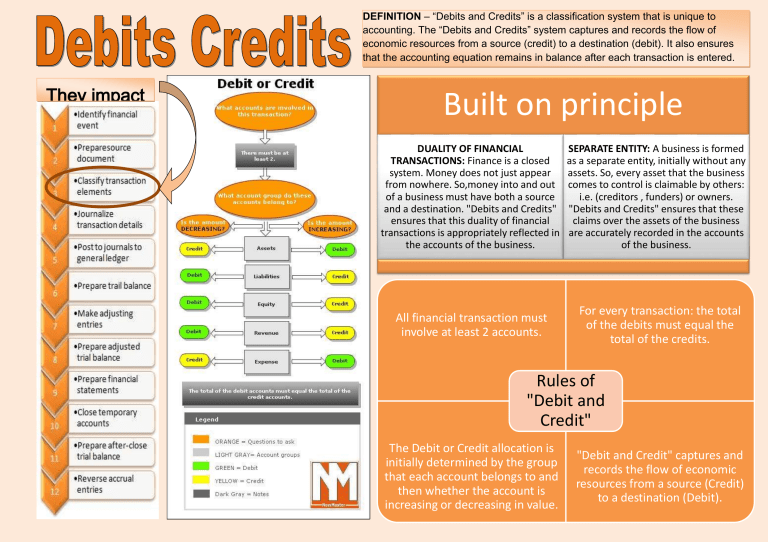

DEFINITION – “Debits and Credits” is a classification system that is unique to accounting. The “Debits and Credits” system captures and records the flow of economic resources from a source (credit) to a destination (debit). It also ensures that the accounting equation remains in balance after each transaction is entered. They impact here: Built on principle DUALITY OF FINANCIAL TRANSACTIONS: Finance is a closed system. Money does not just appear from nowhere. So,money into and out of a business must have both a source and a destination. "Debits and Credits" ensures that this duality of financial transactions is appropriately reflected in the accounts of the business. All financial transaction must involve at least 2 accounts. SEPARATE ENTITY: A business is formed as a separate entity, initially without any assets. So, every asset that the business comes to control is claimable by others: i.e. (creditors , funders) or owners. "Debits and Credits" ensures that these claims over the assets of the business are accurately recorded in the accounts of the business. For every transaction: the total of the debits must equal the total of the credits. Rules of "Debit and Credit" The Debit or Credit allocation is initially determined by the group that each account belongs to and then whether the account is increasing or decreasing in value. "Debit and Credit" captures and records the flow of economic resources from a source (Credit) to a destination (Debit).