§316 – Dividend Defined

advertisement

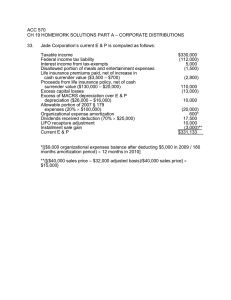

§316 – Dividend Defined Distribution out of E & P accumulated after 2-28-13, or to the extent of current E & P. Portion not taxed as a dividend is Return of Capital to extent of basis. Potion in excess of basis is capital gain. Sec. 312 – Earning and Profits Undefined E & P similar to “retained earnings” but not in all aspects, such as stock dividend does not decrease. E & P represents Corporations economic ability to pay dividends without impairing capital. In practice, E & P almost always represents a costly debacle Increases to E & P Muni interest Life insurance proceeds FIT refunds DRD 80% of 179 Deferred gain if installment method used Decreases to E & P Excess capital losses FIT Fines and Penalties 50% M & E Life insurance premiums Nondeductible contributions Stupid E & P Adjustments Adjustment to straight-line depreciation §179 over 5 years Basically, all other timing differences This is just my opinion Allocating E & P to Distributions Current E & P is allocated pro-rata Accumulated is allocated chronological If deficit in accumulated E & P and positive in current, then dividends to extent of current E &P If deficit in current and positive in accumulated, then dividend to extent of net positive balance Assumption is that current E & P is sufficient Property Dividends Amount distributed is Fair Market Value Amount distributed is decreased by any liabilities §311(b); gain, but not loss recognized by corporation Constructive Dividends Usually arise in closely-held corporation IRS very good on this issue, easy money Examples include personal use of corporate-owned property, bargain sales, satisfaction of personal debt, and loans without bona fide business purpose (most common) Stock Dividends §305(b) General rule is tax free Taxable if in lieu of cash or property Disproportionate distributions taxable Some common, some preferred taxable Convertible preferred that results in disproportionality Stock Redemptions §302(b) and §303 Sale or Exchange treatment is generally desirable Not essentially equivalent §302(b)(1) Substantially disproportionate §302(b)(2) Complete termination Redemption to pay “death taxes” Attribution, §318 Spouse, children, grandchildren and parents By partnership proportionately by partners By estate or trust proportionately by beneficiaries Proportionately by shareholder owning 50% or more of corporation U.S. vs Davis , 90 S.Ct. 1041, 3/23/70, Not essentially equivalent test Immaterial if redemption had a business purpose §318 applies Must result in “meaningful reduction” of shareholder’s interest Redemption after Termination §302(b) complete termination Shareholder may not retain any interest May not acquire any interest within 10 years See §302(c)(2)(B) Redemption to pay death taxes Corporate stock is > 35% of gross estate 2 or more corps work if each is > 20% Applies to extent of death taxes and funeral and admin expense