Introduction to Accounting PP

advertisement

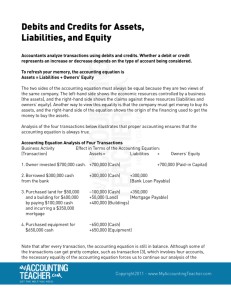

Introduction to Accounting 8th grade Mrs. Stovall What is accounting? • The system of recording and summarizing financial transactions and analyzing, verifying, and reporting the results • http://www.merrianwebster.com/dictionary/accounting Who uses accounting? • Everyone! • Businesses use accounting information to run the business • Investors use it to make decisions about whether to buy a company’s stocks • Creditors use it to make decisions about whether to loan money to a company • IRS use it to determine how much taxes the company must pay • Customers use the information to determine which company to purchase products or services from (you want a company that is going to be around in the future) Key Terms • Assets – things you own • Liabilities – a debt or obligation (money owed) • Owner’s Equity – the amount of the initial investment plus retained earnings (savings). • Income – a monetary gain (usually from the sale of products or service) • Expenses – financial burdens; cost Debits and Credits Analyzing and Recording Business Transactions Setting up and organizing a chart of accounts. Business Transactions 1 Owner invests cash in a business. 2 Owner buys business assets. 3 Services are performed and cash received. 4 Services are performed and billed to customers as accounts receivable. 5 Business expenses are incurred and paid for with cash or paid for later. Documenting Business Transactions • • • • Analyze events (transactions) Decide which accounts are affected. Choose the account category. Determine whether the event will cause an increase or decrease to the account. • Record the transaction with proper debits and credits. Debits and Credits • Every transaction must be recorded. • Every transaction must affect at least two accounts. • Debits must equal credits. • The accounting equation must be in balance. T-accounts • A T account is a format used to show the effect of transactions. • Dollar signs ($) are not used in accounts. T account Left Right Debit Credit The Ledger Account • Account: Cash Balance Date Debit June 1 5,000 Credit Debit 5,000 credit Debits and Credits What is the definition of debit? • The left side of any T account. • A number entered on the left side of any account is said to be debited to an account. What is the definition of credit? • The right side of any T account. • A number entered on the right side of any account is said to be credited to an account. Debits and Credits ___________Account Name (Title)___ Left side/Dr. (debit) __________Account Name (Title)____ Right side/Cr. (credit) Financial Statements • Balance Sheet – An official financial statement that includes the company’s assets and liabilities. It determine the value of the company by subtracting liabilities from assets. • Income Statement – A financial statement of a company’s operation. Shows a company’s income, expenses, and income for a period of time. Shows the company’s profit or loss for a given period of time. Amount earned or lost over a period of time. Formulas • Assets = Liabilities + Owner Equity • Income-Expenses = Net Income or Net Loss • Total Income = Sales & Interest Income • Total Expenses = all expenses • Money In – Money Out = Money remaining (savings, future expenses) BCSIII- Accounting Unit Essential Questions • • • • What are debits? Credits? What are the basic account types? What is an Income Statement? What is a Balance Sheet?