Debit and Credit Theory: Accounting Basics

advertisement

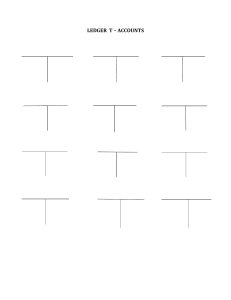

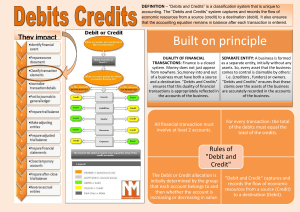

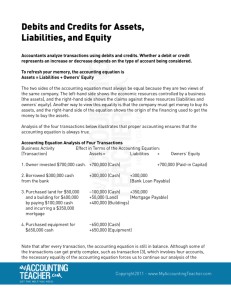

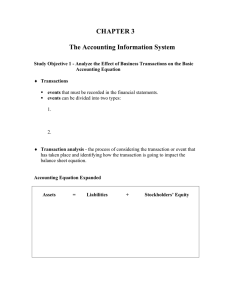

Debit and Credit Theory Accounts Accounts are individual items which affect financial position. Examples are bank, mortgage payable, land, equipment and capital. So far, we have grouped accounts into assets, liabilities and owner’s equity. The Simple Ledger The ledger is a grouping of all of the accounts of a business. You may use the analogy of an account being an individual page and the ledger as being the book made up of those pages. Ledgers were traditionally on cards or on loose leaf paper, but are now almost exclusively computerized. Debits and Credits Each transaction will result in a change to at least two accounts. The accounts may increase (inflow) or decrease (outflow). Each account has two sides; a LEFT side and a RIGHT side. We can represent this using a taccount. ASSETS Truck inflows outflows LIABILITIES Bank Loan outflows inflows Debits and Credits Debit is the word associated with the LEFT side and Credit is the word associated with the RIGHT side. Debit is abbreviated DR and Credits CR. Assets normally carry a DR balance and Liabilities normally have a CR balance. For now, Owner’s Equity will normally have a CR balance but this section has some special rules… more later! Debits and Credits (Continued) The dollar amount debited in a transaction must be equaled by the dollar amount credited. DO NOT try to memorize how accounts are affected by transactions. Learn how to analyze each transaction and how to apply debit and credit theory. Debits and Credits Also, do not think in terms of a debit being an increase or a credit being a decrease.