LCM-CMM-6-Alignment - Life Cycle Initiative

advertisement

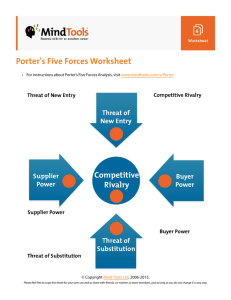

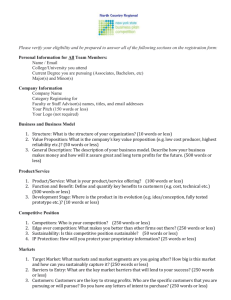

UNEP/SETAC Life-Cycle Initiative Life Cycle Management Capability Maturity Model (LCM-CMM) Building Capacity for Sustainable Value Chains International Life Cycle Partnership To bring science-based life cycle approaches into practice worldwide ALIGNING IMPROVEMENTS WITH BUSINESS STRATEGY WHAT IS COMPANY STRATEGY? • Vision - why the organization exists, the market need it will provide. • Mission - what the organization is going to do to achieve vision, kinds of activities. • Strategy – how it will undertake mission to achieve advantage over competitors by either doing different activities or doing similar activities differently Source: Collis, D. J., & Rukstad, M. G. (2008). Can you say what your strategy is? Harvard Business Review, 86(4), 82-90. VALUE PROPOSITION • Defines – Benefit the company will provide – To which market segments – And how the company’s offering will be uniquely superior to offerings of competitors • What attributes does customer use to evaluate competitive offerings? MAKING A BUSINESS CASE EXTERNAL DRIVERS •Economic –Income inequality –Outsourcing jobs –Trade imbalances •Environmental –Climate change- extreme weather, rising sea, 90°F days, crop damage –Peak oil, price volatility –Air quality- respiratory illness, asthma –Resource depletion- e.g. rare earths –Toxic chemicals –Water scarcity, quality –Land use –Biodiversity & species extinctions •Social –Child, forced labor –Supply chain mgmt in developing economies –Socially responsible investors –Fair trade IMPACT ON COMPANY •Products / Customers –New products & services, brand value –Market restrictions –Taxes- e.g. carbon tax •Factories/ Communities –License to operate, ease of permitting –Improved process efficiency –Employee morale, productivity –Taxes, fines, liabilities •Supply Chain –Public campaigns, supply interruptions –Liability for clean up –Access to quality suppliers •Public/ Communications –Access to capital –Recruitment & retention –Reputation, brand value, stock P/E ratio CAPTURING VALUE Revenue Margin Cost of Sales ROIC Working Capital Invested Capital Fixed Capital BUILD SHAREOWNER VALUE Stakeholder Potential Sources of Shareowner Value Investors Access to socially responsible investor capital; potentially lower weighted average cost of capital (WACC) Employees Hiring and retention of talent; Improved employee morale and productivity Customers Brand loyalty and reputation; goodwill and intangible value; collaboration in developing new products Business partners Access to strategic resources and capabilities Unions Improved labor relations and conflict resolution Value chain associates Cost- reduction/ value enhancing collaboration throughout the value chain Regulatory authorities Validation of specific product/ service quality levels; lobbying regulations in company’s favor; increased flexibility with regulators Governments Favorable fiscal and industry- specific environmental and social policies Local communities and citizens Mutual support and accommodation; “license to operate”; reasonable treatment with respect to local taxes and service fees Non- governmental organizations (NGO) Constructive collaboration with individual organizations and groups; favorable public opinion environment; “license to operate” PORTER’S FIVE FORCES Potential Entrants Bargaining power of suppliers Threat of new entrants Industry Suppliers Rivalry among existing firms Threat of substitute products Buyers Bargaining power of buyers Substitutes Michael E. Porter. "The Five Competitive Forces that Shape Strategy", Harvard Business Review, January 2008, p.86-104 VALUE CHAIN ANALYSIS S U P P O R T A C T I V I T I E S Procurement Human Resource Management Technology Development Procurement Primary Activities Framework for identifying or developing distinct competencies Porter, Michael E. Competitive advantage: Creating and sustaining superior performance. Simon and Schuster, 2008. STRATEGY & SOCIETY Firm strategy, structure, and rivalry Factor Conditions Demand Conditions Related and Supporting Industries Porter, M. E. & Kramer, M.R (2006). Strategy & Society: The Link Between Competitive Advantage and Corporate Social Responsibility. Harvard Business Review, December, 7892. COMPETING FOR THE FUTURE CONCEPT OF SERVED MARKET REVENUE AND MARGIN STRUCTURE What is the basic value proposition? How have we segmented the market? What kind of customers do we serve? Where are our customers? What customers and needs are we NOT serving? Where in business system do we make profit? Where do margins come from? What has determined size of margins? What are major cost & price drivers? CONFIGURATION OF SKILLS AND ASSETS FLEXIBILITY & ADAPTIVENESS Could profits be extracted at a DIFFERENT POINT in the value chain? What do we believe we know how to do well? What physical infrastructure supports us? What kind of skills predominate in our company? What is the trajectory of our development spend? How alert are we to new value delivery models? How easily could investment programs be re- oriented? How easily could the infrastructure be changed? Which constituencies would most resist change? Might customers’ needs be better served by an ALTERNATE CONFIGURATION of skills and assets? What is our VULNERABILITY to the ‘new rules of the game’? Hamel, G. & Prahalad, C.K. (1994). Competing for the future. Harvard Business School Press. Boston, MA MATURITY ASSESSMENT Fix Gaps – Build Key Strengths PROJECT ALIGNMENT Value Proposition Brief description identifying attributes customer uses to evaluate alternative products that are relevant to project ( or relevant internal goals) Key Activities Key activities & skills for successful implementation of strategy that will be addressed by the project Project Description Description of activities to implement project with attention to how these align with key activities & resources Financial Outcomes Near term performance objectives for the project with attention to how these align with value proposition Key Resources Environmental Outcomes Organizational systems and structures addressed by project & critical to success Near term non – financial benefits of project EXAMPLE – Project #2 Install heat recovery on wash line Value Proposition Will support customer desire for reliable, cost – effective suppliers; supprt eco- label requirements Key Activities Project analysis; procedures for collecting, quality assurance of process data Key Resources $ for capital equipment Training for financial analysis of projects Project Description Install equipment to improve energy efficiency, may help reduce water consumption Project will also develop outline for formal energy mgmt. system; develop data systems for eco- labels Financial Outcomes Direct cost savings; <3 year payback Environmental Outcomes Reduced fuel consumption; GHG reductions WORKSHEET #9 -Project Alignment Value Proposition Key Activities Key Resources Project Description Financial Outcomes Environmental Outcomes