Ch02 sec 1

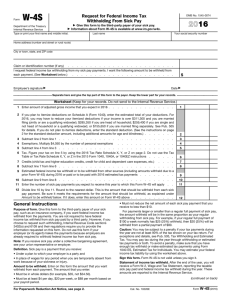

advertisement

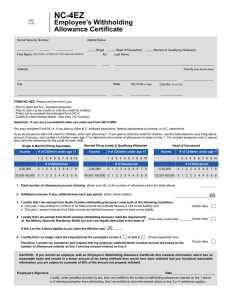

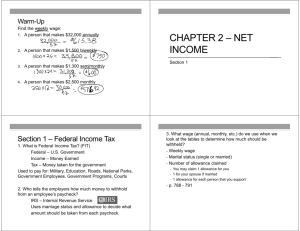

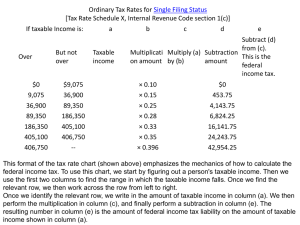

Take-Home Pay The deductions taken out of your paycheck help support schools, roads, national parks, and more. Why do you think you have to pay taxes? Lesson Objective Determine the amount withheld for federal income tax. Content Vocabulary federal income withholding allowance tax federal income tax withholding allowance The number Money withheld of people by an employer an employee from an employee’s supports, which helps paycheck employers to pay federalhow know government much money taxes. to withhold for federal income tax. Example 1 Carla Garza’s gross pay for this week is $425.88. She is married and claims 2 allowances—herself and her husband. What amount will be withheld from Garza’s pay for FIT? Example 1 Answer Steps: 1. Find the income range from the federal tax tables on pages A2-A5 in your textbook. 2. Find the column for 2 allowances. 3. The amount of income to be withheld is $14. Example 2 Lance Han’s gross pay for this week is $386.88. He is married and claims 1 allowance. What amount will be withheld from Han’s pay for FIT? Example 2 Answer Steps: 1. Find the income range from the federal tax tables on pages A2-A5 in your textbook. 2. Find the column for 1 allowance. 3. The amount of income to be withheld is $17. EXAMPLE 3 Use the percentage method of withholding to find the amount of FIT. Deb Boon is single, claims 2 allowances, and earns $293.23. Example 3 Answer Allowance Amount: Number of Allowances X $63.46 2(63.46) = $126.92 Taxable Wage = Gross Pay – Allowance Amount $293.23 - $126.92 = $166.31 Amount Withheld for FIT (From figure 2.1 on page 130): $0 + 10% of excess over $51 = $0 + .10(166.31 – 51) = 0 + 11.531 = $11.53 Practice 1 Use the tax tables on pages A2-A5 in your textbook to find the amount withheld. Joseph Napoli, single. Earns $524 per week. Claims 2 allowances. What is the FIT withheld? Practice 1 Answer $44 Practice 2 Use the tax tables on pages A2-A5 in your textbook to find the amount withheld. Amanda Hagel earns $476 a week. She is married and claims 2 allowances. Next year she will have a child and will claim an additional allowance. How much less will be withheld for federal income tax next year? Practice 2 Answer $312