E&PStu

advertisement

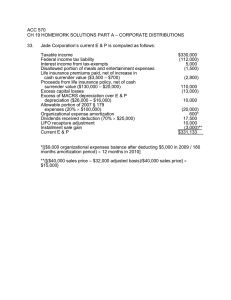

Earnings and Profits Tx 8120 Fore Objectives You should be able to: 1. 2. 3. 4. Explain the _______ of E&P, Determine whether E&P must follow _____ or ________ basis rules. Identify differences between E&P and ________ _______, and Calculate ________ E&P. Earnings & Profits • Code describes how certain transactions _____ E&P but does not _____ the concept • Purpose: – Measures ________-paying ability – Represents how much can be distributed without dipping into _________ • Not same as: – Taxable income or – _______ earnings Calculating Current E&P Taxable income (or net operating loss) + and certain deferred income expenses + not affecting E&P (or deficit) - Current . Residual (or shortfall) increases (decreases) ______ Mazzocchi Bus Co. v. CIR (CA-3, 1994) The owner of a closely-held, _____ basis corporation diverted corporate receipts for his personal use and failed to report the gross income on either the corporate or his individual return. After the owner’s conviction for tax evasion, the corporation paid taxes, penalties, and interest. To treat some of the constructive distribution as a return of capital, the individual argued the corporation can reduce E&P by the ________ but _______ taxes, penalties, and interest. The ______ was silent on this point. Mazzocchi Bus Co. v. CIR (CA-3, 1994) Relying on a long-standing regulation and affirming the Tax Court, the holding required __________. To hold otherwise would “unnecessarily add complexity …, undesirably distort [E&P], and unjustifiably engraft an unprincipled exception ….” Thus, a corporation calculating taxable income using the cash method must determine E&P ___________. Exclusions Increasing CE&P • These items are: – ____ included in gross income – But ________ ability to pay dividends • Examples: – ________ bond interest – _____ insurance proceeds – _______ income tax refund Deferrals Increasing CE&P • Some deferrals require no adjustments: – _________ exchanges – _____________ conversions – Transfers under _____ • Installment sales method __________ : – CE&P increased for ___________ gain when sold – CE&P decreased for __________ gain in later years • __________ contract method disallowed Nondeductibles Decreasing CE&P • These items are: – Not deductible for tax purposes – But __________ ability to pay dividends • Examples: – – – – ______ ______ tax paid _______ and fines _________ contributions and ______ expenses _________ person losses and expenses Nondeductibles Decreasing CE&P (continued) – Interest expense related to _________ income – _____ insurance premiums that corporate beneficiary pays for ____ employees – Disallowed travel, ______, and _____________ – Charitable contributions __ ____ of taxable income – Net capital ______ – _______ income tax Deductions Not Affecting CE&P • These items are: – Deductible in computing taxable income – But do not ________ ability to pay dividends • Dividend _________ deduction • Carryover deductions from other years: – Net _______ _____ deduction – ___________ contribution deduction – ________ loss deduction Deductions Not Affecting CE&P (continued) • Excess depreciation: – CE&P requires __________ over longer lives of __________ depreciation system – CE&P requires ___________ over __ years for any amount “expensed” under §179 • Excess depletion and amortization: – ____ depletion required – _____________ expenses are capitalized Lind et al., p. 168 X Corporation is a cash method taxpayer with the following income and expenses for the year: Gross profit from sales $20,000 Salaries paid to employees 10,250 Tax-exempt interest received 3,000 Dividends received from IBM 5,000 Depreciation* 2,800 LTCG from selling stock 2,500 LTCL from selling stock 5,000 LTCL carryforward from prior year 1,000 Estimated federal income tax paid 800 *Paid $14,000 this year for 5-year property but did not elect §179 immediate deduction. For E&P purposes, the property has a 7-year class life. Compute taxable income and CE&P. Taxable Income CE&P E&P Exercise MedCo has the following income and expenses for the year: Gross manufacturing profit $380,000 Administrative expenses 135,000 Interest income: Corporate notes 43,000 Municipal bonds 8,000 Key man life insurance proceeds 200,000 Depreciation: Book 55,000 Tax 84,000 ADS 52,000 §1231 gain from selling realty 21,000 NOL carryover from last year 55,000 Charity: Current 4,000 Carryforward 2,000 Penalty for late payment of tax 1,000 Capital loss from selling stock 3,000 Compute taxable income and CE&P. Taxable Income CE&P