1st session Personal Management MBadge

advertisement

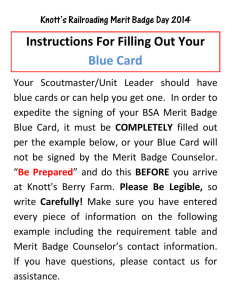

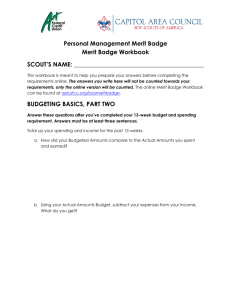

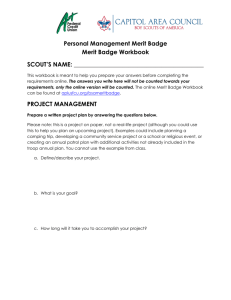

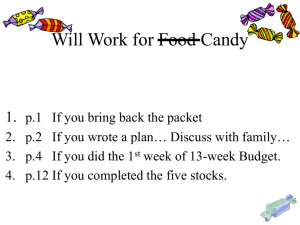

Personal Management Merit Badge $ Lots of effort , but totally worth it! HANDOUT • Fill in the blanks. • OR use your own pages. • You may use the words I’ll suggest, or • You may use other words you like better! Brainless attendance HANDOUT • Name ______________________________________ • Date of merit badge classes: 1st ____________ 2nd ____________ To help you in the future: Keep it! Read again in 5 yrs! * • Boxed portions: To be reviewed with your Merit Badge Counselor. • AFTER you’ve completed EVERYTHING (ready to discuss)! • If I go too fast, stop me. • Bring this handout back next time: Do the following: Choose an item that your family might want to purchase that is considered a major expense. p.2, Requirement #1: HDTV Item chosen: _______________ $1,000 Approximate cost: ___________ (b) Write a plan that tells how your family would save money for it. • We can save money by: Mostly _______ earnings, but each _____________________________ of us could contribute. _____________________________ p.2, Requirement #1 (continued): (b)1. Discuss the plan with your merit badge counselor.* 2. Discuss the plan with your family. **When are you going to do this? • (FHE?) 3. Discuss how other family needs must be considered in this plan.** *When are you going to discuss this with your merit badge counselor? p.2, Requirement #1: Do the following: (c). Develop a written shopping strategy for the purchase: 1. Determine the quality of the item (using consumer publications or rating systems). Google, Yahoo, EBay, Consumer Reports _______________________________________ p.2, Requirement #1: Do the following: (c). Develop a written shopping strategy for the purchase: 2. Comparison shop for the item. Find out where you can buy the item for the best price. Call around Who you called: What you learned: Gwido’s Pawn Shop ____________ Don’t go there! ________________ ________________ ____________ p.2, Requirement #1: Do the following: (c). Develop a written shopping strategy for the purchase: 2. Comparison shop for the item. Find out where you can buy the item for the best price. Study ads Where you looked: What you learned: Newspaper Sears had a great sale ________________ ____________________ www.ebay.com Including shipping… ________________ ____________________ p.2, Requirement #1: Do the following: • (1)(c)2 Yes Did you find a great sale or a discount coupon? ________ ____________________________________________ Consider alternatives: but________ Can you buy the item used? Maybe, ___________________ could, but already found… Should you wait for a sale? I___________________ p.3 Prepare a budget reflecting: Your expected income (allowance, gifts, wages), Your expected expenses & savings (Outgo). Track your actual. 1st Week INCOME EXPENSES & SAVINGS Expected Actual Allowance Job Gifts _________ _________ _________ Total in ______ ______ ______ ______ ______ ______ ______ ______ ______ ______ ______ ______ ______ ______ Expected Actual Donations ______ Savings ______ Savings (for… ______ Save to Buy ______ Junk food ______ _________ ______ Total Out ______ ______ ______ ______ ______ ______ ______ ______ EXAMPLE INCOME OUTGO Expected Actual Allowance $10 _____ Donations $10 Job _____ Savings $10 Gifts _____ Savings (for… _________ ______ _____ Save to buy _________ ______ _____ Junk food _________ ______ _____ _________ Total in _____ Total Out $30 Expected Actual $3 ______ $3 ______ $3 ______ $3 ______ $30 ______ ______ ______ ______ $42 ______ 2(b). Compare expected income with expected expenses. 2. If outgo exceeds income, determine steps to balance: I can increase more or decrease expenses by_______________ buying less junk income by working ___________ Another EXAMPLE INCOME OUTGO Expected Actual Allowance $10 _____ Donations $10 Job _____ Savings $10 Gifts _____ Savings (for… _________ ______ _____ Save to buy _________ ______ _____ Junk food _________ ______ _____ _________ $30 Total in _____ Total Out Expected Actual $3 ______ $3 ______ $3 ______ $3 ______ ______ ______ ______ ______ $12 ______ 2(b). Compare expected income with expected expenses. 2. If expected income exceeds expected outgo, state how you would use the excess money: I could have some for __________________ better stuff later. EXAMPLE INCOME OUTGO Expected Actual $10 Donations Allowance $10 _____ $10 $20 Savings Job _____ $10 $20 Savings (for… Gifts _____ _________ ______ _____ Save to buy _________ ______ _____ Junk food _________ ______ _____ Presents Total in _____ Total Out $30 $50 Expected Actual $3 $ 5 ______ $3 $ 5 ______ $3 $ 5 ______ $3 $ 5 ______ ______ ______ ______ ______ $20 ______ $12 $40 • What actually happened? • This guy should have $10 more now than 1 week ago. If you finish one week of expected and actual by next class... actual income, expenses, and savings for 13 consecutive weeks. p.3-7, Req 2a Track your • • • • • • • • • Income Source Actual ___________ _______ ___________ _______ ___________ _______ ___________ _______ ___________ _______ ___________ _______ Total _______ • • • • • • • • • Expenses Where Actual ___________ _______ ___________ _______ ___________ _______ ___________ _______ ___________ _______ ___________ _______ Total _______ • How are you going to remember to do this each day? (How about putting it on your pillow?) • Share this with your merit badge counselor. Discuss with your merit badge counselor Five of the following concepts: p.8 Req. #3 a. The emotions you feel when you receive money: When I honorably earn money, I feel ______ Good If I’d stolen the money, I’d feel _____ Bad! b. How the amount of money you have with you affects your spending habits: If I have lots of money, I tend to spend ______ more. If I don’t have my money, it is ______ harderto spend. Unless I have a credit card, then it is still easy to spend money I don’t have. * c. Your thoughts when you excited buy something new: happy I usually feel ___________________ Your thoughts about the same item 3 months later: excited happy I’m usually less __________ about it. p.8 Req. #3 Discuss with your merit badge counselor Five of the following concepts: (c) Explain the concept of: buyers remorse Often after buying something people feel _______ sorrow (remorse) and wish they could undo the _________. purchase Especially if they ________ borrowed $, when it is time to make buyer’s remorse payments, they feel sorry or have _______ _______. 3d. How hunger affects you when shopping for food items: If I’m hungry, I tend to buy more . 3e. Your experience of buying an item after seeing or hearing advertisements for it. Did the item work as well Not _______ always. as advertised? ___ Often, the ad makes it sound _____ better than it actually is. Once in awhile it is actually better _____ than I expected. 3f. Your understanding of what happens when you put money into a savings account: teller’s drawer It goes into the ______________, bank’s safe or into the ___________ bank’s bank then into the ___________ loaned out or invested then, most of it gets ___________________ interest for the use of my money. They pay me _______ They can afford to because they charge the borrowers higher rate than the rate they pay me. interest at a ______ Charitable Giving 3g. Explain its purpose and your thoughts about it: I think it is a _______ idea to give to a charity or church. Good charities use money to help the poor ____ and _____, sick worthwhile build buildings for worship __________ and other __________ purposes. 3h. What you can do to better manage your money: I can save _____ more of my earnings for more important things I’ll need in the future. I can use ____ less of it for junk. I can use my money for more ____ worthwhile purposes. p. 9, Requirement #4. Explain the following to your mb counselor: 4a. The difference between saving and investing, including reasons for using one over the other. • “Saving”*usually means: low___ risk way to accumulate money. • My father wanted me to save ever penny I got, I didn’t like that. Save $100 each month at 5% $20,000 $18,000 $16,000 $14,000 $12,000 $10,000 $8,000 $6,000 $4,000 $2,000 $0 1st year Savings $1200 Interest Earned $30 Save $100 each month at 5% $20,000 $18,000 $16,000 $14,000 $12,000 $10,000 $8,000 $6,000 $4,000 $2,000 $0 5th year Savings $6000 Interest Earned $830 Save $100 each month at 5% $20,000 $18,000 $16,000 $14,000 $12,000 $10,000 $8,000 $6,000 $4,000 $2,000 $0 10th year Savings $12000 Interest Earned $3530 Save $100 each month at 5% $20,000 $18,000 $16,000 $14,000 $12,000 $10,000 $8,000 $6,000 $4,000 $2,000 $0 Now 15th year Savings $18000 Interest Earned $8730 earning > $110+ each month p. 9, req 4a Recommended Savings: • Save _____% in an Emergency Fund. 10 Try to never, ever spend this money! • Save enough for your “_____ for ______” sure expenses. Stuff you know you’ll be spending money on once a year! • Save whatever you can just to _____ buy ______ stuff . Savings Goal: 10% 9% 8% 7% 6% 5% 4% 3% 2% 1% 0% Emergency For Sure Buy Stuff p. 9, Requirement #4. Explain the following to your Merit Badge Counselor: 4a. The difference between saving and investing, including reasons for using one over the other. • “Investing” usually higher -risk with a means ______ higher return. hope of a ______ Stocks & Bonds p.9, Requirement 4a. Explain the following to your merit badge counselor. • Reasons for saving: People typically save money emergencies for future needs including ____________. • Reasons for saving rather than investing: People who save money in a bank or credit union are much ____likely to lose less it. And more likely to be able to get it when they ______ want ___ it • Banks and credit unions are usually very careful with our $, and our savings are insured by agencies of the FDIC & _______ NCUA U.S. Government: _____ p.9, Requirement 4a. Explain the following to your merit badge counselor. • Reasons for investing: People invest in hopes of earning __________. more money • Reasons for investing rather than saving: Although the risk of loss is higher, and some work some investments require lots more ______, lots _____ more money. investments earn ___ Stocks & Bonds p.9, Requirement 4b. Explain the following to your merit badge counselor. 4b. Explain the concepts of return on investment and risk. expected • Return on investment refers to the amount you receive __ _____ of in excess the amount you invested. • Risk is a measure of the possibility loss of suffering harm or ____. 140 120 100 80 at 5% • Why would anybody choose 5% when they invest at 25%? • The greater the rate, the higher the ____. risk Return Invest 60 40 20 0 at 10% at 25% actual 120 100 80 Return Invest 60 • or: The greater the risk, the higher 40 possible _______ return and possible _______. loss 20 0 at 5% at 10% at 25% p. 9, Requirement #4c Explain the concepts of simple interest and compound interest. Suppose you bury $1,000, and dig it up 20 years from now • Instead, suppose you put it in the bank and earn 5% for 20 years 3000 2500 2000 1500 • PRINCIPAL 1000 500 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 p. 9, Requirement #4c Explain the concepts of simple interest and compound interest. Simple interest: Interest paid only on the ________ principal balance. 3000 2500 2000 1500 1000 500 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 p. 9, Requirement #4c Explain the concepts of simple interest and compound interest. Now, suppose you have them add your interest to your principal balance. Compound interest: Interest paid on both the principal and previously paid _______ interest. 3000 2500 Compound 2000 Interest 1500 1000 500 Principal 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 p. 9, Req. #4 Explain how these (simple interest & compound interest) affect the results of your investment exercise (p.12). If I save or invest $1000 and I spend all the earnings as I get it, I do not get the advantage of _____________. compounding If I have my earnings added to the investment, I principal earn interest not only on the ________ prior earnings but also on the ______ _________ And, I get compound interest. 3000 2500 2000 1500 1000 500 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 p. 10, Req. #5 Select 5 publicly traded stocks from the business section of the newspaper. a. Explain to your merit badge counselor the importance of the following information for each stock: Current price: much an investor Is important to know how _____ can buy, and help him decide whether to buy ___, sell ___, trade ____, hold or _____ avoid a stock. ____, The current price may be obtained on-line ______, from stock ______, broker or estimated from _________. newspaper a ____ p. 10, Req. #5 Explain the importance of: b. How much the price changed from the previous day: It is important to see if the price changed, and much and whether it went up how _____, __ or down ____. If it went down a lot, something might be wrong with the company. seriously ______ p. 10, Req. #5 Explain the importance of: c. The 52-week high and the 52-week low prices: • It is important to see if the price has been about higher or _____ lower than it is now. the same, or ______, If it went down a lot, something might be wrong with the company, or with seriously ______ the stock market __ in _______. general It might be a good time to ___. buy But it might be a good time to _____ avoid __. it a lot Knowing this is enough to realize you need to know __ ___ more ______! p. 10, Req. # 5 Obtain the business section of your newspaper and obtain the following for 5 stocks: • Usually buy 100 shares at a time. 9/25/04 Date of Newspaper: ________ Name1st stock Close Price Net Change 52-wk high “Name” “Last” “Chg” “1yrhi” ______________ _________ _________ ___________ DeltaAir 3.26 - .70 15.54 Explain: The importance for this stock: Current price (est: _______) __________________________ 3.00 Low enough to buy a bunch Change from previous day: Lost __________________________ 70¢ per share: danger The 52-week high: __________________________ Lost $12.28 p/share: danger Should I buy? • (on 8/28/06: 68¢, then down to $0) p. 10, Req. # 5 Obtain the business section of your newspaper and obtain the following for 5 stocks: (I’ve already given you 1) Date of stock quote: ________ Name 2nd stock Close Price Net Change 52-wk high “Name” “Last” “Chg” “1yrhi” ______________ _________ _________ ___________ Explain: The importance for this stock: Current price (est: _______) __________________________ Change from previous day: __________________________ The 52-week high: __________________________ • SATURDAY