Costs of Production

advertisement

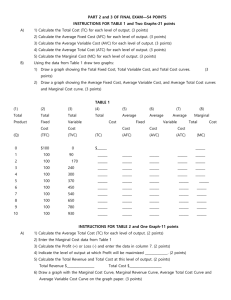

4 Nov 2010 Costs are a critical concept Costs represent a burden sustained to carry out activities ◦ Carry out production ◦ Meet certain goals Costs determine production and pricing Understand costs and you will understand the supply curve Profit = Total Revenue – Total Cost Total Revenue = Price x Quantity Total Costs = Explicit Costs + Implicit Costs Implicit Costs ◦ Value of owner’s time (entrepreneurial value) Difficult to quantify ◦ Opportunity cost of invested capital Interest rates foregone Economic Profit= Total Revenue – Opportunity Costs Opportunity Costs = Implicit + Explicit Costs Examination of Production Process and the Total Cost Workers Output Marginal Product of Labor Cost of Facility Cost of Total Cost Employees (per hour) 0 0 0 $50 0 $50 1 12.5 12.5 $50 $10 $60 2 37.5 25 $50 $20 $70 3 75 37.5 $50 $30 $80 4 125 50 $50 $40 $90 5 168.75 43.75 $50 $50 $100 6 206.25 37.5 $50 $60 $110 7 237.5 31.25 $50 $70 $120 OUTPUT 250 Number of Drinks 200 Inflection Point 150 OUTPUT 100 50 0 0 1 2 3 4 5 6 7 8 Number of workers Marginal Product of Labor 60 50 40 30 Marginal Product of Labor 20 10 0 0 2 4 6 8 Total Cost Total Cost $140 $120 $100 $80 Total Cost $60 $40 $20 $0 0 50 100 150 200 250 Output Fixed Costs ◦ Costs that do not vary with the quantity of output Variable Costs ◦ Costs that vary with the quantity of output produced In our previous example ◦ Fixed Cost: $50 per hour for the Starbucks facility ◦ Variable Cost: $10 per hour wage How do costs vary as the level of production varies? How much does it cost to run the store? How much does it cost when I increase the number of drinks/output? Average Total Cost ◦ Total cost / output Average Fixed Cost ◦ Fixed cost/output Average Variable Cost ◦ Variable cost/output Marginal Cost ◦ Increase in total cost that arises from one more unit MC = (TC2-TC1) / (Q2-Q1) Number of Drinks Total Cost Fixed Cost 0 $50.00 12.5 37.5 Variable Cost Average Fixed Costs Average Variable Costs Average Total Cost $50.00 $0.00 $0.00 0 0 0 $65.00 $50.00 $15.00 $4.00 $1.20 $5.20 $1.20 $84.00 $50.00 $34.00 $1.33 $0.91 $2.24 $0.76 75 $107.00 $50.00 $57.00 $0.67 $0.76 $1.43 $0.61 125 $134.00 $50.00 $84.00 $0.40 $0.67 $1.07 $0.54 168.75 $165.00 $50.00 $115.00 $0.30 $0.68 $0.98 $0.71 206.25 $200.00 $50.00 $150.00 $0.24 $0.73 $0.97 $0.93 237.5 $0.21 $0.80 $1.01 $1.25 $239.00 $50.00 $189.00 Marginal Cost COST CURVES FOR STARBUCKS $6.00 $5.00 $4.00 Average Fixed Costs Average Variable Costs $3.00 Average Total Cost Marginal Cost $2.00 $1.00 $0.00 0 50 100 150 200 250 The increase in efficiency of production as the number of goods being produced increases. Typically, a company that achieves economies of scale lowers the average cost per unit through increased production ◦ fixed costs are shared over an increased number of goods. Decisions Behind the Supply Curve Many buyers and sellers - individual firms have little effect on the price. Goods offered are very similar - demand is very elastic for individual firms. Firms can freely enter or exit the industry no substantial barriers to entry. Market Price (P) is given ◦ Firms are “Price Takers” Profit = Total Revenue (TR) – Total Cost (TC) How much does the Firm receive for a “typical unit”? ◦ AVERAGE REVENUE Total Revenue / Quantity Sold TR/Q = (P x Q)/Q = Price TR/Q = PRICE How much additional revenue does the firm get if it sells one more unit? ◦ MARGINAL REVENUE Change in Total Revenue/ Change in Quantity MARGINAL REVENUE IS ALSO EQUAL TO PRICE!! SEE NEXT SLIDE Quantity (Q) Total Revenue (TR = P X Q) Price (P) Average Revenue AR = TR/Q Marginal Revenue = CHANGE IN TR/CHANGE IN Q 1 $131.00 $131.00 $131.00 2 $131.00 $262.00 $131.00 $131.00 3 $131.00 $393.00 $131.00 $131.00 4 $131.00 $524.00 $131.00 $131.00 5 $131.00 $655.00 $131.00 $131.00 6 $131.00 $786.00 $131.00 $131.00 7 $131.00 $917.00 $131.00 $131.00 8 $131.00 $1,048.00 $131.00 $131.00 9 $131.00 $1,179.00 $131.00 $131.00 10 $131.00 $1,310.00 $131.00 $131.00 QUANTITY TOTAL REVENUE TOTAL COST PROFIT (TR-TC) MARGINAL REVENUE (CHANGE TC/ CHANGE IN Q) MARGINAL COST CHANGE IN PROFIT MR- MC 0 $0.00 $15.00 -$15.00 $131.00 1 $131.00 $115.00 $16.00 $131.00 $100.00 $31.00 2 $262.00 $219.00 $43.00 $131.00 $104.00 $27.00 3 $393.00 $327.00 $66.00 $131.00 $108.00 $23.00 4 $524.00 $439.00 $85.00 $131.00 $112.00 $19.00 5 $655.00 $555.00 $100.00 $131.00 $116.00 $15.00 6 $786.00 $675.00 $111.00 $131.00 $120.00 $11.00 7 $917.00 $799.00 $118.00 $131.00 $124.00 $7.00 8 $1,048.00 $927.00 $121.00 $131.00 $128.00 $3.00 9 $1,179.00 $1,059.00 $120.00 $131.00 $132.00 -$1.00 10 $1,310.00 $1,195.00 $115.00 $131.00 $136.00 -$5.00 Profit is Maximized where Marginal Revenue is equal to Marginal Cost Marginal Cost is always rising When MR > MC ◦ Revenue is increasing faster than costs ◦ Firm should increase production When MR < MC ◦ revenue from the additional unit is less than additional cost ◦ the firm should decrease production. A firm maximizes profits when MR = MC. MC Costs/ Rev ATC P=AR=MR Q* Quantity $160.00 $140.00 $120.00 $100.00 MR $80.00 MC ATC $60.00 $40.00 $20.00 $0.00 0 2 4 6 8 10 12 Since MC is upward sloping, as price increases, quantity produced will increase too. As price falls, quantity produced falls. In each case, the marginal cost curve determines how much the firm is willing to produce at each price ◦ So it translates into the supply curve Total Costs = Variable Costs + Fixed Costs If a business shuts down it will only incur FIXED COSTS (it will not have any revenue either) Company should produce if it can cover its variable costs Total Revenue > Total Variable Costs ◦ Or how about….AR > AVC It means the same thing, we are just adjusting the inequality for quantity Shut down would occur if/when Price falls below the level of the Average Variable Cost ◦ Rember: PRICE is also AVERAGE REVENUE MC COSTS ATC AVC Shut down: P < AVC QUANTITY In the long run, all costs are variable If Total Revenue is less than Total Costs ◦ Or if Average Revenue is less than Average Total Cost ◦ Firm will shut down COSTS MC ATC P = AR QUANTITY In the long run, a firm will enter or exit the market until profit is zero Profit = TR – TC Total Cost includes all the opportunity costs of the firm ZERO PROFIT is EQUILIBRIUM CONDITION ◦ Even if profit is zero, the firm has met satisfaction of opportunity costs Monopolistic Competition One and only one firm that produces a good (or offers a unique service) Characteristics ◦ Barriers to entry ◦ No close substitutes PRICE MAKERS! Recall from our previous discussion that competitive firms are price takers DeBeers Diamonds ALCOA (Aluminum) The cable company Utilities (gas, electric, etc) Morton Salt Monopoly’s power exists in its power to sell ◦ In other words, its profits depend upon DEMAND ◦ The market demand and company demand curve are one and the same Like a competitive firm, a monopoly’s profits are maximized where ◦ MR = MC However, monopoly price will be well above the point where MR = MC MC ATC PROFIT MAX DEMAND MR Government regulation to attack efficiency loss of monopoly Break up monopolies ◦ AT&T Prevent mergers? Fining companies that collude or price discriminate ◦ Walmart More than one buyer/sellers (several…could be numerous) Differentiated products (substitutes) Firms have sufficient knowledge (do not act as if in a vacuum) Free entry and exit Limited competition at first Products that are in the market are close, but not exact substitutes “Every firm has a monopoly of its own product” (British Economist Joan Robinson) Example: Portable Media PLayer ◦ iPOD AAC mP4 ◦ 80% market share MC Costs ATC D = AR MR Quantity Firms that produce close substitutes enter market ◦ There is a profit to be made ◦ As long as: P > MR=MC ◦ P > ATC! MC ATC D = AR MR ZERO ECONOMIC PROFIT P = ATC Inefficiency ◦ Price is always greater than marginal cost Excess capacity ◦ Firm not producing at bottom of ATC ◦ Underserving market Advertising/non-Price Competition ◦ Advertises to attract customers rather than cutting price ◦ Advertising is seen as wasteful Few Sellers/Similar or Identical Products Game Theory ◦ Psychologists call it theory of social situations After all, Economics is a social science ◦ Cooperative Game Theory ◦ Non-Cooperative Game Theory Rules are enforced within the group Groups of firms form coalitions and collude Ever watch “Survivor”? Players make decisions independently Cooperation is self-enforcing Does not exist SUSPECT 1/SUSPECT 2 Not Confess RAT 5, 5 -4, 10 10, -4 1, 1 Not Confess RAT “Ratting” It is the best strategy to pursue, individually, regardless of the strategies pursued by the other player(s) Construction of a Bridge Great for society! Best for each individual as long as someone else builds the bridge It would be great for both firms to set a high price ◦ (e.g., not confess) The firm who “cheats” by undercutting his competitor with a lower price gets a high payoff A Nash Equilibrium is a set of mixed strategies for finite, non-cooperative games between two or more players ◦ No player can improve his or her payoff by changing their strategy. ◦ Each player's strategy is an 'optimal' response based on the anticipated rational strategy of the other player(s) in the game. Nash equilibrium does not necessarily mean the best cumulative payoff for all the players involved Neither suspect confesses ◦ Each derives one (1) measure of utility