Chapter 11 – 12 Monetary Policy

advertisement

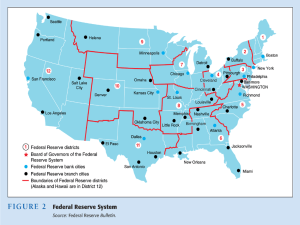

Chapter 11 – 12 Monetary Policy Chapter 11 Section 1 Chapter 12 Sections 1,2, 3 Chapter 11 Section 1 I. Explain the three functions of money. A. Barter Economy – • Moneyless economy that relies on trade. B. Money – • Any substance that functions as a medium of exchange, a measure of value, and a store of value. 3 I. Explain the three functions of money. C. Three functions of money • 1) Medium of exchange • Generally accepted as payment for goods and services. • 2) Measure of value • Expression of worth. • 3) Store of value • Goods or services can be converted into money, which is easily stored until some future time. 4 II. Identify four major types of money used in early societies. A. Commodity Money – • Money that has an alternative use as a commodity (i.e. corn, gunpowder, tobacco). B. Wampum – • Conch and mussel shells used as money by the Narraganset Native Americans. 5 II. Identify four major types of money used in early societies. C. Paper Currency – D. Specie – • Fiat • Money by government decree. • Money in the form of coins. 6 III. Trace the origins of the United States dollar. A. Pesos – • Spanish • Bullion • Ingots or bars of precious metals B. Talers – • Austrian taler • Monetary unit – standard unit of currency 7 IV. Describe the four characteristics of money. A. Portability – B. Durability – • Transferred from one person to another. • Able to last a long time. 8 IV. Describe the four characteristics of money. C. Divisibility – D. Limited Availability– • Easily divisible into smaller units. • Money loses its value when there is too much of it. 9 END CHAPTER 11 Chapter 12 Section 1 I. Identify the unique features of the FED. A. 12 Districts – Atlanta, GA 6 B. Operate independently of one another. C. Private ownership • 1) Member banks – banks that belong to the Federal Reserve System. • 2) The FED is owned by member banks. 12 13 II. Describe the structure of the Federal Reserve System. A. Board of Governors – • 1) • 2) 7 members appointed by President. Regulatory and supervisory agency. B. Federal Open Market Committee – • Makes decisions about the money supply and interest rates. C. Federal Advisory Council – • Provides feedback on the overall health of the economy. 14 III. Explain the major regulatory responsibilities of the FED. A. State Member Bank Supervision – • 1) • 2) All depository institutions must maintain reserves. The FED is responsible for state chartered member banks. B. Holding Companies – • 1) • 2) Corporation that owns one or more banks. Formed to avoid government regulations. 15 III. Explain the major regulatory responsibilities of the FED. C. International Operations– • 1) The FED has broad authority to supervise and regulate foreign banks operating in the United States. D. Mergers – • 1) The FED must approve a merger of two or more banks. 16 III. Explain the major regulatory responsibilities of the FED. E. Check Clearing – • 1) Reserves are shifted from one bank to another. F. Consumer Legislation– • 1) • 2) Truth-in lending laws require sellers to disclose info to people who buy on credit. Regulation Z is a provision that requires truth-in lending disclosures. 17 III. Explain the major regulatory responsibilities of the FED. G. Currency – • 1) • 2) Paper component is printed at the Bureau of Engraving and Printing. Metallic coins are coined at the U.S. Mint. H. Margin Requirement – • 1) Minimum deposits left with a stockbroker to be used as down payments to buy other securities. 18