Accounting Journalizing Purchases and Cash Payments March 2015

advertisement

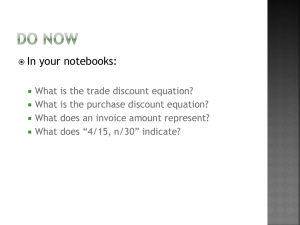

Accounting Journalizing Purchases and Cash Payments March 2015 Today in Accounting • Please use the first 15 minutes of class to update your Budget Challenge – Pay bills, quiz completion and update your spreadsheet. • We will start Chapter 9 with Terms Review – Please look up the definitions of the terms on the handout – Complete the Office Max activity in the book – We will learn about the Purchases Journal – We will complete 9.1 together. You will complete 9.1 Application on your own LESSON 9-1 Journalizing Purchases Using a Purchases Journal Real World Accounting • Read the OfficeMax Article and answer the two questions that follow. Real World Accounting • Answer: Some of the costs of manufacturing an item are the same, regardless of the number of items manufactured. By purchasing larger quantities of an item, the unit cost of manufacturing the item may be reduced. A large company like Boise can influence the manufacture to pass along those savings. Internet Activity Research the three types of corporations and answer the three questions that follow. Chapter 9.1 Vocabulary • merchandise • merchandising business • retail merchandising business • wholesale merchandising business • corporation • share of stock • capital stock • stockholder 7 • • • • • • • • • LESSON 9-1 special journal cost of merchandise markup vendor purchase on account purchases journal special amount column purchase invoice terms of sale page 241 Chapter 9.1 • merchandise • merchandising business • retail merchandising business • wholesale merchandising business • corporation • share of stock • capital stock • stockholder 8 LESSON 9-1 Chapter 9.1 • • • • • • • • • 9 LESSON 9-1 special journal cost of merchandise markup vendor purchase on account purchases journal special amount column purchase invoice terms of sale The Business-Hobby Shack, INC. • Hobby Shack, Inc. is the business that will be used to illustrate all the chapters in Part 2 of this class. Question • Why would a business organize as a corporation? – Answer: Because two or more owners can provide the capital required to operate the business. Question #2 • Can you identify a significant difference between a proprietorship and a corporation? – Answer: A corporation exists independent of its owners. Agenda • Introduce Chapter 9.1 and 9.2 (Journalizing Purchases and Cash Payments) • Start by completing Vocab sheet using the book • Review the accounts debited and credited for Purchases and steps to record in Purchases Journal • Work Together (we will complete this together!) & On Your Own + Application problem (Aplia) • Wrap Up (Next UP) There are many types of journals… • A business with a limited number of daily transactions may record all entries in one journal. • A business with many daily transactions may choose a separate journal for each kind of transaction. Special Journal • A journal used to record only one kind of transaction. • Hobby Shack uses five journals to record daily transactions. Using Special Journals • Purchases Journal-for all purchases of merchandise on account • Cash Payments journal-for all cash payments • Sales Journal-for all sales of merchandise on account • Cash Receipts journal-for all cash receipts • General Journal-for all other transactions Purchasing Merchandise • Businesses add markups to the cost of merchandise to establish selling prices. • Markups must cover all expenses of the business plus enough to earn a net income • If the mark up is too high, sales might be lost to competitors with a lower price. PURCHASING MERCHANDISE • • • • It is a cost account and reduces capital. It has a normal debit balance Purchases account increases by a debit Decreases by a credit. 18 LESSON 9-1 page 236 PURCHASES JOURNAL page 237 A special journal used to record only purchases of merchandise on account. 19 LESSON 9-1 PURCHASE INVOICE page 238 1 4 2 3 1. Stamp the date received and purchase invoice number. 3. Initials of the person who checked the invoice. 2. Place a check mark by each amount. 4. Review the vendor’s terms. 20 LESSON 9-1 PURCHASING MERCHANDISE ON ACCOUNT page 239 November 2. Purchased merchandise on account from Crown Distributing, $2,039.00. Purchase Invoice No. 83. 2 1 1. 2. 3. 4. 21 3 Write the date. Write the vendor name. Write the purchase invoice number. Write the amount of the invoice. LESSON 9-1 4 TOTALING AND RULING A PURCHASES JOURNAL page 240 1 4 3 5 2 1. Rule a single line across the amount column. 2. Write the date. 3. Write the word Total. 22 4. Add the amount column. 5. Write the total. 6. Rule double lines across the amount column. LESSON 9-1 6 TERMS REVIEW merchandise merchandising business retail merchandising business wholesale merchandising business corporation share of stock capital stock stockholder 23 • • • • • • • • • LESSON 9-1 special journal cost of merchandise markup vendor purchase on account purchases journal special amount column purchase invoice terms of sale page 241 Accounting-Chapter 9-2 Journalizing Cash Payments Using a Cash Payments Journal FEBRUARY 25, 2014 Previously… • Reviewed accounting terms related to purchases for a merchandising business – Created our own definition and pictures – 100,000 Pyramid (You All LOVED It) • Learned about the different types of corporations – LLCs – C corporations – S corporations • Journalized purchases and Cash Payments (9.1) Please Answer – Please record your answer on WORD and print out. • You work part time in a local sports equipment store. As part of your duties, you record daily transactions in a journal. One day you ask the owner, “You use the purchase invoice as your source document for recording purchases of merchandise on account. You use a Memo as your source document for recording the entry when supplies are bought on account. Why don’t you use the invoice for both entries”? • How would YOU respond to this question? OBJECTIVES 9.2 • Define Accounting terms related to cash payments for a merchandising business • Identify account concepts and practices related to cash payments for a merchandising business • Journalize cash payments and cash discounts using a cash payments journal. Cash Payments • Every Cash Payment, no matter what the payment is for, is recorded in the cash payments journal. Question: What is the difference between a general amount column and a special amount column? General Amount v. Special Amount Column • General Amount Column: – Not headed with an Account title. • Special Amount Column: – Headed with an Account title GENERAL SPECIAL NO TITLE TITLE General Amount v. Special Amount Column • Question for YOU! – What is recorded in the general amount columns of the cash payments journal? • Answer: Cash Payment transactions that do not occur often. GENERAL SPECIAL NO TITLE TITLE Think about this…. • Why would a vendor offer a cash discount to a customer? Answer: To encourage early payment CASH PAYMENTS JOURNAL page 242 Cash Discount-Deduction that a vendor allows on the invoice amount to encourage prompt payment Purchases Discount-Cash discount on purchases taken by a customer. (notice the column on the worksheet) 32 LESSON 9-2 Cash Payment of an Expense • A cash payment of an expense results in an increase in the expense and a decrease in cash – Expense is debited and Cash is credited. Example: Hobby Shack-Pays for an expense at the time the transaction occurs…Lets take a look! CASH PAYMENT OF AN EXPENSE •The cash payment increases the advertising expense account balance and decreases the cash account balance. •The expense account Advertising Expense has a normal debit balance and increases by a debit of $150.00. •The asset account Cash also has a normal debit balance and decreases by a credit of $150.00 CASH PAYMENT OF AN EXPENSE page 243 November 2. Paid cash for advertising, $150.00. Check No. 292. 1 1. 2. 3. 4. 5. 2 Write the date. Write the account title. Write the check number. Write the debit amount. Write the credit amount. 3 4 5 •The cash payment increases the advertising expense account balance and decreases the cash account balance. BUYING SUPPLIES FOR CASH page 243 November 5. Paid cash for office supplies, $94.00. Check No. 293. 1 1. 2. 3. 4. 5. 2 3 4 Write the date. Write the account title. Write the check number. Write the debit amount. Write the credit amount. LESSON 9-2 5 Question What is the difference between purchasing merchandise and buying supplies? Answer: A business purchases merchandise to sell but buys supplies for use in the business. Supplies are not intended for sale. CASH PAYMENTS FOR PURCHASES page 244 November 7. Purchased merchandise for cash, $600.00. Check No. 301. 2 1 1. 2. 3. 4. 5. 3 4 Write the date. Write the account title. Write the check number. Write the debit amount. Write the credit amount. LESSON 9-2 5 What is Meant by…………… TERMS OF SALE 2/10, n/30 ANSWER: •2% of the invoice may be deducted if paid within 10 days. •Net 30 means that the total invoice amount must be paid within 30 days CASH PAYMENTS ON ACCOUNT WITH PURCHASES DISCOUNTS page 245 November 8. Paid cash on account to Gulf Craft Supply, $488.04, covering Purchase Invoice No. 82 for $498.00, less 2% discount, $9.96. Check No. 302. 5 1 2 4 3 1. 2. 3. 4. 5. 6. Write the date. Write the account title of the vendor. Write the check number. Write the debit amount. Write the credit amount. Write the credit amount. LESSON 9-2 6 CASH PAYMENTS ON ACCOUNT WITHOUT PURCHASES DISCOUNTS November 13. Paid cash on account to American Paint, $2,650.00, covering Purchase Invoice No. 77. Check No. 303. 1 2 4 3 1. 2. 3. 4. 5. Write the date. Write the vendor account title. Write the check number. Write the debit amount. Write the credit amount. LESSON 9-2 5 page 246 TERMS REVIEW • • • • • • • cash payments journal cash discount purchases discount general amount column list price trade discount contra account LESSON 9-2 Exit Ticket • Merchandise is purchased for $2,000 on March 5th with terms 2/10,N/30. What is the amount due on – March 11 ________ – March 17 ________ • Merchandise with a list price of $3,000 is purchased on account for $1,800 on May 1. Terms are 1/15,N/30. How much is due if paid on May 20th? Bell Ringer Answer Answer: – An invoice for supplies can easily be confused with one for merchandise – The distinction between the two is in how the items are to be used (Example?) – A memo identifying the items to be used as supplies helps avoid recording supplies as a purchase of merchandise. Performing Additional Cash Payments Journal Operations Accounting February 28, 2014 Bell Ringer • Describe the kinds of transactions for which a business typically writes checks? • Answer: Cash paid for merchandise or supplies was explained in Chapters 1 & 2 – Buying Assets – Paying on Account – Paying Expenses Objectives • Prepare a petty cash report and journalize the reimbursement of the petty cash fund. • Total, prove, and rule a cash payments journal and start a new cash journal page. This lesson… • Illustrates how to record mistakes made in working with the cash in a petty cash fund. • Question: What kind of cash payments should be made using a petty cash fund? -Small expenses without writing a check. Errors are always made… • These errors cause a difference between the actual cash on hand and the recorded amount of cash that should be on hand. Vocabulary 9.3 • Cash Short-a petty cash on hand amount that is less than a recorded amount. (p. 248) • Cash Over-a petty cash on hand amount that is more than a recorded amount. (p. 248) • The custodian in the next example prepares a petty cash report when the petty cash fund is to be replenished. PETTY CASH REPORT 1. Write the date and 1 custodian name. 2. Write the fund total. 3. Summarize petty cash payments. 4. Calculate and write the 3 total payments. 5. Calculate and write the recorded amount on hand. 5 6. Write the actual amount of cash on hand. 7. Subtract the actual amount on hand from the recorded amount on hand and write the amount. 8. Write the total of the replenish amount. 51 LESSON 9-3 page 248 2 4 6 7 8 REPLENISHING A PETTY CASH FUND • Cash Short as DEBIT • Cash Over as CREDIT REPLENISHING A PETTY CASH FUND page 249 1. Date 2. Account titles 3. Check number 4. Expense amounts 5. Cash short as a debit; cash over as a credit 4 5 6 1 2 53 3 LESSON 9-3 6.Total cash payment Remember • A journal is proved and ruled whenever a journal page is filled and always at the end of the month. • Why? – To prove that debits equal credits. – If they do not equal, the errors must be found and corrected before any more work is completed ( starting a new cash payments journal page) TOTALING, PROVING, AND RULING A CASH PAYMENTS JOURNAL page 250 PAGE TO CARRY TOTALS FORWARD 1 4 2 1. 2. 3. 4. 5. 6. 55 3 5 Rule a single line. Write the date. Write the words Carried Forward in the Account Title column. Place a check mark in the Post. Ref. column. Write each column total. Rule double lines. LESSON 9-3 6 STARTING A NEW CASH PAYMENTS JOURNAL PAGE page 251 1 2 1. 2. 3. 4. 5. 56 3 4 5 Write the journal page number. Write the date. Write the words Brought Forward in the Account Title column. Place a check mark in the Post. Ref. column. Record the column totals. LESSON 9-3 TOTALING, PROVING, AND RULING A CASH PAYMENTS JOURNAL AT THE END OF A MONTH page 252 1 2 3 1. 2. 3. 4. 5. 57 4 Rule a single line. Write the date. Write the word Totals in the Account Title column. Write each column total. Rule double lines. LESSON 9-3 5 TERMS REVIEW • cash short • cash over 58 LESSON 9-3 page 253 Exit Ticket • Briefly summarize the procedure for preparing a petty cash report? • What is the usual balance of the account Cash Short and Over? • List the five steps for ruling a cash payments journal at the end of the month. LESSON 9-4 Journalizing Other Transactions Using a General Journal Tuesday February 28, 2012 Accounting Today’s Objective • Journalize purchases returns and allowances and other transactions using a general journal Here we go! • Companies frequently buy items other than merchandise on account, such as supplies or equipment. • These transactions require a credit to accounts payable to record the liability 9.4 Vocabulary • Purchases Return-credit allowed for the purchase price of returned merchandise, resulting in a decrease in the customer’s accounts payable. (p. 256) • Purchases allowance-credit allowed for part of the purchase price of merchandise that is not returned, resulting in a decrease in the customer’s accounts payable. (p. 256)-(Damaged but still usable- reduced price) 9.4 Vocabulary • Debit memorandum-a form prepared by the customer showing the price deduction taken by the customer for returns and allowances. (p. 256) Review…. • Remember that a memo is used for special messages within a company. • In the illustration you are about to see, the memo ensures that the invoice received for supplies brought is NOT recorded as a purchase of merchandise on account. MEMORANDUM FOR BUYING SUPPLIES ON ACCOUNT 66 LESSON 9-4 page 254 Question for YOU! • Should office supplies purchased by an office supplies company to sell to its customers be recorded as a merchandise purchase? • Should office supplies bought by the same company for use by employees be recorded the same way? – NO, it should be recorded as office supplies or store supplies. Buying Supplies on Account • Increase in supplies and an increase in accounts payable; • What is Debited and Credited? – Supplies is debited and Accounts Payable is credited. Buying Supplies on Account • You will see a diagonal line in the Post Ref column. This means that since both the general ledger account (Acct Payable & the vendor account) are affected by the credit part of the entry….this will be explained later. BUYING SUPPLIES ON ACCOUNT page 255 November 6. Bought store supplies on account from Gulf Craft Supply, $210.00. Memorandum No. 52. 2 4 3 7 1 1. Write the date. 2. Write the account title. 3. Write the memorandum number. 4. Write the debit amount. 70 5 6 5. Write the account title and vendor name. 6. Place a diagonal line in the Post. Ref. column. 7. Write the credit amount. LESSON 9-4 DEBIT MEMORANDUM FOR PURCHASES RETURNS AND ALLOWANCES 71 LESSON 9-4 page 256 JOURNALIZING PURCHASES RETURNS AND ALLOWANCES page 257 November 28. Returned merchandise to Crown Distributing, $252.00, covering Purchase Invoice No. 80. Debit Memorandum No. 78. 2 5 1 3 4 6 1. Write the date. 2. Write the account title and vendor name. 3. Place a diagonal line in the Post. Ref. column. 72 7 4. 5. 6. 7. Write debit memorandum number. Write the amount. Write Purchases Returns and Allow. Write the amount. LESSON 9-4 TERMS REVIEW • purchases return • purchases allowance • debit memorandum 73 LESSON 9-4 page 258 To do list • Aplia 9.4 • Exit Ticket • Prepare for Test – Online Test and Xtra Study Tools on c21accounting web-site Exit Ticket • Why is a memo used as the source document when supplies are bought on account? • What is the primary difference between a purchases return and a purchases allowance?