Module 5 Class Exercises

advertisement

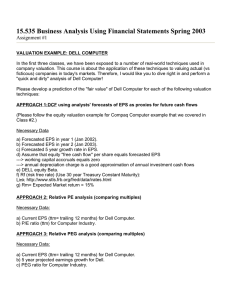

Module 5 Class M5-11. Computing Percentage-of-Completion Revenues (LO1) Bartov Corporation agreed to build a warehouse for a client at an agreed contract price of $2,500,000. Expected (and actual) costs for the warehouse follow: 2012, $400,000; 2013, $1,000,000; and 2014, $500,000. The company completed the warehouse in 2014. Compute revenues, expenses, and income for each year 2012 through 2014 using the percentage-ofcompletion method. (Round percentages to the nearest whole number.) M5-18. Analyzing Income Tax Disclosure (LO3) Dell Inc. reports the following footnote disclosure to its 10-K report ($ millions). a. What amount of income tax expense does Dell report in its income statement for 2011? b. How much of Dell's income tax expense is current (as opposed to deferred)? c. Why do deferred tax assets and liabilities arise? How do they impact the tax expense that Dell reports in its 2011 income statement? M5-19. Defining and Computing Earnings per Share (LO5) Cleantech Solutions International reports the following information in footnotes to its 2010 Form 10-K. a. Explain the concepts of basic and diluted earnings per share. b. Compute basic and diluted EPS for 2010. c. What is the effect of dilutive securities on EPS, in percentage terms? M5-20. Assessing Revenue Recognition for Advance Payments (LO1) Koonce Company operates a performing arts center. The company sells tickets for its upcoming season of six Broadway musicals and receives $420,000 cash. The performances occur monthly over the next six months. a. When should Koonce record revenue for the Broadway musical series? b. Prepare journal entries to show the $420,000 cash receipt and recognition of the first month's revenue.