Fundamentals of Intermediate Accounting

Weygandt, Kieso, and Warfield

Chapter 5: Income Statement and

Related Information

Prepared by

Bonnie Harrison, College of Southern Maryland

LaPlata, Maryland

Chapter 5

Income Statement and Related Information

1

2

3

4

5

After studying this chapter, you should be able to:

Identify the uses and limitations of an income

statement.

Prepare a single-step income statement.

Prepare a multi-step income statement.

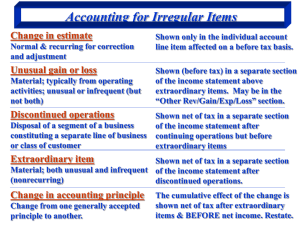

Explain how irregular items are reported.

Explain intraperiod tax allocation.

2

Chapter 5

Income Statement and Related Information

After studying this chapter you should be able to :

6

7

8

Explain where earnings per share information

is reported.

Prepare a retained earnings statement.

Explain how other comprehensive income is

reported.

3

Usefulness of Income Statement

1. Evaluate the past performance of the

enterprise.

2. Provide a basis for predicting future

performance.

3. Help assess the risk or uncertainty of

achieving future cash flows.

4

Limitations of the Income

Statement

1. Items that cannot be measured reliably are

not reported in the income statement.

2. Income numbers are affected by the

accounting methods employed.

3. Income measurement involves judgment.

5

The Single Step Income Statement

• This statement presents information in

broad categories.

• Major sections are Revenues and Expenses.

• The Earnings per Share amount is shown at

the bottom of the statement.

• There is no distinction between operating

and non-operating activities.

Single Step Statement

Revenues

Expenses

=

NET INCOME

Earnings per

Share

Revenues

Sales

Other Revenues

Expenses

Cost of Goods Sold

Selling & Admn Expenses

Interest Expense

Income Tax Expense

The Multiple Step Income Statement

• The presentation divides information into

major sections on the statement.

• The statement distinguishes operating from

non-operating activities.

• Continuing operations are shown separately

from irregular items.

• The income tax effects are shown separately

as well.

Multiple Step Income Statement

1

Operating

Section

Non-Operating

2

Section

3

4

Sales Revenue

less: Cost of Goods Sold

less: Selling Expenses

less: Administrative Expenses

Add: Other Revenues and Gains

Less: Other Expenses and Losses

Income Tax

Irregular

Items

5 Earnings per Share

Discontinued Operations (net of tax)

Extraordinary Items (net of tax)

Cumulative Effect of a Change in

Accounting Principle (net of tax)

Irregular Items: Discontinued

Operations

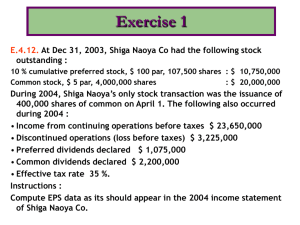

Criteria for Discontinued Operations

Discontinued operations refer to the disposal of a

segment.

To qualify:

The segment must be a distinct line of business

Its assets and operations must be distinguishable

from other assets and operations.

A distinction is made between:

the segment’s results of operations and

the disposal of the segment’s assets

Reporting Discontinued Operations

There are two important dates in reporting

discontinued operations:

• the measurement date and

• the disposal date

The measurement date is when management

commits itself to a plan of segment’s disposal.

The disposal date is the date of sale of segment.

Irregular Items:

Extraordinary Items

Extraordinary Items

• Extraordinary items are:

nonrecurring material items that

differ significantly from typical activities

• Extraordinary items must meet two tests:

they must be unusual and

they must be infrequent

• The environment in which the business operates

is of primary importance

Extraordinary Items: what they are not

• Losses from write-down or write-off of receivables,

inventories, etc.

• Gains and losses from exchange or translation of

foreign currency

• Gains and losses from the abandonment of

property used in business

• Effects of strike

• Adjustments or accruals on long term contracts.

Unusual Gains & Losses

• Items that are unusual OR infrequent, but

not both.

• If material, disclose separately.

• Do not disclose, net of taxes.

Irregular Items:

Cumulative Effect of a Change

in Accounting Principle

Change in Accounting Principle

• An accounting change results when:

• a new principle, different from the one in

use, is adopted.

• The effect of the change is to be disclosed

after extraordinary items.

• A change in principle is to be distinguished

from a change in estimates.

• A change from FIFO to LIFO method in

inventory costing is an example.

Change in Accounting Principle

Gilbert company buys and places in service an asset

on 1/1/2002. The cost is $100,000. Estimated useful

life is 4 years. Ignore salvage value. Tax rate is 30%.

The company uses the double-declining method of

depreciation in 2002 and 2003. It changes to the

straight-line method in 2004 (1/1/2004.)

Present the effect of the change in accounting principle.

Change in Accounting Principle

Year

Double-declining

Straight line

balance depreciation depreciation

2002 $50,000

2003 $25,000

Presentation

$25,000

$25,000

Net difference

Increases net income

Difference

$25,000

$ -0$25,000

Extraordinary Item

$XXXX

Cumulative Effect on prior years of

retroactive application of new depreciation

method (net of tax, $7,500)

$17,500

Changes in Accounting Estimates

• Accounting estimates will changes as new

events occur, more experience is acquired or

additional information is obtained

• Changes in accounting estimates are

accounted for in period of change and future

periods.

Changes in Accounting Estimates:

Example

On 1/1/2004, Gilbert Company (see preceding example

for accounting principle change) revises the useful life

of the asset to be 3 more years (2004, 2005 and 2006).

The salvage value is estimated to be $5,000.

This change involves a revision of initial estimates.

The depreciation method remains straight-line.

Changes in Accounting Estimates: Example

Book value (1/1/2004):

Less: Salvage value

Revised depreciable cost:

Revised depreciable cost:

Remaining useful life:

Annual straight-line depreciation:

(years 2004, 2005 and 2006)

$50,000

($5,000)

---------$45,000

$45,000

3 years

$15,000

Note: The changes in useful life and salvage value

do not affect prior periods

Intraperiod Tax Allocation

• Tax expense for year related to specific

items.

• Used for:

–

–

–

–

Income from continuing operations

Discontinued operations

Extraordinary items

Change in accounting principle

24

Earnings per Share

• Earnings per share is a significant business indicator

figure.

• It is computed as:

Net Income less Preferred Dividends

Weighted Average of Common Shares Outstanding

• Earnings per share is required to be disclosed on the

income statement for all the major sections.

• Earnings per share is subject to dilution (reduction), if

issue of additional shares is possible in the future.

Retained Earnings Statement

• Retained earnings are increased by net income and

decreased by net loss and dividends for the year.

• Corrections of errors in prior period financial

statements are shown as prior period adjustments

to the beginning balance in retained earnings.

• Any part of retained earnings, appropriated for a

specific purpose, is shown as restricted earnings.

Other Comprehensive Income –

all changes in equity during a

period, except those resulting

from investments by or

distributions to owners.

27

Other Comprehensive Income

must be displayed as:

• A separate statement of comprehensive

income OR

• Combined income statement and

comprehensive income statement OR

• Part of statement of stockholders equity

28

COPYRIGHT

Copyright © 2003 John Wiley & Sons, Inc. All rights

reserved. Reproduction or translation of this work

beyond that named in Section 117 of the 1976 United

States Copyright Act without the express written

consent of the copyright owner is unlawful. Request

for further information should be addressed to the

Permissions Department, John Wiley & Sons, Inc.

The purchaser may make back-up copies for his/her

own use only and not for distribution or resale. The

Publisher assumes no responsibility for errors,

omissions, or damages, caused by the use of these

programs or from the use of the information

contained herein.