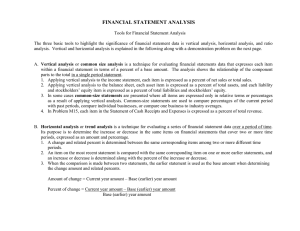

Financial Statement Analysis

advertisement

0 CHAPTER 16 Financial Statement Analysis © 2009 Cengage Learning 1 Introduction How can we determine: The ability of an organization to pay loans? Whether we are earning a fair return on our investment? The adequacy of cash flow to pay operating expenses? How to improve the overall performance of the company? Answer: Financial Statement Analysis 1 2 Why Analyze Financial Statements? Key Concept Ratio analysis provides additional information necessary to enhance the decision-making ability of the users of the information. 2 Limitations of Financial Statement Analysis 3 When comparing companies and interpreting financial statement analysis, differences in accounting methods and cost flow assumptions need to be considered. 3 4 Limitations of Financial Statement Analysis Key Concept Rather than focus on a single ratio, decision makers need to evaluate a company by comparing ratios to those of previous years, budgeted amounts, and industry standards. 4 5 Limitations of Financial Statement Analysis Ratios of a company should be compared with industry standards: Dun & Bradstreet http://www.dnb.com Moody’s http://www.moodys.com Standard & Poor’s http://www.standardpoor.com Dow Jones Retrieval http://www.dowjones.com 5 6 The Impact of Inflation on Financial Statement Analysis Financial statements, and thus financial ratios, are prepared using historical costs and are not adjusted for the effects of increasing prices. 6 7 Horizontal Analysis Key Concept Horizontal analysis is used to analyze changes in accounts occurring between years. 7 8 Horizontal Analysis Cash Comparative Balance Sheets 2007 2006 $130,000 $110,000 $130,000 - $110,000 = $20,000 $20,000/$110,000 = 18.2% increase Prepaid Insurance $25,000 $30,000 $25,000 - $30,000 = ($5,000) ($5,000)/$30,000 = (16.7%) decrease 8 9 Horizontal Analysis Changes in the income statement are analyzed in the same way. A few results: Sales increased 7.7% Cost of goods sold increased 9.9% Total operating expenses increased 27.6% Operating income decreased 26.2% Net income decreased .05% 9 10 Horizontal Analysis Trend Analysis: horizontal analysis of financial statements over several years Can be used to: Build prediction models to forecast financial performance in the future. Identify problem areas by looking for sudden or abnormal changes in accounts. 10 11 Vertical Analysis Compares financial statements of different companies and financial statements of the same company across time after controlling for differences in size. Common-size financial statements are statements in which all items have been restated as a percentage of a selected item on the statements. 11 12 Vertical Analysis Key Concept Vertical analysis uses common-size financial statements to remove size as a relevant variable in ratio analysis. 12 13 Vertical Analysis Comparative Balance Sheet Asset accounts are stated as a percentage of total assets. Liability and stockholders’ equity accounts are stated as a percentage of total Liabilities & Stockholders’ Equity. 13 14 Vertical Analysis Working Capital = Current Assets – Current Liabilities Measure of an entity’s LIQUIDITY, or its ability to meet its immediate financial obligations More useful if we have information concerning the makeup of Working Capital 14 15 Vertical Analysis Common-Size Comparative Income Statements Percentages are based on NET sales The gross profit percentage is usually closely watched 15 Comparison of Robyn’s and Competitor 16 Percentage of Assets Robyn’s Cash 14.0% Inventory 24.0 Prepaids 2.7 P & E, net 33.3 L-T investment 11.8 Competitor 17.0% 20.0 3.4 39.5 10.5 Why are there differences? 16 17 Comparison of Robyn’s and Competitor Accounts payable Income tax Long-term debt Cost of goods sold Operating expense Net income after tax Percentage of Total Liabilities and Equity Robyn’s Competitor 6.5% 8.5% 1.1 2.0 10.8 13.5 71.4 65.0 19.0 23.5 13.6 10.5 17 18 Ratio Analysis and Return on Investment Key Concept Ratio analysis is useful in assessing the impact of transactions on ROI, residual income, EVA, and other key measures of performance. 18 Current Ratio or Working Capital Ratio 19 Current Assets Current Ratio = Current Liabilities Measures the entity’s liquidity. This ratio tells us the amount of current assets for every dollar of current liabilities. What is considered to be a good Current Ratio? 19 20 Acid-Test Ratio or Quick Ratio Quick Ratio = Quick Assets Current Liabilities This ratio is a stricter test of a company’s ability to pay its current debts with highly liquid current assets. This ratio removes inventories and prepaid assets from the amount of current assets used in the calculation. A quick ratio of less than 1.0 should be of concern. 20 21 Cash Flow from Operations to Current Liabilities Ratio Net Cash Provided by Operating Activities Average Current Liabilities Cash flow from operations is sometimes used as the numerator because all debt is paid with cash. The ratio is an indication of whether enough cash is being generated from operations to pay current obligations. 21 22 Number of Days’ Sales in Receivables Number of Days in the Period Accounts Receivable Turnover This ratio is the average number of days to collect a credit sale. This ratio varies according to the credit policy of the particular business and the industry standards. This ratio has an impact on Return On Investment. 22 23 Inventory Turnover Ratio Cost of Goods Sold Average Inventory Determines how many times during the period the cost of the inventory was sold. Determining what is good is dependent on the industry and company standards. For example, grocery stores would have a much higher expected turnover than car dealerships. 23 24 Number of Days Inventory Is Held Before Sale Number of Days in the Period Inventory Turnover Another way to look at inventory turnover is to calculate the number of days inventory is held before it is sold. This may vary according to the particular business and industry standards. This ratio has an impact on Return On Investment. 24 25 Cash-to-Cash Operating Cycle Ratio Number of Days in Inventory + Number of Days in Receivables Measures the length of time between the purchase of inventory and the collection of cash from sales. 25 26 Debt-to-Equity Ratio Total Liabilities Total Stockholders’ Equity A solvency ratio that measures the ability to stay financially healthy over the long run. Indicates the preference of the entity for debt or equity financing. 26 27 Times Interest Earned Net Income + Interest Expense + Income Tax Interest Expense Measures a company’s ability to meet current interest payments to creditors by specifically measuring its ability to meet current-year interest payments out of current-year earnings. Especially important to bankers and other lenders. 27 28 Debt Service Coverage Ratio Cash Flow from Operations Before Interest and Taxes Interest and Principal Payments Measures the amount of cash generated from operating activities that is available to repay principal and interest in the upcoming year. The ratio indicates the amount of cash generated for every $1 in interest and principal paid. 28 Cash Flow from Operations to Capital Expenditures Ratio 29 Cash Flow from Operations - Total Dividends Paid Cash Paid for Acquisitions Measures a company’s ability to use cash flow from operations to finance its acquisitions of property, plant, and equipment. The ability to use cash from operations diminishes the need to acquire outside financing, such as debt. 29 30 Return on Assets Net Income + Interest Expense (net of tax) Average Total Assets Considers the return to investors on all assets invested in the company. Interpretation is based on the company’s required return on assets, industry standards, and trends. 30 Return on Common Stockholders’ Equity 31 Net Income - Preferred Dividends Average Common Stockholders’ Equity Measures the return to common stockholders as a percentage of stockholders’ equity. Adequacy of return is dependent on a number of factors, including the risk of the investment. 31 32 Earnings per Share Net Income - Preferred Dividends Average Number of Common Shares Outstanding Used to measure performance. Used to compare the performance of companies of different sizes. Used with caution to compare performance across different industries. 32 33 Price Earnings Ratio Current Market Price EPS Important for investors because of the relationship of earnings to dividends and the market price of a company’s stock. P/E ratio is very dependent on the industry. 33