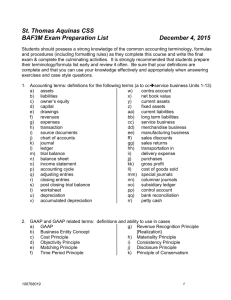

The Purchasing Process is divided in 4 stages: They are ---

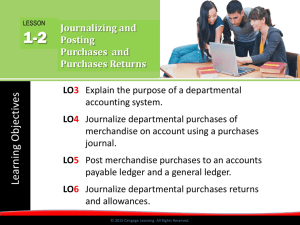

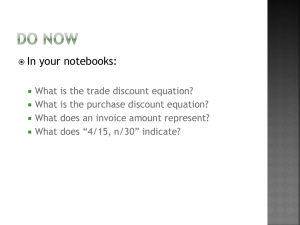

advertisement

The Purchasing Process is divided in 4 stages: They are ---1. 2. 3. 4. When a company needs to buy supplies, equipment, or merchandise---- When you order from a supplier-- information from the purchase requisition is used to write a purchase order. The purchase order contains: A supplier accepts a purchase order by shipping the items and billing the buyer for them. A shipment includes a packing slip that lists all shipped items. When a shipment arrives: Processing the Supplier’s Invoice The supplier sends an invoice, or bill, to the buyer containing the terms and the item quantity, description, price, and total cost. The accounting department checks the invoice against the packing slip and purchase order. Purchases Discounts The buyer may receive a purchases discount for early payment. If the credit terms listed on the invoice are 2/10, n/30, the buyer can receive a 2% discount if payment is made within 10 days, the discount period. The Purchases Accounts Merchandise bought to sell to customers is recorded in the Purchases account, a temporary account that is classified as a cost of merchandise account. The Purchases account follows the rules of debit and credit for expense accounts. The Accounts Payable Subsidiary Ledger A business that makes many purchases on credit will set up an accounts payable subsidiary ledger with an account for each creditor or supplier. The Accounts Payable Subsidiary Ledger Form The ledger account form has a space for the creditor’s name and address and contains three amount columns: Merchandise Purchases on Account When a purchase of merchandise on account is recorded, a diagonal line is entered in the Posting Reference column to indicate the credit amount is posted in two places. Purchases Returns and Allowances A purchase return occurs when a business returns merchandise for a full credit. A purchase allowance occurs when a business keeps unsatisfactory merchandise but pays a discounted price. A debit memorandum is used to notify suppliers of a purchase return or request for purchases allowance. Controls over Cash A business can manage cash payments by following these procedures: Recording Cash Purchase of Insurance Businesses purchase insurance to protect against losses from theft, fire, and flood. An insurance premium is paid at the beginning of the covered period and is recorded in the Prepaid Insurance asset account The shipping terms define if a buyer will be charged for the shipment of goods. Shipping terms are stated as: FOB destination – FOB shipping point –