Click to

advertisement

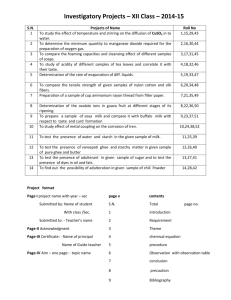

September 2012, Volume: 54 ISSUE VOLUME Investeurs Chronicles Cover Story…… The taste of India- The truly Cooperatiove movement of India Open Forum……. News …… News on Emerging Markets Stats Watch……. Finally, Govt bites reforms The imbalance of India- bullet China In Focus…… Euro Crisis: Where do we stand? Outlook…….. Crude Oil Figure Facts Call Rates as on 21st September 2012 7.00% - 8.10% Forex Forward Rates against INR as on 21st September, 2012 Spot Rate 1 mth 3 mth 6 mth US Dollar 53.91 53.83 54.41 55.17 Euro 69.44 69.87 70.66 71.71 Sterling 87.00 87.51 88.43 89.63 Yen 68.46 68.89 69.66 70.71 Swiss 57.40 57.76 58.44 59.35 Franc Source: Hindu BusinessLine 18,752 .83 5691. 15 17,766 .78 5363. 45 Libor Rates Libor % US Euro Sterling Yen Swiss Franc 1 mth 0.21 0.07 0.51 0.14 0.009 3 mth 0.36 0.15 0.62 0.19 0.04 6 mth 0.65 0.38 0.87 0.31 0.15 12 mth 0.98 0.67 1.33 0.53 0.35 Sensex Nifty Forward Cover US Euro Sterling Yen Swiss Franc 1 mth 7.28% 7.53% 7.13% 7.64% 7.63% 3 mth 6.82% 7.13% 6.67% 7.11% 7.35% 6 mth 6.29% 6.63% 6.13% 6.66% 6.89% 63989 31906 31566 63440 Gold (10 gm) Silver (1 Kg) As on 21st September 2012 Source: Hindu BusinessLine Commodities Commodities Unit (1000kg) Aluminum 111150 Copper 450300 Zinc 109950 55.34 114.30 111.40 53.91 As on 21st September 2012 Crude Oil ($/barrel) Dollar/INR Data from 10th September’12 to 21st September’12 Outlook-Crude oil Stats Watch The imbalance in India-China Crude Oil The Federal Reserve's pledge towards a new round of economic stimulus, a tightening global supply picture in view of the ongoing unrest in the resource-rich Middle East and a German court's green light to the Eurozone bailout fund have strengthened oil prices to around mid- to upper $90s a barrel. Partly offsetting this favorable view has been high U.S. crude stocks and worries about China's growth outlook. Brent crude oil spot prices have increased at a relatively steady pace from their 2012 low of $89 per barrel on June 25 to their recent high of $117 per barrel on August 23 because of the seasonal tightening of oil markets and continuing unexpected production outages. However, given the recessionary in the West, it is expected that Brent crude oil prices to fall from recent highs over the rest of 2012, averaging $111 per barrel over the last 4 months of 2012 and $103 per barrel in 2013. Although, short term view for crude oil is of decline, yet, the long term price trajectory for crude oil remains bullish on account of demand-supply mismatch. According to the Energy Information Administration (EIA), world crude consumption grew by an estimated 1.0 million barrel per day in 2011 to a record-high level of 88.3 million barrels per day. In 2010, oil demand increased by over 2 million barrels per day to 87.3 million barrels per day, which more than made up for the losses of the previous 2 years, and surpassed the 2007 level of 86.3 million barrels per day (reached prior to the economic downturn). The agency, in its most recent Short-Term Energy Outlook, said that it expects global oil demand growth of 0.8 million barrels per day in 2012 and 1.0 million barrels per day in 2013. EIA's latest forecasts assumes that demand will be lackluster in U.S., Europe and Japan but this will be more than made up by impressive consumption surge coming from Russia, the Middle East and Brazil. The other major energy consultative body, the Paris-based International Energy Agency (IEA), the energymonitoring agency of 28 industrialized countries, also said that it expects world oil consumption to grow by 0.8 million barrels per day during both 2012 and 2013 to average 89.8 million barrels per day and 90.6 million barrels per day, respectively. As long as growth from developing nations continues and the global output is unable to keep up with that, we are likely to experience a surge in the price of a barrel of oil in the long term. ‘The taste of India’- The truly Co-operative movement of India Cover Story The seeds of this unusual saga were sown more than 65 years back in Anand, a small town in the state of Gujarat in western India, where Amul was born. It takes a sheer amount of brilliance to start from scratch and build a worldwide famous institution which stands out as the No. 1 on a global level. Amul has honored its contract with the consumer. The contract that is symbolised by the Amul brand means quality. It means value for money. It means availability. And it means service. How did the Amul brand become what it is? To answer that, we must journey back in time, to the history books, to the time of India’s independence because Amul’s birth is indelibly linked to the freedom movement in India. It was Sardar Vallabhbhai Patel who said that if the farmers of India are to get economic freedom then they must get out of the clutches of the ‘middlemen’. Inception Over six decades ago the life of a farmer in Kaira was very much like that of farmers anywhere else in India. The milk marketing system was controlled by contractors and middlemen. As milk is perishable, farmers were compelled to sell their milk for whatever they were offered. The first Amul cooperative was the result of a farmers’ meeting in Samarkha (Kaira district, Gujarat) on 4 January 1946, called by Morarji Desai under the advice from Sardar Vallabhbhai Patel, to fight rapacious milk contractors. It was Sardar’s vision to organise farmers, to have them gain control over production, procurement and marketing by entrusting the task of managing these to qualified professionals, thereby eliminating the middle men, the bane in farmers’ prosperity. In January 1946, Milk producers’ cooperatives in villages, federated into a district union, and resolved to handle alone the sale of milk from Kaira to the government-run Bombay Milk Scheme. This was the origin of the Anand pattern of cooperatives. The colonial government refused to deal with the cooperative. The farmers called a milk strike. After fifteen days the government capitulated. This was the beginning of Kaira District Cooperative Milk Producers’ Union Ltd., Anand, registered on 14 December 1946. Its objective was to provide proper marketing facilities for the milk producers of the district. The Union began pasteurizing milk in June 1948, for the Bombay Milk Scheme – just a handful of farmers in two village co-operative societies producing about 250 liters a day. Kaira Union introduced the brand “Amul” for marketing its product range. The word “Amul” is derived from Sanskrit word ‘Amulya’ which means ‘priceless’ or precious’. Amul grew from strength to strength thanks to the inspired leadership of Tribhuvandas Patel, the founder Chairman and the committed professionalism of Dr. VergheseKurien, who was entrusted the task of running the dairy from 1950. Milkman of India Dr. Kurien used his experience to work with the manager of the local Kaira District Cooperative Milk Producers’ Union to build an in-house processing plant and organize the cooperative to handle its own marketing directly to consumers.After years of initial struggle, the cooperative began to produce dramatic results, involving over two million farmers. This led to the birth of Amul business model, the largest food product business in India. Based on the cooperative’s successes, Prime Minister Shri LalBahadurShastri created the National Dairy Development Board (NDDB) in 1965 to replicate the model nationally. The Prime Minister cited Dr. Kurien's "extraordinary and dynamic leadership" upon naming him chairman. The reformer par excellence, the “Milkman of India", Dr. Kurien attributed individual dairy producer as the cornerstone of his endeavors. In collaboration with farmers, cooperative managers, and public officials, Dr. Kurien successfully established the dairy program known across India as "Operation Flood” that, between 1970 and 1996, allowed dairy farmers to own and operate milk production, processing, and marketing for the urban areas around the country. When Operation Flood began in 1970, total annual milk procurement was only 190,000 tons, with 278,000 farmers involved in the program. By 1998, at the time of DrKurien’s retirement as chairman, the NDDB’s programs involved more than ten million dairy producers in 81,000 cooperatives, supplying almost five million tons of milk annually to over 1,000 cities and towns throughout the country. Reaching nearly 250 million people, Operation Flood was the largest agricultural development program in the world. India emerged as the largest producer of milk in the world in 1998, surpassing the United States. As a result of Dr. Kurien’s leadership, domestic milk prices have stabilized, India's towns and cities now receive an adequate supply of hygienic milk, and the 12 million small farmers and landless laborers who make up the majority of dairy cooperative membership now have a regular source of income. In addition, 95 percent of the equipment used in NBBD cooperatives is domestically produced. Despite these achievements, perhaps Dr. Kurien’s greatest contribution with Operation Flood was to put the farmer in command as the owner of his or her own cooperative – a pivotal factor in the program’s success. People power: Amul's secret of success Looking back on the path traversed by Amul, the following features make it a pattern and model for emulation elsewhere. Amul has been able to: Produce an appropriate blend of the policy makers farmers board of management and the professionals: each group appreciating its roles and limitations Bring at the command of the rural milk producers the best of the technology and harness its fruit for betterment Provide a support system to the milk producers without disturbing their agro-economic systems Plough back the profits, by prudent use of men, material and machines, in the rural sector for the common good and betterment of the member producers and Even though, growing with time and on scale, it has remained with the smallest producer members. In that sense, Amul is an example par excellence, of an intervention for rural change. Amul succeeded mainly because it provides an assured market at remunerative prices for producers' milk besides acting as a channel to market the production enhancement package. What's more, it does not disturb the agro-system of the farmers. It also enables the consumer an access to high quality milk and milk products. Contrary to the traditional system, when the profit of the business was cornered by the middlemen, the system ensured that the profit goes to the participants for their socio-economic up liftmen and common good. The Amul Model The Amul Model of dairy development is a three-tiered structure with the dairy cooperative societies at the village level federated under a milk union at the district level and a federation of member unions at the state level. Establishment of a direct linkage between milk producers and consumers by eliminating middlemen Milk Producers (farmers) control procurement, processing and marketing Professional management Emerging Markets South Africa: Interest rates unchanged Russia: Putin Makes Dam Deals in Kyrgyzstan, Writes Off $500M Deb The Reserve Bank will maintain current interest rates, governor Gill Marcus said Russia agreed on 20th September to write off nearly $500 million in debt due from Kyrgyzstan on 20th September. It will leave the repo rate unchanged at 5.0% after a surprise in exchange for a package of deals that will extend Moscow's military and energy footprints 50 basis-point rate cut in July. The prime lending rate is currently at on the volatile fringes of the former Soviet Union. As Kyrgyzstan confirmed plans to close 8.5%.Marcus earlier said further interest rate cuts will depend on growth and a U.S. base used to fly troops in and out of Afghanistan after Washington's lease expires inflation in coming months and should not be taken as a given. in 2014, President Vladimir Putin secured a 15-year extension to Russia's lease on its own base in the country. Brazil’s Finance Chief Attacks US Over QE3 Guido Mantega, Brazil’s finance minister, has warned that the U.S. Federal Indonesia: Dollar-denominated bonds to enter Indonesian market in 2013 Reserve’s “protectionist” move to roll out more quantitative easing will reignite The Indonesian government will start selling dollar-denominated bonds to domestic investors the currency wars with potentially drastic consequences for the rest of the next year, after previously offering them only to foreign investors overseas, according to the world.He saidit was depressing the dollar and aimed at boosting U.S. exports. Finance Ministry's debt management office.The introduction of dollar-denominated bonds will add more financial instruments to Indonesia, consequently attracting investors holding Brazil: Reserve Cuts to Get Banks Lending their assets in a non-rupiah currency and reducing the volatility of the rupiah against other Brazil’s Banco Central (Central Bank, BC) has reduced its compulsory reserve foreign exchange currencies, according to the Finance Ministry. requirements for the country’s banks, freeing up some R$30 billion (US$15 billion) of the R$380 billion (US$189 billion) of funds that must be safeguarded Philippines: Approved FDIs reach P44.1 billion in second quarter in the BC’s accounts. It is hoped that money could be injected into the economy Total approved foreign direct investments (FDIs) in the second quarter of 2012 rose to P44.1 through increased access to loans by the banks.The Central Bank statement also billion, or 9.4 percent higher than the P40.3 billion recorded in the same period last year, announced it had now scrapped the additional six-percent requirements on according to the National Statistical Coordination Board (NSCB) on 20 th September. demand deposits (“à vista”), and as of October 29th it will reduce those on term Meanwhile, total approved FDIs for the first six months of 2012 reached P62.6 billion, which deposits (“a prazo”) from twelve to eleven percent. went up slightly by 0.4 percent from last year’s P62.3 billion. InFocus Euro Crisis: Where do we stand? Europe has cleared more key obstacles on the road to containing its sovereign debt crisis and stabilizing the euro zone after Germany's constitutional court allowed a permanent bailout fund to go ahead on 12th September. Coupled with a European Central Bank decision to buy short-term bonds of states that apply for assistance and abide by strict conditions, and with EU proposals for a single euro zone banking supervisor, the ruling clears the way for a concerted effort to draw a line under the crisis. However, political risks still lurk on the path to repairing the flawed euro construct, and Europe has yet to find a strategy to revive economic growth that would enable highly indebted states to reduce debt burdens and put the jobless back to work. Among the bailed-out euro zone countries, Ireland is inching its way back towards the capital markets and Portugal is doggedly implementing a tough austerity programme, and has just been granted an extra year to achieve its fiscal targets.Enthusiastic market reaction after the German ruling, with Spanish and Italian bonds rallying, shares rising and the euro hitting a four-month high, showed many investors believe the euro zone is finally starting to get on top of the crisis. But there remain some hurdles; one of them is Spain which is under strong pressure to apply for a Bailout Package that would allow the ECB to intervene to bring down shorter-term borrowing costs, while keeping Spain in capital markets. With the ECB effectively declaring itself a buyer of last resort for troubled governments' debt, provided they maintain fiscal discipline and implement economic reforms, predictions of a euro zone breakup have become less imminent.However, some in Germany still fear the bailout strategy will lead to moral hazard, loose fiscal policy, inflation and eventually a collapse of the euro. Other obstacles to a smooth resolution of the euro zone crisis include Greece's serial failure to meet its fiscal and economic reform targets, although there is no sign of the EU or the IMF preparing to pull the plug on Athens, and financial trouble among euro zone minnows Cyprus and Slovenia.Economists are also worried that France, the euro zone's number two economy and a crucial contributor to the rescue, is failing to cut public spending or embark on structural economic reforms under way elsewhere in the euro zone. It can be said that the Euro Crisis is not over yet .It comes in waves. Grave risks are still ahead .However with the reforms brought about by the German Government & the ECB, it is likely that the turmoil will be less vicious than the ones before. The World is definitely watching. Open Forum Finally, Govt bites reforms bullet Government economic policies have been in a bind over an extended period of time, essentially because of political economy problems. In this context, the recent measures are indeed commendable. These measures predictably invite intense debate and dissent, but if the government is able to ride through the storm, there would be benefits to the economy over the medium-term. Reduction of subsidies always invites loud protests and liberalising foreign investment raises emotional alarm bells. It would be a major achievement if a roll-back is avoided. Overall Growth The overall growth rate in 2012-13 would be around 5.5-6.0 per cent. Although this would be the lowest growth rate in a decade, it has to be viewed in the context of a difficult global situation. The medium-term aspiration is a growth rate of around 8 per cent, which, itself, will be a Herculean task. Petroleum Prices Given our dependence on petroleum imports (about 70 per cent of consumption) ideally, a pass-through of the import price would be desirable, but political economy constraints result in the fuel subsidy going out of control, thereby adversely affecting the gross fiscal deficit. The fuel subsidy bill, which was as low as Rs 2,900 crore in 2008-09, swelled to Rs 68,500 crore in 2011-12. The gross under-recoveries for petroleum products are estimated at Rs 1,67,000 crore, of which over 60 per cent is accounted for by diesel. The recent hike in diesel prices by 12 per cent is a salutary measure, notwithstanding the cascading effect on other prices. In the debate on subsidies, two issues need to be borne in mind. First, India cannot defer paying the price for imported petroleum. Secondly, an economy cannot subsidise itself and the overall burden has to be borne instantaneously. All that can be done is to shunt the burden from one segment to another. It is erroneously argued that reduction of the petroleum subsidy results in inflation. When the petroleum price is not passed on, the fiscal deficit goes up and this results in generalised inflation. Thus, there is merit in a pass-through, but the political economy resolution is easier said than done. The reduction in the subsidy on Liquefied Petroleum Gas (LPG) is an appropriate measure. A lower price for the first six cylinders and a higher price for consumption of more cylinders is, however, administratively difficult to implement. More importantly, the proposed system lacks distributive justice. First, nuclear families are more prevalent among the upper income groups and joint family living is more prevalent among the lower income groups. Secondly, in practice, the better-off segments obtain supplies from more than one distribution agency. In fact, during periods of surfeit of cylinders, the distribution agencies were thrusting cylinders on consumers. Thirdly, an underground market in cylinders would develop. The Nandan Nilekani Committee had rightly recommended a phased introduction of direct cash subsidies. This should be expeditiously implemented, so that there is a single price for LPG. FDI Reform The four bold measures on FDI are: (i) 51 per cent FDI in multi-brand retail (subject to individual states option), (ii) 49 per cent FDI in civil aviation, (iii) 74 per cent FDI in broadcast services and (iv) approved FDI in power exchanges. These would raise loud protests of a massive FDI invasion. No such flooding is likely to take place in the immediate ensuing period. The overall policy was, all along, meant to favour FDI over portfolio investment, but in practice, portfolio investment has been significantly liberalised without a commensurate reduction in FDI red tape. As such, the slew of FDI measures merit support. Public Sector Divestment The announcement of public sector divestment to the tune of Rs 15,000 crore (total for the year budgeted at Rs 30,000 crore) is timely and preferable to crowding it towards the end of the financial year. Ideally, the sale of family silver should be used to build up a Consolidated Sinking Fund (CSF) to repay public debt. Finance Commissions in the late 1980s and early 1990s strongly recommended a CSF and the country will pay a high price for ignoring this advice. Monetary Policy The year-on-year inflation on the Wholesale Price Index (WPI) at 7.6 per cent and the Consumer Price Index (CPI) at 10 per cent, is well beyond the RBI’s comfort zone of 5.05.5 per cent; moreover, official indices always underestimate the actual inflation rate. The RBI’s Mid-Quarter Review on September 17, 2012, correctly emphasises that in the recent period, growth risks have increased while inflation risks remain. The reduction of the cash reserve ratio (CRR) from 4.75 per cent to 4.50 per cent, releasing Rs 17,000 crore, appears to be in the nature of support to the government’s recent measures, rather than responding to any need for increased liquidity. The continuing inflationary pressures should be of overriding concern to the RBI, and any further policy relaxations should be rear-ended and not front-ended. They should be undertaken only after there is a significant and enduring reduction in the consumer price index. Source: Hindubusinessline About Investeurs Consulting P. Limited Investeurs Consulting Pvt. Ltd. is a business and financial advisory company, successfully serving businesses since 1994; we offer advisory and consultancy services for successful fund syndication. We have serviced diverse businesses by arranging finance of over $5.25 billion. We are strategic advisors to our clients during the ideation phase, implementation through start-up phase, and trusted advisors overall. All businesses go through a similar life cycle.Once an idea is conceived and a business is established, a company requires capital to fund ongoing growth and expansion. The Capital Structure has to be optimally structured during each phase of business cycle. Investeurs perceives the requirement and accordingly arranges funds to help companies smoothly achieve milestones in the process. Investeurs Competency Kit Alignment of services with client’s business Round the year Financial assistance Facilitator between Banks and Clients Hassel free & on time service Industry & Market updates TeamChronicle Akanksha Srivastava akanksha@investeurs.com NidhiGogia nidhi@investeurs.com ShagunKhivsara shagun@investeurs.com Harpreet Kaur harpreet@investeurs.com Disclaimer: Investeurs Chronicles is prepared by Research & Analysis Team of Investeurs Consulting Private Limited to provide the recipient with relevant information pertaining to the world economy. The information contained in the document is based on the releases made by various newspaper & publications; hence, we are not responsible for any inaccuracies in the information provided. Investeurs Consulting P. Limited S-26,27,28, 3rdFloor,Veera Tower, Green Park Ext. New Delhi-110016, www.investeurs.com