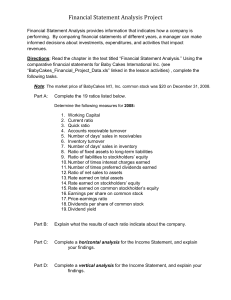

0324662963_144094

advertisement

17 Financial Statement Analysis Student Version 17-1 11-1 1 Describe basic financial statement analytical methods. 17-2 11-2 1 Horizontal Analysis The percentage analysis of increases and decreases in related items using comparative financial statements is called horizontal analysis. 17-3 11-3 1 Exhibit 1 Comparative Balance Sheet— Horizontal Analysis Horizontal Analysis: Difference Base year (2009) 17-4 11-4 $17,000 = 3.2% $533,000 1 Exhibit 2 Comparative Schedule of Current Assets—Horizontal Analysis Horizontal Analysis: Difference $25,800 = 39.9% Base year (2009) $64,700 17-5 11-5 1 Exhibit 3 Comparative Income Statement— Horizontal Analysis Horizontal Analysis: Increase amount $296,500 = 24.0% Base year (2009) $1,234,000 17-6 11-6 1 Exhibit 4 Comparative Retained Earnings Statement—Horizontal Analysis Horizontal Analysis: 17-7 11-7 Increase amount $37,500 Base year (2009) $100,000 = 37.5% 1 Vertical Analysis A percentage analysis used to show the relationship of each component to the total within a single statement is called vertical analysis. 17-8 11-8 1 Vertical Analysis of Balance Sheet In a vertical analysis of the balance sheet, each asset item is stated as a percent of the total assets. Each liability and stockholders’ equity item is stated as a percent of the total liabilities and stockholders’ equity. 17-9 11-9 1 Exhibit 5 Comparative Balance Sheet— Vertical Analysis Vertical Analysis: Current assets Total assets 17-10 11-10 $550,000 = 48.3% $1,139,500 1 Vertical Analysis of the Income Statement In a vertical analysis of the income statement, each item is stated as a percent of net sales. 17-11 11-11 1 Exhibit 6 Comparative Income Statement—Vertical Analysis Vertical Analysis: Selling expenses $191,000 = 12.8% Net sales $1,498,000 17-12 11-12 1 Common-Size Statements In a common-sized statements, all items are expressed as a percentage. Common-sized statements are useful in comparing the current period with prior periods, individual businesses, or one business with with industry percentages. 17-13 11-13 1 Exhibit 7 17-14 11-14 Common-Sized Income Statement 2 Use financial statement analysis to assess the solvency of a business. 11-15 17-15 2 Working Capital The excess of current assets of a business over its current liabilities is called working capital. The working capital is often used in evaluating a company’s ability to pay current liabilities. 17-16 11-16 2 Working Capital = Current Assets – Current Liabilities Current assets Current liabilities Working capital 17-17 11-17 2010 $550,000 –210,000 $340,000 2009 $533,000 –243,000 $290,000 2 Current Ratio The current ratio, sometimes called the working capital ratio or bankers’ ratio measures a company’s ability to pay its current liabilities. 17-18 11-18 2 Current Ratio = Current assets Current liabilities Current ratio Current Assets Current Liabilities 2010 $550,000 $210,000 2.6 $550,000 $210,000 17-19 11-19 2009 $533,000 $243,000 2.2 $533,000 $243,000 2 Quick Ratio A ratio that measures the “instant” debt-paying ability of a company is called the quick ratio or acidtest ratio. 17-20 11-20 2 Quick assets are cash and other current assets that can be quickly converted to cash. 2010 Quick assets: Cash Temporary Investments Accounts receivable (net) a. Total quick assets b. Current liabilities Quick ratio (a ÷ b) 17-21 11-21 $ 90,500 75,000 115,000 $280,500 $210,000 1.3 2009 $ 64,700 60,000 120,000 $244,700 $243,000 1.0 2 Accounts Receivable Turnover The relationship between sales and accounts receivable may be stated as the accounts receivable turnover. Collecting accounts receivable as quickly as possible improves a company’s solvency. 17-22 11-22 2 Accounts Receivable Turnover = a. Net sales Accounts receivable (net): Beginning of year End of year Total b. Average (Total ÷ 2) Accounts receivable turnover (a ÷ b) 17-23 11-23 Net Sales Average Accounts Receivable 2010 $1,498,000 2009 $1,200,000 $ 120,000 115,500 $ 235,000 $ 117,500 $ 140,000 120,000 $ 260,000 $ 130,000 12.7 9.2 2 Number of Days’ Sales in Receivables The number of days’ sales in receivables is an estimate of the length of time (in days) the accounts receivable have been outstanding. Number of Days’ = Sales in Receivables 17-24 11-24 Average Accounts Receivable Net Sales 365 Average Daily Sales 2 2010 a. Average accounts receivable (Total accounts receivable ÷ 2) Net sales b. Average daily sales (Sales ÷ 365) Number of days’ sales in receivables (a ÷ b) 17-25 11-25 2009 $ 117,500 $1,498,000 $ 130,000 $1,200,000 $ $ 4,104 28.6 3,288 39.5 2 Inventory Turnover The relationship between the volume of goods (merchandise) sold and inventory may be stated as the inventory turnover. The purpose of this ratio is to assess the efficiency of the firm in managing its inventory. 17-26 11-26 2 Inventory Turnover = a. Cost of goods sold Inventories: Beginning of year End of year Total b. Average (Total ÷ 2) Inventory turnover (a ÷ b) 17-27 11-27 Cost of Goods Sold Average Inventory 2010 2009 $1,043,000 $ 820,000 $ 283,000 264,000 $ 547,000 $ 273,500 $ 311,000 283,000 $ 594,000 $ 297,000 3.8 2.8 2 Number of Days’ Sales in Inventory The number of days’ sales in inventory is a rough measure of the length of time it takes to purchase, sell, and replace the inventory. 17-28 11-28 2 Average Inventory Number of Days’ = Sales in Inventory Average Daily Cost of Goods Sold Cost of Goods Sold 365 a. Average inventory (Total ÷ 2) Cost of goods sold b. Average daily cost of goods sold (COGS ÷ 365 days) Number of days’ sales in inventory (a ÷ b) 17-29 11-29 2010 $ 273,500 $1,043,000 2009 $ 297,000 $ 820,000 $2,858 $2,247 95.7 132.2 2 Ratio of Fixed Assets to Long-Term Liabilities The ratio of fixed assets to long-term liabilities is a solvency measure that indicates the margin of safety of the noteholders or bondholders. It also indicates the ability of the business to borrow additional funds on a longterm basis. 17-30 11-30 2 Ratio of Fixed Assets to = Long-Term Liabilities Fixed Assets (net) Long-Term Liabilities 2010 a. Fixed assets (net) b. Long-term liabilities Ratio of fixed assets to long-term liabilities (a ÷ b) 17-31 11-31 $444,500 $100,000 4.4 2009 $470,000 $200,000 2.4 2 Ratio of Liabilities to Stockholders’ Equity The relationship between the total claims of the creditors and owners—the ratio of liabilities to stockholders’ equity—is a solvency measure that indicates the margin of safety for creditors. 17-32 11-32 2 Total Liabilities Ratio of Liabilities to = Stockholders’ Equity Total Stockholders’ Equity 2010 a. Total liabilities b. Total stockholders’ equity Ratio of liabilities to stockholders’ equity ( a÷ b) 17-33 11-33 $310,000 $829,500 0.4 2009 $443,000 $787,500 0.6 2 Number of Times Interest Charges Earned Corporations in some industries normally have high ratios of debt to stockholders’ equity. For such corporations, the relative risk of the debtholders is normally measured as the number of times interest charges are earned (during the year), sometimes called the fixed charge coverage ratio. 17-34 11-34 2 Number of Times Interest = Charges Earned Income before income tax a. Add interest expense b. Amount available to meet interest charges Number of times interest charges earned (b ÷ a) 17-35 11-35 Income Before Income Tax + Interest Expense Interest Expense 2010 2009 $162,500 6,000 $134,600 12,000 $168,500 $146,600 28.1 12.2 2 Number of Times Preferred Dividends Are Earned The number of times interest charges are earned can be adapted for use with dividends on preferred stock. Number of Times Preferred Dividends = Are Earned 17-36 11-36 Net Income Preferred Dividends 3 Use financial statement analysis to assess the profitability of a business. 17-37 11-37 3 Profitability Analysis Profitability analysis focuses primarily on the relationship between operating results and the resources available to a business. 17-38 11-38 3 Ratio of Net Sales to Assets = a. Net sales Total assets: Beginning of year End of year Total b. Average (Total ÷ 2) Average Total Assets 2010 $1,498,000 2009 $1,200,000 $1,053,000 1,044,500 $2,097,500 $1,048,750 $1,010,000 1,053,000 $2,063,000 $1,031,500 Ratio of net sales to assets (a ÷ b) 17-39 11-39 Net Sales 1.4 1.2 3 Rate Earned on Total Assets = Net income Plus interest expense a. Total Total assets: Beginning of year End of year Total b. Average (Total ÷ 2) Rate earned on total assets (a ÷ b) 17-40 11-40 Net Income + Interest Expense Average Total Assets 2010 $ 91,000 6,000 $ 97,000 2009 $ 76,500 12,000 $ 88,500 $1,230,500 1,139,500 $2,370,000 $1,185,000 $1,187,500 1,230,500 $2,418,000 $1,209,000 8.2% 7.3% 3 Rate Earned on = Stockholders’ Equity a. Net income Stockholders’ equity: Beginning of year End of year Total b. Average (Total ÷ 2) Rate earned on stockholders’ equity (a ÷ b) 17-41 11-41 Net Income Average Total Stockholders’ Equity 2010 $ 91,000 2009 $ 76,500 $ 787,500 829,500 $1,617,000 $ 808,500 $ 750,000 787,500 $1,537,500 $ 768,750 11.3% 10.0% 3 Rate Earned on Common = Stockholders’ Equity Net income Less preferred dividends a. Remainder—common stock Common stockholders’ equity: Beginning of year End of year Total b. Average (Total ÷ 2) Rate earned on common stockholders’ equity (a ÷ b) 17-42 11-42 Net Income – Preferred Dividends Average Common Stockholders’ Equity 2010 91,000 9,000 82,000 2009 $ 76,500 9,000 $ 67,500 $ 637,500 679,500 $1,317,000 $ 658,500 $ 600,000 637,500 $1,237,500 $ 618,750 12.5% 10.9% $ $ 3 Net Income – Preferred Dividends Earnings per Share (EPS) = on Common Stock Shares of Common Stock Outstanding Net income Preferred dividends a. Remainder—identified with common stock b. Shares of common stock Earnings per share on common stock (a ÷ b) 17-43 11-43 2010 $91,000 9,000 2009 $76,500 9,000 $82,000 50,000 $67,500 50,000 $1.64 $1.35 3 Market Price per Share of Common Stock Price-earnings (P/E) ratio = Earnings per Share on Common Stock Market price per share of common stock Earnings per share on common stock Price-earnings ratio on common stock 17-44 11-44 2010 2009 $41.00 $27.00 ÷ 1.64 ÷ 1.35 25 20 3 Dividends per Share = Dividends Shares of Common Stock Outstanding 2010 2009 a. Dividends $40,000 $30,000 b. Shares of common stock outstanding 50,000 50,000 Dividends per share of common stock (a ÷ b) 17-45 11-45 $0.80 $0.60 3 Dividends per Share of Common Stock Dividend Yield = Market Price per Share of Common Stock a. Dividends per share of common stock b. Market price per share of common stock Dividend yield on common stock 17-46 11-46 2010 2009 $ 0.80 $ 0.60 41.00 27.00 2.0% 2.2% 17-47 11-47