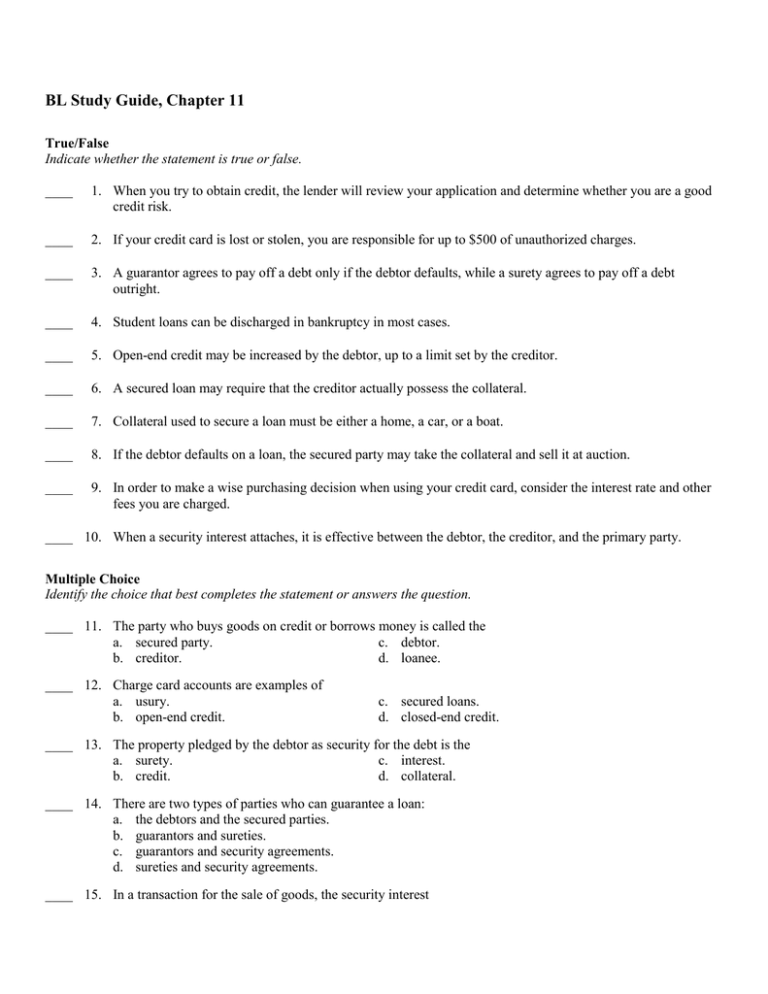

BL Study Guide, Chapter 11

advertisement

BL Study Guide, Chapter 11 True/False Indicate whether the statement is true or false. ____ 1. When you try to obtain credit, the lender will review your application and determine whether you are a good credit risk. ____ 2. If your credit card is lost or stolen, you are responsible for up to $500 of unauthorized charges. ____ 3. A guarantor agrees to pay off a debt only if the debtor defaults, while a surety agrees to pay off a debt outright. ____ 4. Student loans can be discharged in bankruptcy in most cases. ____ 5. Open-end credit may be increased by the debtor, up to a limit set by the creditor. ____ 6. A secured loan may require that the creditor actually possess the collateral. ____ 7. Collateral used to secure a loan must be either a home, a car, or a boat. ____ 8. If the debtor defaults on a loan, the secured party may take the collateral and sell it at auction. ____ 9. In order to make a wise purchasing decision when using your credit card, consider the interest rate and other fees you are charged. ____ 10. When a security interest attaches, it is effective between the debtor, the creditor, and the primary party. Multiple Choice Identify the choice that best completes the statement or answers the question. ____ 11. The party who buys goods on credit or borrows money is called the a. secured party. c. debtor. b. creditor. d. loanee. ____ 12. Charge card accounts are examples of a. usury. b. open-end credit. c. secured loans. d. closed-end credit. ____ 13. The property pledged by the debtor as security for the debt is the a. surety. c. interest. b. credit. d. collateral. ____ 14. There are two types of parties who can guarantee a loan: a. the debtors and the secured parties. b. guarantors and sureties. c. guarantors and security agreements. d. sureties and security agreements. ____ 15. In a transaction for the sale of goods, the security interest a. b. c. d. is not legally enforceable by the secured party. is not available to be sold at auction if a default occurs. attaches to the actual individual goods. attaches to after-acquired property. ____ 16. Credit that can be increased by the debtor by continuing to purchase goods or services on credit is called a. installment credit. c. closed-end credit. b. open-end credit. d. credit with collateral. ____ 17. When the security interest is on inventory, the security interest attaches to a. all the inventory, including new inventory that comes or goes from the business. b. all the inventory owned at the time of the attachment. c. a percentage of all the new inventory coming into the business. d. a percentage of all the inventory owned at the time of the attachment. ____ 18. When you buy a car on credit, it is important to know the APR, which is the a. cost of the loan in dollars and cents. b. collateral your lender will require. c. true interest rate of the loan. d. total amount you will borrow. ____ 19. If you dispute a purchase you made using your credit card, you a. have no recourse. b. must pay the bill and then negotiate a refund from the merchant. c. should cancel your credit card. d. do not have to pay the bill for the item. ____ 20. In Germany, all car dealers must offer a warranty on used cars for a period of at least a. one year. c. two years. b. six months. d. three months. Completion Complete each statement. 21. The party who sells goods on credit or lends money is called the ____________________. 22. Buying a car and paying for it in installments is an example of ____________________ credit. 23. A(n) ____________________ loan is one in which creditors obtain an interest in something of value that they can take if you do not repay the loan. 24. ____________________ credit is credit given for a specific amount of money and cannot be increased by making additional purchases. 25. ____________________ is the failure to make timely payments on a loan. 26. The interest rate on an unsecured loan is usually much ____________________ than on a secured loan. 27. When the government pays your interest on your student loan while you are in school, it is considered a(n) ____________________ loan. 28. ____________________ is the fee creditors charge for loaning money. 29. When you purchase your car on ____________________, you are receiving the product now and paying for it later. Matching Match each term with its definition. a. credit b. interest c. creditor d. debtor e. open-end credit f. g. h. i. j. closed-end credit APR collateral finance charge security interest ____ 30. Party who buys goods on credit or borrows money ____ 31. Credit that can be increased by the creditor, by continuing to purchase food or services on credit ____ 32. Fee the borrower pays to the lender for using money ____ 33. The true interest rate of the loan ____ 34. Credit that is extended only for a specific amount of money and cannot be increased by making additional purchases ____ 35. Party who sells goods on credit or lends money ____ 36. An arrangement through which you may receive cash, goods, or services now and pay for them in the future ____ 37. The cost of the loan in dollars and cents ____ 38. Consumer goods, cars, inventory, homes, and other items pledged to protect a lender if the borrower fails to repay ____ 39. Attaches when it is legally enforceable by the secured party Short Answer 40. Why is the interest rate higher on an unsecured loan than on a secured loan? Who do you think is most likely to acquire an unsecured loan.