n = S

advertisement

A stability criterion for Stochastic Hybrid Systems

A. Abate, L. Shi, S. Simic and S.S. Sastry

Framework

Dynamics: ODE’s, possibly

nonlinear (flows have bounded

Lipschitz constant)

Underlying Markov Chain

Temporal transitions t

(statistically distributed)

Single shared equilibrium q

Reset maps: bounded Lip

constant.

Theorem

LTI systems; Define:

l

p

i

n = Si=1,..,nLip(ji ) i

p

P

i

m = Si,j=1,..,nLip(Rij) ij;

•If nm <1, then equilibrium q is

stable in probability (sufficient

condition).

Extension: valid for NL vector

fields, with fixed-time switches.

Simulations: HS with 5 nodes,

linear vector fields, reset maps

Stability in Probability: q is

are the identity, jumps at fixed

(asymptotically) stable in prob. times.

if, for every D, q ε D, there

exists a region E, included in

D, s.t. the hybrid flow starting

in any point in E will end up

evolving in D, as time goes to

infinity, with Probability 1.

{limt P[|x(t)-q|>e]=0, for all e}

Additional assumptions:

n Domains (scalability: it works

with n->∞)

Vector fields fi , with flows ji

Reset maps Rij

Steady-state distr. p=[ p1,...,pn]

E[ti] = li

May 10, 2004

University of California at Berkeley

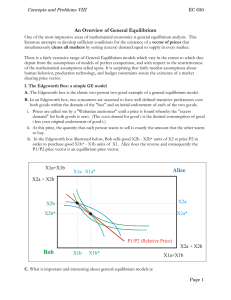

Application: Stocks Pricing

Market has fixed number of equities (n), with an

equilibrium price;

X = # of stockholders willing to buy 1 title;

Y = # of operators willing to sell 1 title.

3 regions: Equilibrium, Overpricing, Depreciation:

At every switch, one transaction can be made:

2D birth-death, continuous-time MC.

Rationale: Given starting domain (status of the

market) and equities’ value, prediction of the longterm dynamics of the stocks’ prices

Future work: investigate other kinds of stability.