2012 Federal Withholding Tax Table

advertisement

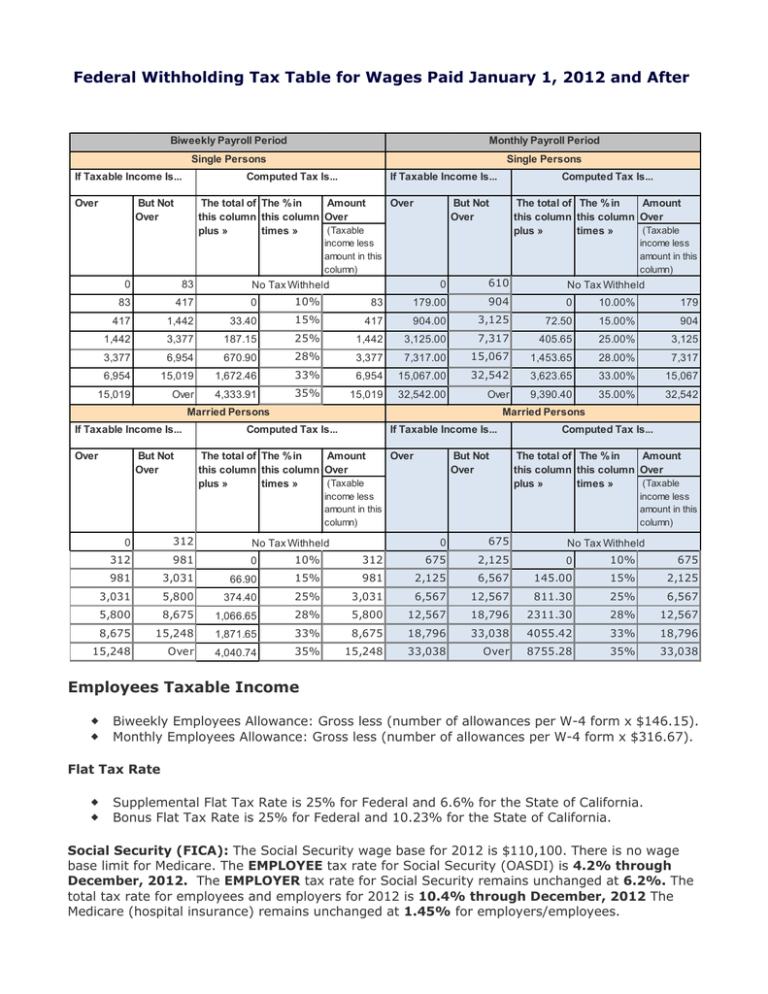

Federal Withholding Tax Table for Wages Paid January 1, 2012 and After Biweekly Payroll Period Monthly Payroll Period Single Persons If Taxable Income Is... Over Single Persons Computed Tax Is... But Not Over Computed Tax Is... If Taxable Income Is... The total of The % in Amount this column this column Over (Taxable plus » times » Over But Not Over The total of The % in Amount this column this column Over (Taxable plus » times » income less amount in this column) 0 83 income less amount in this column) No Tax Withheld 0 610 No Tax Withheld 83 417 0 10% 83 179.00 904 0 10.00% 179 417 1,442 33.40 15% 417 904.00 3,125 72.50 15.00% 904 1,442 3,377 187.15 25% 1,442 3,125.00 7,317 405.65 25.00% 3,125 3,377 6,954 670.90 28% 3,377 7,317.00 15,067 1,453.65 28.00% 7,317 6,954 15,019 1,672.46 33% 6,954 15,067.00 32,542 3,623.65 33.00% 15,067 15,019 Over 4,333.91 35% 15,019 32,542.00 Over 9,390.40 35.00% 32,542 Married Persons If Taxable Income Is... Over But Not Over Married Persons Computed Tax Is... If Taxable Income Is... The total of The % in Amount this column this column Over (Taxable plus » times » Over But Not Over Computed Tax Is... The total of The % in Amount this column this column Over (Taxable plus » times » income less amount in this column) 0 312 No Tax Withheld 312 981 0 10% 312 income less amount in this column) 0 675 675 2,125 No Tax Withheld 0 10% 675 981 3,031 66.90 15% 981 2,125 6,567 145.00 15% 2,125 3,031 5,800 374.40 25% 3,031 6,567 12,567 811.30 25% 6,567 5,800 8,675 1,066.65 28% 5,800 12,567 18,796 2311.30 28% 12,567 8,675 15,248 1,871.65 33% 8,675 18,796 33,038 4055.42 33% 18,796 15,248 Over 4,040.74 35% 15,248 33,038 Over 8755.28 35% 33,038 Employees Taxable Income Biweekly Employees Allowance: Gross less (number of allowances per W-4 form x $146.15). Monthly Employees Allowance: Gross less (number of allowances per W-4 form x $316.67). Flat Tax Rate Supplemental Flat Tax Rate is 25% for Federal and 6.6% for the State of California. Bonus Flat Tax Rate is 25% for Federal and 10.23% for the State of California. Social Security (FICA): The Social Security wage base for 2012 is $110,100. There is no wage base limit for Medicare. The EMPLOYEE tax rate for Social Security (OASDI) is 4.2% through December, 2012. The EMPLOYER tax rate for Social Security remains unchanged at 6.2%. The total tax rate for employees and employers for 2012 is 10.4% through December, 2012 The Medicare (hospital insurance) remains unchanged at 1.45% for employers/employees. Tax Table - Federal Instructions How to Calculate Federal Income Tax Withholding for 2012 Steps to calculate federal withholding taxes are shown in the example below. You may also calculate your tax withholding by going to At Your Service Online (http://blink.ucsd.edu/HR/benefits/AYSO/ ). Example: A married employee is paid $4,750 gross each month. The employee has $800 of tax deferred deductions. The employee claims single marital status and 3 withholding allowances on the W-4 form. The federal income tax is calculated as follows: Calculation of Federal Withholding Tax Based on 2011 Tax Information Step 1: Determine Taxable Income Step 2: Determine Value of Allowances A. Gross Earnings 4750.00 B. Less tax deferred deductions (see note below for list of tax deferred deductions) -800.00 C. Taxable Income D. The value of one allowance (See Federal Tax Table for amount) E. The number of allowances on W-4 Form 3950.00 316.67 3 F. Multiply D by E -950.01 Step 3: G. Income subject to Withholding (subtract F from C) 2999.99 Determine tax table income. Step 4: H. Determine Payroll Period: Monthly Calculate I. Determine W-4 marital status: Single federal withholding. J. Determine appropriate tax table section: Monthly Payroll Period/Single Person K. Find the appropriate range by comparing the Tax Table Income (G) to the ranges of the tax table section determined (J). For this example, the income of $2999.99 is between the range of "$904 but not over $3125." L. List the income subject to withholding (G) 2999.99 M. Subtract the lower value of the appropriate range (see K). This is called the marginal income N. Difference -904.00 O. List tax rate P. Multiply N by O Q. Add the tax amount on the marginal income of taxable income. In this example, the tax amount on $2,038 is ... R. Total federal tax withholdings (add P and Q) 2095.99 15% 314.40 72.50 386.90 Note: Tax deferred deductions can include UCRP, DCP-CAS, 403b, 457(b), DEPCARE, pre-taxed parking, pre-taxed vanpool deduction, HFSA and employee-paid health.