Chapter 3 Lecture Notes

advertisement

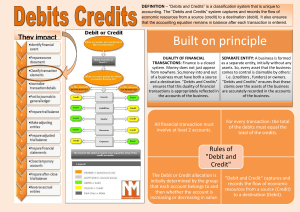

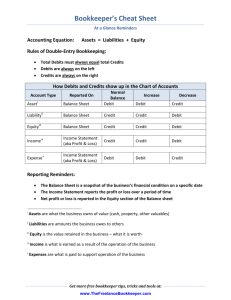

Chapter 3 Lecture Notes In chapter 2 you learned how to prepare financial statements and the basic relationship in the accounting equation; remember, Assets = Liabilities + Owner’s Equity. In this chapter you will be introduced to tools that accountants use in analyzing business transactions and the chart of accounts. The T account is a tool used to illustrate transactions. T accounts resemble the letter T; the name of the account is written on top of the T, the debits are on the left side and the credits are on the right side. T accounts simplify recordkeeping by grouping similar transactions together. When recording an increase to an asset account, you will place increases on the left (debit) side – remember that assets are on the left side of the accounting equation. You will place increases to the liabilities and owner’s capital accounts on the right side (credit) of the T – remember that liabilities and owner’s equity are on the right side of the accounting equation. (**Many people have trouble thinking in terms of debit and credit; if you need to think of it as left and right until you get the hang of it – see page 71 for a chart). It is important that the equation remain in balance; the balances of all T accounts will result in a balanced accounting equation. The procedure for getting the balance of a T account is as follows: 1) total all amounts on the debit (left) side, 2) total all amounts on the credit (right) side, and 3) subtract the smaller from the larger amount to get the balance. Remember – debits are always on the left side, credits are always on the right side, and the normal balances for each account correspond to which side of the accounting equation they are on. Once you have the balance for each T account you may prepare the Trial Balance. This is not a formal financial statement, but rather a statement which tests the accuracy of total debits and total credits after the transactions have been recorded. If the debits do not equal the credits, there are several possible errors – see page 73 for a list of common errors and how to find them. It is important to note, that even if the trial balance balances, this does not mean that there are no errors. Finally you come to the chart of accounts – this is a list of the company’s accounts which are numbered for quick reference and identification. Not all companies will use the same numbers for each account, but the same format is generalized. Permanent and temporary accounts are introduced at the end of the chapter, it will be important to remember the difference when you get to closing entries in chapter 6. Remember, in accounting everything you learn builds on a previous concept so it is necessary to retain the information as you go.