Speaker Bios – 2014 YP Conference - CU Reach

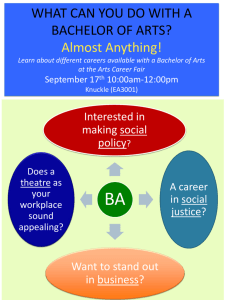

advertisement

2014 Young Professionals Conference Speaker Bios Patrick Basler First Financial CU CEO Patrick.basler@firstfcu.org 773-565-2000 Professional Background: Early in my CU career worked at a small CU, in all areas – Teller, Accounting, Lending, Operations, Financial, etc. After 1 year, promoted to VP of Marketing, in that capacity for 5 years. Left that role, then after a 2-year stint as VP Marketing for a CUSO, returned to a natural person CU ($40M) as the EVP. After being in that role 5 years, had the opportunity to interview for my current position of CEO. I have served on a variety of CU, Chamber, Chapter Committees and Boards, currently serving on the Board of the IL CU League. Educational Background: Undergraduate degree from University of Wisconsin-Milwaukee, double major Finance and Marketing. CUNA Management School Graduate 2006. What was your first connection to a credit union? My last semester of college began working at a small CU as an intern, per the advice of my career counselor. Was hired upon graduation, and the rest is history. When you were a child, what did you want to be when you grew up? Employed. What are three words that describe the future of the credit union movement? Opportunity, Competition, Collaboration/Cooperation Melissa Clopper-Lord Members “First” Community Credit Union Business Development Representative melissa@membersfirstccu.com 217-223-4384 ext. 202 Professional Background: I started at Members “First” in 2002 as a Member Service Representative. In 2007 the position for Business Development Representative opened up and with my experience as an MSR I felt I could make the position my 1 own and have been doing it ever since. Educational Background: Bachelor’s Degree in Business Administration with an emphasis in marketing from Kaplan University. What was your first connection to a credit union? My first connection was my father. He was a member at Members “First” and one day he came through the drive-up and saw a sign for a new branch opening and I applied. Having no idea what a credit union was, to me it was a job to help me get through college. When you were a child, what did you want to be when you grew up? I always dreamed of being an Interior Designer, but now I don’t see myself anywhere but where I am in the credit union industry. What are three words that describe the future of the credit union movement? Limitless Potential & Reimagined Aaron M. Heldt NuMark Credit Union Marketing Specialist aheldt@numarkcu.org 815-744-8763 Professional Background: I started in the banking industry while in high school while working as a part-time teller for a community bank. After college, I returned to the community bank for and worked as a personal banker/assistant branch manager for 2.5 years. Educational Background: Eastern Illinois University 2010 Graduate Bachelors of Science Degree in Business - Major in Marketing What was your first connection to a credit union? Back in December 2012, beginning at NuMark Credit Union When you were a child, what did you want to be when you grew up? I wanted to be an engineer and design roller coasters. What are three words that describe the future of the credit union movement? Growth, Innovative, Service John (Sean) F. Hession Illinois Credit Union System President/CEO shession@icul.com 630-983-3410 Professional Background: Sean Hession is an experienced CEO of small to mid-sized, growth oriented firms. He has extensive experience 2 directing and leading startup and growth organizations within financial services, healthcare administration, transaction processing, and business intelligence sectors. The first half of his career was with larger organizations, chief among them 10 years with First National Bank of Omaha with positions in electronic banking, consumer lending, product development and strategy development. The second half of his career has been in smaller, more entrepreneurial ventures, most notably a healthcare transaction processing start-up he co-founded which went from initiation to $40mm of revenue in five years. Mr. Hession most recently served as President/CEO of Callahan & Associates in Washington, D.C., the leading provider of analytics, strategic insight, and leadership to credit union industry decision-makers. He holds a Bachelor’s degree in economics from Iowa State University and served in Miriam’s Kitchen and the National Men’s’ Chorus while in DC. Educational Background: Bachelor’s Degree in Economics from Iowa State University. Graduate work in Financial and Monetary economics from the University of Nebraska. What was your first connection to a credit union? Through the controller of the company I owned who served on the Board of Centris Federal Credit Union. When you were a child, what did you want to be when you grew up? A doctor like by Dad. What are three words that describe the future of the credit union movement? Trusted Financial Partner. Jennifer Laud First Financial Credit Union Director of Marketing & Innovation Jennifer@firstfcu.org 773-565-2009 Professional Background: In the beginning of 2010, I started my first job after college as a Member Service Representative for First Financial Credit Union. Later that year, FFCU brought their marketing operations in-house and I became Director of Marketing. In my current position as the Director of Marketing and Innovation, I identify opportunities to better communicate benefits and add value to membership. My role includes managing promotions and communication channels, connecting with the community and employer groups, and developing or enhancing products and services to address member needs. In the credit union community, I’ve had the opportunity to participate in Filene Research Institute’s i3 program. After finishing my i3 tenure in the fall of 2013, I became more active with the Cooperative Trust. I now participate in their mentorship program and 3ntrust innovation team. In the summer of 2014 I was nominated for the CUES Next Top Credit Union Executive competition and am working on a project for state-wide credit union awareness with the Illinois League. Educational Background: I hold a Bachelor of Arts in Economics from the University of Wisconsin-Madison. This summer, I earned my Certified Credit Union Executive designation by completing CUNA’s Credit Union Management School. I am also currently enrolled in the MBA program at DePaul University with concentrations in Marketing Strategy and Planning and Brand and Product Management with an expected graduation in Spring of 2016. 3 What was your first connection to a credit union? I became familiar with credit unions at the University of Wisconsin, but did not become knowledgeable about the credit union difference until I began working for First Financial. I remember researching credit unions as I was applying and thinking, “why aren’t all financial institutions build as cooperatives? It makes so much sense and benefits so many more people!” After that, I was hooked. When you were a child, what did you want to be when you grew up? An artist, because who doesn’t love a good beret, smock and paint pallets? Some of my most vivid memories as a kid are making cottonball bunny paintings in kindergarten, drawing Scottish terriers out on adventures and experimenting with different art kits my relatives gave me for birthdays. Luckily, marketing is an incredibly creative field and lets me live out at least part of my childhood dream! What are three words that describe the future of the credit union movement? Collaborative, Niche-oriented, Community-focused James Marshall Filene Research Institute Manager, The Cooperative Trust jamesm@filene.org Professional Background: James is the Manager of The Cooperative Trust at Filene Research Institute. The Cooperative Trust is grassroots community of young people who work in credit unions and cooperatives by Credit Union National Association. He focuses on bringing sustainability and longevity of the Trust as well as increasing its profile as it moves into the next stages of development. As an active member of The Cooperative Trust, James Crashed the GAC in 2013 and was a finalist for the Credit Union Foundation's Tracy Slane Award. Before joining Filene and the Trust, James was Head of Marketing at Plane Saver Credit Union in London, one of the largest credit unions in the UK. He worked on a variety of projects and campaigns based on increasing the membership base of the credit union and loan application targets. Specializing in branding, social media, and marketing strategies, James successfully used these mediums to aid in reaching the company’s membership recruitment and lending loan targets consistently during his tenure at Plane Saver. Educational Background: James graduated from St. Mary's University College of the University of Surrey with an Upper Second Class degree, with Honors, in Management Studies. Currently studying for an MA in Marketing at Durham Business School, Durham University – one of the top business schools in Europe, James is also looking to graduate and then go on to gain Associate status at the Chartered Institute of Marketing (ACIM status). What was your first connection to a credit union? My first connection to a credit union was when I graduated college at 20 years old, in 2009 - the height of the economic crisis. There were no jobs available at all. Anywhere. I found a small marketing assistant role at this thing called a credit union… Whatever that was. The rest, as they say, is history! When you were a child, what did you want to be when you grew up? I wanted to be a dinosaur; I wasn’t very fussy as to which one. If I could have chosen though, I wanted to be a triceratops. Sadly, the technology wasn’t available and still isn’t. One day though, I’m sure! What are three words that describe the future of the credit union movement? Full of opportunity. 4 Scott Leiser Cornerstone Credit Union Member Service Representative SLeiser@cornerstonecu.org 815-266-4437 Professional Background: I started Cornerstone just over three years ago. I started on our teller as a Member Service Representative. At the end of August I accepted a position in our call center and will be moving to that department sometime in October. Before coming to Cornerstone Credit Union I worked for McDonald’s for 13 years working my way from part time crew person to Assistant General Manager. Educational Background: I have my Associates of Science degree from Highland Community College in Freeport, IL. After Highland I took a break to figure out what I wanted to do next. That break last about 10 years, but in March 2014 I enrolled at Columbia College where I am currently working on my Bachelor’s degree in Finance. What was your first connection to a credit union? I have been a member of a credit union since I was 16, but I always thought it was a bank. It was not until I started at Cornerstone in 2011 that I had my first real connection. When you were a child, what did you want to be when you grew up? The President of the United States What are three words that describe the future of the credit union movement? Dynamic, Modernistic, Pliable Wednesday Medlen Community Plus Federal Credit Union/Illinois Youth Involvement Council Membership & Business Development Officer wmedlen@cplusfcu.org and members@cuplus.org 217-893-8201 Professional Background: Chairman of the Illinois Youth Involvement Council 2013-2014 Young Professional Advisory Board Member IYIC Representative for the John L Kelly Chapter since 2008 I work as the Membership Officer and Business Development Officer for Community Plus Federal Credit Union since 2007. Educational Background: Associates Degree in Office Administration from Parkland College Certified Credit Union Financial Counselor through CUNA What was your first connection to a credit union? I first worked for Credit Union 1 over 15 years ago in the Call Center because I needed a job. I learned how to answer member questions about their account but never understood the importance of their role to credit unions or why credit unions were so special. It wasn’t until I started working for Community Plus Federal Credit Union that I really understood the credit union movement. 5 When you were a child, what did you want to be when you grew up? I have always and still do love animals. I was constantly bringing home injured birds or rabbits so I wanted to become a marine biologist or a veterinarian. But who knew that my path would change and lead me towards credit unions. What are three words that describe the future of the credit union movement? Innovative, Leader, Forward thinking Tom Pierce Midwest Operating Engineers CU President tpierce@moecu.com 708-482-9606 Professional Background: I’ve been in the credit union industry since 1995. I started as a part-time teller and then moved on to Marketing Director at Progress Credit Union. I have worked in all areas outside of accounting in credit unions. I have been President for the last 10 years at Canals & Trails CU and MOECU. Educational Background: Bachelor of Science in Marketing from Elmhurst College What was your first connection to a credit union? Our security officer at a grocery store was President of a credit union and he introduced a few of us to credit unions. When you were a child, what did you want to be when you grew up? A professional athlete What are three words that describe the future of the credit union movement? People Helping People!!!!! Jennifer Riebold Scott CU Community Relations Supervisor jriebold@scu.org 618-345-1000 Professional Background: Community Relations Representative at Scott CU for 3 years (right out of college) before recently taking over the supervisor position. Educational Background: Bachelor of Arts in Communication with a minor in English from Truman State University (Kirksville, MO) What was your first connection to a credit union? I interned with a professional baseball team whose presenting sponsor was a credit union. Through the internship I started working closely with the credit union’s marketing director and fell in love with community 6 relations. When you were a child, what did you want to be when you grew up? An elementary school teacher What are three words that describe the future of the credit union movement? Dynamic, technological, vital Jana’ Stevens CEFCU Community Relations Manager jstevens@cefcu.com 309.633.3675 Professional Background: Jana has been with CEFCU for 20 years, serving the last 16 as the credit union’s Community Relations Manager. Responsibilities for the department include corporate social responsibility, social media, media relations, event planning, and crisis communications. Educational Background: Bachelors in Communications from Bradley University. Pursing an MBA in Social Media Marketing from Southern New Hampshire University. What was your first connection to a credit union? I was a member of CEFCU before I ever even knew it…my father was a long-term employee of Caterpillar Tractor Company, which was the original “sponsor” for CEFCU. (Caterpillar Employees Credit Union) When you were a child, what did you want to be when you grew up? A test pilot and astronaut What are three words that describe the future of the credit union movement? Growth, Potential, Awareness Peter Paulson Corporate America Family Credit Union President/CEO Peter.paulson@cafcu.org 847-214-2010 Professional Background: Currently: President/CEO of Corporate America Family Credit Union Chairman of Corporate America Financial Services, Inc. Director of The Hope Group (Corporate America’s philanthropic organization) Chairman of the Illinois Credit Union League, LSC and Services Credit Union Illinois Governor’s Board of Credit Union Advisors American Management Association (AMA) General Management Council for Growing Organizations Fiserv XP2 Advisory Board President’s Advisory Board at Judson University 7 Previous: Greater Iowa Credit Union Glenbrook Credit Union Columbia College (taught undergraduate accounting courses) Board Member, Habitat for Humanity, local affiliate i3 Team, Filene Research Institute Educational Background: Iowa State University – Bachelor’s Degree in Business Administration Loyola University – Master’s Degree in Business Administration What was your first connection to a credit union? Worked for Greater Iowa Credit Union during college. When you were a child, what did you want to be when you grew up? Electrician What are three words that describe the future of the credit union movement? Service, Growth, Technology MaryAnn Pusateri Financial Partners Credit Union CEO maryann@mypfcu.org 847.675.6610 Professional Background: President/CEO - Partnership Financial Credit Union (formerly Niles Township Schools Credit Union) 1988 – Present CUES - Board Member and Officer - 10+ years Northern Cook County Chapter - Board Member and Officer – 15+ years DFI - Credit Union Examiner – 2 years NARDA Credit Union – Manager – 2 years Educational Background: University of Illinois - BS in Finance DePaul University – Master program courses CUES Management School – 3 year program CUNA Management School – 3 year program What was your first connection to a credit union? My first involvement with credit unions began as a DFI Examiner. When you were a child, what did you want to be when you grew up? Math Teacher What are three words that describe the future of the credit union movement? Market Exposure/Understanding, Collaboration, Management Development 8 Janet Schuler Canals & Trails Credit Union President janets@canals-trailscu.org 815-838-7159 Professional Background: Canals & Trails Credit Union for 12 years. I worked as the Member Service Representative for 3years, Operations Manager for 5 years and now the President for the last 3 years. Educational Background: Bank teller Certificate, 1992 Teller Training Institute, Renton, Washington Currently enrolled at Joliet Junior College to obtain a Business Administration degree What was your first connection to a credit union? When I was in high school my step-dad had me get an account at a credit union. When you were a child, what did you want to be when you grew up? I wanted to be a secretary. What are three words that describe the future of the credit union movement? Family helping family. Derrell Walls CTAFC FCU CEO Derrell.walls@att.net Professional Background: I am currently the CEO of CTAFC Federal Credit Union, & I also am a commercial insurance underwriter for Allstate. Before Allstate, I was employed at Bank of America as an Teller Operations Specialist. Educational Background: I have my BA in Finance from DeVry University. I also have my MBA as well as a Masters in Accounting & Financial Management from Keller Graduate School. I recently completed my first year of CUNA Management School. What was your first connection to a credit union? My mother started a savings account for me at the CTAFC federal credit union when I was a child. I've been a member ever since. When you were a child, what did you want to be when you grew up? When I was a child I wanted to be a Lawyer. I have always enjoyed debate so law seem right up my alley, until I realized I don’t really like history. 9