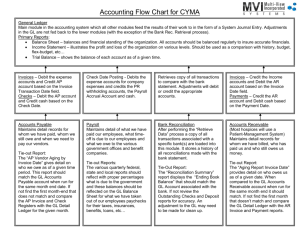

Purchase journals and cash payment journals

advertisement

In your notebooks: What is the trade discount equation? What is the purchase discount equation? What does an invoice amount represent? What does “4/15, n/30” indicate? THE PURCHASE JOURNAL: Journalized purchases on account on a purchase journal Debit Purchases Credit AP (with vendor’s name) THE CASH PAYMENTS JOURNAL: 1. Journalized expenses and supplies on a cash payments journal 2. Journalized payments for merchandise with and without Trade discounts on a cash payments journal Use “Purchases” in Account title Cash purchases of merchandise are journalized in the cash payment journal Purchase discounts is like a grocery store that accepts vendor coupons. Trade discount equation list price x trade disc. rate = trade disc. then list price – trade disc. = invoice amount. Purchase discount equation purchase invoice amt x purchase disc. rate = purchase disc. then purchase invoice amt. - purchase disc. = cash amount after disc. Petty cash fund Enables business to pay cash for small expenses without writing check Errors may be made when making payments from petty cash fund, causing differences between amount recorded and amount actually on hand Must complete a Petty Cash Report to reconcile the actual cash on hand versus the cash that should be in your petty cash fund. A short amount means that what’s on hand is less than what should be there, and so your replenishment amount needs to be increased An (over) amount means what you have on hand is more than what you should have, and your replenishment amount need to be decreased. November 18: Paid cash to replenish the petty cash fund, $208.66: office supplies, $32.33; advertising, $50.00; miscellaneous, $128.50; cash over, $2.17. Check No. 310.. CASH PAYMENTS JOURNAL PAGE ? GENERAL JOURNAL DATE ACCT. TITLE CK. NO. POST. REF. DEBIT CREDIT ACCOUNTS PAYABLE DEBIT PURCHASES DISCOUNT CREDIT CASH CREDIT 2013 1 1 2 2 3 19 18 Supplies- Office 20 Advertising Expense 21 Miscellaneous Expense 22 Cash Short and Over 23 310 32.33 208.66 19 50.00 20 128.50 21 2.17 22 23 Petty cash over and petty cash short recorded in account titled Cash Short and Over Temporary account that is closed to Income Summary account at end of fiscal period Balance can be either debit or credit Balance usually debit because petty cash fund more likely to be short than over Short recorded in general debit Over recorded in general credit Journal proved and ruled whenever journal page is filled and always at the end of a month “Carried Forward” on last line of Cash Payments Journal Single line above column totals, double lines below column totals Prove debits equal credits underneath journal Once journal is totaled and proved, journal is ruled in preparation for forwarding to next page “Brought Forward” in Account Title Column Check mark in Post. Ref. column to show nothing on line needs to be posted Proof of equality of debits and credits must occur at month’s end After cash payments journal is totaled and proved at end of month, journal is ruled When do we journalize in the General Journal? When we are buying anything OTHER THAN MERCHANDISE on account If transaction is not a cash payment, can’t be in cash payments journal If transaction is not purchase of merchandise on account, can’t be in purchases journal IF TRANSACTION CAN’T BE RECORDED IN ONE OF SPECIAL JOURNALS, IT MUST BE RECORDED IN GENERAL JOURNAL Buy supplies on account Invoice received from vendor, similar to purchase invoice received when merchandise is purchased Memorandum attached to invoice to assure no mistake is made than that the invoice is for store supplies, NOT purchases DEBIT Supplies – Store CREDIT Accounts Payable Memorandum is source document Equality of debits and credits checked after each journal entry When we have a PURCHASE RETURN AND ALLOWANCE Purchase return: Customer doesn’t want to keep merchandise, and is allowed to return for the purchase price Purchases allowance: Customer is discontent with merchandise, so vendor allows customer to keep it and gives a reduced price for the merchandise Decreases customer’s accounts payable Decreases customer’s accounts payable Source document: Debit Memorandum Form prepared by customer showing price deduction taken by customer for returns and allowances Called this because customer records amount as a debit (deduction) to vendor account to show decrease in amount owed Diagonal line in Post Ref. column to indicate two accounts being impacted (Accounts Payable and Vendor Account) Purchases Returns and Allowances Account that enables a business to evaluate the effectiveness of its merchandise purchasing activities This account is credited for the amount of purchases returns or allowances Decrease amount of purchases, so it is a contra account to Purchases account Thus, normal balance of Purchase Returns and Allowances account is a credit Nov 28. returned merchandise to Crown Distributing, $252.00, Covering Purchase Invoice No. 80. Debit Memorandum No. 78. GENERAL JOURNAL 11 GENERAL JOURNAL DATE ACCT. TITLE DOC NO. POST. REF. DEBIT CREDIT 2013 1 1 2 2 30 31 28 Accounts Payable/Crown Distributing Purchases Returns and Allowances DM 18 252.00 30 252.00 31 32 32 33 33 34 34 PRACTICE: WT 9-4 OYO 9-4 Application problems 9-1 thru 9-5 Mastery Problem