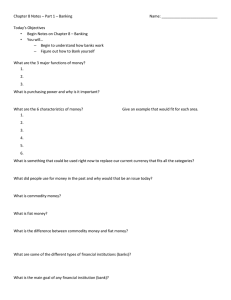

Financial Markets & Institutions: Capital Flow & Types

advertisement

FINANCIAL MARKETS and INSTITUTIONS CAPITAL FLOW PROCESS In a well-functioning economy, capital flows efficiently from those who supply capital to those who demand it. Suppliers of capital – individuals and institutions with “excess funds.” These groups are saving money and looking for a rate of return on their investment. Demanders or users of capital – individuals and institutions who need to raise funds to finance their investment opportunities. These groups are willing to pay a rate of return(interest) on the capital they borrow THREE WAYS CAPITAL FLOW FROM SAVERS TO BORROWERS • Direct transfer • Investment Bank - securities pass through the investment bank • Financial intermediary - intermediary create new securities for savers. FINANCIAL MARKETS WHAT IS A MARKET? • Market - place/venue where goods and services are exchanged • Financial Market - place where funds/financial assets are traded. lender: those with surplus of funds borrower: those need funds TYPES OF FINANCIAL MARKETS • • • • Money vs. Capital Primary vs. Secondary Spot vs. Futures Public vs. Private TYPES OF FINANCIAL MARKETS i. Money vs. Capital Money Market : borrowed for less than 1Y Capital Market : borrowed for 1Y or longer i. Money vs. Capital ii. Primary vs. Secondary Primary Market : new issues are sold to the public Secondary Market : outstanding issues traded among investors TYPES OF FINANCIAL MARKETS iii. Spot vs Futures Spot Market : transaction “on-the-spot” Future Market : contract specifying terms of future trading iv. Public vs. Private Private: transactions between two parties Public: standardized contracts traded on exchanges. FINANCIAL INSTITUTIONS FINANCIAL INSTITUTIONS • is a company engaged in the business of dealing with financial and monetary transactions such as deposits, loans, investments and currency exchange ; • Virtually everyone living in a developed economy has an ongoing or at least periodic need for the services of financial institutions ; • can operate at several scales from local community credit unions to international investment banks. TYPES OF FINANCIAL INSTITUTIONS • Commercial banks : middleman between savers and borrowers • Investment banks : an organization that helps to sell new investment securities (bonds, stocks). • Financial services corporations : a firm that offers a wide range of financial services, including investment banking, commercial banking, brokerage and insurances. TYPES OF FINANCIAL INSTITUTIONS • • Mutual funds - collect money from savers and invest such funds in stocks, bonds, and other financial instruments. - registered entities and are regulated by the Securities and Exchange Commission (SEC) Pension funds-retirement plans; established by corporations and government for the purpose of funding retirement plans for employees. TYPES OF FINANCIAL INSTITUTIONS • • Hedge funds – unregulated fund - special type of mutual fund which typically require large minimum investments from high net worth individuals and institutions. Life Insurance companies – collect premiums from insured parties, invest them in different kinds of financial instruments and make payments to the beneficiaries of the insured. THANK YOU! Presented by: CASTILLO, KYRACRISTA P. MBAN - 1206