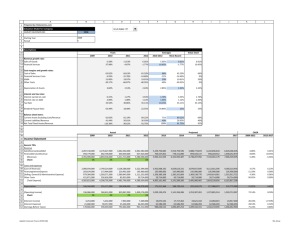

The Balance Sheet

advertisement

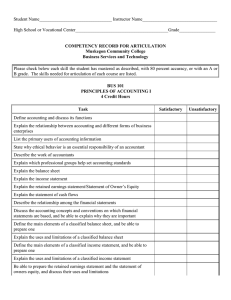

The Balance Sheet Assets = Liabilities + Equity Balance Sheet • Is Statement of Financial Position • Not necessarily the value of a business • Only an estimate of market Value Balance Sheet • Assets of a business ultimately valued by their ability to generate revenue • True value determined from actual sale to third party Primary Financial Statements • Balance Sheet • Earnings Statement • Cash Flow Statement Types of Accounts • Assets • Liabilities • Equity • Income • Expenses Beginning Balance Sheet Assets Liabilities Ending Balance Sheet Assets Equity +/- Net Income +/- Valuation Changes - Family living withdrawals + Capital contributions Liabilities Equity Account Valuation • All accounts have dollar value • Asset Accounts • Cost Basis • Market Value Current Assets • Those that will be realized in cash, sold or consumed in the current operating cycle (1 year) Current Assets • Inventories • Raised for Sale • Raised for use in Production • Purchased for Resale • Purchased for use in Production • Page II-32 Valuation Issues • Inventories • Lower of Cost or Market • Blending Non Current Assets • Machinery & Equipment • Breeding Livestock • Buildings & Improvements • Land • Other Valuation Issues • Raised Breeding Stock • Full Cost Absorption • Base Value Method • Page II-36, F-1 Current Liabilities • Those that will be discharged by use of current assets or creation of additional current liabilities in the current operating cycle. Deferred Taxes • Tax liability in event of liquidation • Liquidation Value –Tax Basis times tax rate • Page II-24 Depreciation • Allocation of the expense that reflects “using up” of capital assets Depreciation Original Cost – Salvage Value Years of useful Life Depreciation Issues • Straight line • Accelerated • Front end loaded • Short life span • Section 179 • Zero Salvage Value Depreciation Issues • Capitalize or Expense • Small tools • Equipment • Major repairs • Improvements Example Farm’s Balance Sheet Total Assets Beginning $551,166 Ending Average $600,566 $575,866 Total Liabilities $356,060 $363,119 $359,590 Net Worth $195,106 $237.447 $216.276 % in Debt 64% 60% 62% Leverage • <40% - Financially Sound • 40-70% - Vulnerable • >70% - Financial Stress • >100% - Insolvent Accounts Receivable Sales Revenue Sales/Week = 52 weeks Accts. Receivable = Weeks to Collect Sales/Week Inventory Cost of Goods Sold Inventory = Turnover Inventory 52 Weeks = Average Inventory Inv. Turnover Holding Time Accounts Payable Inventory Ave. Inv. Holding Time =COGS/Wk Accounts Payable = Weeks to Pay COGS/Wk