Chapter 6- Source Documents

advertisement

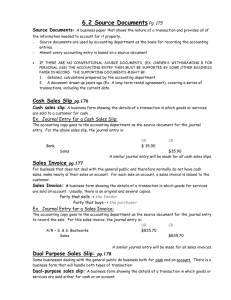

Chapter 6Source Documents Source Document (p.184) Is a business paper that shows the nature of a transaction. Who & Why? Government Bank Tax Audited Credit available Loan Customer Owner proof of transaction records/ reference Information found on source documents for transactions include: Nature Types of the transaction of product or service Names of customers or creditors Transaction Amount date of money involved Cost Principle (p. 35) State that accounting for purchases must be at cost price (price you paid for it) Value does not change even if market value changes, only if you sell the item Objectivity Principle (p. 58) Accounting will be recorded on the basis of objective evidence (proof), thus accounting entries will be based on fact and not on personal opinion Source documents provide the proof for transactions and are kept on file for reference purposes Bills Utilities Telephone Insurance Many more Cheque Monthly Payments Online Direct withdrawal Purchase Invoice: When the business purchases something on account. The seller will send you a purchase invoice ‘Purchase on account’ Journal entry: Asset or Expense A/P DR CR Sales Invoice When the vendor sells something on account; send the debtor a sales invoice for goods purchased or services provided ‘Sale on account’ Journal entry A/R Revenue DR CR Cash Sales Slip: Manual total of a cash sale Point of Sale Summary A computerized sales register that allows a business and its customers to exchange funds electronically (debit) Credit Cards Pay within 30 days or charged with interest Cash Receipts Daily Summary Cash receipts list of money coming in from customers (deposit) Sales cash Payment by A/R Cheques: Received from debtors (A/R) ‘Received on account’ Journal Entry: Bank A/R DR CR Cheque Copies (company issues) Copy of cheque your business has written for: Assets purchased Expenses paid Liabilities paid Owner drawings Bank Advice Bank The Bank’s Point of View When bank decrease the business’s cash account (ie. Service changes) Bank’s bank account increases Business’s bank account decreases Bank Debit Memo: Credit Memo: When bank increases the business’s cash account (ie. Interest earned) Bank’s bank account decreases Business’s bank account increases