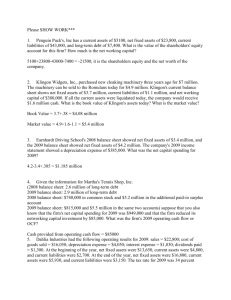

FINANCIAL STATEMENTS

advertisement

UNDERSTANDING FINANCIAL STATEMENTS THE BALANCE SHEET What is a BALANCE SHEET? A “statement of financial condition” On a particular date (a “snapshot”) OBJECTIVES: – a fundamental understanding of accounts described on a balance sheet – a feel for the relationship of each account to the financial statements as a whole The Basic Equation ASSETS = LIABLITIES + STOCKHOLDERS’ EQUITY – Where assets are economic resources (the left side of the equation) – Where liabilities and equities are claims to those resources (the right side of the equation) Another look: Basic Equation ASSETS are what the firm owns LIABILITIES are what the firm owes to outsiders EQUITIES are what the firm owes to insiders Therefore: Assets = Liabilities + Stockholders’ Equity represents equality between resources and claims to resources Classify each account Salary Expense Sales Land Accounts Payable Accounts Rec Equipment Cash Notes payable Prepaid insurance Supplies Supply Expense Accumulated Depreciation Depreciation expense Common Stock Retained Earnings Patent Some General Parameters Financial statements are often CONSOLIDATED Balance sheet is DATED (end of accounting period): calendar year or fiscal year or interim period Some COMPARATIVE DATA is presented (e.g. balances for end of previous year shown on balance sheet) ASSETS (the “left” side) Generally presented in order of liquidity Current Assets -- defined as cash or assets expected to be converted to cash within one year or operating cycle, whichever is longer – operating cycle is time required to purchase/manufacture the inventory, sell it and collect the cash ASSETS (continued) Noncurrent Assets -- defined as assets expected to be converted to cash after the completion of one year or one operating cycle, whichever is longer A Look at Current Assets Cash Marketable Securities (short-term) Accounts Receivable Notes Receivable (short-term) Inventory Prepaid Expenses ...and Noncurrent Assets? Long-term Investments Property, Plant and Equipment Intangible Assets “Other” Assets -- the “catchall” category Okay, let’s go one-by-one: First we’ll look at typical current assets Then we’ll turn our attention to typical noncurrent assets – Later we’ll look at liabilities and equities (the “right” side of the equation) Objective is to understand what the category is and what the numbers mean (sometimes this is easy, then sometimes….) Cash The most liquid of assets Generally includes currency, coin, balances in checking and other demand or “near demand” accounts Marketable Securities May include t-bills, CDs, stocks, bonds Debt vs. equity securities Classifications – Held to maturity – Trading securities – Securities available for sale Investment Category Held to maturity Trading Avail for Sale Type Debt Debt & Eq Debt & Eq Revenue Interest Int & Div Int & Div Value on BS Amortized Cost Market Value Market Value Recog Unreal G/L on IS? No Yes No (unrealized g/l in equity sec) Cash Flow Investing Operating Investing Description Intent and ability to hold until maturity Traded within 3 month Not in other categories The following events apply to the investment activities of Duffy Company. 1. Duffy purchased $25,000 of debt securities on January 1, 20X1. 2. Duffy sold $5,000 of the debt securities purchased in Event No. 1 for $6,000. 3. Duffy received $2,000 of interest income on December 31, 20X1. 4. The market value of the remaining debt securities was $20,500 on December 31, 20X1. Required: Record the effects of each event in a financial statements model assuming the debt securities are classified as (1) held-to-maturity, (2) trading, or (3) available-for-sale. When recording amounts in the cash flow column, indicate whether the item is an operating activity (OA), investing activity (IA) or a financing activity (FA). Solution Click here to download solution Solution is labeled Demo Problem 8-1 You probably want to go ahead and print it off because there is another solution on the page for a problem on inventory. Accounts Receivable Arise from credit-sale transactions Reported on the balance sheet at NET REALIZABLE VALUE – Accounts Receivable $$$ – Less Allowance for Doubtful Accounts $$$ – Net Accounts Receivable $$$ A Word on the “Allowance…” Management must estimate the dollar amount of accounts they expect to be uncollectible Affects balance sheet valuation AND bad debt expense on income statement Can be important in assessing earnings quality -- changes should be analyzed Analyzing receivables - Kodak Trade receivables Miscellaneous rec Total (net of allowances of 89 and 136) 2000 1999 $2,245 $2,140 408 397 $2,653 $2,537 2000 Receivables (from balance sheet) Allowance (Note 20 1999 $2,653 $2,537 89 136 Total Receivables $2,742 $2,673 Sales (from income statement 13,994 14,089 Inventory Consist of items held for sale or used in manufacture of goods for sale Merchandising Company – one type of inventory (finished goods) Manufacturing Company – three types of inventories (raw materials, work-in-process, finished goods) Often a BIG dollar item -- often firm’s major revenue producer Inventory Issues Major concern with method of valuation (which MUST be DISCLOSED) – FIFO (first-in, first-out) – LIFO (last-in, first-out) – Weighted Average Cost Effect of inflation on CGS and NI Illustration of Fifo/Lifo 1/1 BI 200@$3 3/1 Purchase 300@$3.50 6/1 Purchase 400 @ $4.00 11/1 purchase 100 @ $4.50 $600 1050 1600 450 Total CGAS (1000 units) $3700 Sold 700 units Had 1000 units available for sale, sold 700, so must have 300 left in ending inventory. For FIFO, the ending inventory will be the last 300 units in (since first units were sold). For LIFO, the ending inventory will be the first 300 units in (since the last ones in were sold) FIFO LIFO Weighted Average Cost of Goods Available for Sale $3700 $3700 $3700 Less Ending Inventory 100@4.50 200@4.00 $1250 200@3.00 100@3.50 $950 $3700/1000 = $3.70 per unit 300@3.70 $1110 Cost of Goods Sold $2450 200@3.00 300@3.50 200@4.00 $2650 100@4.50 400@4.00 200@3.50 $2590 700@3.70 More Inventory Issues Inventory valuations SIGNIFICANTLY affects BOTH the balance sheet and the income statement Disclosure of inventory cost flow assumption found on face of balance sheet or (more commonly) in notes Inventory reported on balance sheet at LOWER OF COST OR MARKET Pleasant Grove Electronics carries four different types of calculators. The quantities, costs, and market values are shown below. Based on this information, determine the amount of the required lower of cost or market (LCM) writedown assuming Pleasant Grove determines LCM on an individual basis. (solution is 8-4 on page you printed) Type Quantity Unit Cost Unit Mkt A 100 $12 B 550 8 6 C 710 25 24 D 240 20 22 15 Kodak - inventories (in millions) 2000 1999 Sales (from income statement $13,994 $14,089 1,718 1,519 Inventories Prepaid Expenses Represent expenses paid in advance -included in current assets if they expire within one year or operating cycle Usually not a material item Present few or no reporting or valuation issues ON TO NONCURRENT ASSETS……. Property, Plant & Equipment (PP&E) Often called “fixed assets” Represent major resource commitments which benefit a firm for more than one year Recorded at HISTORICAL cost; cost allocated over asset’s useful life through DEPRECIATION (exception: land is not depreciated) PP&E Issues PP&E is reported on balance sheet at historical cost less accumulated depreciation to date Depreciation process involves ESTIMATES Depreciated cost reported on balance sheet is reliable; one might seriously question how relevant it is... More PP&E Issues Firm has CHOICE of depreciation method: accelerated, straight-line Comparison among firms can be made difficult with different methods and different estimates Use of EBITDA Proportion of fixed assets (PP&E) in a firm’s asset structure determined by nature of the business Depreciation Methods Straight Line (78%) Cost – Salvage Value Useful Life Depreciation Expense (IS) Accumulated Depreciation (BS) Units of Production Method is similar but uses units of activity as denominator Example Jones Brothers purchases new equipment for $50,000. It is estimated to have a useful life of 5 years and a salvage value of $10,000. How much is the annual depreciation? 50,000-10,000 = $40,000/5 = $8,000 per year 5 years Year 1 $8,000 dep exp, $42,000 net asset value Year 2 $8,000 dep exp, $34,000 net asset value….. Year 5 $8,000 dep exp, $10,000 net asset value Depreciation Methods Accelerated Methods (4%) Declining balance rate Considered accelerated method Accelerated method Straight line Depreciation Expense Year Intangible Assets Resources with expected future economic benefits but lacking a physical substance Some examples are patents, copyrights, goodwill Goodwill can be material if firm is heavily involved in acquisition activity Amortization for cost recovery – Shorter of economic life, legal life or 40 years Patent – right to manufacture, sell, lease invention Copyright – protection against illegal reproductions of creator’s written works, designs, and literary productions Franchise – contract between 2 parties granting franchisee certain rights and privileges (life defined by contract_ Trademark – symbol, design, logo (unlimited legal life) Legal life is 17 years from date patent is grated Legal life is life of creator plus 50 years If lump sum made, rather than periodic payments, capitalize and amortize If internally developed, no cost assigned Goodwill Prior to FASB 142 – Pooling (no goodwill recognized) – Purchase (goodwill shown and amortized/40 yr) 1/1/02 FAS 142 – Pooling eliminated – Goodwill evaluated annually to determine if it has lost value Intel Natural Resources Standing timber and underground deposits of oil, gas, and minerals – Physically extracted in operations – Replaceable only by an act of nature Total cost minus salvage Total estimated units Depletion expense (IS) Accumulated depletion (BS) Other Assets Can include multitude of other noncurrent items, for example – property held for sale – long-term investments – start-up costs in connection with a new business – cash surrender value of life insurance policies – long term advance payments NOW WHAT???? NOW, HOW ABOUT THE OTHER (“RIGHT”) SIDE OF THE BALANCE SHEET……. Let’s take a look at liabilities and equities (the “claims” to the assets we just looked at…) LIABILITIES & EQUITIES REPRESENT CLAIMS TO ASSETS LIABILITIES: Creditor Claims EQUITIES: Owner Claims Constitute the “right” side of equation LIABILITIES May be CURRENT or LONG-TERM -same criteria of “one-year or operating cycle, whichever is longer” applies here as well Represent claims by creditors of the firm A Look at Current Liabilities Accounts Payable Short-term Notes Payable Accrued Liabilities Unearned Revenues (Deferred Credits) Current Maturity Portion of Long-term Debt Deferred Taxes (some, not all or even most…) …and Long-Term Liabilities? Notes or Mortgages Payables Bonds Payable Pension and Lease Obligations Deferred Taxes (most) Warranty Obligations Other Long-Term Debt Okay, let’s look at some of these…..starting with Current Liabilities Accounts Payable Usually defined as obligations arising from purchases of merchandise for resale or of raw materials Few valuation or reporting issues Significant changes from period to period often result from changes in sales volume Short-Term Notes Payable Promissory notes due within a year (or operating cycle if more appropriate) Usually are interest-bearing Usually reported at face value because of short-term nature Accrued Liabilities Result from accrual basis of accounting Represent expenses that have been INCURRED and thus ACCRUED, but have NOT BEEN PAID in cash Examples are Interest Payable and Wages Payable In this case, cash flow follows expense recognition Unearned Revenue Sometimes called “deferred credits” Results from a prepayment received in advance for services or products Under accrual accounting, revenue is recognized when EARNED, not when received in cash -- in this case, cash flow precedes revenue recognition Current Maturities - LT Debt Represent principal payments on debt that are due within one year Confirms the old adage that nothing is long-term forever -- eventually it has to be paid as a current item! Now, how about those items that are STILL LONG-TERM LIABILITIES Notes or Mortgages Payable Represent any mortgages or notes payable that do not have any principal repayment requirements during the coming year Bonds Payable Once again, represent items that do not have any principal payment requirements within the next year Bond characteristics Secured v. unsecured Registered v. bearer Coupon bonds Term v. serial Callable Convertible Junk bonds Bond with stock warrants Pension & Lease Obligations Generally reported at the present value of expected future cash outflows Can represent MAJOR liabilities for many firms and have a significant impact on the balance sheet Defined benefit vs. defined contribution Warranty Obligations Represent liability of a firm to repair or replace merchandise that it sells Some estimating is necessary, but if the firm regularly sells items with a warranty attached, the liability must be disclosed... Postemployment Liabilities Medical bills for retired employees Reported as liability on balance sheet Deferred Income Taxes Financial Statement Income DOES NOT NECESSARILY EQUAL Taxable Income!!! Taxes paid are based on TAXABLE income as defined by the IRS; tax expense reported on income statement is based on FINANCIAL statement income Deferred Income Taxes (cont.) Deferred Income Taxes result from TIMING (temporary) differences in taxable and financial statement income Examples are many: – depreciation (major difference for many) – pension expense – installment sale accounting – others More on Deferred Taxes Classification may be current or long-term depending on the asset or liability underlying the temporary difference Most are found in the long-term liability section Other Long-Term Debt Once again, a “catch-all” category for long term obligations not reported elsewhere Keeping debt off the books – Enron -------------------------NOW, WHAT ABOUT OWNER CLAIMS??? Stockholders’ Equity Represent claims to assets by OWNERS, i.e. stockholders Is often referred to as a RESIDUAL; this flows from a restatement of the basic equation: ASSETS - LIABILITIES = EQUITIES More on Stockholders’ Equity Usually consists of STOCK ACCOUNTS AND ADDITIONAL PAID-IN CAPITAL and RETAINED EARNINGS -- may have other equity accounts Additional paid-in capital is the difference between par value and what was received for the stock Stock Par, no par and stated value Market, book, liquidation, redemption value Authorized, issued, outstanding Common vs. preferred Cumulative vs. non-cumulative Convertible vs. non-convertible Callable Stock vs. Bond Bond is debt, stock is ownership Bonds mature, stock doesn’t Most bonds require periodic interest payments. Dividends payable only when declared Bond interest deductible for both book and tax, dividends are not. Retained Earnings In simplest terms, represents the cumulative undistributed earnings of the business since its inception Represent funds the company has chosen to “retain” and reinvest in the business RETAINED EARNINGS DOES NOT REPRESENT A PILE OF CASH!!!!!!! “Other” Equity Accounts? Can include such things as unrealized holding gains/losses on investments, treasury stock, foreign currency translation effects So, What Have We Learned? Balance Sheet is a “snapshot” Assets = Liabilities & Equities Can “walk” through a balance sheet and (a) understand what the account titles mean and (b) have at least the beginnings of an understanding of where some of the numbers come from Caution Flags Reductions in the allowance for doubtful accounts when accounts receivable are increasing Sales and receivables growing at substantially different rates or moving in opposite directions Sales and inventories growing at substantially different rates or moving in opposite directions. Categories of inventories moving in opposite directions Excessive use of “other” for material, unexplained items Write-down in value of goodwill Borrowings growing faster than assets being financed; debt rising when assets are decreasing Caution Flags cont’d Financial statement notes obscure rather than enlighten Changes in and additions to financial statement notes require PhD in accounting and measurement by yardstick rather than ruler Substantial amount of income from unpredictable and possibly unsustainable sources, such as pension plans Extensive use of stock options for employee compensation So What’s Next? Everything you want or need to know cannot be found on the balance sheet Next we will look at the income statement and try to understand what it’s trying to tell us Also, we need to become aware there are many important relationships between income statement and balance sheet items…….. Valedico!