Paycheck Paystub Brief

advertisement

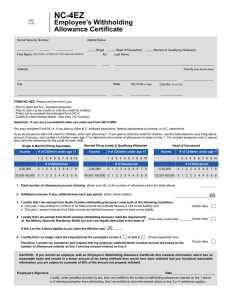

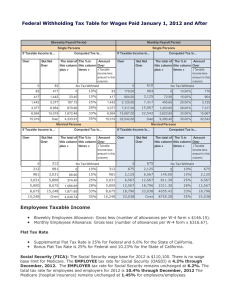

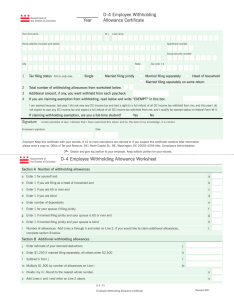

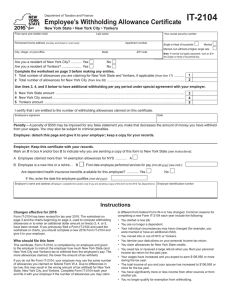

Ordinary Tax Rates for Single Filing Status [Tax Rate Schedule X, Internal Revenue Code section 1(c)] If taxable Income is: a b c d Over $0 9,075 36,900 89,350 186,350 405,100 406,750 But not over $9,075 36,900 89,350 186,350 405,100 406,750 -- Taxable income e Subtract (d) from (c). Multiplicati Multiply (a) Subtraction This is the on amount by (b) amount federal income tax. × 0.10 × 0.15 × 0.25 × 0.28 × 0.33 × 0.35 × 0.396 $0 453.75 4,143.75 6,824.25 16,141.75 24,243.75 42,954.25 This format of the tax rate chart (shown above) emphasizes the mechanics of how to calculate the federal income tax. To use this chart, we start by figuring out a person's taxable income. Then we use the first two columns to find the range in which the taxable income falls. Once we find the relevant row, we then work across the row from left to right. Once we identify the relevant row, we write in the amount of taxable income in column (a). We then perform the multiplication in column (c), and finally perform a subtraction in column (e). The resulting number in column (e) is the amount of federal income tax liability on the amount of taxable income shown in column (a). Minnesota State Tax Claiming Zero Allowances The maximum amount of taxes is withheld. Meaning, when it comes time to file your tax return you will most likely receive a refund. If you are claimed as a dependent on someone else’s tax return, you should claim zero allowances. Claiming One Allowance (best option if you are single with one job) If you are single and have one job, by claiming one allowance will most likely result in a refund when you file your taxes. Claiming Two Allowances If you are single, claiming two allowances will get you close to your tax liability but may result in tax due when filing your taxes. If you are single and work more than one job, you can claim one allowance at each job or two allowances at one job and zero at the other. If you are married, you should claim two allowances Claiming Three Allowances If you are married and have one child, you should claim three allowances. Additional Allowances If you file as head of household you can claim additional allowances If you had at least $1,900 of child or dependent care expenses that you plan on claiming credit If you are eligible to claim the Child Tax Credit IRS Withholding Calculator If you are an employee, the Withholding Calculator can help you determine whether you need to give your employer a new Form W-4, Employee's Withholding Allowance Certificate to avoid having too much or too little Federal income tax withheld from your pay. You can use your results from the calculator to help fill out the form. Who Can Benefit From The Withholding Calculator? Employees who would like to change their withholding to reduce their tax refund or their balance due; Employees whose situations are only approximated by the worksheets on the paper W-4 (e.g., anyone with concurrent jobs, or couples in which both are employed; those entitled to file as Head of Household; and those with several children eligible for the Child Tax Credit); Employees with non-wage income in excess of their adjustments and deductions, who would prefer to have tax on that income withheld from their paychecks rather than make periodic separate payments through the estimated tax procedures. Ready to start? Make sure scripting is enabled before using this application. Continue to the Withholding Calculator Tips For Using This Program Have your most recent pay stubs handy. Have your most recent income tax return handy. Estimate values if necessary, remembering that the results can only be as accurate as the input you provide. To Change Your Withholding: Use your results from this calculator to help you complete a new Form W-4, Employee's Withholding Allowance Certificate. Submit the completed Form to your employer.