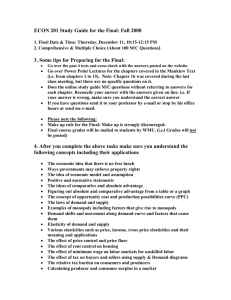

Fall 2013 Quiz 2 Worksheet

advertisement

Quiz 2 Work Sheet: For this assignment you can use a calculator. Try to do the entire problem and use your calculator to find the final answer. On the quiz you can leave your answers unsolved if the arithmetic is complicated (as is the case for the average fixed costs below). 1. You are given the following relationship between Quantity and Utility Qx or Qy TUx TUy 1 12 20 2 20 30 3 26 36 4 30 40 5 32 42 Assume the following levels of income: a) $10 b) $20 c) $30 Assume the following prices of Y: a) $2 b) $5 c) $10 For each combination of income and prices of Y (i.e. income is $10 and Py is $2), draw the demand curve for X. (Hint: Pick prices of X and find the optimal consumption (Q) of X which allows you to spend all of your income given the price of Y. Draw on a curve. Your demand curve should have 5 units of X on the quantity axis.) How does this exercise demonstrate the concept of ceteris paribus? 2. You are given the following information about productivity of an hour of labour: L Qx Qy 1 70 8 2 160 20 3 260 36 4 300 44 5 330 50 6 354 54 Assume the following fixed costs: a) $100 b) $300 c) $500 d) $1000 Assume the following wages: a) $10 b) $20 c) $30 Draw the APL, MPL for X and Y. Draw the AVC, ATC and MC for X and Y. If this market is competitive, what will the long run price for X and Y become? Why? If this market requires 20,000 units to meet long run demand for X, how many firms will operate if this is a constant cost, perfectly competitive industry? Tell the story of what will happen if the market for X now requires a) 25,000 units or b) 15,000 units to meet long run demand. Give both the long run and short run story including the relative (not specific) prices and quantities at both the firm and industry level. 3. You are given the following minimums which match the following quantities Q = 5, Q = 50 and Q = 40: a) MC = $100 ATC = $300 AVC = $250 b) MC = $5 ATC = $50 AVC = $45 c) MC = $100 ATC = $2000 AVC = $ 1300 What is the value of average fixed cost, the price and quantity of at the shut down point, and the price and quantity at the point of normal profits? Show each case on a stylized graph. 4. You are given the following demand curves: a) P = 80 – 2Q b) P = 100 – 2Q c) P = 100 – 5 Q d) P = 100 – 10 Q Suppose long run exhibits constant returns to scale with constant long run marginal costs. Why would constant returns to scale lead to constant long run marginal costs? LRATC is a) $5 b) $10 c) $50 How much will a perfectly competitive industry produce and why? Show on a graph. Now take the demand curves in part a) and double the number in front of Q (for example MR = 80 – 4Q for demand given by P = 80 – 2Q.) This is the equation for the MR of a Monopoly for that particular demand curve. How much will a monopoly produce? Why? Compare the market outcomes for competition with that of a monopoly. Calculate and show on a graph: a) Consumer and b) producer surplus, c) total welfare and d) any DWL (if it occurs) for both a perfect competitive industry and a monopoly. b) Suppose short run supply of a competitive industry and the short run marginal cost for the monopoly is given by the following equations: i) MC = 2Q ii) MC= 5Q iii) MC = 10Q iv) MC = 20 + 2Q v) MC = 20 + 5Q vi) MC = 95 + 2Q Calculate and show on a graph the profit maximizing level of output, the price, Consumer surplus, producer surplus and the DWL (if it exists) for each of the demand curves above. Compare the market outcomes for perfect competition with that of a monopoly. In terms of costs, what is the relationship between marginal returns and returns to scale for these costs? 5. Suppose the government wants to regulate the Monopoly found in problem 4. What are the possible options? What are the issues facing the government of the regulations actually working?