Your Presentation Title Goes Here

advertisement

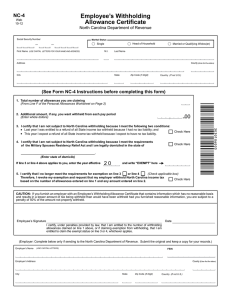

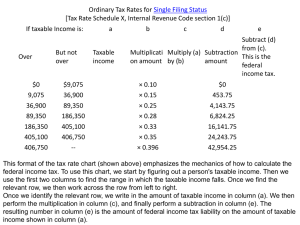

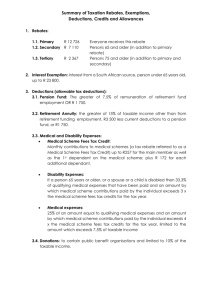

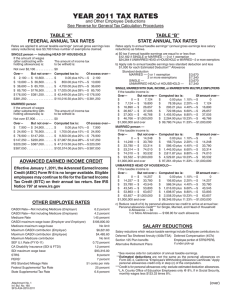

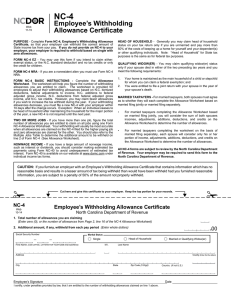

Exemptions vs Withholding Allowances • Exemptions are claimed on your Form 1040 Tax Return. You are allowed one exemption for yourself, one for your spouse, and one for each qualifying dependent • Allowances are claimed on your Form W4. The purpose of Form W-4 is to assist your employer with estimating the appropriate amount to withhold from your paycheck Exemptions vs Withholding Allowances For Educational and Illustrative Purposes only For Educational and Illustrative Purposes only Pumping Up Your Take-Home Pay This table shows APPROXIMATELY, how much a family earning $70,000/year, filing MFJ, with 3 children claiming ZERO allowances on their Form W-4 will give to the GOVERNMENT…interest free Marital Status Salary Approximate Monthly Value of each Withholding Allowance Single Married Up to $25,350 Up to $42,350 $50 Single Married $ 25,350 to $ 61,400 $ 42,350 to $102,300 $50 Single Married $ 61,400 to $128,100 $102,300 to $155,950 $83 W4 with 0 allowances = $694/month =$8,328 Per Year For Educational and Illustrative Purposes only Minimize Taxes Strategy • Correct Tax Withholding • Business Tax Deductions • Tax Record Keeping Software (audit proof your business) Business Tax Deduction Advantage W-2 Employees vs Home-Based Business Owners Example based on a married couple filing jointly with three children COUPLE # 1 COUPLE # 2 COUPLE # 3 Primary Job $70,000 Primary Job $70,000 Primary Job $70,000 *1040 Deductions -$32,600 Part-Time Job $12,000 Part-Time Business $12,000 Total Income $82,000 Total Income $82,000 *Total 1040 Deductions -$32,600 *Total 1040 Deductions -$32,600 $49,400 TAXABLE INCOME $37,400 TAXABLE INCOME $49,400 Total Business Deductions -$25,000 TAXABLE INCOME $24,400 *Total 1040 Deductions include a Standard Deduction of $12,600 + $20,000 ($4,000 x 5 exemption) $32,600. These numbers change annually. ADDITIONAL DEDUCTIONS FROM HOME-BASED BUSINESS Car/Truck Communication Meals Entertainment $5,475 $1,500 $2,000 $1,500 Wages Medical Reimbursement Travel Depreciation $4,700 $750 $2,050 $1,000 Business Gifts General Business Expenses Auto Interest Tax Deductible Investments $25 $1,000 $500 $4,500 For Educational and Illustrative Purposes only Annual Mortgage $1,775($21,300) – (Interest ($14,000) / Taxes ($2,500) = $16,500 Tithes = $2,000 Business Income $12,000 Charity = $499 - Business Expenses $25,000 = $18,999 = ($13,000) Pumping Up Your Take-Home Pay This table shows APPROXIMATELY, how much a family earning $70,000/year, filing MFJ, with 3 children paychecks will INCREASE with each extra allowance they claim on their Form W4. Marital Status Salary Approximate Monthly Value of each Withholding Allowance Old W4 (0 allowances ) = $694 New W4 (16 allowances) = $0 Single Married Up to $25,350 Up to $42,350 $50 Single Married $ 25,350 to $ 61,400 $ 42,350 to $102,300 $50 $50 x 16 allowance = $800/ Month Single Married $ 61,400 to $128,100 $102,300 to $155,950 $83 Pay Increase of $8,328 Per Year= $694 They will get their entire $694 back/month! For Educational and Illustrative Purposes only Sample Paystub $500 per month x 12 = $6,000 Savings per year