn a commercial return consistent with risk assumed to enhance the financial sustainability of DBSA DBSA SADC Portfolio PSI Approvals - Sector Split (31 August 2006) Funded 15 feasibility studies for NEPAD regional integration projects, with a capital value of R32 billion of which 2 projects with a capital value of R4.4 billion are in the financing stage Cumulative approvals of R15.0 billion for 205 projects (including 9 Funds: R0.86 billion) Cumulative signed agreements (commitments): R11.8 billion Cumulative disbursements: R9.8 billion Net income for year ended 31 March 2006: R245 million 3% 12% 4% 31% 0% 15% 0% 0% 0% 19% 16% Commercial ICT Roads And Drainage Transportation Education Institution Building Sanitation Water Energy Residential Facilities Social Infrastructure PSI Approvals - Regional Split (31 August 2006) 3% 1% 10% 2% 3% 1% 9% 3% 5% 4% 15% 31% 0% Angola Malawi Namibia Tanzania Botswana Mauritius Seychelles Uganda 5% 8% DRC Mozambique South Africa Zambia Lesotho Multi-Regional Swaziland PSI portfolio growth (R'million) 8,000 6,000 4,000 2,000 FY-2002 FY-2003 FY-2004 FY-2005 FY-2006 FY-2007 9 Gross Book Approvals What Happens to DBSA’s Surpluses? 10 Development Fund: focuses on capacity building of local government in South Africa Siyenza Manje: Focuses on the provision of expertise to the under-resourced municipalities in South Africa Technical Assistance grants to build institutional capacities of borrowers and RECs Infrastructure in Africa Although Infrastructure is a core component of regional integration, the reality is: Investment in Infrastructure in Africa is on the decline, and PPPs as investment method is also on the decline 11 Infrastructure Investment in Africa South of Sahara (ASS) compared to other regions Total Investment by Region, 1990-2003 East Asia and Pacific Europe and Central Asia Latin America and the Caribbean Middle East and North Africa US$ millions 12 Source: PPI Database, World Bank 20 02 20 00 19 98 19 96 19 94 Sub-Saharan Africa 19 92 19 90 80,000.00 70,000.00 60,000.00 50,000.00 40,000.00 30,000.00 20,000.00 10,000.00 0.00 -10,000.00 19 19 73 19 74 19 75 19 76 19 77 19 78 19 79 19 80 19 81 19 82 19 83 19 84 19 85 19 86 19 87 19 88 19 89 19 90 19 91 19 92 19 93 19 94 19 95 19 96 19 97 19 98 20 99 20 00 20 01 20 02 03 ODA for SSA (US$2002m) 13 6,000 5,000 4,000 3,000 2,000 1,000 0 45% 40% 35% 30% 25% 20% 15% 10% 5% 0% Infrastructure (US$2002m) Infrastructure (% ODA total) ODA for SSA (% ODA total) Drop in ODA Financing in Infrastructure Progress with PPPs in ASS Number of PPI Projects by Sector, 1990-2003 35 30 25 20 15 10 5 0 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 Energy Telecom Transport Water Numbe r of PPI Proje cts by Type , 1990-2003 35 30 25 20 15 10 5 0 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 14 Concession Source: PPI Database, World Bank Divesture Greenfield Project Management or Lease Contract Declining PPI Flows to Developing Countries 15 What are the specific challenges that lead to declining ODA, PPP projects and overall infrastructure investment? 16 The challenges to enhanced spending on infrastructure (DBSA experience) 1. Weak public sector sponsors / government Governments generally lack the skills required to drive PPPs. Private sector participation is often resisted by public sector officials, for fear of: Loss of control, Negative implications of reductions in staff numbers Negative public reaction, and Potential risk of failure that will reflect badly on them. Limited PPP experience countries creates an element of risk and fear of unknown There is a tendency for greater PPP vision by parastatal and government utility agents than directly from national governments. 17 The challenges to enhanced spending on infrastructure (DBSA experience) 2. Affordability of beneficiaries Affordability of recipient countries for infrastructure is low. Excessive public sector debt (HIPC countries). Affordability of end users is low. Tariffs are likely to increase where PPPs are implemented and such projects will inevitably require government or donor financial support in the early years. Unlike PPPs in developed countries which often focus on operational improvements, PPPs in require substantial capital investment, as well as operational improvements 18 The challenges to enhanced spending on infrastructure (DBSA experience) 3. Low institutional, managerial capacity and skills levels Institutional Capacity shortages in respect of: Project initiation, Policy support for active PPP development in each sector, Regulatory and enforcement framework, Weak or ineffective regulatory powers over natural monopolies, Lack of a private sector and customer focus Low management capacity and skills result in: 19 Additional project risk The challenges to enhanced spending on infrastructure (DBSA experience) 4. Legal systems Legal and regulatory systems to support complex PPP ventures are weak and where they may exist are not effectively enforced. 5. Government / Political Interference Interference particularly in respect of tariffs and the autonomy of PPPs at operational level reduces potential financial success. Fluctuating budgetary allocations or non-availability of government funds for PPPs which have been initiated, but require government support, can undermine success and increase project risk. 20 Towards a solution – DBSA’s approach Technical assistance Provide technical assistance to prepare regional projects and package them to a bankable proposition Provide long-term financing (up to 15 years) in Rand, US$, Euro Equity 21 Selective equity stakes reduce risk for market participants, ensures a stronger role for the DBSA and potentially improves the Bank’s financial returns Local capital markets development Focus on support for capital market development and local currency financing to attract local investment in infrastructure. Towards a solution – DBSA’s approach Catalyse private sector investment The DBSA is well positioned to work at enhanced private sector participation by creating appropriate funding packages DBSA can provide junior or subordinated debt, guarantees and equity contributions to reduce overall project risk to private sector participants. Equity contributions also potentially increase the Bank’s financial returns Capacity building Skills – DBSA has taken on a stronger advisory role providing greater non-investment support to sponsor/governments. Institution building – DBSA assists the building of institutions directly through technical assistance, partnering with governments, DFI’s and NGO’s and training (Vulindlela Academy) 22 Towards a solution – DBSA’s approach 23 Knowledge sharing The DBSA has a strong knowledge sharing role. This is provided through an advisory role, technical assistance, joint project appraisal, post-project evaluation and the facilitation of knowledge. Dissemination through reports such as the Development Report and various conferences and workshops Question: How has the DBSA fared in supporting regional infrastructure projects through PPPs? 24 Examples of DBSA support to Regional Integration through PPP-based Infrastructure Projects: Project in preparation - East African Submarine Cable System (EASSy) Project in implementation: - Maputo Development Corridor 25 N 4 Toll Road Maputo Port Rehabilitation Mozal Aluminum Smelter The East Africa Submarine Cable System EASSy 26 27 EASSy: The ICT Challenge Lack of connectivity and prohibitive communications costs are hampering economic development and growth in East and Southern Africa: Connecting E&S Africa to the Global Economy is Critical: 28 international wholesale bandwidth prices are 20 to 40 times higher than in the US; international and sub-regional telephone call prices are 10 to 20 times that of other developing countries; dial-up Internet monthly access prices range from 1 to 10 times the monthly GNI per capita. Reducing isolation of E&S Africa Increasing regional and international trade transactions : a 10% decrease in the price of country to country phone calls can lead to an 8% increase in bilateral trade. Reducing transaction costs to governments and business Improving competitiveness of E&S African economies and attracting more investment in services and IT/Business Process Outsourcing The EASSy Programme 1. The establishment of a high capacity fibre optic submarine cable system along the East Coast of Africa (EASSy). 2. The establishment of broadband backhaul systems to connect land-locked countries in Southern and East Africa to the EASSy submarine cable system. 3. The rationalisation and co-ordination of terrestrial ICT infrastructure and development projects in Southern and East Africa. 29 EASSy: 5 IMPLEMENTATION PHASES 4. The establishment of broadband backhaul systems to connect land-locked countries (and coastal countries not yet connected) in West and Central Africa to the SAT-3 / WASC submarine cable system. 5. The rationalisation and co-ordination of terrestrial ICT infrastructure and development projects in West and Central Africa. 30 EASSy: DBSA Support Support to and participated in a workshop to rationalize and harmonize ICT networks in Eastern and Southern Africa (COMTEL, COM 7, SRII and EASSy), leveraging: Supported the feasibility study together with AfD, AfDB and IFC, this leveraging: 31 Similar workshops for West and North Africa EIB support to legal council and KfW support to EIA DBSA is currently considering investment in implementation being considered Maputo Development Corridor 32 DEVELOPMENT 33 CORRIDORS Maputo Development Corridor N4 Toll Road In 1996 the South Africa and Mozambique governments signed a 30 year concession for a private consortium Trans African Concessions (TRAC) to build, operate and transfer a R3 billion toll road between Gauteng in South Africa and Maputo in Mozambique SA banks ABSA, Standard, NEDCOR and First National Bank, together with DBSA provided and pension funds and TRAC provided 20% equity and 80% debt, supported by guarantees by South Africa and Mozambique Reduced overloading, facilitated growth in tourism and other investments in Maputo Mozal aluminum smelter and the natural gas plants at Pande and Temane 34 Maputo Development Corridor (Cont) Maputo Port After the toll road success, next step was rehabilitating Maputo Port The Mozambican national ports and rails authority (CFM) formed a joint venture with a private consortium led by British Mersey Docks and Harbour Company for a 15 year, $70 million concession to finance, rehabilitate, operate and upgrade the Port of Maputo Port efficiency has increased from 4.3 m tonnes in 2002 to 5.95 m tonnes in 2005 The fresh produce terminal reported a 25% year on year increase in 2004 in citrus exports handled 35 Maputo Development Corridor (Cont) Mozal Phases I and II Aluminum Smelter Total cost US$ 2,2 billion DBSA investment US$103 million Regeneration of Mozambique economy 36 Mozal I contributed: US$160 million to GDP 9000 construction workers 747 permanent jobs Trained 5000 people Mozal II contributed: US$170 million to GDP 6000 jobs Tax revenue US$ 4,1 million Conclusion DBSA is managing to achieve development impact with all its investments and is remaining financially sustainable by cross-subsidizing low-yielding investments with surpluses on high yielding investments The DBSA has managed to participate in significant PPP based infrastructure projects within a declining investment environment Reminder: Infrastructure development is but one element of regional and needs attention ion within an integrated framework with the other elements 37 I Thank You For Your Attention 38 Contact Details Development Bank of Southern Africa 39 Registered office 1258 Lever Road Postal Address PO Box 1234 Telephone +2711 313 3911 Headway Hill Halfway House Fax +2711 313 3086 Halfway House Midrand South Africa South Africa 1685 1685 WEBSITE ADDRESS: www.dbsa.org Piet Viljoen Africa Partnerships Unit DBSA pietv@dbsa.org