Federal Taxes - Lyndhurst School

advertisement

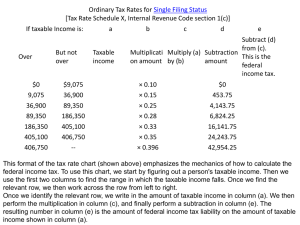

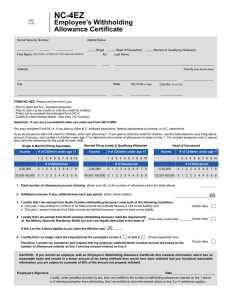

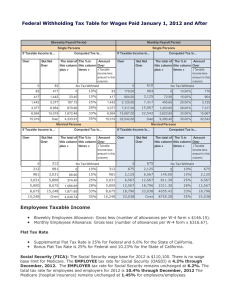

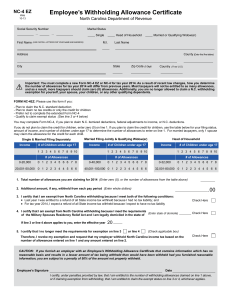

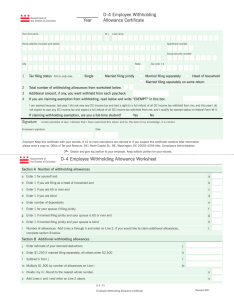

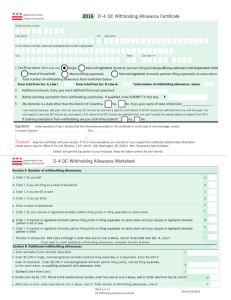

FEDERAL INCOME TAXES Social Security - FICA Federal Withholding Tax (social security/medicare) W4 W2 PROGRESSIVE TAX SYSTEM https://www.khanacademy.org/economicsfinance-domain/core-finance/taxestopic/taxes/v/tax-brackets-and-progressivetaxation Social Security • A federal insurance program that provides benefits to retired persons, the disabled, and the spouses/children of deceased workers – Includes Medicare which is healthcare for Americans 65 and older • http://www.khanacademy.org/humanities/am erican-civics/v/social-security-intro FICA • Federal Insurance Contribution Act (a/k/a Social Security) – Social Security (6.2% of gross pay) – Medicare (1.45% of gross pay) • Payroll/Income taxes are withheld from employees’ pay (complete a W4 form) • Employer pays the amount withheld from employees paycheck and also pays the same amount to the Federal Government • See video on how FICA tax is calculated • http://www.khanacademy.org/humanities/americancivics/v/fica-tax Federal Withholding Tax • Form W-4 Employee’s Withholding Allowance Certificate – Employer uses to compute amount of tax to withhold from each paycheck based on number of allowances (dependents) – As allowances (dependents) increase, amount of tax deducted decreases Federal Withholding Tax • Form W-2 – Provided to Employee from Employer before January 31 – Shows total amount of federal taxes paid for the previous year by the Employee – Must be attached to federal tax return and used to calculate federal tax due or refund INTEREST INCOME • 1099 INT form – Sent to recipient before January 31 – Must be attached to Federal Income Tax Return Any interest earned from bank accounts (a separate 1099 INT for each account from each bank) All interest income is taxable unless specifically excluded. 1099 INT FORM W2 vs. W4 W2 Form • Calculated at the end of the year • Reflects all earnings earned that year • Reflects all taxes paid that year based on earnings W4 • Completed at time of job acceptance • Determine how much tax taken out of each paycheck • As amount of allowances increases, tax taken out decreases • 0 allowance = $62 • 1 allowance = $51 1040 EZ • INCOME – – – – – Line 1 Wages, salaries, and tips from W2 Line 2 Taxable interest from 1099 INT (if earned from bank accts.) Line 4 Add together to find ADJUSTED GROSS INCOME Line 5 Exemption and Standard Deduction($9,750) LINE 6 = TAXABLE INCOME (amount of income to be taxed) • PAYMENTS, CREDITS, AND TAX – Line 7 Federal Income Tax withheld from W2 – Line 9 Total payments and credits – LINE 10 = TAX (use tax tables to find tax due MUST KNOW TAXABLE INCOME) • REFUND – If total payments (line 9) is greater than total tax (line 10) Overpaid = refund • OWE – if tax (line 10) is greater than total payments (line 9) Didn’t pay enough = due and owing • SIGN HERE – You signature, date, occupation, and daytime phone number GIFTS FROM THE IRS EXEMPTION Amount tax payers can claim for themselves and dependents. Reduces the income subject to tax • 2012 = 3800 • 2013 = 3900 STANDARD DEDUCTION Reduces the income subject to tax and varies depending on filing status, age, blindness, and dependency. • 2012 = 5950 • 2013 = 6100