Document

advertisement

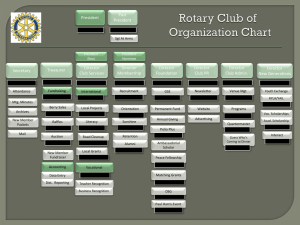

NON-PROFIT-MAKING ORGANISATIONS (CLUBS AND SOCIETIES) NON-PROFIT-MAKING ORGANISATIONS Definition: An organisation whose primary purpose is to provide a service for its users. Examples: Central Government institutions - eg the National Health Service Local Government institutions- eg public libraries Charities Social and Leisure Clubs We concentrate our study on this last category only. NON-PROFIT-MAKING ORGANISATIONS Ownership: A club is owned by its members Raising of Finance: Members fees or subscriptions - the main source of finance Clubs may also receive grants from the local authority or other body to help finance the purchase of assets Fund-raising events eg raffles, dances Additional services provided eg a bar or cafe Donations from other organisations Liability: Members have no liability for the club’s debts. NON-PROFIT-MAKING ORGANISATIONS Control: A club is run by a committee elected by the members. The committee normally comprises the following office bearers: • Chairperson - who leads the committee and chairs meetings • Secretary - who is responsible for all administration • Treasurer - who looks after the financial affairs of the club These posts are voluntary but an Honorarium (fee) may be paid All members can attend the club’s Annual General Meeting Club members are entitled to vote on major issues Club members can vote out the office bearers and re-elect new ones NON-PROFIT-MAKING ORGANISATIONS Financial Record Keeping It is the responsibility of the Treasurer to: record all cash received and paid out in the Receipts and Payments Account take care of all the club’s banking matters prepare the Club’s final accounts once a year consisting of: • the Income and Expenditure Account • the Balance Sheet prepare a report to present at the AGM on the financial state of the club answer any questions club members have about the club’s finances NON-PROFIT-MAKING ORGANISATIONS Capital and Revenue Items Capital transactions are those involving long term items and include: • the purchase and sale of fixed assets • the borrowing or repayment of loans Revenue transactions are short term and concern the day-to-day running of an organisation. They include: • the payment of expenses by the organisation eg rent paid • the payment of expenses to the organisation eg rent received NON-PROFIT-MAKING ORGANISATIONS The Receipts and Payments Account: A summary of all cash and bank transactions throughout the year. Procedure: Start with the Opening Cash/Bank Balance at the start of the year add on all cash and cheques received during the year regardless of: • what the transaction is for ie include capital and revenue items • what time period the transaction applies to subtract all cash and cheques paid during the year regardless of: • what the cash/cheque is for ie include capital and revenue spending • what time period the payment applies to what is left is the Closing Cash/Bank Balance for the year. NON-PROFIT-MAKING ORGANISATIONS The Amateur Musical Society Receipts and Payments Account for year ended 31 May 20.. £ £ Opening Balance 300 Add Receipts: Subscriptions Received 2,000 – Life Memberships Received 2,500 Donations Received 300 – Bar Takings 700 5,900 Sale of Concert Tickets 400 Less Payments: 6,200 Purchase of Piano 1,000 – Hire of Concert Hall 320 – Lighting and Heating 200 – Bar Supplies 300 2,000 Concert Expenses 180 Closing Balance 4,200 - NON-PROFIT-MAKING ORGANISATIONS Profit Statements from Fund-Raising Activities: A club often runs special fund-raising events or a bar or cafe in order to generate additional finance and provide additional entertainment and services for its members. For each of these events/services, a profit statement is prepared. In the case of a bar or café, a Trading Account is prepared. All relevant items concerning each event is included in the profit statement/Trading Account. Profits made from these events/services are individually listed as income items in the Income and Expenditure Account. Losses are listed as expenditure items. NON-PROFIT-MAKING ORGANISATIONS Subscriptions: Paid by members but not always for the full year or on time. Clubs calculate how much of the subscriptions received applies to the current year as follows: Subscriptions Received this year Add Subs in advance last year Add Subs in arrears this year Less Subs in arrears last year Less Subs in advance this year = Subscriptions which apply only to the current year This is entered as income in the Income and Expenditure Account NON-PROFIT-MAKING ORGANISATIONS Life Membership: Some clubs allow members to pay one lump-sum payment Like subscriptions, clubs need to identify how much of the lump-sum payment applies to each year Estimate how many years the member will use the club Divide life membership received by the number of years This tells you how much membership fee applies to each year This is entered as income in the Income and Expenditure Account Example: Life Membership Fee Number of years usage £500 = £50 each year 10 per member The balance of the life membership is a long-term liability NON-PROFIT-MAKING ORGANISATIONS Profit Statement for Annual Concert Sale of Concert Tickets £400 Less Hire of Hall £320 Concert Expenses 180 500 Loss on Concert £100 Bar Trading Account Bar Takings (Sales) £700 Less Cost of Sales: Opening Bar Stock £120 Add Purchase of Bar Supplies 300 420 Less Closing Bar Stock 70 350 Profit on Bar £350 NON-PROFIT-MAKING ORGANISATIONS Surplus or Deficit? Since a club’s main purpose is to provide a service for members and not to make a profit, clubs do not use the terms ‘profit’ or ‘loss’ in the accounting statements. Clubs therefore do not prepare Profit and Loss Accounts Clubs prepare Income and Expenditure Accounts instead. If, in the process or providing a service to members, a club makes a profit, it is called a Surplus. A loss is called a Deficit The surplus or deficit is calculated in the Income and Expenditure Account NON-PROFIT-MAKING ORGANISATIONS Income and Expenditure Account The equivalent of a firm’s Profit and Loss Account List and total up all revenue income applying to the year in question only - including any profits from special events/services This means adjustments must be made for accruals and prepayments List, total up and deduct all revenue expenditure applying to the year in question only - including any losses from special events/services Again, adjust items for accruals and prepayments When total income exceeds expenditure the club makes a Surplus When total expenditure exceeds income the club makes a Deficit NON-PROFIT-MAKING ORGANISATIONS The Amateur Musical Society Income and Expenditure Account for year ended 31 May 20.. £ £ Income: Subscriptions (Note 1) 1,900 Life Memberships (Note 2) 250 Donations Received 300 Profit on Bar (Bar Trading A/c) 350 Less Expenditure: Loss on Concert Depreciation on Piano Lighting and Heating Surplus 2,800 100 150 200 - 450 2,350- Note 1 Subscriptions Received 2000 – Note 2 Life Membership 2,500 LessSubscriptions for next year 100 Years 10 1900 - NON-PROFIT-MAKING ORGANISATIONS Accumulated Fund A business’s net worth or value is measured by its capital A club’s net worth or value is measured by its Accumulated Fund Procedure: Accumulated Fund at the beginning of the year is the: Value of assets at the Value of liabilities at the minus beginning of the year beginning of the year Opening Accumulated Fund (at the beginning of the year) appears in the Balance Sheet under the ‘Financed by’ heading The Amateur Musical Society’s Opening Accumulated Fund is Bank Balance £300 + Bar Stocks £120 + Sheet Music £800 = £1,220 Add to this any surplus or deduct any deficit to find the club’s Accumulated Fund at the end of the year. NON-PROFIT-MAKING ORGANISATIONS The Amateur Musical Society Balance Sheet as at 31 May 20.. Fixed Assets: At Cost Agg Dep NBV Sheet Music 800 800 Piano 1,000 150 850 1,800 150 - 1,650 Current Assets: Bar Stock 70 Bank 4,200 4,270 Less Current Liabilities: Subscriptions in Advance 100 4,170 5,820 Financed by: Opening Accumulated Fund (300+120+800) 1,220 Add Surplus 2,350 3,570 Long Term Liabilities: Life Membership 2,250 5,820 -