Chapter 13 – Reporting of Contingencies DELL COMPUTER CORP

advertisement

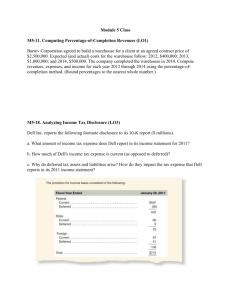

Chapter 13 – Reporting of Contingencies DELL COMPUTER CORP CONSOLIDATED STATEMENTS OF FINANCIAL POSITION (in millions) LIABILITIES AND STOCKHOLDERS’ EQUITY 2013 Current liabilities: Short-term debt Accounts payable Accrued and other Short-term deferred revenue Total current liabilities Long-term debt Long-term deferred revenue Other non-current liabilities $ Total liabilities Commitments and contingencies (Note 10) 3,843 11,579 3,644 4,373 23,439 5,242 3,971 4,187 36,839 Common stock and capital in excess of $.01 par value; shares authorized: 7,000; shares issued: 3,413 and 3,390, respectively; shares outstanding: 1,738 and 1,761, respectively 12,187 2012 $ 2,867 11,656 3,740 3,738 22,001 6,387 3,855 3,373 35,616 12,554 NOTE 10 — COMMITMENTS AND CONTINGENCIES Lease Commitments — Dell leases property and equipment, manufacturing facilities, and office space under noncancelable leases. Certain of these leases obligate Dell to pay taxes, maintenance, and repair costs. At February 1, 2013, future minimum lease payments under these non-cancelable leases are as follows: $137 million in Fiscal 2014; $132 million in Fiscal 2015; $106 million in Fiscal 2016; $86 million in Fiscal 2017; $53 million in Fiscal 2018; and $99 million thereafter. Rent expense under all leases totaled $137 million, $107 million, and $87 million for Fiscal 2013, Fiscal 2012, and Fiscal 2011, respectively. Purchase Obligations — Dell has contractual obligations to purchase goods or services, which specify significant terms, including fixed or minimum quantities to be purchased; fixed, minimum, or variable price provisions; and the approximate timing of the transaction. As of February 1, 2013, Dell had $399 million, $100 million, and $16 million in purchase obligations for Fiscal 2014, Fiscal 2015, and Fiscal 2016 and thereafter, respectively. Legal Matters — Dell is involved in various claims, suits, assessments, investigations, and legal proceedings that arise from time to time in the ordinary course of its business, including those identified below, consisting of matters involving consumer, antitrust, tax, intellectual property, and other issues on a global basis. Dell accrues a liability when it believes that it is both probable that a liability has been incurred and that it can reasonably estimate the amount of the loss. Dell reviews these accruals at least quarterly and adjusts them to reflect ongoing negotiations, settlements, rulings, advice of legal counsel, and other relevant information. To the extent new information is obtained and Dell's views on the probable outcomes of claims, suits, assessments, investigations, or legal proceedings change, changes in Dell's accrued liabilities would be recorded in the period in which such determination is made. For some matters, the amount of liability is not probable or the amount cannot be reasonably Page 1 of 14 estimated and therefore accruals have not been made. The following is a discussion of Dell's significant legal matters and other proceedings: Copyright Levies - Dell's obligation to collect and remit copyright levies in certain European Union (“EU”) countries may be affected by the resolution of legal proceedings pending in Germany against various companies, including Dell's German subsidiary, and elsewhere in the EU against other companies in Dell's industry. The plaintiffs in those proceedings, some of which are described below, generally seek to impose or modify the levies with respect to sales of such equipment as multifunction devices, phones, personal computers, and printers, alleging that such products enable the copying of copyrighted materials. Some of the proceedings also challenge whether the levy schemes in those countries comply with EU law. Certain EU member countries that do not yet impose levies on digital devices are expected to implement legislation to enable them to extend existing levy schemes, while some other EU member countries are expected to limit the scope of levy schemes and their applicability in the digital hardware environment. Dell, other companies, and various industry associations have opposed the extension of levies to the digital environment and have advocated alternative models of compensation to rights holders. Dell continues to collect levies in certain EU countries where it has determined that based on local laws it is probable that Dell has a payment obligation. The amount of levies is generally based on the number of products sold and the perproduct amounts of the levies, which vary. In all other matters, Dell does not believe there is a probable and estimable claim. Accordingly, Dell has not accrued any liability nor collected any levies. On December 29, 2005, Zentralstelle Für private Überspielungrechte (“ZPÜ”), a joint association of various German collecting societies, instituted arbitration proceedings against Dell's German subsidiary before the Board of Arbitration at the German Patent and Trademark Office in Munich, and subsequently filed a lawsuit in the German Regional Court in Munich on February 21, 2008, seeking levies to be paid on each personal computer sold by Dell in Germany through the end of calendar year 2007. On December 23, 2009, ZPÜ and the German industry association, BCH, reached a settlement regarding audio-video copyright levy litigation (with levies ranging from €3.15 to €13.65 per unit). Dell joined this settlement on February 23, 2010, and has paid the amounts due under the settlement. However, because the settlement agreement expired on December 31, 2010, the amount of levies payable after calendar year 2010, as well as Dell's ability to recover such amounts through increased prices, remains uncertain. German courts are also considering a lawsuit originally filed in July 2004 by VG Wort, a German collecting society representing certain copyright holders, against Hewlett-Packard Company in the Stuttgart Civil Court seeking levies on printers, and a lawsuit originally filed in September 2003 by the same plaintiff against Fujitsu Siemens Computer GmbH in Munich Civil Court in Munich, Germany seeking levies on personal computers. In each case, the civil and appellate courts held that the subject classes of equipment were subject to levies. In July 2011, the German Federal Supreme Court, to which the lower court holdings have been appealed, referred each case to the Court of Justice of the European Union, DELL INC. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) submitting a number of legal questions on the interpretation of the European Copyright Directive which the German Federal Supreme Court deems necessary for its decision. Dell has not accrued any liability in either matter, as Dell does not believe there is a probable and estimable claim. Proceedings seeking to impose or modify copyright levies for sales of digital devices also have been instituted in courts in Spain and in other EU member states. Even in countries where Dell is not a party to such proceedings, Page 2 of 14 decisions in those cases could impact Dell's business and the amount of copyright levies Dell may be required to collect. The ultimate resolution of these proceedings and the associated financial impact to Dell, if any, including the number of units potentially affected, the amount of levies imposed, and the ability of Dell to recover such amounts, remain uncertain at this time. Should the courts determine there is liability for previous units shipped beyond the amount of levies Dell has collected or accrued, Dell would be liable for such incremental amounts. Recovery of any such amounts from others by Dell would be possible only on future collections related to future shipments. Convolve Inc. v Dell Inc. - Convolve, Inc. sued Dell, Western Digital Corporation (“Western Digital”), Hitachi Global Storage Technologies, Inc., and Hitachi Ltd. (collectively “Hitachi”) on June 18, 2008 in the U.S. District Court for the Eastern District of Texas, Marshall Division, alleging that the defendants infringed United States Patent No. 4,916,635 (entitled “Shaping Command Inputs to Minimize Unwanted Dynamics”) and United States Patent No. 6,314,473 (entitled “System for Removing Selected Unwanted Frequencies in Accordance with Altered Settings in a User Interface of a Data Storage Device”). Western Digital and Hitachi are hard drive suppliers of Dell. The plaintiff sought damages for each product with an allegedly infringing hard drive sold by Dell, plus exemplary damages for allegedly willful infringement. On July 26, 2011, a jury found that the patents had been infringed and awarded the plaintiff an amount of damages that is not material to Dell. The jury decision is subject to final approval and entry by the judge. Other Litigation - The various legal proceedings in which Dell is involved include commercial litigation and a variety of patent suits. In some of these cases, Dell is the sole defendant. More often, particularly in the patent suits, Dell is one of a number of defendants in the electronics and technology industries. Dell is actively defending a number of patent infringement suits, and several pending claims are in various stages of evaluation. While the number of patent cases has grown over time, Dell does not currently anticipate that any of these matters will have a material adverse effect on Dell's business, financial condition, results of operations, or cash flows. As of February 1, 2013, Dell does not believe there is a reasonable possibility that a material loss exceeding the amounts already accrued for these or other proceedings or matters has been incurred. However, since the ultimate resolution of any such proceedings and matters is inherently unpredictable, Dell's business, financial condition, results of operations, or cash flows could be materially affected in any particular period by unfavorable outcomes in one or more of these proceedings or matters. Whether the outcome of any claim, suit, assessment, investigation, or legal proceeding, individually or collectively, could have a material adverse effect on Dell's business, financial condition, results of operations, or cash flows will depend on a number of variables, including the nature, timing, and amount of any associated expenses, amounts paid in settlement, damages, or other remedies or consequences. Indemnifications — In the ordinary course of business, Dell enters into contractual arrangements under which Dell may agree to indemnify the third party to such arrangements from any losses incurred relating to the services they perform on behalf of Dell or for losses arising from certain events as defined within the particular contract, for example, litigation or claims relating to past performance. Such indemnification obligations may not be subject to maximum loss clauses. Historically, payments related to these indemnifications have been immaterial. Certain Concentrations — Dell's counterparties to its financial instruments consist of a number of major financial institutions with credit ratings of AA and A by major credit rating agencies. In addition to limiting the amount of agreements and contracts it enters into with any one party, Dell monitors its positions with, and the credit quality of the counterparties to, these financial instruments. Dell does not anticipate nonperformance by any of the counterparties. Page 3 of 14 Dell's investments in debt securities are in high quality financial institutions and companies. As part of its cash and risk management processes, Dell performs periodic evaluations of the credit standing of the institutions in accordance with its investment policy. Dell's investments in debt securities have stated maturities of up to three years. Management believes that no significant concentration of credit risk for investments exists for Dell. DELL INC. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) As of February 1, 2013, Dell did not have significant concentrations of cash and cash equivalent deposits with its financial institutions. Dell markets and sells its products and services to large corporate clients, governments, and health care and education accounts, as well as to small and medium-sized businesses and individuals. No single customer accounted for more than 10% of Dell's consolidated net revenue during Fiscal 2013, Fiscal 2012, or Fiscal 2011. Dell purchases a number of components from single or limited sources. In some cases, alternative sources of supply are not available. In other cases, Dell may establish a working relationship with a single source or a limited number of sources if Dell believes it is advantageous to do so based on performance, quality, support, delivery, capacity, or price considerations. Dell also sells components to certain contract manufacturers who assemble final products for Dell. Dell does not recognize the sale of these components in net sales and does not recognize the related profits until the final products are sold by Dell to end users. Profits from the sale of these parts are recognized as a reduction of cost of sales at the time of sale. Dell's gross non-trade receivables as of February 1, 2013, and February 3, 2012, were $2.9 billion and $3.0 billion, respectively, and four contract manufacturers account for the majority of these receivables. Dell has net settlement agreements with the majority of these contract manufacturers that allow Dell to offset the accounts payable to the contract manufacturers from the amounts receivable from them. As of February 1, 2013, and February 3, 2012, $2.5 billion and $2.9 billion, respectively, of these receivables met the criteria for net recognition and were offset against the corresponding accounts payable balances for these contract manufacturers in the accompanying Consolidated Statements of Financial Position. THE GOODYEAR TIRE & RUBBER COMPANY NOTES TO FINANCIAL STATEMENTS Note 18. Commitments and Contingent Liabilities Environmental Matters We have recorded liabilities totaling $43 million and $46 million at December 31, 2012 and December 31, 2011, respectively, for anticipated costs related to various environmental matters, primarily the remediation of numerous waste disposal sites and certain properties sold by us. Of these amounts, $9 million and $11 million were included in Other Current Liabilities at December 31, 2012 and December 31, 2011, respectively. The costs include legal and consulting fees, site studies, the design and implementation of remediation plans, post-remediation monitoring and related activities, and will be paid over several years. The amount of our ultimate liability in respect of these matters may be affected by several uncertainties, primarily the ultimate cost of required remediation and the extent to which other responsible parties contribute. We have limited potential insurance coverage for future environmental claims. Since many of the remediation activities related to environmental matters vary substantially in duration and cost from site to site and the associated costs for each vary depending on the mix of unique site characteristics, in some cases we cannot reasonably estimate a range of possible losses. Although it is not possible to estimate with certainty Page 4 of 14 the outcome of all of our environmental matters, management believes that potential losses in excess of current reserves for environmental matters, individually and in the aggregate, will not have a material adverse effect on our financial position, cash flows or results of operations. Workers’ Compensation We have recorded liabilities, on a discounted basis, totaling $307 million and $302 million for anticipated costs related to workers’ compensation at December 31, 2012 and December 31, 2011, respectively. Of these amounts, $57 million and $63 million were included in Current Liabilities as part of Compensation and Benefits at December 31, 2012 and December 31, 2011, respectively. The costs include an estimate of expected settlements on pending claims, defense costs and a provision for claims incurred but not reported. These estimates are based on our assessment of potential liability using an analysis of available information with respect to pending claims, historical experience, and current cost trends. The amount of our ultimate liability in respect of these matters may differ from these estimates. We periodically, and at least annually, update our loss development factors based on actuarial analyses. At December 31, 2012 and December 31, 2011, the liability was discounted using a risk-free rate of return. At December 31, 2012, we estimate that it is reasonably possible that the liability could exceed our recorded amounts by approximately $40 million. General and Product Liability and Other Litigation We have recorded liabilities totaling $298 million and $293 million, including related legal fees expected to be incurred, for potential product liability and other tort claims, including asbestos claims, presently asserted against us at December 31, 2012 and December 31, 2011, respectively. Of these amounts, $40 million were included in Other Current Liabilities at December 31, 2012 and December 31, 2011. The amounts recorded were estimated based on an assessment of potential liability using an analysis of available information with respect to pending claims, historical experience and, where available, recent and current trends. Based upon that assessment, at December 31, 2012, we do not believe that estimated reasonably possible losses associated with general and product liability claims in excess of the amounts recorded will have a material adverse effect on our financial position, cash THE GOODYEAR TIRE & RUBBER COMPANY AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued) flows or results of operations. However, the amount of our ultimate liability in respect of these matters may differ from these estimates. Asbestos. We are a defendant in numerous lawsuits alleging various asbestos-related personal injuries purported to result from alleged exposure to asbestos in certain products manufactured by us or present in certain of our facilities. Typically, these lawsuits have been brought against multiple defendants in state and Federal courts. To date, we have disposed of approximately 105,600 claims by defending and obtaining the dismissal thereof or by entering into a settlement. The sum of our accrued asbestos-related liability and gross payments to date, including legal costs, totaled approximately $407 million through December 31, 2012 and $388 million through December 31, 2011. A summary of recent approximate asbestos claims activity follows. Because claims are often filed and disposed of by dismissal or settlement in large numbers, the amount and timing of settlements and the number of open claims during a particular period can fluctuate significantly. (Dollars in millions) 2012 2011 2010 Pending claims, beginning of year New claims filed during the year Claims settled/dismissed during the year 78,500 2,200 (7,500) 83,700 2,200 (7,400) 90,200 1,700 (8,200) Pending claims, end of year 73,200 78,500 83,700 Payments (1) $ Page 5 of 14 18 $ 23 $ 26 ________________________________ (1) Represents amount spent by us and our insurers on asbestos litigation defense and claim resolution. We periodically, and at least annually, review our existing reserves for pending claims, including a reasonable estimate of the liability associated with unasserted asbestos claims, and estimate our receivables from probable insurance recoveries. We had recorded gross liabilities for both asserted and unasserted claims, inclusive of defense costs, totaling $139 million and $138 million at December 31, 2012 and December 31, 2011, respectively. The recorded liability represents our estimated liability over the next ten years, which represents the period over which the liability can be reasonably estimated. Due to the difficulties in making these estimates, analysis based on new data and/or a change in circumstances arising in the future could result in an increase in the recorded obligation in an amount that cannot be reasonably estimated, and that increase could be significant. The portion of the liability associated with unasserted asbestos claims and related defense costs was $68 million at December 31, 2012 and $64 million at December 31, 2011. At December 31, 2012, our liability with respect to asserted claims and related defense costs was $71 million, compared to $74 million at December 31, 2011. We maintain primary insurance coverage under coverage-in-place agreements, and also have excess liability insurance with respect to asbestos liabilities. After consultation with our outside legal counsel and giving consideration to agreements with certain of our insurance carriers, the financial viability and legal obligations of our insurance carriers and other relevant factors, we determine an amount we expect is probable of recovery from such carriers. We record a receivable with respect to such policies when we determine that recovery is probable and we can reasonably estimate the amount of a particular recovery. We recorded a receivable related to asbestos claims of $73 million at December 31, 2012 and $67 million at December 31, 2011. We expect that approximately 50% of asbestos claim related losses would be recoverable through insurance through the period covered by the estimated liability. Of these amounts, $10 million was included in Current Assets as part of Accounts Receivable at December 31, 2012 and $8 million at December 31, 2011. The recorded receivable consists of an amount we expect to collect under coverage-in-place agreements with certain primary carriers as well as an amount we believe is probable of recovery from certain of our excess coverage insurance carriers. We believe that, at December 31, 2012, we had approximately $160 million in limits of excess level policies potentially applicable to indemnity and defense costs for asbestos products claims. We also had coverage under certain primary policies for indemnity and defense costs for asbestos products claims under remaining aggregate limits, as well as coverage for indemnity and defense costs for asbestos premises claims on a per occurrence basis, pursuant to coverage-in-place agreements at December 31, 2012. THE GOODYEAR TIRE & RUBBER COMPANY AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued) We believe that our reserve for asbestos claims, and the receivable for recoveries from insurance carriers recorded in respect of these claims, reflects reasonable and probable estimates of these amounts, subject to the exclusion of claims for which it is not feasible to make reasonable estimates. The estimate of the assets and liabilities related to pending and expected future asbestos claims and insurance recoveries is subject to numerous uncertainties, including, but not limited to, changes in: • the litigation environment, • Federal and state law governing the compensation of asbestos claimants, • recoverability of receivables due to potential insolvency of carriers, Page 6 of 14 • our approach to defending and resolving claims, and • the level of payments made to claimants from other sources, including other defendants and 524(g) trusts. As a result, with respect to both asserted and unasserted claims, it is reasonably possible that we may incur a material amount of cost in excess of the current reserve; however, such amounts cannot be reasonably estimated. Coverage under insurance policies is subject to varying characteristics of asbestos claims including, but not limited to, the type of claim (premise vs. product exposure), alleged date of first exposure to our products or premises and disease alleged. Depending upon the nature of these characteristics, as well as the resolution of certain legal issues, some portion of the insurance may not be accessible by us. Other Actions. We are currently a party to various claims and legal proceedings in addition to those noted above. If management believes that a loss arising from these matters is probable and can reasonably be estimated, we record the amount of the loss, or the minimum estimated liability when the loss is estimated using a range, and no point within the range is more probable than another. As additional information becomes available, any potential liability related to these matters is assessed and the estimates are revised, if necessary. Based on currently available information, management believes that the ultimate outcome of these matters, individually and in the aggregate, will not have a material adverse effect on our financial position or overall trends in results of operations. Our recorded liabilities and estimates of reasonably possible losses for the contingent liabilities described above are based on our assessment of potential liability using the information available to us at the time and, where applicable, any past experience and recent and current trends with respect to similar matters. Our contingent liabilities are subject to inherent uncertainties, and unfavorable judicial or administrative decisions could occur which we did not anticipate. Such an unfavorable decision could include monetary damages, fines or other penalties or an injunction prohibiting us from taking certain actions or selling certain products. If such an unfavorable decision were to occur, it could result in a material adverse impact on our financial position and results of operations in the period in which the decision occurs, or in future periods. Income Tax and Other Tax Matters The calculation of our tax liabilities involves dealing with uncertainties in the application of complex tax regulations. We recognize liabilities for anticipated tax audit issues based on our estimate of whether, and the extent to which, additional taxes will be due. If we ultimately determine that payment of these amounts is unnecessary, we reverse the liability and recognize a tax benefit during the period in which we determine that the liability is no longer necessary. We also recognize income tax benefits to the extent that it is more likely than not that our positions will be sustained when challenged by the taxing authorities. We derecognize income tax benefits when based on new information we determine that it is no longer more likely than not that our position will be sustained. To the extent we prevail in matters for which liabilities have been established, or determine we need to derecognize tax benefits recorded in prior periods, our results of operations and effective tax rate in a given period could be materially affected. An unfavorable tax settlement would require use of our cash, and lead to recognition of expense to the extent the settlement amount exceeds recorded liabilities and, in the case of an income tax settlement, result in an increase in our effective tax rate in the period of resolution. A favorable tax settlement would be recognized as a reduction of expense to the extent the settlement amount is lower than recorded liabilities and, in the case of an income tax settlement, would result in a reduction in our effective tax rate in the period of resolution. While the Company applies consistent transfer pricing policies and practices globally, supports transfer prices through economic studies, seeks advance pricing agreements and joint audits to the extent possible and believes its transfer prices to be appropriate, such transfer prices, and related interpretations of tax laws, are occasionally challenged by various taxing authorities globally. We have received various tax assessments challenging our interpretations of applicable tax laws in various jurisdictions. Although we believe we have complied with applicable tax laws, have strong positions and defenses and have historically been successful in defending such Page 7 of 14 claims, our results of operations could be materially adversely affected in the case we are unsuccessful in the defense of existing or future claims. THE GOODYEAR TIRE & RUBBER COMPANY AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued) In September 2011, the State of Sao Paulo, Brazil issued an assessment to us for allegedly improperly taking tax credits for value-added taxes paid to a supplier of natural rubber during the period from January 2006 to August 2008. The assessment, including interest and penalties, totals 92 million Brazilian real (approximately $45 million). We received similar assessments from the State of Sao Paulo, Brazil in December 2010 for allegedly improperly taking tax credits for value-added taxes paid to other suppliers of natural rubber during the period from January 2006 to October 2009. These assessments, including interest and penalties, totaled 88 million Brazilian real (approximately $43 million). We have filed responses contesting all of the assessments and are defending these matters. In the event we are unsuccessful in defending one or more of these assessments, our results of operations could be materially affected. Binding Commitments and Guarantees At December 31, 2012, we had binding commitments for raw materials, capital expenditures, utilities, and various other types of contracts. Total commitments on contracts that extend beyond 2013 are expected to total approximately $3.4 billion. In addition, we have other contractual commitments, the amounts of which cannot be estimated, pursuant to certain long term agreements under which we will purchase varying amounts of certain raw materials and finished goods at agreed upon base prices that may be subject to periodic adjustments for changes in raw material costs and market price adjustments, or in quantities that may be subject to periodic adjustments for changes in our or our suppliers' production levels. We have off-balance sheet financial guarantees written and other commitments totaling approximately $45 million at December 31, 2012, compared to $105 million at December 31, 2011, primarily related to our obligations in connection with the financing of the construction of our new Global and North American Tire Headquarters facility. In addition, we will from time to time issue guarantees to financial institutions or other entities on behalf of certain of our affiliates, lessors or customers. Normally there is no separate premium received by us as consideration for the issuance of guarantees. We also generally do not require collateral in connection with the issuance of these guarantees. If our performance under these guarantees is triggered by non-payment or another specified event, we would be obligated to make payment to the financial institution or the other entity, and would typically have recourse to the affiliate, lessor or customer. The guarantees expire at various times through 2023. We are unable to estimate the extent to which our affiliates’, lessors’ or customers’ assets would be adequate to recover any payments made by us under the related guarantees. Indemnifications At December 31, 2012, we were a party to various agreements under which we had assumed obligations to indemnify the counterparties from certain potential claims and losses. These agreements typically involve standard commercial activities undertaken by us in the normal course of business; the sale of assets by us; the formation of joint venture businesses to which we had contributed assets in exchange for ownership interests; and other financial transactions. Indemnifications provided by us pursuant to these agreements relate to various matters including, among other things, environmental, tax and shareholder matters; intellectual property rights; government regulations and employment-related matters; and dealer, supplier and other commercial matters. Certain indemnifications expire from time to time, and certain other indemnifications are not subject to an expiration date. In addition, our potential liability under certain indemnifications is subject to maximum caps, while other indemnifications are not subject to caps. Although we have been subject to indemnification claims in the past, we cannot reasonably estimate the number, type and size of indemnification claims that may arise in the future. Due to Page 8 of 14 these and other uncertainties associated with the indemnifications, our maximum exposure to loss under these agreements cannot be estimated. We have determined that there are no indemnifications or guarantees other than liabilities for which amounts are already recorded or reserved in our consolidated financial statements under which it is probable that we have incurred a liability. Warranty We recorded $24 million and $20 million for potential claims under warranties offered by us at December 31, 2012 and 2011, respectively, the majority of which is recorded in Other Current Liabilities. THE GOODYEAR TIRE & RUBBER COMPANY AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued) The following table presents changes in the warranty reserve during 2012 and 2011: 2012 (in millions) $ Balance at January 1 Payments made during the period Expense recorded during the period Translation adjustment Balance at December 31 $ 2011 20 $ (17) 21 — 24 $ 17 (11) 15 (1) 20 INTERNATIONAL PAPER CO. CONSOLIDATED BALANCE SHEET 2012 In millions, except per share amounts, at December 31 2011 LIABILITIES AND EQUITY Current Liabilities Notes payable and current maturities of long-term debt Accounts payable Accrued payroll and benefits Liabilities of businesses held for sale $ 444 $ 719 2,775 2,500 508 467 44 43 1,227 1,009 Total Current Liabilities 4,998 4,738 Long-Term Debt 9,696 9,189 Nonrecourse Financial Liabilities of Special Purpose Entities (Note 11) 2,036 — Deferred Income Taxes 3,026 2,497 Pension Benefit Obligation 4,112 2,375 473 476 1,176 758 Other accrued liabilities Postretirement and Postemployment Benefit Obligation Other Liabilities Commitments and Contingent Liabilities (Note 10) Equity Common stock $1 par value, 2012 – 439.9 shares and 2011 – 438.9 shares Paid-in capital Retained earnings Accumulated other comprehensive loss Less: Common stock held in treasury, at cost, 2012 – 0.013 shares and 2011 – 1.9 shares Total Shareholders’ Equity Noncontrolling interests Page 9 of 14 440 439 6,042 5,908 3,662 3,355 (3,840) (3,005) 6,304 6,697 — 52 6,304 6,645 332 340 6,636 Total Equity 6,985 $ 32,153 $ 27,018 Total Liabilities and Equity NOTE 10 COMMITMENTS AND CONTINGENT LIABILITIES PURCHASE COMMITMENTS AND OPERATING LEASES Certain property, machinery and equipment are leased under cancelable and non-cancelable agreements. Unconditional purchase obligations have been entered into in the ordinary course of business, principally for capital projects and the purchase of certain pulpwood, logs, wood chips, raw materials, energy and services, including fiber supply agreements to purchase pulpwood that were entered into concurrently with the Company’s 2006 Transformation Plan forestland sales and in conjunction with the 2008 acquisition of Weyerhaeuser Company’s Containerboard, Packaging and Recycling business. At December 31, 2012, total future minimum commitments under existing non-cancelable operating leases and purchase obligations were as follows: In millions Lease obligations 2013 $ Purchase obligations (a) 198 $ 2014 2015 2016 70 $ 2017 Thereafter 136 $ 106 $ 50 $ 3,213 828 722 620 808 2,654 141 3,411 $ 964 $ 828 $ 690 $ 858 $ 2,795 Total $ (a) Includes $3.6 billion relating to fiber supply agreements entered into at the time of the Company’s 2006 Transformation Plan forestland sales and in conjunction with the 2008 acquisition of Weyerhaeuser Company’s Containerboard, Packaging and Recycling business. Rent expense was $231 million, $205 million and $210 million for 2012, 2011 and 2010, respectively. GUARANTEES In connection with sales of businesses, property, equipment, forestlands and other assets, International Paper commonly makes representations and warranties relating to such businesses or assets, and may agree to indemnify buyers with respect to tax and environmental liabilities, breaches of representations and warranties, and other matters. Where liabilities for such matters are determined to be probable and subject to reasonable estimation, accrued liabilities are recorded at the time of sale as a cost of the transaction. ENVIRONMENTAL PROCEEDINGS International Paper has been named as a potentially responsible party in environmental remediation actions under various federal and state laws, including the Comprehensive Environmental Response, Compensation and Liability Act (CERCLA). Many of these proceedings involve the cleanup of hazardous substances at large commercial landfills that received waste from many different sources. While joint and several liability is authorized under CERCLA and equivalent state laws, as a practical matter, liability for CERCLA cleanups is typically allocated among the many potential responsible parties. Remedial costs are recorded in the consolidated financial statements when they become probable and reasonably estimable. International Paper has estimated the probable liability associated with these matters to be approximately $92 million in the aggregate at December 31, 2012. One of the matters referenced above is a closed wood treating facility located in Cass Lake, Minnesota. During 2009, in connection with an environmental site remediation action under CERCLA, International Paper submitted to the EPA a site remediation feasibility study. In June 2011, the EPA selected and published a proposed soil remedy at the site with an estimated cost of $46 million. The overall remediation reserve for the site is currently $48 million to address this selection of an alternative for the soil remediation component of the overall site remedy. In October 2011, the EPA released a public Page 10 of 14 statement indicating that the final soil remedy decision would be delayed. In the unlikely event that the EPA changes its proposed soil remedy and approves instead a more expensive clean-up alternative, the remediation costs could be material, and significantly higher than amounts currently recorded. In October 2012, the Natural Resource Trustees for this site provided notice to International Paper and other potentially responsible parties of their intent to perform a Natural Resource Damage Assessment. It is premature to predict the outcome of the assessment or to estimate a loss or range of loss, if any, which may be incurred. In addition to the above matters, other remediation costs typically associated with the cleanup of hazardous substances at the Company’s current, closed or formerly-owned facilities, and recorded as liabilities in the balance sheet, totaled approximately $46 million at December 31, 2012. Other than as described above, completion of required remedial actions is not expected to have a material effect on our consolidated financial statements. The Company is a potentially responsible party with respect to the Allied Paper, Inc./Portage Creek/Kalamazoo River Superfund Site (Kalamazoo River Superfund Site) in Michigan. The EPA asserts that the site is contaminated primarily by PCBs as a result of discharges from various paper mills located along the river, including a paper mill formerly owned by St. Regis. The Company is a successor in interest to St. Regis. International Paper has not received any orders from the EPA with respect to the site and is in the process of collecting information from the EPA and other parties relative to the Kalamazoo River Superfund Site to evaluate the extent of its liability, if any, with respect to the site. Accordingly, it is premature to estimate a loss or range of loss with respect to this site. Also in connection with the Kalamazoo River Superfund Site, the Company was named as a defendant by Georgia-Pacific Consumer Products LP, Fort James Corporation and Georgia Pacific LLC in a contribution and cost recovery action for alleged pollution at the Kalamazoo River Superfund Site. The suit seeks contribution under CERCLA for $79 million in costs purportedly expended by plaintiffs as of the filing of the complaint, and for future remediation costs. The suit alleges that a mill, during the time it was allegedly owned and operated by St. Regis, discharged PCB contaminated solids and paper residuals resulting from paper de-inking and recycling. Also named as defendants in the suit are NCR Corporation and Weyerhaeuser Company. In mid-2011, the suit was transferred from the District Court for the Eastern District of Wisconsin to the District Court for the Western District of Michigan. The case has been split into a liability phase and a potential subsequent allocation/damages phase. The Company is now involved in the liability phase of the case and believes it is premature to predict the outcome or to estimate the amount or range of loss, if any, which may be incurred. International Paper and McGinnis Industrial Maintenance Corporation, a subsidiary of Waste Management, Inc., are potentially responsible parties at the San Jacinto River Superfund Site in Harris County, Texas, and have been actively participating in investigation and remediation activities at this Superfund Site. In December 2011, Harris County, Texas filed a suit against the Company in Harris County District Court seeking civil penalties with regard to the alleged discharge of dioxin into the San Jacinto River since 1965 from the San Jacinto River Superfund Site. Also named as defendants in this action are McGinnis Industrial Maintenance Corporation, Waste Management, Inc. and Waste Management of Texas, Inc. Harris County is seeking civil penalties pursuant to the Texas Water Code, which provides for the imposition of civil penalties between $50 and $25,000 per day. The case is in its preliminary stages and it is therefore premature to predict the outcome or to estimate a loss or range of loss, if any, which may be incurred. In October 2012, a civil lawsuit was filed against the same defendants, including the Company, in the District Court of Harris County by what are now 363 plaintiffs seeking medical monitoring and damages with regard to the alleged discharge of dioxin into the San Jacinto River since 1965 from waste impoundments that are a part of the San Jacinto Superfund Site. This case is in its early stages and it is Page 11 of 14 therefore premature to predict the outcome or to estimate a loss or range of loss, if any, which may be incurred. In December 2012, residents of an up-river neighborhood filed a civil action against the same defendants, including the Company, in the District Court of Harris County alleging property damage and personal injury from the alleged discharge of dioxin into the San Jacinto River from the San Jacinto Superfund Site. This case is in the discovery phase and it is therefore premature to predict the outcome or to estimate a loss or range of loss, if any, which may be incurred. In August 2011, Temple-Inland's Bogalusa, Louisiana paper mill received predictive test results indicating that Biochemical Oxygen Demand (BOD) limits for permitted discharge from the wastewater treatment pond into the Pearl River were exceeded after an upset condition at the mill and subsequently confirmed reports of a fish kill on the Pearl River (the Bogalusa Incident). Temple-Inland initiated a full mill shut down, notified the Louisiana Department of Environmental Quality (LDEQ) of the situation and took corrective actions to restore the water quality of the river. On September 2, 2011, Bogalusa mill operations were restarted upon receiving approval from the LDEQ. The LDEQ, the Mississippi DEQ, and other regulatory agencies in those states have each given notice of intent to levy penalties and recover restitution damages resulting from the Bogalusa Incident. Temple-Inland settled for a total of approximately $1 million the known claims of various Mississippi regulatory agencies and the Louisiana Department of Wildlife and Fisheries (LDWF). In September 2012, the settlement with the LDWF for restitution damages related to the Bogalusa Incident was vacated by a state district court. However, on January 15, 2013, the state Court of Appeals reversed the trial court's decision, upheld the validity of the LDWF settlement and dismissed the underlying lawsuit. On February 14, 2013, the plaintiff appealed the Court of Appeals' decision to the Louisiana Supreme Court. The Company continue's to believe the settlement is valid and will vigorously defend our position. The LDEQ has not yet levied a civil enforcement penalty. Such a penalty is expected, however, and is likely to exceed $1 million, but is not expected to be material. A plea agreement has been reached with the U.S. Attorney's Office in New Orleans as a result of a federal criminal investigation into the Bogalusa Incident. Pursuant to the plea agreement, on February 6, 2013, Temple-Inland subsidiary, TIN Inc., pleaded guilty in U.S. District Court to a misdemeanor violation of the Clean Water Act and a misdemeanor violation of the National Wildlife Refuge statute. The plea agreement, which remains subject to court approval, provides for a financial penalty, which is not material, and a two-year corporate probation period for TIN Inc. Temple-Inland (or its affiliates) is a defendant in 23 civil lawsuits in Louisiana and Mississippi related to the Bogalusa Incident. Fifteen of these civil cases were filed in Louisiana state court shortly after the incident and have been removed and consolidated in an action pending in the U.S. District Court for the Eastern District of Louisiana along with a civil case originally filed in that court. During August 2012, an additional 13 causes of action were filed in federal or state court in Mississippi and Louisiana. In October 2012, International Paper and the Plaintiffs' Steering Committee, the group of attorneys appointed by the Louisiana federal court to organize and coordinate the efforts of all the plaintiffs in this litigation, reached a tentative understanding on key structural terms and an amount for resolution of the litigation. Preliminary approval for the proposed class action settlement was granted in December 2012. In the interim, all civil litigation arising out of the August 2011 discharge has been stayed. We do not believe that a material loss is probable in this litigation LEGAL PROCEEEDINGS In September 2010, eight containerboard producers, including International Paper and Temple-Inland, were named as defendants in a purported class action complaint that alleged a civil violation of Section 1 of the Sherman Act. The suit is captioned Kleen Products LLC v. Packaging Corp. of America (N.D. Ill.). The complaint alleges that the defendants, beginning in August 2005 through November 2010, conspired Page 12 of 14 to limit the supply and thereby increase prices of containerboard products. The alleged class is all persons who purchased containerboard products directly from any defendant for use or delivery in the United States during the period August 2005 to the present. The complaint seeks to recover an unspecified amount of treble actual damages and attorney’s fees on behalf of the purported class. Four similar complaints were filed and have been consolidated in the Northern District of Illinois. Moreover, in January 2011, International Paper was named as a defendant in a lawsuit filed in state court in Cocke County, Tennessee alleging that International Paper violated Tennessee law by conspiring to limit the supply and fix the prices of containerboard from mid-2005 to the present. Plaintiffs in the state court action seek certification of a class of Tennessee indirect purchasers of containerboard products, damages and costs, including attorneys’ fees. The Company disputes the allegations made and intends to vigorously defend each action. However, because both actions are in the preliminary stages, we are unable to predict an outcome or estimate a range of reasonably possible loss. Temple-Inland was named as a defendant in a lawsuit filed in August 2011 in the United States District Court for the Northern District of Texas captioned Tepper v. Temple-Inland Inc. This lawsuit was brought by the liquidation trustee for Guaranty Financial Group, Inc., Temple-Inland’s former financial services business which was spun off by Temple-Inland in 2007, on behalf of certain creditors of the business. The lawsuit alleged, among other things, that Temple-Inland and certain of its affiliates, officers, and directors caused the failure of Guaranty Financial Group and its wholly-owned subsidiary Guaranty Bank and asserted various claims related to the failure. In October 2012, the Company entered into a settlement with the liquidation trustee and the Federal Deposit Insurance Corporation (FDIC) to resolve this litigation. The settlement, which has been approved by the bankruptcy court, resolved all claims related to the spinoff and subsequent failure of Guaranty Bank that have been or could be asserted by the trustee or the FDIC, in its capacity as Receiver of Guaranty Bank, against Temple-Inland and its affiliates or any of its former officers, directors or employees. In exchange for this full release from liability, Temple-Inland agreed to release certain bankruptcy-related claims it and other defendants asserted in the Guaranty Financial Group bankruptcy, and to make $80 million in payments ($38 million to the trustee and $42 million to the FDIC) (the Settlement Amount), a portion of which will be tax deductible. In December 2012, the settlement closed and the Settlement Amount was paid and releases were exchanged. In anticipation of this settlement and based on a May 2012 preliminary settlement agreement with the liquidation trustee, in the second quarter of 2012, the Company established a purchase price accounting reserve relating to this matter in this same amount. As noted below and as previously reported, the Company is seeking to recover a portion of this settlement amount from insurers. Temple-Inland is a defendant in a lawsuit captioned North Port Firefighters’ Pension v. Temple-Inland Inc., filed in November 2011 in the United States District Court for the Northern District of Texas and subsequently amended. The lawsuit alleges a class action against Temple-Inland and certain individual defendants contending that Temple-Inland misrepresented the financial condition of Guaranty Financial Group during the period December 12, 2007 through August 24, 2009. Temple-Inland distributed the stock of Guaranty Financial Group to its shareholders on December 28, 2007, after which Guaranty Financial Group was an independent, publicly held company. The action is pled as a securities claim on behalf of persons who acquired Guaranty Financial Group stock during the putative class period. Although focused chiefly on statements made by Guaranty Financial Group to its shareholders after it was an independent, publicly held company, the action repeats many of the same allegations of fact made in the Tepper litigation. On June 20, 2012, all defendants in the lawsuit filed motions to dismiss the amended complaint. The motion is fully briefed and the Company is awaiting a decision from the court. The Company believes the claims made against Temple-Inland in the North Port lawsuit are without merit, and the Company intends to defend them vigorously. The lawsuit is in its preliminary stages, and thus the Page 13 of 14 Company believes it is premature to predict the outcome or to estimate the amount or range of loss, if any, which may be incurred. Each of the individual defendants in both the Tepper litigation and the North Port litigation has requested advancement of their costs of defense from Temple-Inland and has asserted a right to indemnification by Temple-Inland. The Company believes that all or part of these defense costs, a portion of the settlement amount in the Tepper litigation and any potential damages awarded against the individual defendants in the North Port litigation and covered by any Temple-Inland indemnity would be covered losses under Temple-Inland’s directors and officers insurance. The carriers under the applicable policies have been notified of the claims and each has responded with a reservation of rights letter. The Company is currently being challenged by Brazilian tax authorities concerning the statute of limitations related to the use of certain tax credits. The Company is appealing an unfavorable March 2012 administrative court ruling. The potential loss to the Company in the event of a final unfavorable outcome is approximately $31 million. The Company is involved in various other inquiries, administrative proceedings and litigation relating to environmental and safety matters, contracts, sales of property, intellectual property, personal injury, labor and employment and other matters, some of which allege substantial monetary damages. While any proceeding or litigation has the element of uncertainty, the Company believes that the outcome of any of the lawsuits or claims that are pending or threatened or all of them combined (other than those that cannot be assessed due to their preliminary nature) will not have a material effect on its consolidated financial statements. TWIN DISC, INCORPORATED AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (June 30, 2012) O. CONTINGENCIES The Company is involved in litigation of which the ultimate outcome and liability to the Company, if any, are not presently determinable. Management believes that final disposition of such litigation will not have a material impact on the Company’s results of operations or financial position. Page 14 of 14