APB - Market & Outlook 12-2007

Baring Asset Management (Asia) Limited

19th Floor, Edinburgh Tower

15 Queen’s Road Central, Hong Kong

Tel: (852) 2841 1411

Fax: (852) 2868 4110 www.barings.com

The Asia Pacific Fund, Inc.

Market Outlook and

Investment Strategy

Franki Chung and Henry Chan

December 2007

Table of Contents

Section 1: Performance and Portfolio Review

Section 2: Asian Investment Outlook

Page

2 - 19

20 - 47

1

(S:\Investment Management\Accounts\Tango\Presentations\0801-BM.ppt)

Section 1:

Performance and

Portfolio Review

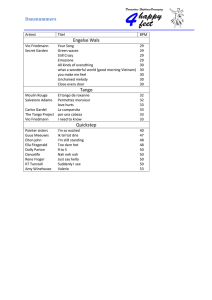

Performance Summary Highlights

3 month period to November 30, 2007

Fund’s NAV returns: +11.5% in USD terms

(+57.3% inc. dividends over 12 month period to 11/30/07)

Fund’s share price returns: +9% in USD terms

(+50.3% inc. dividends over 12 month period to 11/30/07)

Fund’s ranking in Micropal survey: 3 rd quartile for 3 month period and Top 15% for 12 month periods to Nov 2007

Strong long-term track record maintained

3

(S:\Investment Management\Accounts\Tango\Presentations\0801-BM.ppt)

The Asia Pacific Fund, Inc.

Long-Term Performance (Cumulative NAV Returns over

1, 3, 5 and 10 year periods to November 30, 2007)

(%)

400

350

300

250

200

150

100

50

0

Micropal Ranking +

57.3

Portfolio *

MSCI AC F/E (Free) x Jap Gross

45.0

1 Yr to 11/30/2007

30/212

159.0

129.8

3 Yrs to

11/30/2007

23/177

291.7

255.1

5 Yrs to

11/30/2007

26/153

373.5

215.7

10 Yrs to

11/30/2007

5/89

Fund performance are bid to bid, net of fees, gross income, US$. For risks associated with investment securities in emerging and less developed markets, please refer to the Offering Document for details. Transactions in derivatives, warrants and forward contracts and other fund derivatives instruments may be used for the purpose of meeting the investment objective of the Fund. The Net Asset Value of the Fund may have a high volatility due to these instruments and techniques being included in its scheme property and may involve a greater degree of risk. Past performance is not an indication of future performance.

Data source - © 2007 Morningstar, Inc. (See Important Information)

Strong long-term track record maintained

4

(S:\Investment Management\Accounts\Tango\Presentations\0801-BM.ppt)

The Asia Pacific Fund, Inc.

Short-Term Performance

(NAV Returns over 3 month period to November 30, 2007)

0

-10

-20

40

30

20

10

70

60

50

Portfolio *

MSCI AC F/E (Free) x Jap Gross

10.1

10.0

14.4

11.7

11.5

11.4

57.3

45.0

Micropal Ranking +

-11.5

-9.3

11/30/2007

194/220

10/31/2007

100/220

9/30/2007

42/220

3 mths to

11/30/2007

130/219

1 year

30/211

Fund performance are bid to bid, net of fees, gross income, US$. For risks associated with investment securities in emerging and less developed markets, please refer to the Offering Document for details. Transactions in derivatives, warrants and forward contracts and other fund derivatives instruments may be used for the purpose of meeting the investment objective of the Fund. The Net Asset Value of the Fund may have a high volatility due to these instruments and techniques being included in its scheme property and may involve a greater degree of risk. Past performance is not an indication of future performance.

Data source - © 2007 Morningstar, Inc. (See Important Information)

In line with referenced Benchmark, but slightly below Micropal Peer Average over 3 month period

5

(S:\Investment Management\Accounts\Tango\Presentations\0801-BM.ppt)

Performance Attribution Analysis - Summary

(3 month period to November 30, 2007)

Positive Contributors:

Asset Allocation

Stock Selection

Negative Contributor:

Sector Allocation

6

(S:\Investment Management\Accounts\Tango\Presentations\0801-BM.ppt)

Performance Analysis - Details

Asset and Sector Allocation (3 month period to Nov 30, ’07)

Positive Asset Allocation :

Overweight China

Negative Sector Allocation :

Underweight Telecoms and Real Estate

Overweight Materials

7

(S:\Investment Management\Accounts\Tango\Presentations\0801-BM.ppt)

Performance Analysis

Stock Selection – Highlights of largest positive contributors

(3 month period to November 30, 2007)

Stock

Zijin Mining Group

(listed in HK)

(2.1% of NAV)

Hengan Intl

(listed in HK)

(1.9% of NAV)

Inco Intl Nickel Indo

(listed in Indonesia)

(0.8% of NAV)

HDFC

(listed in India)

(1.3% of NAV)

Event

China’s leading gold producer, with some copper interests (stock price rose by 64.5%)

China’s leading provider of personal hygiene tissue-based products (inc. sanitary napkins and baby diapers) (stock price rose by

42.4%)

Indonesia’s largest listed nickel producer

(61% owned by CVRD Inco) (stock price rose by 91.8%)

India’s leading provider of housing finance; company is extremely well-managed, with sustainable growth in sales and profits (stock price rose by 45.4%)

8

(S:\Investment Management\Accounts\Tango\Presentations\0801-BM.ppt)

Price Momentum Factor peaked in October, after a 12 month strong out-performance

1.0

0.8

0.6

0.4

0.2

0.0

-0.2

-0.4

-0.6

May

2006

Asia Pacific Fund

VaR Factor Exposures, last 18 months

(as at November 30, 2007)

Aug

2006

Value

Nov

2006

Growth

Feb

2007

Size

May

2007

Aug

2007

Momentum

Nov

2007

Market Index

Cumulative Factor Returns, last 18 months

(as at November 30, 2007)

25%

20%

15%

10%

5%

0%

-5%

-10%

-15%

May

2006

Aug

2006

Value

Nov

2006

Growth

Feb

2007

Size

May

2007

Aug

2007

Momentum

Nov

2007

Source: Baring Asset Management

We continued to reduce the Fund’s exposure to stocks with high price momentum

9

(S:\Investment Management\Accounts\Tango\Presentations\0801-BM.ppt)

Local Currency exchange rate (US$/Local rate)

(3 month period to November 30, 2007)

08/31/2007 11/30/2007 Change %*

North Asia

New Taiwan Dollar

Chinese Renminbi

South Korean Won

Hong Kong Dollar

ASEAN

Philippine Peso

Singaporean Dollar

Malaysian Ringgit

Thai Baht

Indonesian Rupiah

Indian Rupee

33.00

7.55

938

7.80

32.26

7.40

921

7.79

+2.3

+2.0

+1.9

+0.1

46.54

1.52

3.50

34.31

9,390

40.88

42.78

1.45

3.36

33.85

9,370

39.63

+8.8

+5.3

+4.1

+1.4

+0.2

+3.2

*: + denotes an appreciation of the local currency vs the USD (and vice-versa)

Source: Factset

Strong Asian currencies’ performance vs the USD

10

(S:\Investment Management\Accounts\Tango\Presentations\0801-BM.ppt)

Asian Stock Markets: Country Performance

(3 month period to November 30, 2007)

Gross return in USD

Country - Index

North Asia

MSCI Hong Kong Free

MSCI China Free

MSCI Korea Free

MSCI Taiwan Free

ASEAN

MSCI Indonesia Free

MSCI Malaysia Free

MSCI Philippines Free

MSCI Thailand Free

MSCI Singapore Free

MSCI India Free

MSCI AC Far East Free Ex Japan Gross

(%)

+33.9

+11.4

+23.3

+20.9

+4.1

-0.8

+31.0

+14.4

+12.1

+9.1

+7.9

Source: Factset

‘Growth’ markets of India, Indonesia and HK-China led, while ‘Technology-dominated’ markets of Korea/Taiwan lagged

11

(S:\Investment Management\Accounts\Tango\Presentations\0801-BM.ppt)

Asian Stock Markets: Sectoral Performance

(3 month period to November 30, 2007)

Gross return in USD

(%)

MSCI Energy

MSCI Telecommunication Services

MSCI Real Estate

MSCI Consumer Staples

MSCI Financials

MSCI Industrials

MSCI Consumer Discretionary

MSCI Utilities

MSCI Materials

MSCI Health Care

MSCI Information Technology

+38.6

+23.1

+21.9

+14.7

+12.9

+11.3

+7.4

+5.3

+4.5

+0.3

-0.6

Source: Factset

12

(S:\Investment Management\Accounts\Tango\Presentations\0801-BM.ppt)

Energy and Telecoms led, while Technology and Health Care lagged

The Asia Pacific Fund, Inc.

Country Allocation (as at November 30, 2007)

Country

08/31/2007

(%)

11/30/2007

(%)

Significant

Change *

North Asia

Hong Kong/China

South Korea

Taiwan

ASEAN

Singapore

Indonesia

Malaysia

Philippines

Thailand

India

Cash

80.6

44.0

20.5

16.1

16.0

11.8

2.1

1.8

0.3

0.0

1.2

2.2

78.4

43.0

20.9

14.5

16.8

11.9

3.4

0.6

0.4

0.7

1.5

3.3

* Only 1% change or more is highlighted by arrow moves

Source: Factset

Reduced China and Malaysia in order to fund other markets and Cash

13

(S:\Investment Management\Accounts\Tango\Presentations\0801-BM.ppt)

The Asia Pacific Fund, Inc.

Country Allocation vs Asian universe including India

(as at November 30, 2007)

Country

North Asia

Hong Kong/China

South Korea

Taiwan

ASEAN

Singapore

Indonesia

Philippines

Thailand

Malaysia

India

Pakistan

Cash

Asia Pacific MSCI All Country

Fund Asia x-Japan

(%) (%)

78.4

43.0

20.9

14.5

16.8

11.9

3.4

0.4

0.7

0.6

1.5

0.0

3.3

73.1

36.8

21.3

15.0

15.3

6.6

2.5

0.8

2.0

3.5

11.2

0.3

0.0

Difference

5.2

6.1

-0.4

-0.5

1.5

5.3

0.8

-0.4

-1.3

-3.0

-9.7

-0.3

3.3

Source: Factset

14

(S:\Investment Management\Accounts\Tango\Presentations\0801-BM.ppt)

The Asia Pacific Fund, Inc.

Sector Allocation (as at November 30, 2007)

Sector

Financials

Information Technology

Industrials

Materials

Consumer Discretionary

Energy

Consumer Staples

Telecom Services

Health Care

Utilities

Chinese ‘A-share’ ETF

Cash

08/31/2007

(%)

3.4

3.0

0.0

0.5

3.4

2.2

23.0

19.3

18.2

12.3

8.4

6.2

11/30/2007

(%)

4.9

5.2

0.0

0.0

1.8

3.3

25.0

16.0

15.7

13.0

6.6

8.4

Significant

Change *

* Only 1% change or more is highlighted by arrow moves

Source: Factset

Industrials, Technology and Cons. Disc. reduced;

Financials, Cons. Staples and Telecoms raised

15

(S:\Investment Management\Accounts\Tango\Presentations\0801-BM.ppt)

Highlights of Portfolio Activity

(3 month period to November 30, 2007)

HK/China

Took profits in ‘Cyclical Growth’:

Consumer (Lifestyle Intl), Materials (Zijin Mining, Alum Corp of

China), Industrials (Zhuzhou Times, Nine Dragons, Guangshen

Railways) and A-share ETF

Added to ‘Defensive Growth’ (China Mobile, ICBC Bank, Henderson Land

& Devpt)

Taiwan

Added to Undervalued Property plays/ Materials (Asia Cement)

Switched Technology stocks (sold Siliconware Precision and Firich

Enterprise, bought Advanced Semicon and Asustek)

(Cont.)

16

(S:\Investment Management\Accounts\Tango\Presentations\0801-BM.ppt)

Highlights of Portfolio Activity

(3 month period to November 30, 2007)

ASEAN

Reduced Malaysia

Added to Indonesia, Singapore and Thailand

Korea

Added to ‘Special Situations’ (Samsung

Corp, Korea Invt, KT&G) and Materials (Posco)

Reduced exposure to YTD winners (Samsung Heavy) or under-performing stocks (Hynix Semi, Woori Investment)

17

(S:\Investment Management\Accounts\Tango\Presentations\0801-BM.ppt)

Portfolio Characteristics

(as at November 30, 2007)

P/E using FY1 Est (X)

P/E using FY2 Est (X)

Dividend Yield (%)

EPS FY1/FY0 growth (%)

EPS FY2/FY1 growth (%)

Hist 3 Yr EPS Growth (%)

Hist 3 Yr Sales Growth (%)

Asia Pacific Fund

26.5

20.9

1.5

+50.3

+26.3

+43.6

+31.2

Source : FactSet

Growth and quality bias maintained

18

(S:\Investment Management\Accounts\Tango\Presentations\0801-BM.ppt)

The Asia Pacific Fund, Inc.

Premium/Discount Graph

Source: Bloomberg (12/2007)

‘Range bound’ trend, with discount trading

19

(S:\Investment Management\Accounts\Tango\Presentations\0801-BM.ppt) between 7.5% to 12.5%

Section 2:

Global and Asian Investment Outlook

Asia’s Long-Term Outlook:

We retain our positive stance

Sustainable growth, boosted by rising domestic demand

Improving corporate returns and healthy balance sheets

Undervalued currencies, fairly-valued equity markets

Secular re-rating of Asian assets expected to continue

21

(S:\Investment Management\Accounts\Tango\Presentations\0801-BM.ppt)

Barings’ Global Economic forecasts for 2008

OECD G7 economies expected to grow at a slower rate, caused by weaker US consumption and much reduced new bank lending

But prospects for US recession still unlikely (less than

40% probability)

US Federal Reserve expected to continue to ease, but extent and speed dependent on inflation trend

Asian economies will likely feel some negative impact through weaker exports, but are expected to continue to grow solidly

Net, net, a more challenging global economic backdrop

22

(S:\Investment Management\Accounts\Tango\Presentations\0801-BM.ppt)

Barings’ Asian Economic forecasts for 2008

Continuing growth in domestic demand expected to remain the key driver of growth in Asia

China and India expected to continue to grow solidly, helping to boost intra-regional trade

Other Asian economies likely to grow at trend rate, some helped by favourable recent electoral outcomes

Asian central banks’ policy direction expected to remain mixed (ie, HK to cut, China to raise)

Asian currencies likely to continue to strengthen vs the

USD

Key risks include rising inflation and tighter-than-expected monetary policy

Net, net, still a favourable economic backdrop for equity investors in the region

23

(S:\Investment Management\Accounts\Tango\Presentations\0801-BM.ppt)

Current Concerns in Equity Markets

Global and regional inflation rates to continue to rise, forcing central banks to tighten more aggressively (or to cut rates by less) than currently expected

Fear of a US and global recession developing, causing risk aversion to reign in the short-term

Current high earnings expectations to cause disappointment

24

(S:\Investment Management\Accounts\Tango\Presentations\0801-BM.ppt)

We are monitoring the above risks closely

Global Risk Aversion Dominates:

Another buying opportunity in Asian equities ?

Risk index

10.0

8.0

6.0

4.0

Euphoria

2.0

0.0

-2.0

-4.0

Panic

-6.0

Jan-06 Mar-06 May-06 Jul-06 Sep-06 Nov-06 Jan-07 Mar-07 May-07 Jul-07 Sep-07 Nov-07

Source: Credit Suisse (12/2007)

It has paid to buy a strong growth story (such as Asia) in times of rising global risk aversion

25

(S:\Investment Management\Accounts\Tango\Presentations\0801-BM.ppt)

Significant Outflows in Aug/Nov ‘07 in EM Asia:

Precursor to US recession …. or .… high risk aversion ?

(US$bn)

10

8

6

4

2

-

(2)

(4)

(6)

(8)

(10)

(12)

(14)

(16)

(18)

(20)

Monthly Net Foreign Buying in EM Asia

2.6

(15.2)

(18.3)

Source: Morgan Stanley (12/2007)

26

(S:\Investment Management\Accounts\Tango\Presentations\0801-BM.ppt)

Recent ‘panic selling’ probably caused by rising global risk aversion

Asia vs OECD World:

Some signs of decoupling …..

8

6

4

2

0

(2)

(4)

(6)

Jan-86 Jan-89 Jan-92

OECD G7 LEI (Left)

Asia LEI (Right)

Jan-95 Jan-98 Jan-01 Jan-04

% YoY

Jan-07

18

16

14

8

6

12

10

4

2

0

-2

30

20

10

0

-10

-20

-30

-40

-50

-60

Jan-

88

Jan-

90

Analyst Revision - MSCI A/P, % (Left)

OECD LEI (Right)

Jan-

92

Jan-

94

Jan-

96

Jan-

98

Jan-

00

Jan-

02

Jan-

04

Jan-

06

% YoY

10%

8%

6%

4%

2%

0%

-2%

-4%

-6%

Jan-

08

-8%

Source: Morgan Stanley (12/2007)

…. at both the economic and earnings levels

27

(S:\Investment Management\Accounts\Tango\Presentations\0801-BM.ppt)

Asian Economic De-Coupling from OECD:

Korean exports example

(%)

35

30

25

20

15

10

5

0

-5

Contribution to Korea’s Export Growth, %

2002-2006

YTD 2007

Source: Morgan Stanley (12/2007)

28

(S:\Investment Management\Accounts\Tango\Presentations\0801-BM.ppt)

Less to the US, more to the region and other EM/European nations

Asian Exports: How important are they, REALLY ?

Headline: yes ….. but value-added: not so much !

Export share of GDP (%)

35%

30%

25%

20%

15%

10%

5%

0%

Source: UBS (12/2007)

Estimated value-added share Headline Exports

Asian export sector’s value added contribution to the region’s GDP appears to be less than 5%

29

(S:\Investment Management\Accounts\Tango\Presentations\0801-BM.ppt)

So, can Asia withstand a G3 recession?

Theoretically yes, but practically …… ?

(y-y %)

32

24

16

8

0

(8)

(16)

Real total domestic demand weaker correlation as

Asian domestic demand

(+8.3% y-y) is stronger

Real exports US real imports stronger correlation as Asian domestic demand (+4.1% y-y) is weaker

32

24

16

8

0

Source: BNP Paribas (12/2007)

If Asian’s current strong domestic demand continues, its correlation with the US economy should diminish over time

30

(S:\Investment Management\Accounts\Tango\Presentations\0801-BM.ppt)

Food:

Important for Asia’s headline CPI

30

20

10

0

(% share)

60

50

40

Food as a % of CPI

Source: BNP Paribas (12/2007)

A key risk factor to watch

31

(S:\Investment Management\Accounts\Tango\Presentations\0801-BM.ppt)

Asia & China’s Core vs Headline Inflation:

Headline: worrying …… Core: tame

(%)

6% Asia ex-Japan

Asia ex-Japan

CPI

Core CPI

5%

4%

3%

2%

1%

0%

Jan-01 Jan-02 Jan-03 Jan-04 Jan-05 Jan-06 Jan-07

China

(%)

7%

6%

5%

4%

3%

2%

1%

0%

-1%

-2%

Jan-01

China

Jan-02 Jan-03

CPI

Non-Food CPI

Jan-04 Jan-05 Jan-06 Jan-07

Source: Morgan Stanley (12/2007)

Will Asian central banks act on headline or core inflation trends ?

32

(S:\Investment Management\Accounts\Tango\Presentations\0801-BM.ppt)

Property Prices’ Past 10 Year Trend:

US peaked, but Asia is still catching up ……

60

40

20

0

-20

-40

(%)

120

100

80

US Korea Thailand Taiwan Sing HK

Source: UBS (12/2007)

More upside expected in Asia

33

(S:\Investment Management\Accounts\Tango\Presentations\0801-BM.ppt)

HK Housing Affordability:

Fine

Index

110

90

70

50

30

10

Affordability Ratio

Source: UBS (12/2007)

Plenty of room for the value of an average property to rise

34

(S:\Investment Management\Accounts\Tango\Presentations\0801-BM.ppt)

HK Housing Sector:

Strong demand, limited supply

Units

40,000

35,000

30,000

25,000

20,000

15,000

10,000

5,000

-

Total Private Residential Completion (unit)

Forecast adjusted down in Nov 07

Source: UBS (12/2007)

Unlike the US, more favourable supply/demand characteristics

35

(S:\Investment Management\Accounts\Tango\Presentations\0801-BM.ppt)

HK Banking system:

Borrow, please !

(%)

200%

150%

100%

50%

0%

$HK bn

2,800

1,400

-

-1,400

-2,800

Net deposit (RHS) Total LDR (LHS)

Source: UBS (12/2007)

Banks are seriously cashed-up !

36

(S:\Investment Management\Accounts\Tango\Presentations\0801-BM.ppt)

Asian Equities vs. Asian Bonds:

Equities still cheaper

(%)

0.0

-1.0

-2.0

-3.0

-4.0

-5.0

-6.0

4.0

3.0

2.0

1.0

APXJ

700

600

500

400

300

200

100

-

10Y Bond Yield - Fwd Earnings Yield (%) (LHS)

Avg. -1 Std dev (LHS)

Avg. +1 Std dev (LHS)

MSCI_ Price_USD AP ex JP (RHS)

Source: Morgan Stanley (12/2007)

Rising investor’s confidence needed to close the gap

37

(S:\Investment Management\Accounts\Tango\Presentations\0801-BM.ppt)

Asia Interest Rates:

Still low

(%)

16

14

12

10

Core Asia Interbk 3M

8

6

Asia Interbk 3M

LIBOR 3M

4

2

-

Jan-92 Jan-94 Jan-96 Jan-98 Jan-00 Jan-02 Jan-04 Jan-06

Source: Morgan Stanley (12/2007)

Low nominal and real Asian interest rates are expected to remain supportive for equity markets

38

(S:\Investment Management\Accounts\Tango\Presentations\0801-BM.ppt)

In a world of Downgrades, what are you prepared to pay for this EPS Growth series?

Asset 1

Asset 2

2006

EPS Growth (in % terms)

2007e 2008f 2009f CAGR 06-09e

+17.8

+27.7

+21.4

+16.3

+20.7%

+30.2

+11.9

+20.6

+27.1

+22.3%

Source: Morgan Stanley (12/2007)

39

(S:\Investment Management\Accounts\Tango\Presentations\0801-BM.ppt)

15x ? ….....… 25x ? ......... or higher ?

Asia Trades at a Premium to the US:

Deservedly so ?

(P/E)

27

25

23

21

19

17

15

13

11

9

7

Jan-88 Jan-91

Fed Easing

Jan-94

12M Fwd PE

Jan-97 Jan-00

Fwd PE- AP ex JP

Jan-03 Jan-06

S&P 500

Source: Morgan Stanley (12/2007)

The re-pricing of Asian vs US assets is likely to continue to favour Asia

40

(S:\Investment Management\Accounts\Tango\Presentations\0801-BM.ppt)

Profit Outlook:

US vs Asia

EPS index

(2007: starting at 100 on base date of February ‘06)

116

113

110

107

104

101

98

95

Feb 06

US: down revisions

Sep 06

2008

2007

Apr 07 Nov 07

130

125

120

115

110

105

100

95

Feb 06

Asia Pacific Ex-Japan: up revisions

2008

2007

Sep 06 Apr 07 Nov 07

Source : JP Morgan (12/2007)

Asia uptrend pausing, US downtrend worsening

41

(S:\Investment Management\Accounts\Tango\Presentations\0801-BM.ppt)

Profit Outlook:

Asia’s out-performers

EPS index

(2007: starting at 100 on base date February ‘06)

China Singapore

155

145

135

125

115

105

95

Feb 06 Sep 06

2008

Apr 07

2007

Nov 07

136

128

120

112

104

96

Feb 06 Sep 06

2008

Apr 07

2007

Nov 07

Source : JP Morgan (12/2007)

A pause in the upward earnings surprise trend ?

42

(S:\Investment Management\Accounts\Tango\Presentations\0801-BM.ppt)

Profit Outlook:

Selective in ASEAN

EPS index

(2007: starting at 100 on base date February ‘06)

135

125

115

105

95

Feb 06

Indonesia

Sep 06

2008

Apr 07

2007

Nov 07

Thailand

110

106

102

98

94

90

86

82

Feb 06

2007

Sep 06

2008

Apr 07

Source : JP Morgan (12/2007)

Mixed trends in ASEAN

Nov 07

43

(S:\Investment Management\Accounts\Tango\Presentations\0801-BM.ppt)

Profit Outlook :

Asia’s recovery plays

114

111

108

105

102

99

96

93

90

Feb 06

EPS index

(2007: starting at 100 on base date February ‘06)

Taiwan Korea

Sep 06

2008

Apr 07

2007

Nov 07

115

110

105

100

95

90

85

80

Feb 06

2008

2007

Sep 06 Apr 07

Source : JP Morgan (12/2007)

Selective growth opportunities in Korea and Taiwan

44

(S:\Investment Management\Accounts\Tango\Presentations\0801-BM.ppt)

Nov 07

Earnings Growth vs Valuations:

What the consensus expects in Asia and the World

World

US

P/E (E) EPS Growth (%)

2007 E 2008 E 2007 E 2008 E 2009 E

15.9

13.9

9.9

14.6

11.0

17.4

Emerging Markets 16.4

15.0

14.0

1.7

23.6

16.1

17.1

12.4

11.7

ASIA 18.1

15.4

21.0

17.2

15.9

Div. Yield

2007 E

2.4

1.9

2.3

2.3

ROE (%)

2007 E

16.2

16.9

18.0

16.2

Source: Goldman Sachs, IBES (12/2007)

45

(S:\Investment Management\Accounts\Tango\Presentations\0801-BM.ppt)

More sustainable and consistent earnings growth expected in Asia/EM, yet valuations of latter still not expensive

Key Investment Themes for Asia in 2008

Assuming no US recession and no inflation blow-out in the region, Asian markets are expected to achieve a sixth year of positive return in 2008

The more sustainable the high earnings growth trend, the more expensive the market is likely to become (i.e., India,

China )

Favourable electoral outcomes in Korea, Taiwan and

Thailand can turn these under-performing markets around dramatically

46

(S:\Investment Management\Accounts\Tango\Presentations\0801-BM.ppt)

The Fund’s Key Sectoral Investment themes

Consumption, infrastructure and financials themes

Other regional asset reflation plays

Re-construction of Asia – engineering, construction, building materials, capital goods

Improved supply side discipline of “cyclical” sectors – energy, materials (and technology ?)

47

(S:\Investment Management\Accounts\Tango\Presentations\0801-BM.ppt)

Consumption, Asset Reflation and Infrastructure/Construction

Important Information

This document is provided as a service to professional investors/advisers. It is issued in the United Kingdom by Baring Asset Management

Limited and/or by its investment adviser affiliates in other jurisdictions. The affiliate serving as the Asia Pacific Fund’s investment adviser is Baring Asset Management (Asia) Limited. In the United Kingdom this document is issued only to persons falling within a permitted category under (i) the FSA’s rules made under section 238(5) of the Financial Services and Markets Act 2000 and (ii) the Financial

Services and Markets Act 2000 (Promotion of Collective Investment Schemes) (Exemptions) Order 2001.

This is not an offer nor a solicitation to buy or sell any investment referred to in this document. Baring Asset Management group companies, their affiliates and/or their directors, officers and employees may own or have positions in any investment mentioned herein or any investment related thereto and from time to time add to or dispose of any such investment. This document may include forwardlooking statements, which are based upon our current opinions, expectations and projections as of the date on the cover hereof. We undertake no obligation to update or revise any forward-looking statements. Actual results could differ materially from those anticipated in the forward-looking statements. The value of any investments and any income generated may go down as well as up and is not guaranteed. Past performance will not necessarily be repeated. Changes in rates of exchange may have an adverse effect on the value, price or income of an investment. There are additional risks associated with investments (made directly or through investment vehicles which invest) in emerging or developing markets. Compensation arrangements under the Financial Services and Markets Act 2000 of the

United Kingdom will not be available.

Private investors in the Company referred to herein should obtain their own independent financial advise before making investments. This document must not be relied on for purposes of any investment decisions. Before investing in the Company, we recommend that all relevant documents, such as reports and accounts and prospectus should be read, which specify the particular risks associated with investment in the Company, together with any specific restrictions applying and the basis of dealing. The Company may not be available for investment in all jurisdictions. There may also be prohibitions or restrictions on distribution of this document and other material relating to the Company and accordingly recipients of any such documents are advised to inform themselves about and to observe any such restrictions.

Research Material

Baring Asset Management only produces research for its own internal use. Where details of research are provided in this document it is provided as an example of research undertaken by Baring Asset Management and must not be used, or relied upon, for the purposes of any investment decisions. The information and opinions expressed herein may change at anytime.

For data sourced from Morningstar: © 2007 Morningstar, Inc. all rights reserved. The information contained herein: (1) is proprietary to

Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

Complied (Boston): January 2, 2008

48

(S:\Investment Management\Accounts\Tango\Presentations\0801-BM.ppt)